# CPIDataAnalysis

35.05K

U.S. CPI data will be released tonight, with expectations at 2.7%–2.8%. As a key macro indicator, it could trigger short-term volatility in BTC and other risk assets. What’s your take? Will BTC rally or pull back?

CryptoFiler

#CPIDataAhead Gold and silver are doing something markets can’t ignore — they keep printing new all-time highs.

This isn’t just a commodity rally. It’s a message.

As the new year begins, capital is flowing away from risk and into safety. That usually happens when investors are uncertain about inflation, interest rates, and global stability. CPI data and Fed policy remain the key drivers, and markets are clearly not fully convinced that inflation risks are gone.

Historically, when fear rises:

Gold moves first

Bitcoin stays volatile

Liquidity becomes selective

But once inflation cools and moneta

This isn’t just a commodity rally. It’s a message.

As the new year begins, capital is flowing away from risk and into safety. That usually happens when investors are uncertain about inflation, interest rates, and global stability. CPI data and Fed policy remain the key drivers, and markets are clearly not fully convinced that inflation risks are gone.

Historically, when fear rises:

Gold moves first

Bitcoin stays volatile

Liquidity becomes selective

But once inflation cools and moneta

BTC1,75%

- Reward

- 9

- 13

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

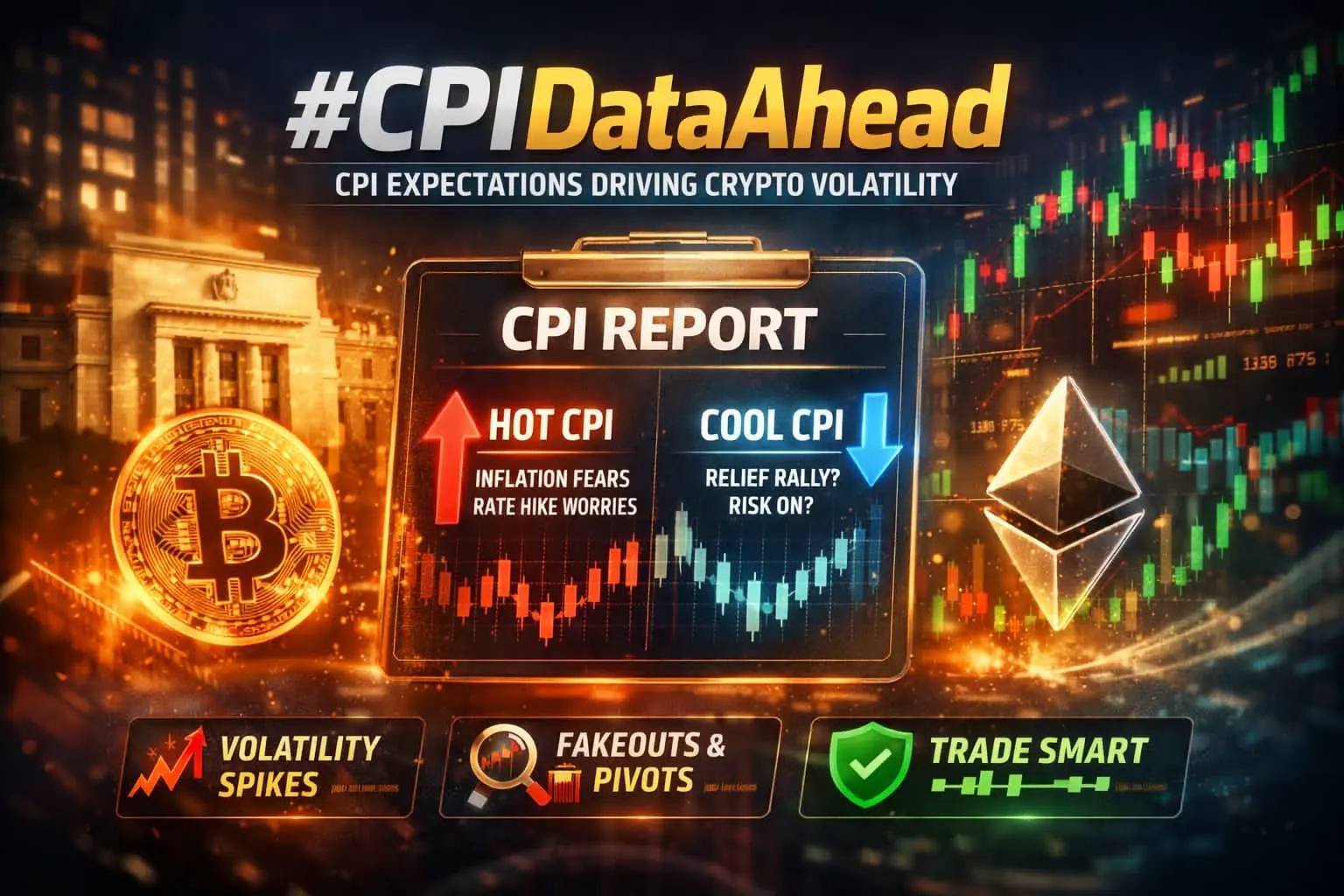

#CPIDataAhead CPI Is Approaching — And the Market Is Loading the Next Move

All eyes are locked on CPI.

This is not just another data print — it’s a macro trigger that often defines the next directional phase for crypto. Time and again, major moves in BTC, ETH, and the broader altcoin market have been ignited by inflation data shifting expectations around liquidity, rates, and risk appetite.

CPI doesn’t just move price — it reshapes sentiment.

A hot CPI can spark sharp volatility, force deleveraging, and trigger liquidity sweeps on both sides.

A cool CPI often fuels risk-on behavior, pushing ca

All eyes are locked on CPI.

This is not just another data print — it’s a macro trigger that often defines the next directional phase for crypto. Time and again, major moves in BTC, ETH, and the broader altcoin market have been ignited by inflation data shifting expectations around liquidity, rates, and risk appetite.

