Gate Private Wealth Management Monthly Report—October 2025

Abstract

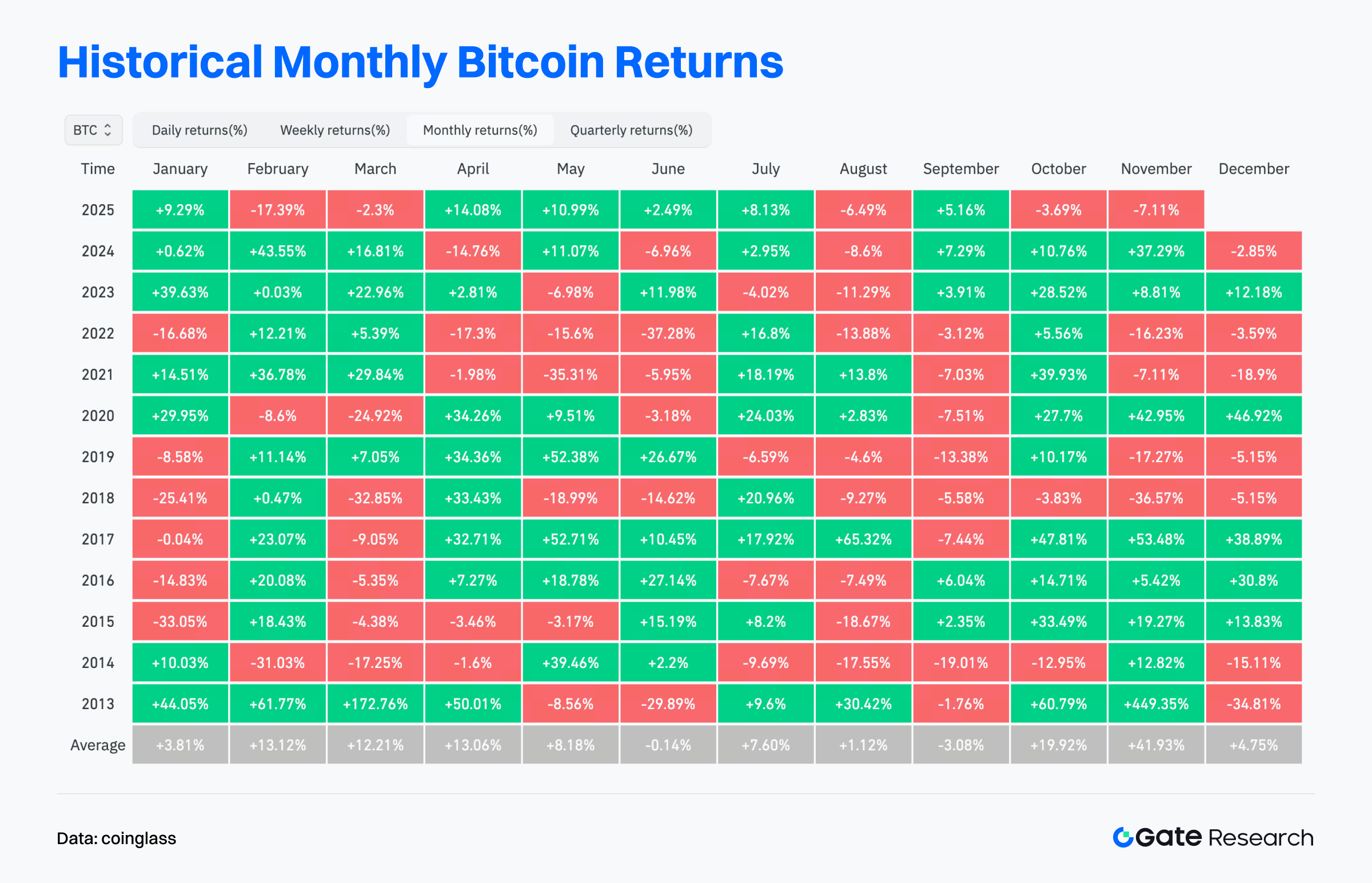

- After reaching a new high of $125,400 in early October, Bitcoin failed to reclaim the $120,000 mark by month-end, recording its first October loss since 2018. Overall, the crypto market significantly underperformed traditional risk assets.

- The top 30% of quantitative fund portfolios still achieved an impressive annualized return of 35.4%, substantially outperforming Bitcoin.

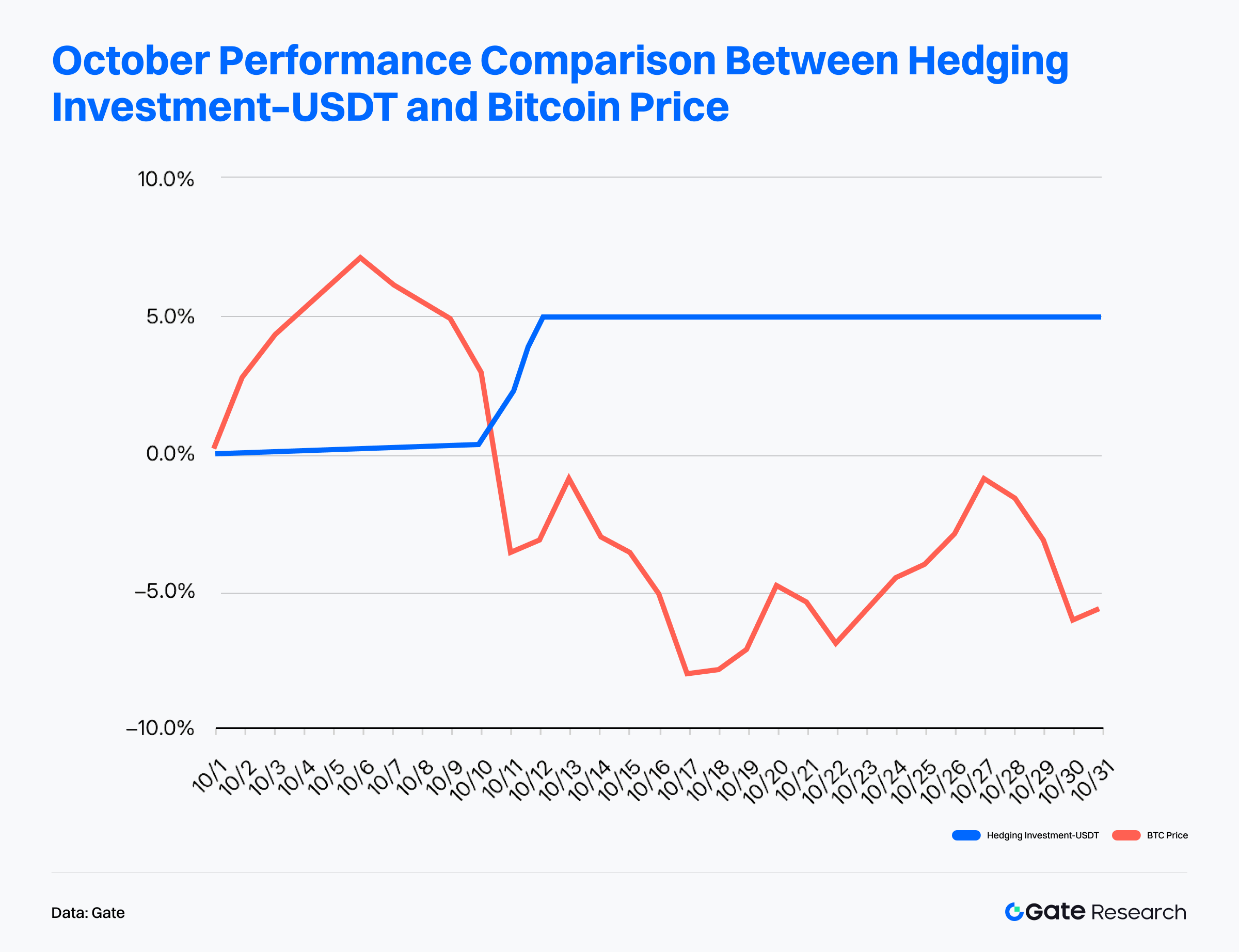

- The Hedged Investment–USDT strategy delivered particularly strong results, posting a 5% positive return despite Bitcoin’s over 5.5% decline during the month. Its annualized return in October reached 59%, with a 12-month return of 16.4%, ranking first among all quantitative products.

