BTC_POWER_LA

No content yet

BTC_POWER_LA

At 7:30 PM PST we will have another "Physics of Bitcoin" show.

Giovanni will cover new results concerning the daily slopes and their use in option trading.

Steve agenda's is below.

The show will be here on X, YouTube and Twitch.

Links in the comments.

Giovanni will cover new results concerning the daily slopes and their use in option trading.

Steve agenda's is below.

The show will be here on X, YouTube and Twitch.

Links in the comments.

BTC-0,91%

- Reward

- 1

- Comment

- Repost

- Share

I asked Claude to add the Bitcoin Power Law Theory in the investment thesis for a institutional grade report.

BTC-0,91%

- Reward

- 2

- Comment

- Repost

- Share

This is just a draft for now but soon the Scientific Bitcoin Institute will create official reports like this one.

BTC-0,91%

- Reward

- 2

- Comment

- Repost

- Share

Another power law.

- Reward

- like

- Comment

- Repost

- Share

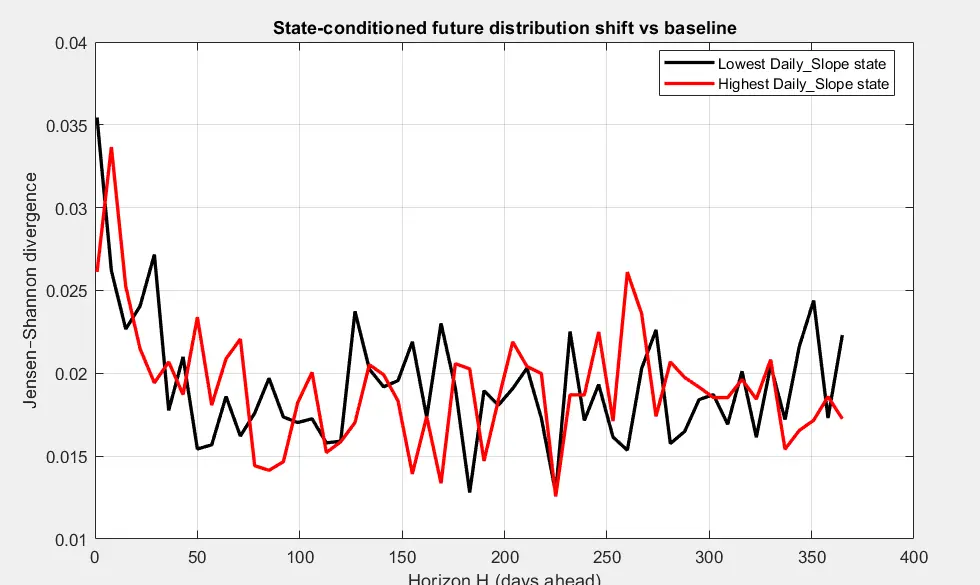

The graph below shows the Jensen-Shannon divergence for the Daily Slopes.

This is what ChatGPT says about the result.

1. What this plot actually measures (in plain terms)

Each point on the curve is the Jensen–Shannon divergence (JSD) between:

the distribution of normalized daily slopes in a rolling window and a reference distribution (from an early baseline window)

So the curve answers:

“How different is the current statistical behavior of normalized growth compared to the early scaling regime?”

Important:

This is not price divergence.

This is distributional divergence of the noise around th

This is what ChatGPT says about the result.

1. What this plot actually measures (in plain terms)

Each point on the curve is the Jensen–Shannon divergence (JSD) between:

the distribution of normalized daily slopes in a rolling window and a reference distribution (from an early baseline window)

So the curve answers:

“How different is the current statistical behavior of normalized growth compared to the early scaling regime?”

Important:

This is not price divergence.

This is distributional divergence of the noise around th

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

Even across bubbles, crashes, institutionalization, and macro shocks, the normalized slope distribution never leaves the same statistical family.

In physics terms: the system undergoes renormalization of fluctuations but remains in the same universality class

This is strong evidence that: Bitcoin’s growth dynamics are governed by a stable scaling process regime changes modify volatility structure but do not change the underlying attractor.