CPI doesn’t just move price — it reshapes sentiment.

A hot CPI can spark sharp volatility, force deleveraging, and trigger liquidity sweeps on both sides.

A cool CPI often fuels risk-on behavior, pushing ca

- Reward

- 13

- 9

- Repost

- Share

OrangeFlavored :

:

2026 GOGOGO 👊View More

#CPIDataAhead

The market is gearing up for one of the most important macro events of the month — the upcoming CPI release. Inflation data has been a key driver of volatility across equities, crypto, and commodities, and traders are watching closely for any shift in the trend.

What to watch this time:

🔹 Whether inflation cools or re-accelerates

🔹 Impact on Fed rate expectations

🔹 Short-term risk sentiment across crypto

🔹 Potential liquidity spikes at the moment of release

A lower CPI could bring a risk-on rally, while a hotter print may introduce renewed selling pressure. Staying prepared i

The market is gearing up for one of the most important macro events of the month — the upcoming CPI release. Inflation data has been a key driver of volatility across equities, crypto, and commodities, and traders are watching closely for any shift in the trend.

What to watch this time:

🔹 Whether inflation cools or re-accelerates

🔹 Impact on Fed rate expectations

🔹 Short-term risk sentiment across crypto

🔹 Potential liquidity spikes at the moment of release

A lower CPI could bring a risk-on rally, while a hotter print may introduce renewed selling pressure. Staying prepared i

- Reward

- 9

- 9

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#CPIDataAhead

Markets aren’t waiting for opinions — they’re waiting for data.

The upcoming CPI print is a hard trigger, not a headline.

This number will decide: • Whether the rate-cut narrative survives

• The direction of bond yields and the dollar

• If risk assets are rewarded or punished

A hot CPI reinforces higher-for-longer and tight liquidity.

A cooling CPI revives easing expectations and risk appetite.

Bitcoin and ETH are sitting at decision zones.

This is not a moment for prediction — it’s a moment for discipline.

Volatility is guaranteed.

Opportunity belongs only to those who wait for

Markets aren’t waiting for opinions — they’re waiting for data.