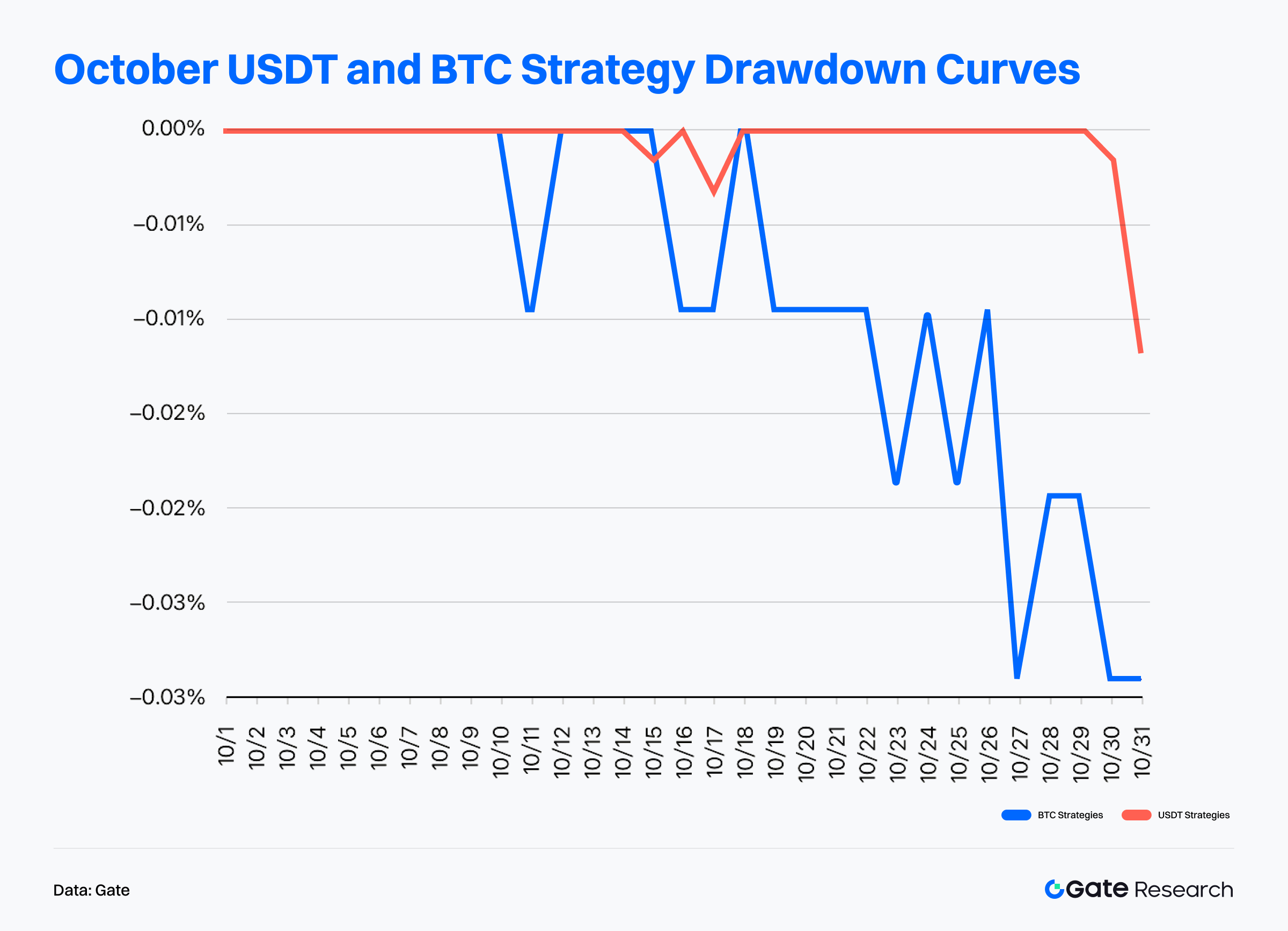

- Overall drawdowns of quantitative funds in October remained minimal, with the maximum drawdown for USDT strategies at 0.01% and BTC strategies at 0.03%.

- Looking ahead to November, macro liquidity conditions and policy expectations are likely to continue driving market trends, while the crypto market may remain in a high-volatility, low-trend consolidation phase.

1. October Market Review

- Crypto Market Price Analysis: The long-awaited “Uptober” failed to materialize in October. After reaching a new high of $125,400 at the start of the month, Bitcoin was unable to reclaim the $120,000 mark by month-end, recording its first October loss since 2018 and its largest October decline since 2014. Ethereum also underperformed, failing to hold above the $4,000 level and extending its downward channel trend. Altcoins generally lagged, though capital rotated into Solana and early-stage AI+DePIN projects, which continued to strengthen across multiple incubation platforms. The x402 Protocol drew notable attention in October for enabling AI agents to autonomously pay for API services, marking a potential breakthrough in Web3 payments. Meanwhile, discussions around the EU’s proposed 2027 privacy coin ban and concerns over CBDC-related privacy risks fueled strong gains in masternode and privacy coin sectors, with DASH and ZEC rallying against the broader market trend.

- Liquidity Analysis: Despite Bitcoin’s monthly decline, institutional trading activity remained robust. The CME Bitcoin futures open interest reached an all-time high, signaling ample market liquidity. Additionally, spot Bitcoin and Ethereum ETFs continued to see net inflows in October, totaling $3.5 billion and $670 million, respectively. On-chain data showed Ethereum exchange reserves dropping to multi-year lows (15.6 million ETH), reducing sell-side supply, while staking levels surged to 35.7 million ETH. This combination of high staking participation and low liquid supply may set the stage for a potential rebound ahead.

- Market Sentiment Analysis: The Fear & Greed Index plunged from 74 to 23, entering the “extreme fear” zone. Volatility spiked from 1.2% to 2.3%, while Bitcoin’s long/short ratio indicated that short positions dominated for most of the month — a sign of mounting selling pressure and deepening market fear.