In physics terms: the system undergoes renormalization of fluctuations but remains in the same universality class

This is strong evidence that: Bitcoin’s growth dynamics are governed by a stable scaling process regime changes modify volatility structure but do not change the underlying attractor.

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

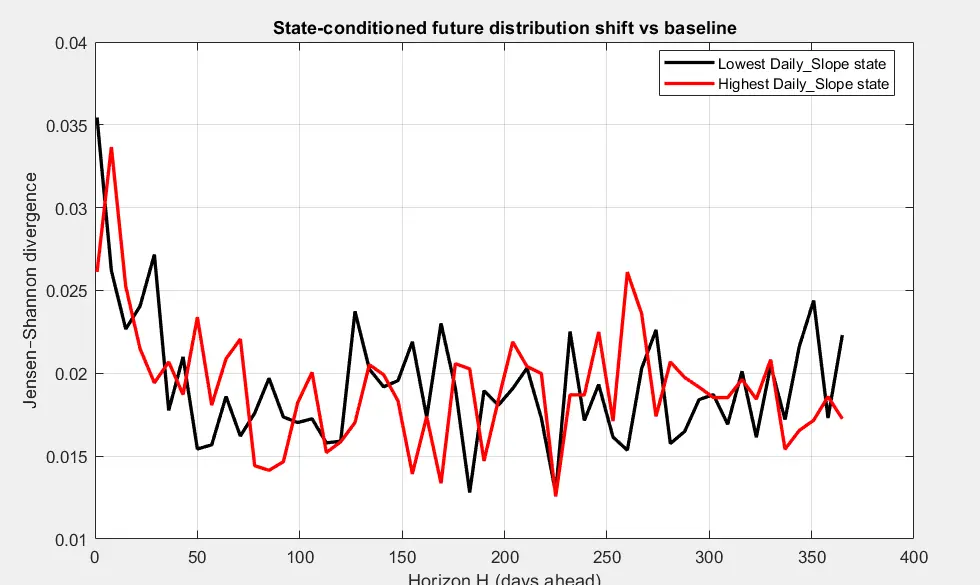

Each row is a state bin of the current Daily_Slope (quantile bins from very low to very high).

Each column is a forecast horizon H (days ahead).

Each pixel color is the Jensen–Shannon divergence between:

the future distribution conditioned on being in that state today

vs

the unconditional future distribution at the same horizon.

So each cell answers:

“If Bitcoin is in this normalized-growth state today, how different is the distribution of normalized growth H days in the future from baseline?”

This is a state-conditional memory map of the normalized dynamics.

This map independently supports:

✔

Each column is a forecast horizon H (days ahead).

Each pixel color is the Jensen–Shannon divergence between:

the future distribution conditioned on being in that state today

vs

the unconditional future distribution at the same horizon.

So each cell answers:

“If Bitcoin is in this normalized-growth state today, how different is the distribution of normalized growth H days in the future from baseline?”

This is a state-conditional memory map of the normalized dynamics.

This map independently supports:

✔

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

Large fluctuations have short memory (about 2 months). They condition the price behavior for short times but they don't have lasting consequences.

The dominant scale behavior is what is left and defines the long term trajectory.

The dominant scale behavior is what is left and defines the long term trajectory.

- Reward

- like

- Comment

- Repost

- Share

This map independently supports:

✔ Scaling law is the dominant organizing principle

✔ Deviations are structured noise with short memory

✔ No persistent state-conditioned dynamics

✔ No regime breaks in normalized coordinates

✔ Institutions damp extremes but don’t alter universality class

In short:

This is exactly what a complex adaptive system near a scaling fixed point should look like.

✔ Scaling law is the dominant organizing principle

✔ Deviations are structured noise with short memory

✔ No persistent state-conditioned dynamics

✔ No regime breaks in normalized coordinates

✔ Institutions damp extremes but don’t alter universality class

In short:

This is exactly what a complex adaptive system near a scaling fixed point should look like.