The upcoming CPI print is a hard trigger, not a headline.

This number will decide: • Whether the rate-cut narrative survives

• The direction of bond yields and the dollar

• If risk assets are rewarded or punished

A hot CPI reinforces higher-for-longer and tight liquidity.

A cooling CPI revives easing expectations and risk appetite.

Bitcoin and ETH are sitting at decision zones.

This is not a moment for prediction — it’s a moment for discipline.

Volatility is guaranteed.

Opportunity belongs only to those who wait for

- Reward

- 7

- 4

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#CPIDataAhead

Inflation Data as the Next Major Market Catalyst

With the upcoming CPI release, global markets are entering a high-sensitivity phase where macro data, not narratives, will dictate short-term direction. Inflation prints remain one of the most powerful inputs shaping interest rate expectations, dollar strength, and cross-asset capital flows.

This CPI reading is not just about the headline number it’s about what it implies for central bank flexibility in 2026.

Why This CPI Print Matters More Than Usual

1. Policy Expectations Are Finely Balanced

Markets are currently pricing a narr

Inflation Data as the Next Major Market Catalyst

With the upcoming CPI release, global markets are entering a high-sensitivity phase where macro data, not narratives, will dictate short-term direction. Inflation prints remain one of the most powerful inputs shaping interest rate expectations, dollar strength, and cross-asset capital flows.

This CPI reading is not just about the headline number it’s about what it implies for central bank flexibility in 2026.

Why This CPI Print Matters More Than Usual

1. Policy Expectations Are Finely Balanced

Markets are currently pricing a narr

BTC1,75%

- Reward

- 7

- 12

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

📊 #CPIDataAhead

Today’s CPI (Consumer Price Index) release is a key macro event for both crypto and traditional financial markets. CPI measures inflation and plays a major role in shaping the Federal Reserve’s interest rate policy.

🔍 Why the market is cautious:

📈 Higher-than-expected CPI ➜ Inflation pressure remains strong

➜ Fed may keep rates higher for longer

➜ BTC, ETH, and altcoins could face selling pressure

📉 Lower-than-expected CPI ➜ Rate-cut expectations increase

➜ Risk assets, including crypto, may see a bullish reaction

⚠️ Volatility Warning Sharp price moves are likely immediate

Today’s CPI (Consumer Price Index) release is a key macro event for both crypto and traditional financial markets. CPI measures inflation and plays a major role in shaping the Federal Reserve’s interest rate policy.

🔍 Why the market is cautious:

📈 Higher-than-expected CPI ➜ Inflation pressure remains strong

➜ Fed may keep rates higher for longer

➜ BTC, ETH, and altcoins could face selling pressure

📉 Lower-than-expected CPI ➜ Rate-cut expectations increase

➜ Risk assets, including crypto, may see a bullish reaction

⚠️ Volatility Warning Sharp price moves are likely immediate

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#CPIDataAhead

Markets are entering a critical phase as investors prepare for the upcoming Consumer Price Index (CPI) release. CPI is one of the most influential macroeconomic indicators, as it directly measures inflation by tracking changes in the prices consumers pay for goods and services. Its impact extends across equities, bonds, forex, commodities, and increasingly, the crypto market.

Understanding CPI and Its Importance

CPI provides insight into whether inflation is accelerating, stabilizing, or cooling. Central banks closely monitor this data because inflation trends play a decisive ro

Markets are entering a critical phase as investors prepare for the upcoming Consumer Price Index (CPI) release. CPI is one of the most influential macroeconomic indicators, as it directly measures inflation by tracking changes in the prices consumers pay for goods and services. Its impact extends across equities, bonds, forex, commodities, and increasingly, the crypto market.

Understanding CPI and Its Importance

CPI provides insight into whether inflation is accelerating, stabilizing, or cooling. Central banks closely monitor this data because inflation trends play a decisive ro

BTC1,75%

- Reward

- 6

- 10

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#CPIDataAhead 📊⚡

Global markets are approaching a critical macro moment as the **CPI (Consumer Price Index)* data release draws near. This report is one of the most influential economic indicators, often acting as a **volatility catalyst** across equities, forex, and especially crypto markets.