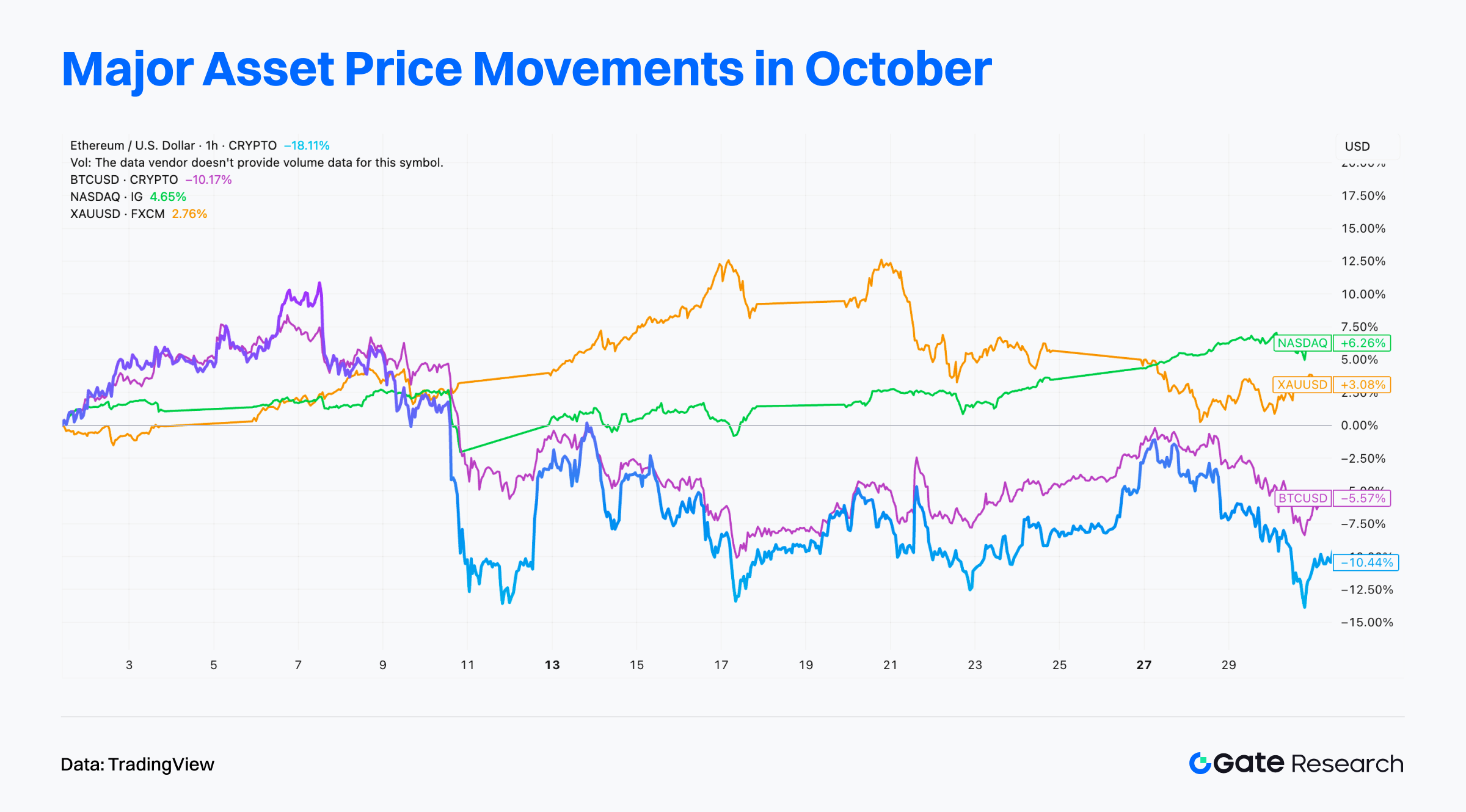

- Macro Fundamentals: Tariff-related headlines triggered panic across risk assets, leading to over $19 billion in leveraged liquidations that rattled futures markets. Although a 25-basis-point rate cut at month-end offered temporary relief, the Fed’s hawkish tone left uncertainty surrounding a potential December rate cut. Gold outperformed global equities in early October, hitting a record high of $4,356, followed by a strong rebound in tech stocks, where better-than-expected earnings lifted the NASDAQ by 6% for the month. Overall, the crypto market underperformed traditional risk assets, weighed down by macroeconomic uncertainty and tighter liquidity conditions.

2. Gate Private Wealth Product Matrix

Gate Private Wealth offers two main strategy categories: clients can choose either stable income products that outperform U.S. Treasury yields, or high-return quantitative fund portfolios designed for growth.

2.1 Gate Earn Products

- Simple Earn: A flexible wealth management solution designed to keep funds actively generating returns. Clients can subscribe to over 800 crypto-denominated flexible or fixed-term products to earn interest. On top of the base annualized rate, USDT products offer an additional 9% annualized yield, with new users eligible for bonuses up to 200%.

- Dual Investment: A short-term structured product involving two different cryptocurrencies, allowing clients to choose between selling high or buying low based on market outlook. The longer the investment period, the higher the potential yield multiplier. Currently supporting 64 tokens, clients can easily invest by selecting the token, market direction, and duration. Compared with spot trading, dual currency investments offer a higher safety margin, and even if not executed, investors still earn stable interest income.

