#CryptoMarketWatch The Future of Digital Assets: Where Crypto Is Headed as a Global Financial Layer

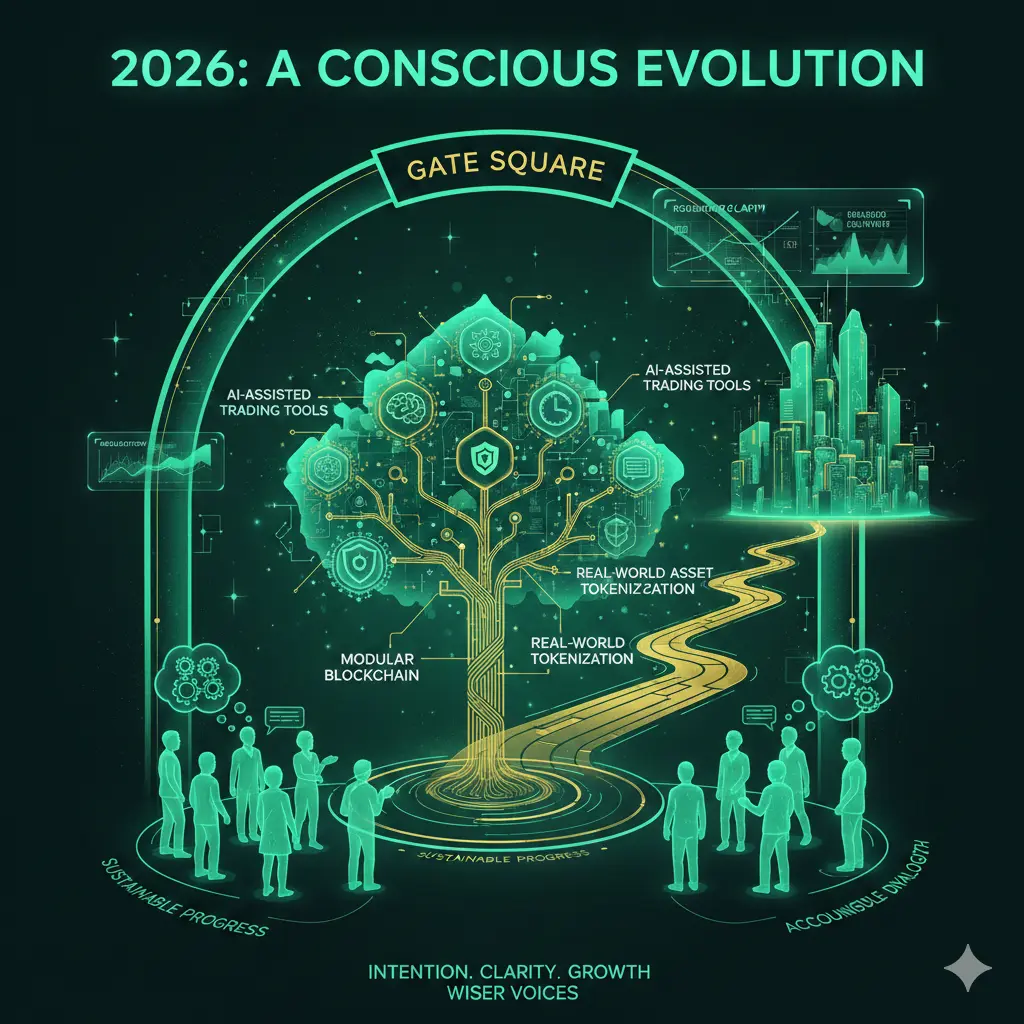

The crypto market is no longer defined by hype cycles alone. As we move deeper into 2026 and beyond, digital assets are transitioning into a structured financial layer that increasingly mirrors — and in some cases improves upon — traditional markets. What defines this new era is not explosive speculation, but integration: with macroeconomics, technology, regulation, and real-world economic activity. The market is evolving from what could be into what is being built and used.

Volatility has not d

The crypto market is no longer defined by hype cycles alone. As we move deeper into 2026 and beyond, digital assets are transitioning into a structured financial layer that increasingly mirrors — and in some cases improves upon — traditional markets. What defines this new era is not explosive speculation, but integration: with macroeconomics, technology, regulation, and real-world economic activity. The market is evolving from what could be into what is being built and used.

Volatility has not d