CPI reflects the pace of inflation in the economy. Its outcome directly impacts **Federal Reserve policy expectations**, interest-rate outlooks, and overall liquidity — all of which play a major role in crypto price action.

🔍 Why CPI Is So Important for Crypto

🔹 Inflation trends guide future **rate hi

Global markets are approaching a critical macro moment as the **CPI (Consumer Price Index)* data release draws near. This report is one of the most influential economic indicators, often acting as a **volatility catalyst** across equities, forex, and especially crypto markets.

CPI reflects the pace of inflation in the economy. Its outcome directly impacts **Federal Reserve policy expectations**, interest-rate outlooks, and overall liquidity — all of which play a major role in crypto price action.

🔍 Why CPI Is So Important for Crypto

🔹 Inflation trends guide future **rate hi

- Reward

- 9

- 12

- Repost

- Share

YemenBit :

:

My account publishes cryptocurrency news 24 hours a day.View More

#CPIDataAhead

CPI Data Update | Market Reaction Analysis

The latest CPI data has now been released and came fully in line with market expectations. As anticipated, the print delivered no real bullish surprise, resulting in only a short-lived relief bounce across risk assets.

Market behavior:

• Brief rally immediately after release

• Momentum faded quickly

• Price retraced and dipped soon after

• No structural trend shift confirmed

This reaction reinforces a familiar pattern:

When macro data meets expectations, liquidity not headlines decides direction.

Trade management update:

Our short

CPI Data Update | Market Reaction Analysis

The latest CPI data has now been released and came fully in line with market expectations. As anticipated, the print delivered no real bullish surprise, resulting in only a short-lived relief bounce across risk assets.

Market behavior:

• Brief rally immediately after release

• Momentum faded quickly

• Price retraced and dipped soon after

• No structural trend shift confirmed

This reaction reinforces a familiar pattern:

When macro data meets expectations, liquidity not headlines decides direction.

Trade management update:

Our short

- Reward

- 8

- 13

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#CPIDataAhead Macro Pressure Is About to Define the Next Crypto Move 🔥

All attention is locked on the upcoming CPI (Consumer Price Index) release, one of the most important macroeconomic events for financial markets. This is not just another data print — CPI directly shapes inflation expectations, Federal Reserve policy outlook, and global liquidity conditions. For crypto, this data often acts as the starting signal for major trends, not the end of them.

Crypto markets don’t move in isolation. Every meaningful breakout or correction in BTC, ETH, and altcoins is rooted in macro pressure. CPI i

All attention is locked on the upcoming CPI (Consumer Price Index) release, one of the most important macroeconomic events for financial markets. This is not just another data print — CPI directly shapes inflation expectations, Federal Reserve policy outlook, and global liquidity conditions. For crypto, this data often acts as the starting signal for major trends, not the end of them.

Crypto markets don’t move in isolation. Every meaningful breakout or correction in BTC, ETH, and altcoins is rooted in macro pressure. CPI i

- Reward

- 15

- 12

- Repost

- Share

MrThanks77 :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

2.92K Popularity

31.22K Popularity

10.84K Popularity

569 Popularity

111 Popularity

142 Popularity

125.43K Popularity

9.81K Popularity

101.3K Popularity

2.25K Popularity

153.17K Popularity

1M Popularity

245.16K Popularity

226 Popularity

302.07K Popularity

News

View More"I'm f***ing coming" Market cap rebounds and surpasses $15 million

1 h

Data: "I'm damn coming" short-term surge exceeds 40%, market cap reaches 20 million USD

1 h

Due to the valuation controversy surrounding Starknet yesterday, the two whales have already positioned themselves for STRK shorts and partially took profits today.

1 h

Peter Schiff: Selling precious metals at record highs and switching to BTC and MSTR is a major mistake

1 h

Argentine cryptocurrency trading platform Lemon launches Bitcoin-backed Visa credit card

1 h

Pin