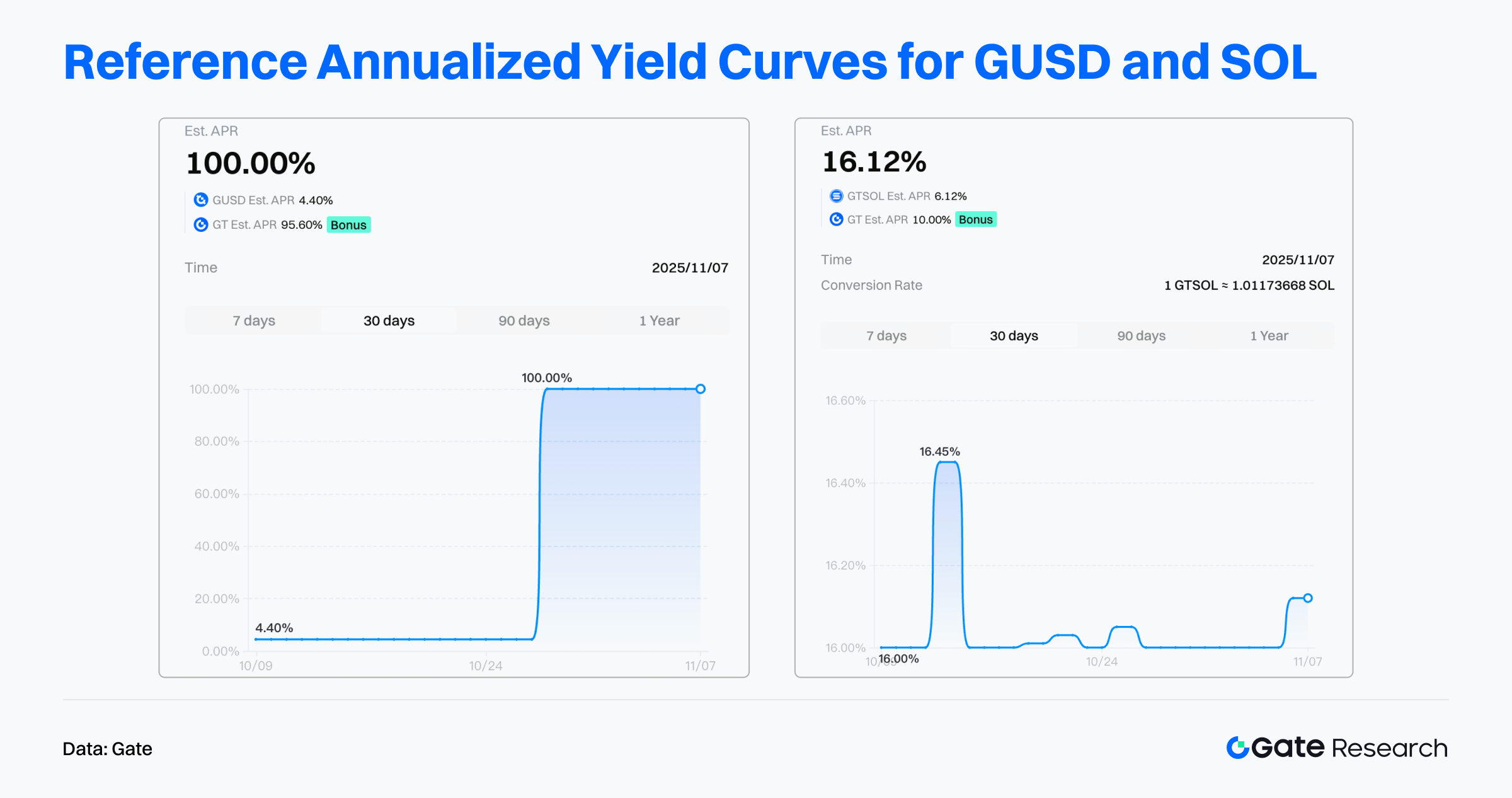

- Staking: A principal-protected on-chain investment solution, aggregating a range of popular Proof-of-Stake (PoS) projects. Clients can stake crypto assets to earn attractive on-chain yields. For example, staking via GUSD minting offers an annualized yield of 4.4%, exceeding U.S. Treasury rates, while Gate provides additional rewards up to 95.6% APY.

2.2 Quant Fund

Designed as medium- to long-term high-yield products, Gate’s quantitative funds offer higher returns than traditional savings or fixed-income products, managed by top-tier asset management teams to diversify risk and help clients grow their wealth with minimal time commitment.

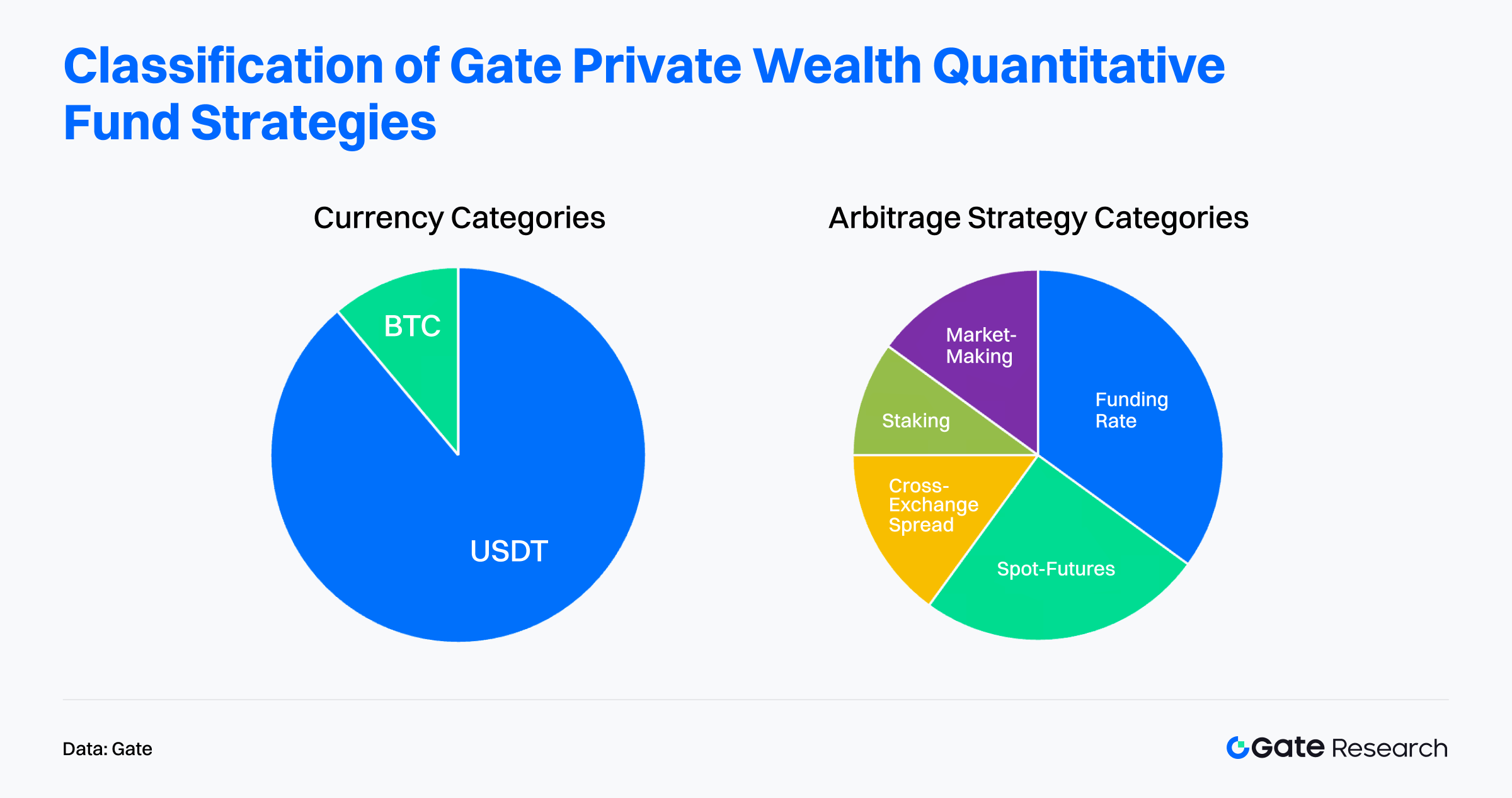

Gate’s quantitative funds primarily adopt market-neutral arbitrage strategies, effectively hedging against market volatility. Overall, they feature low risk, high returns, and full reserve transparency (100% proof of reserves).

3. October Performance of Gate Private Wealth Products

3.1 Overview of Gate Earn Performance in October

In October, Gate Earn maintained stable overall returns. Users holding USDT, BTC, and ETH also received additional bonus rewards from Gate. The annualized yield for USDT fluctuated between 2–5%, with an extra 9% annualized bonus offered by Gate, and new users eligible for up to 200% in additional rewards.

For the Dual Investment program, October’s volatile and declining market created favorable conditions for a “low-price buy-in” strategy. In periods of high implied volatility (IV), selling options generates higher yields, making this strategy especially effective.

By setting a lower target price and activating the auto-reinvestment feature, users can continuously operate a USDT-based low-buy cycle. If the target price is not reached, users still earn interest income in USDT, which compounds through reinvestment for sustainable yield growth.

If the low-buy order is executed, users purchase the target asset at a lower price, thereby reducing downside risk while still earning interest during the holding period — effectively balancing return and risk.

Regarding the Staking program, Gate launched several incentive campaigns in late September.

- The SOL staking bonus program went live, offering an additional ~10% yield on top of the base 6% annualized return for GTSOL through collaborations with multiple SOL DeFi ecosystem projects.

- Simultaneously, the GUSD minting reward campaign was introduced. The base annualized yield for GUSD—backed by real-world assets (RWAs) such as tokenized U.S. Treasuries—stood at 4.4%, with an additional 95.6% reward yield layered on top. GUSD is minted using USDT or USDC and serves as a yield-bearing certificate, with its returns primarily sourced from Gate ecosystem revenues, RWA-based Treasury yields, and stablecoin-backed income-generating assets.

Overall, Gate’s wealth management products feature high flexibility in subscription and redemption, along with steady yields, offering clients an optimal balance between liquidity and returns.