- Reward

- like

- Comment

- Repost

- Share

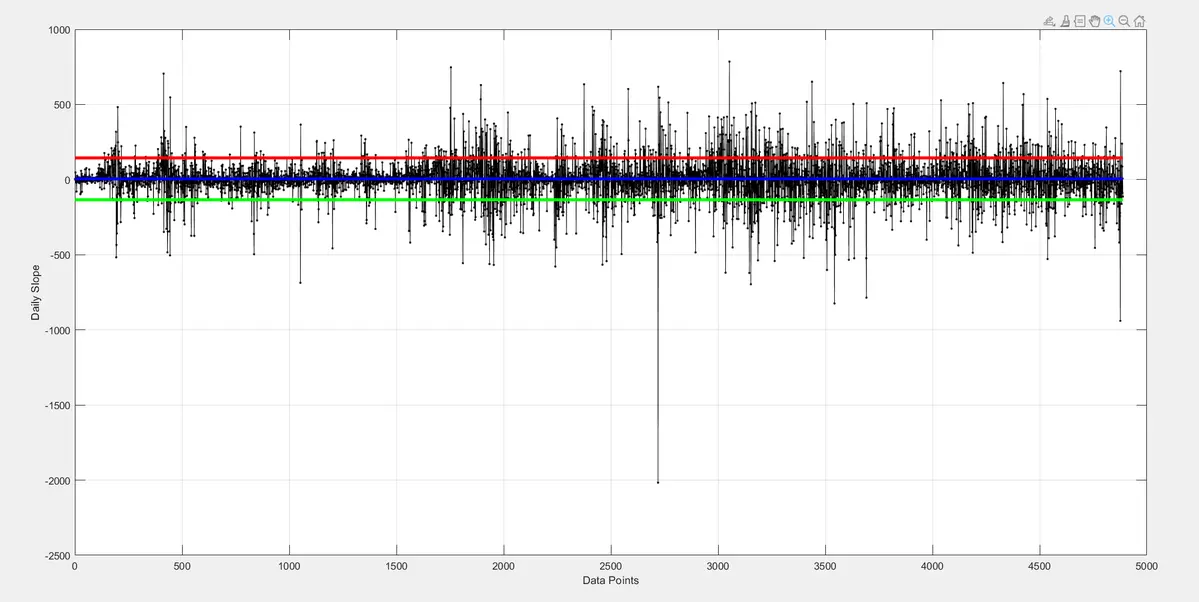

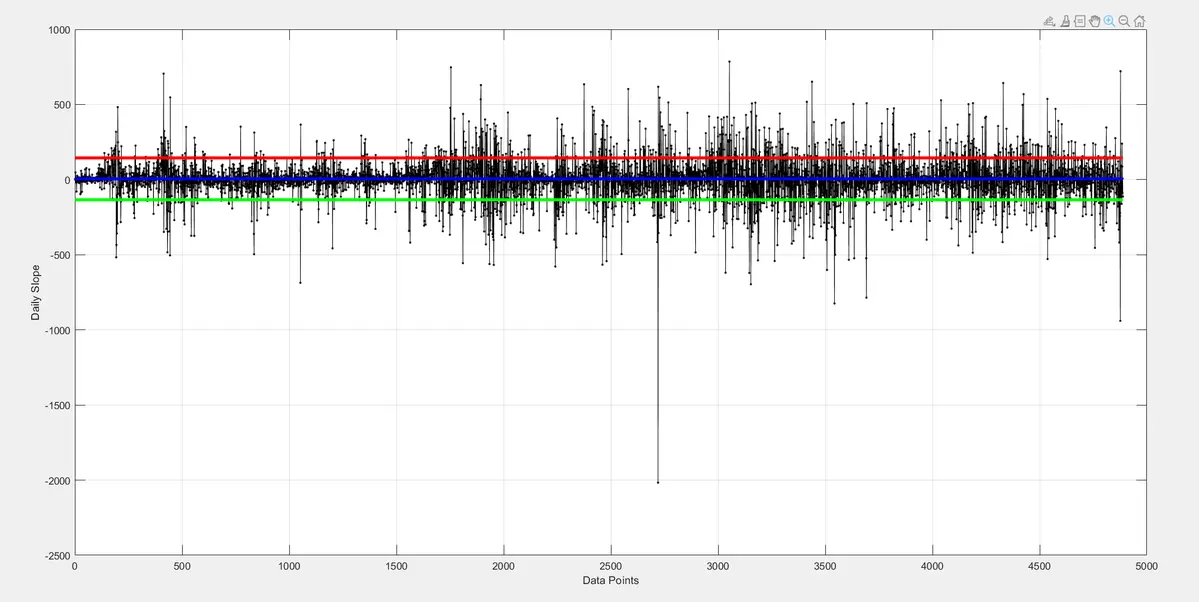

The sequence of the Daily slopes or normalized returns is the most stable BTC parameter. It tells us the core behavior of Bitcoin statistically.

It includes both its stochastic behavior and the long term power law deterministic growth.

Even during these chaotic recent changes the parameter behaves in a similar fashion in the past.

Its mean is around 5.9 that is the same slope we observe using regression. It tends to regress to mean if push too much in either direction.