3.2 Overview of Quant Fund Performance in October

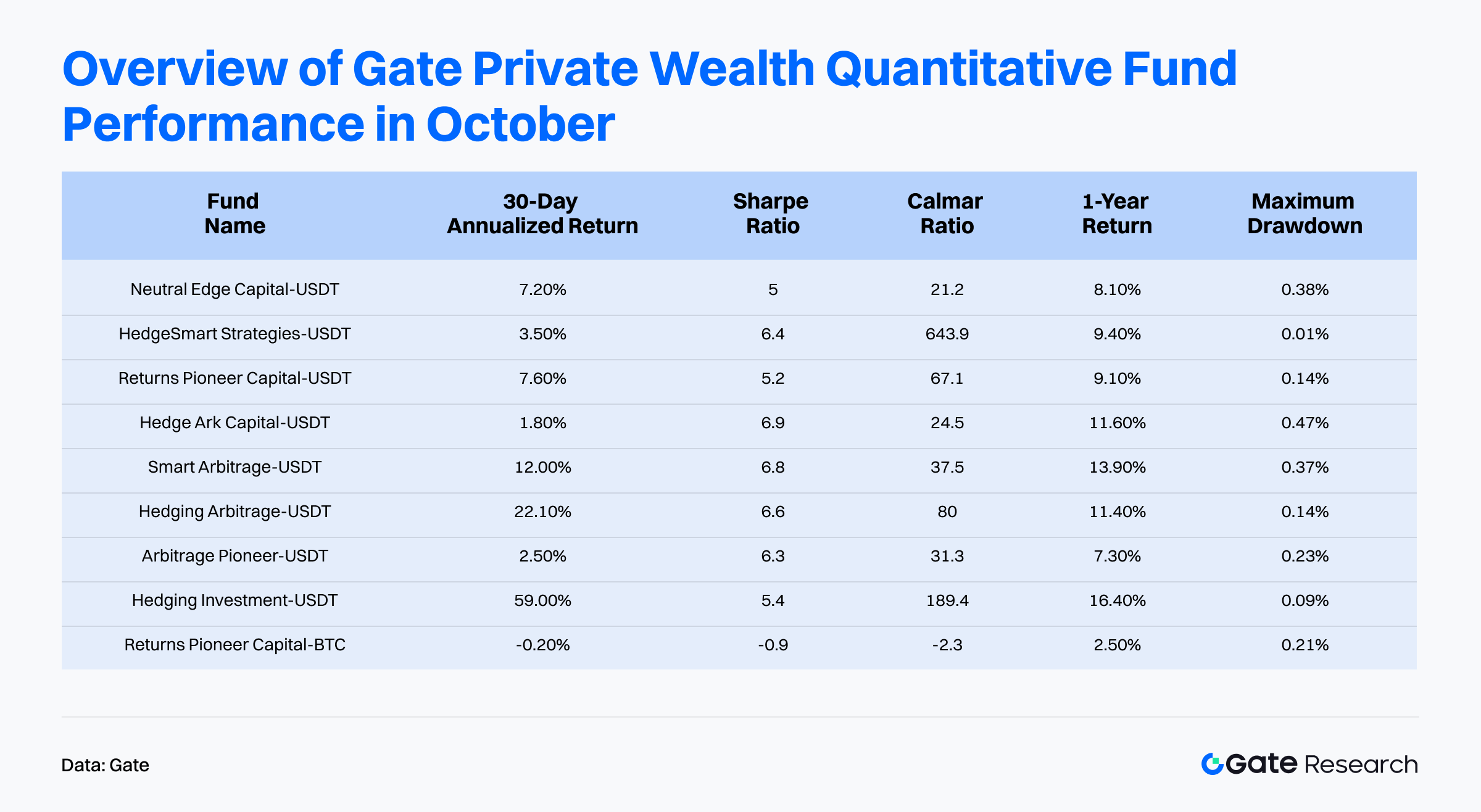

In October, all nine quantitative fund products available to Gate Private Wealth clients delivered stable and consistent performance. The fund managers primarily used USDT as the base currency due to its high liquidity, price stability, and security, as well as its greater flexibility in executing trading strategies.

From a strategic perspective, these products are centered around arbitrage strategies, with management teams typically operating multiple arbitrage mechanisms in parallel to diversify sources of return. These include spot–futures arbitrage, funding rate arbitrage, and cross-exchange spread arbitrage, among others.

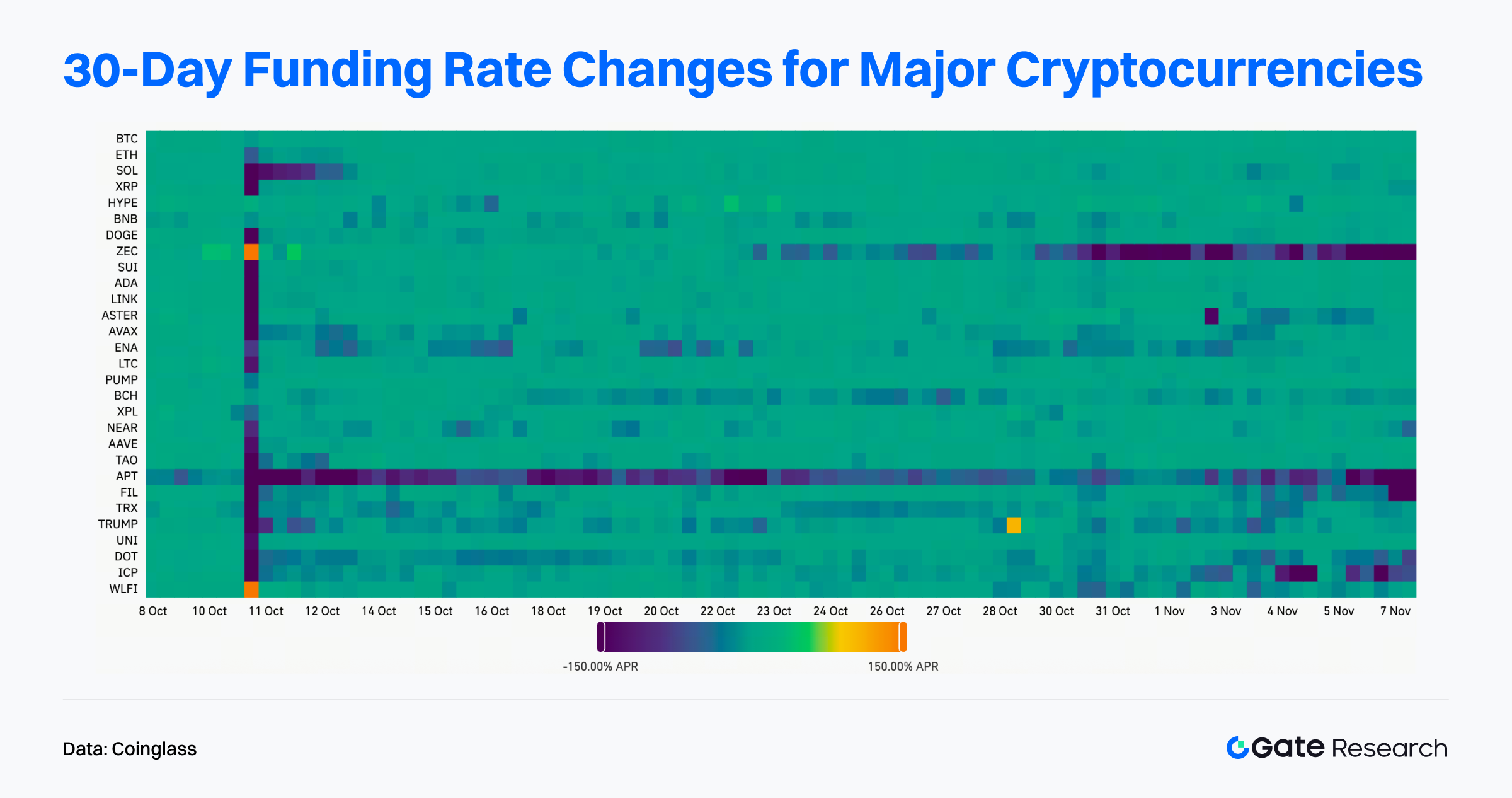

In terms of core yield indicators for arbitrage strategies, funding rates remained mostly positive throughout October, though early in the month, several major cryptocurrencies briefly saw negative funding rates, reflecting leveraged short positioning and a temporary oversold condition in the market. From mid to late October, funding rates gradually returned to neutral levels, market sentiment stabilized, and long-short positioning regained balance.

Meanwhile, futures premium data showed that at the beginning of October, the basis rate for near-term contracts reached an annual high of around 1.3%, representing an ideal entry point for arbitrage positions. Entering at this level would have allowed investors to lock in approximately 5.3% annualized returns. Overall, by employing a “long spot + short perpetual futures” strategy, managers not only captured positive funding rate income but also earned additional returns from the convergence of spot–futures price spreads.

From a performance standpoint, USDT and BTC strategies recorded annualized returns of 14.5% and -0.2%, respectively, demonstrating consistent strategy performance.

The 180-day Sharpe ratios were generally above 5, indicating strong risk-adjusted returns. Historical maximum drawdowns were typically below 0.5%, while Calmar ratios were significantly higher than those of market beta strategies, underscoring the funds’ ability to achieve superior returns under strict risk control. Overall, the funds exhibited high stability and robust defensive risk management capabilities.

3.2.1 Stratified Performance Analysis

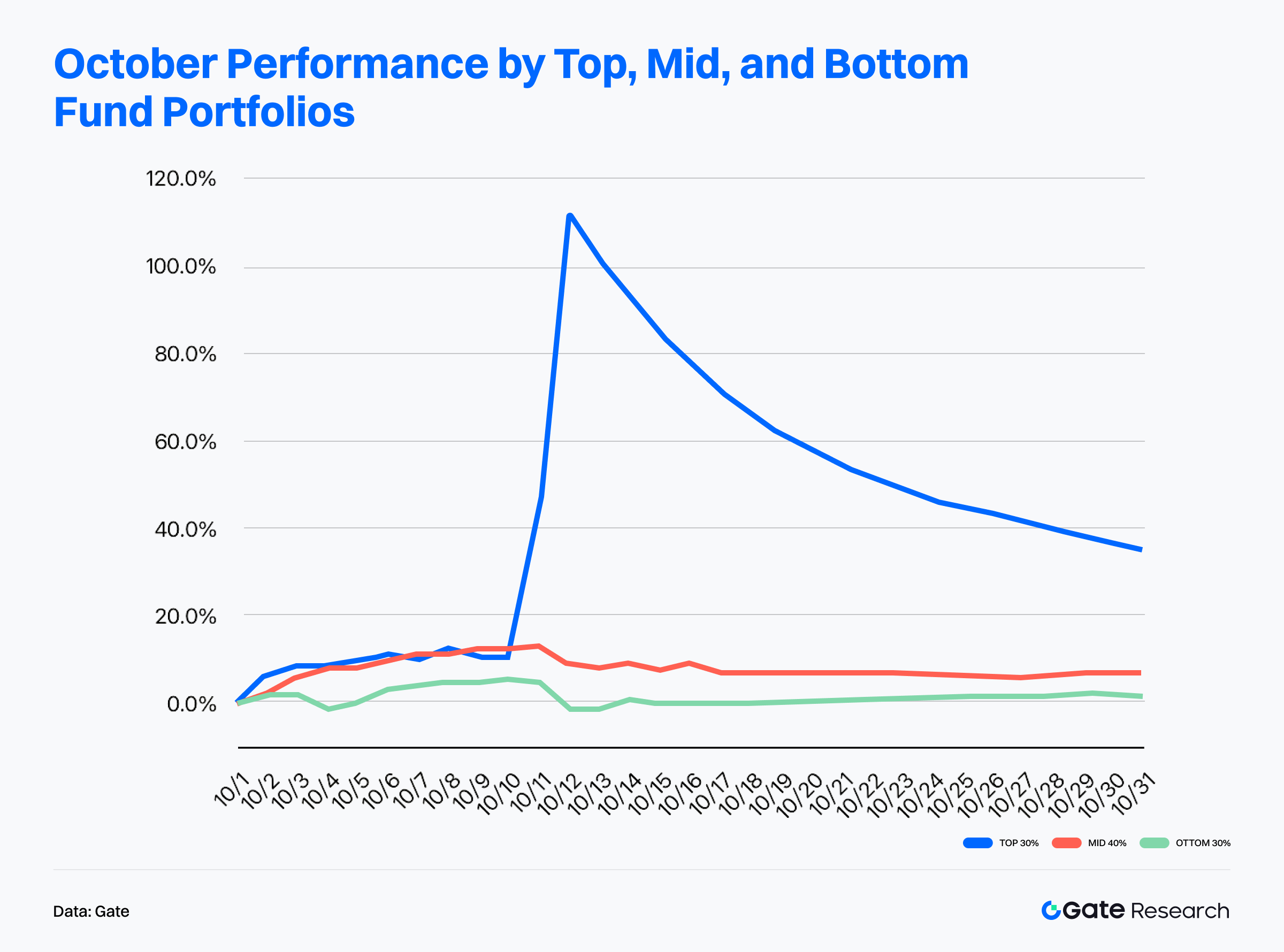

All quantitative fund products were categorized by monthly returns into three groups: Top 30% Best-Performing Fund Portfolio, Mid 40% Moderately Performing Portfolio, and Bottom 30% Lagging Portfolio. After fitting their respective NAV trends, the results show:

Despite major cryptocurrencies experiencing overall downward fluctuations in October, the Top 30% portfolio achieved an impressive annualized return of 35.4%, significantly outperforming Bitcoin. The Mid 40% portfolio recorded an annualized return of 6.3%, exceeding the 10-year U.S. Treasury yield (4.14%). Even the Bottom 30% portfolio maintained a positive annualized return of 1.6%, reflecting robust and volatility-resistant strategy performance overall.