It includes both its stochastic behavior and the long term power law deterministic growth.

Even during these chaotic recent changes the parameter behaves in a similar fashion in the past.

Its mean is around 5.9 that is the same slope we observe using regression. It tends to regress to mean if push too much in either direction.

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

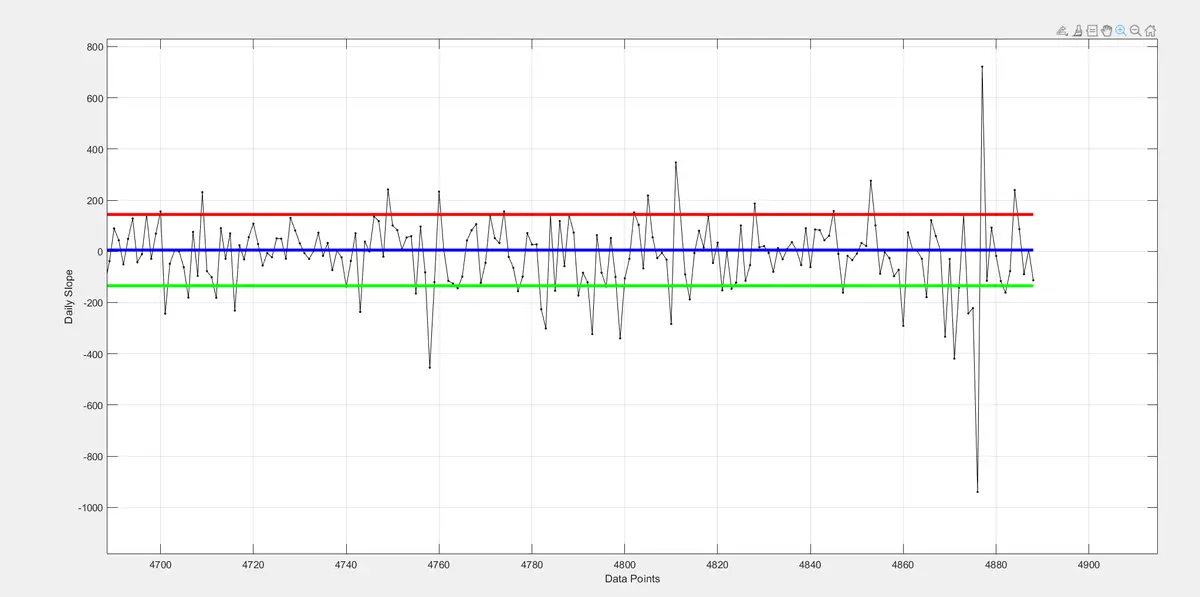

This is a zoom-in of the daily slopes.