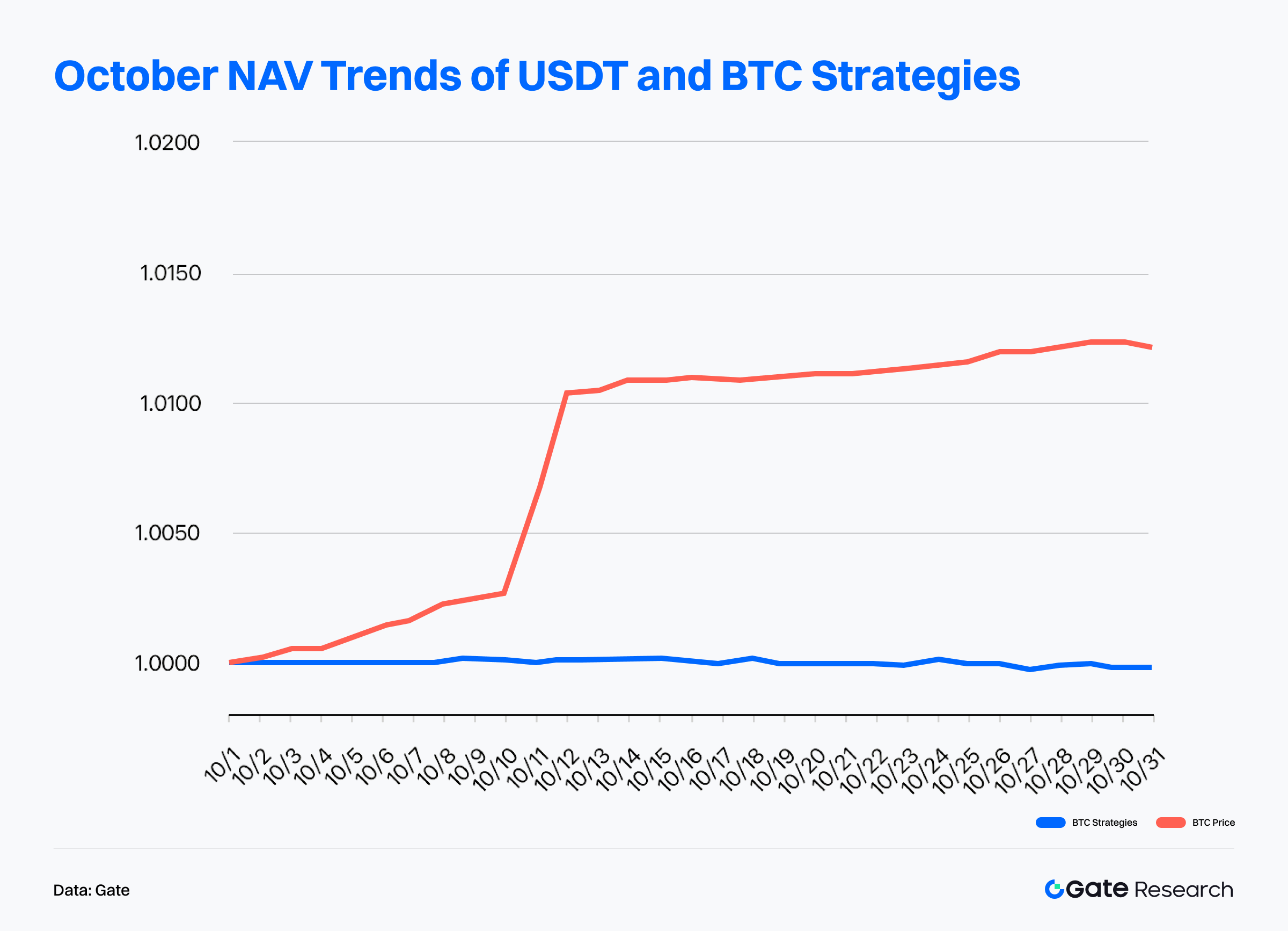

From a base currency perspective, by fitting all fund NAVs under the USDT and BTC strategies into two representative indices, it is clear that USDT-based strategies maintained steady upward performance throughout October. During mid-month, NAVs rose notably and remained resilient even amid end-of-month market pullbacks, showing no significant drawdown. Overall, USDT strategies outperformed BTC strategies, demonstrating stronger volatility resistance and more stable returns

When compared with Bitcoin’s price trend, USDT strategies stood out with an average annualized return of 14.5% in October. Notably, Hedging Investment–USDT delivered exceptional performance—achieving a 5% positive return even as Bitcoin dropped over 5.5% during the month, showcasing its strong anti-volatility capability. The product recorded an annualized return of 59% in October and a 1-year return of 16.4%, ranking first among all quantitative products.

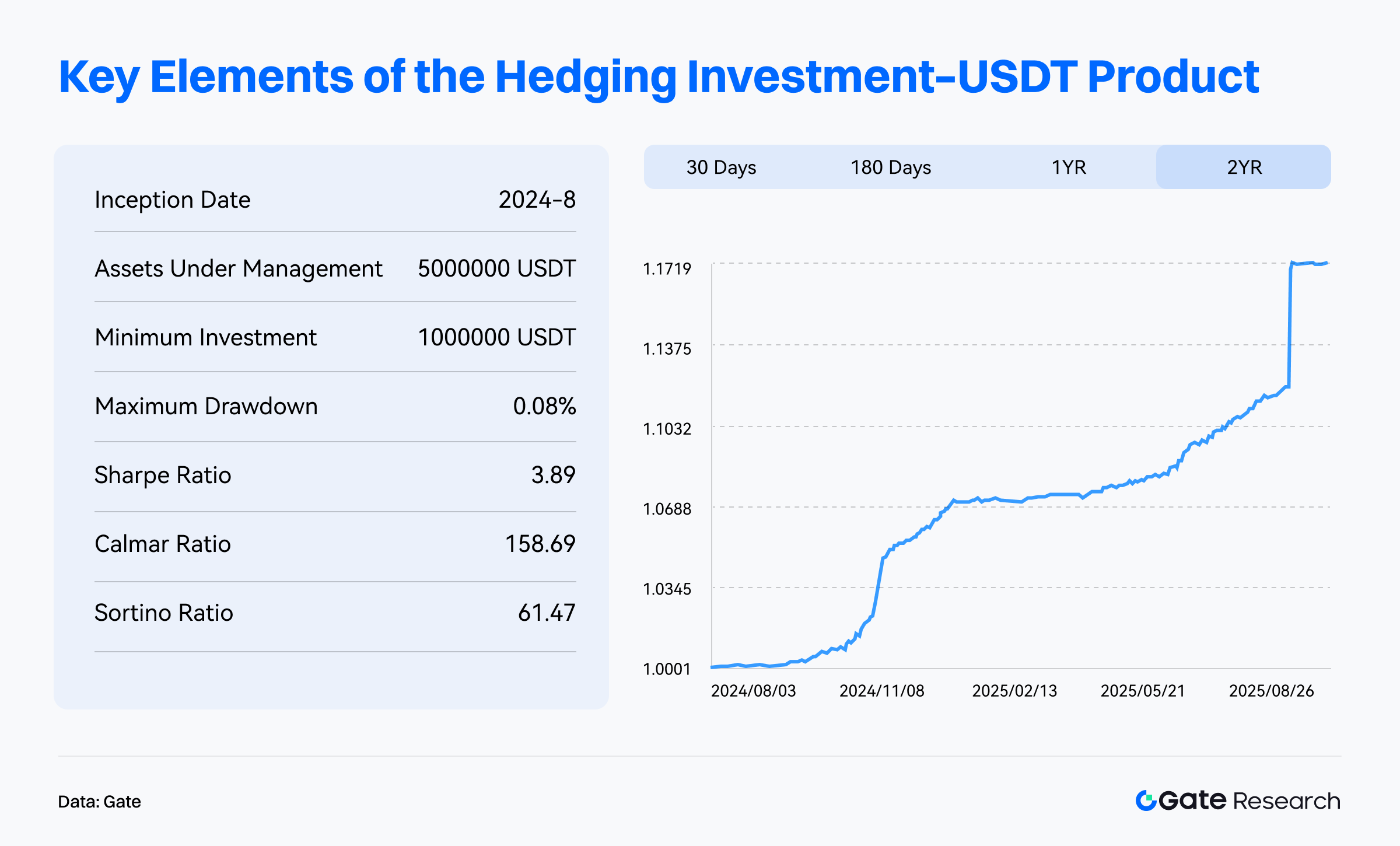

The Hedging Investment–USDT strategy primarily employs futures-spot arbitrage, funding rate arbitrage, and market-making arbitrage mechanisms to capture low-risk price spreads across markets and deliver high returns. Over the past two years, the strategy has maintained stable growth, with a Sharpe ratio of 3.89 and a maximum historical drawdown of only 0.08%. Its core team members are graduates of world-renowned universities and have held positions at leading global investment institutions, bringing deep expertise in quantitative research and risk management—making it ideal for investors seeking steady appreciation and diversified asset allocation.