Aside from the recent large spike — comparable in magnitude to some of the largest corrections we’ve seen in past cycles — the overall behavior is not fundamentally different from historical regimes. In other words, the volatility of the short-term growth rate looks dramatic in isolation, but it is still well within the envelope of what Bitcoin has exhibited before.

Crucially, the system is still growing along the trajectory implied by the power law. What has changed is not the underlying scaling behavior, but the reference level around which price is osc

Aside from the recent large spike — comparable in magnitude to some of the largest corrections we’ve seen in past cycles — the overall behavior is not fundamentally different from historical regimes. In other words, the volatility of the short-term growth rate looks dramatic in isolation, but it is still well within the envelope of what Bitcoin has exhibited before.

Crucially, the system is still growing along the trajectory implied by the power law. What has changed is not the underlying scaling behavior, but the reference level around which price is osc

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

Daily slopes or normalized returns are the most stable BTC parameter. It tells us the core behavior of Bitcoin statistically.

The include both its stochastic behavior and the long term power law deterministic growth.

Even during these chaotic recent changes the parameter behaves in a similar fashion in the past.

Its mean is around 5.9 that is the same slope we observe using regression. It tends to regress to mean if push too much in either direction.

The include both its stochastic behavior and the long term power law deterministic growth.

Even during these chaotic recent changes the parameter behaves in a similar fashion in the past.

Its mean is around 5.9 that is the same slope we observe using regression. It tends to regress to mean if push too much in either direction.

BTC-0,91%

- Reward

- 2

- Comment

- Repost

- Share

I think all serious Bitcoiners should learn how to do covered calls, on IBIT or Bitcoin itself.

Using the latest Monte Carlo simulation of the power law slopes indicators one can establish a reliable strike price with a 2 weeks expiration date.

This strat works 97 % of the time statistically and it is possible to get a Bitcoin yield of about 2 % a month easily.

Using the latest Monte Carlo simulation of the power law slopes indicators one can establish a reliable strike price with a 2 weeks expiration date.

This strat works 97 % of the time statistically and it is possible to get a Bitcoin yield of about 2 % a month easily.

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

Happy birthday, Galileo — my illustrious countryman who showed us how to lead the way. Your way of thinking and teaching helped me understand Bitcoin better.

BTC-0,91%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

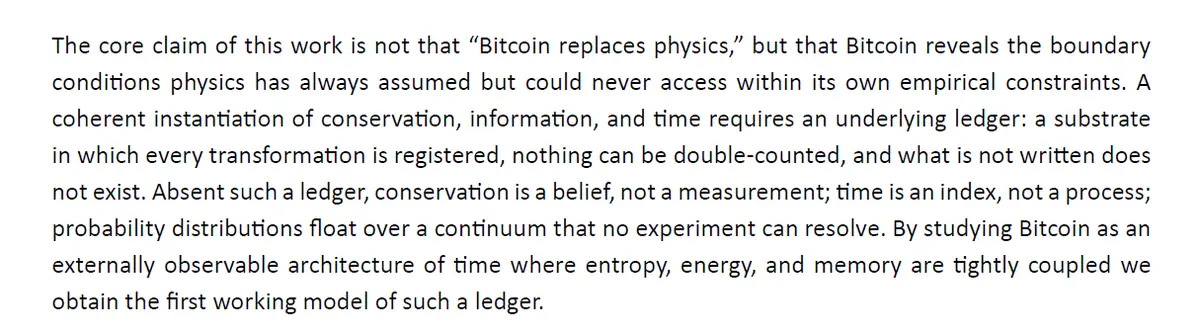

This core idea is not bad at all. I already made many times the claim that the Bitcoin ledger reminds me of the conservation laws in physics.

But execution on this idea is fundamental, most of the equations and statements that follow are problematic.

But execution on this idea is fundamental, most of the equations and statements that follow are problematic.

BTC-0,91%

- Reward

- 1

- 1

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊Trending Topics

View More214.9K Popularity

853.53K Popularity

47.7K Popularity

89.11K Popularity

457.54K Popularity

Pin