3.2.2 Strategy Drawdown Curve Analysis

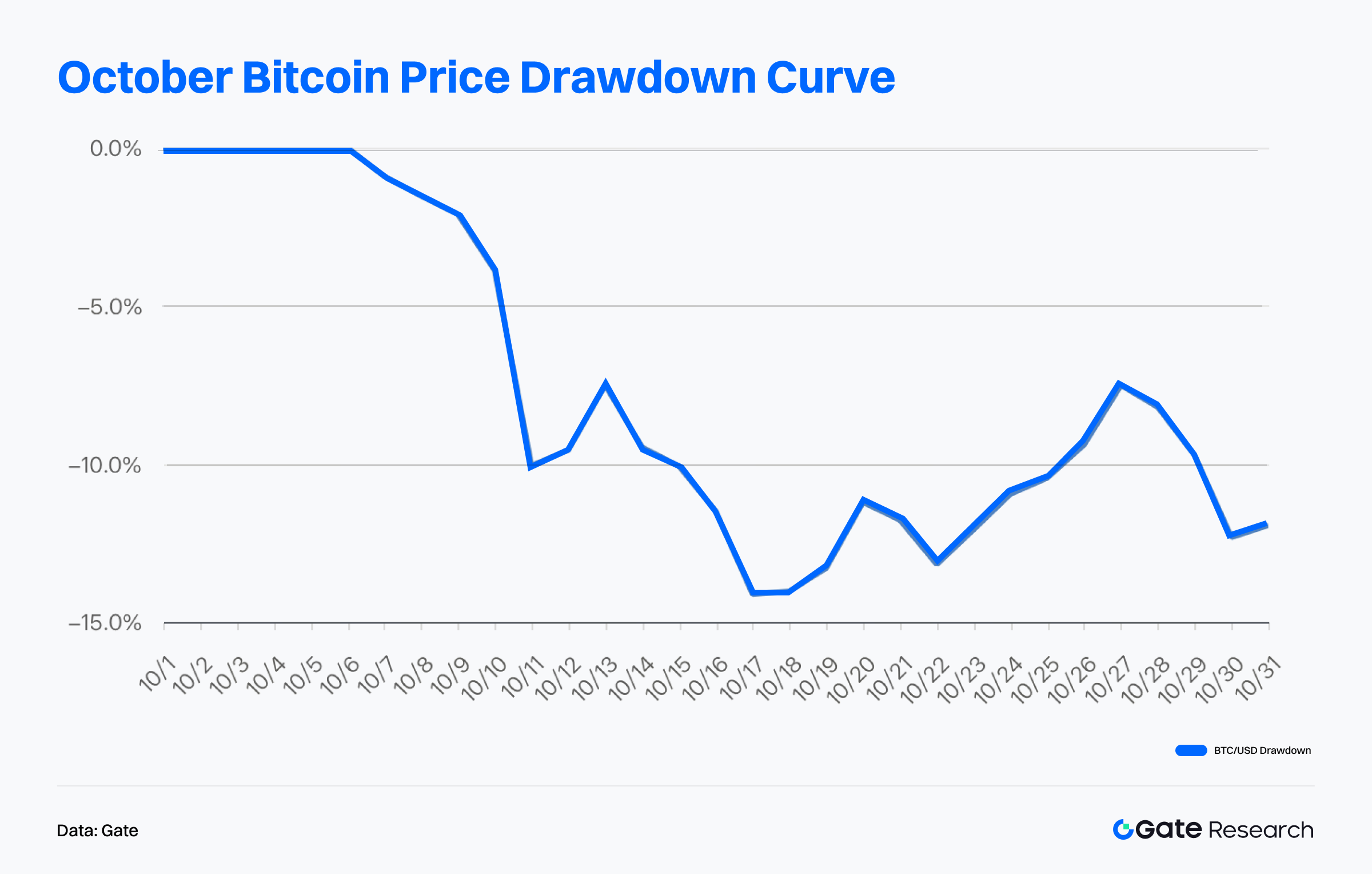

In October, the overall drawdown level of Gate’s quantitative funds remained low. The maximum drawdown for USDT strategies was only 0.01%, and for BTC strategies, 0.03%, demonstrating excellent risk control. In contrast, due to macro policy uncertainty and geopolitical events, Bitcoin’s maximum monthly drawdown once expanded to 14.1%. Although market sentiment improved temporarily in late October, narrowing Bitcoin’s losses to around 7.5%, risk appetite weakened again toward the end of the month, leaving the overall monthly drawdown at approximately 12%.

Overall, during October’s volatile market, Gate’s quantitative funds achieved a rare combination of steady growth and minimal drawdown through rigorous risk management systems and diversified arbitrage strategies. From the perspectives of return distribution, asset allocation, and drawdown control, the funds significantly outperformed the market’s beta performance, offering investors a portfolio choice that balances both security and returns.

4. Market Outlook

Looking ahead to November, macro liquidity conditions and policy expectations will continue to dominate market direction. On one hand, falling U.S. Treasury yields and a weaker dollar have provided temporary relief for the crypto market, though volatility remains high. On the other hand, while October marked the end of a three-year quantitative tightening cycle, financing pressures are still accumulating. The Secured Overnight Financing Rate (SOFR), which reflects Treasury-backed borrowing costs, has surged recently, suggesting that mounting money market stress could compel central banks to intervene to support liquidity — potentially setting the stage for a market rebound.

In the short term, the crypto market is likely to maintain a “high-volatility, low-trend” consolidation pattern. If economic indicators such as employment and inflation continue to decline, expectations for a December rate cut may resurface, providing a short-term boost to risk assets. Meanwhile, on-chain capital structures are expected to improve further, with net inflows of stablecoins and ongoing accumulation by spot ETFs potentially serving as key market support factors.

Additionally, several structural opportunities are emerging — particularly in AI, DePIN, and payment & digital identity sectors — which may attract focused capital inflows during periods without a clear market narrative.

References:

- Gate, https://www.gate.com/private-wealth

- Gate, https://www.gate.com/institution/quant-fund

- Gate, https://www.gate.com/crypto-market-data/market-sentiment/fear-and-greed-index/btc

- TradingView, https://www.tradingview.com/chart/mfJYpxo7/?symbol=CRYPTO%3AETHUSD

- Coinglass, https://www.coinglass.com/Basis

- Coinglass, https://www.coinglass.com/FundingRateHeatMap

- Coinglass, https://www.coinglass.com/today

- CoinMarketCap, https://coinmarketcap.com/etf/

- Brave Newcoin, https://bravenewcoin.com/insights/ethereum-eth-price-prediction-ethereum-set-for-6500-rally-following-technical-bounce-at-3800

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Perpetual Contract Funding Rate Arbitrage Strategy in 2025

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market