Ethena USDe (USDE) iyi bir yatırım mı?: Bu yeni stablecoin’in potansiyeli ve riskleri üzerine analiz

Giriş: Ethena USDe (USDE) Yatırım Durumu ve Piyasa Beklentileri

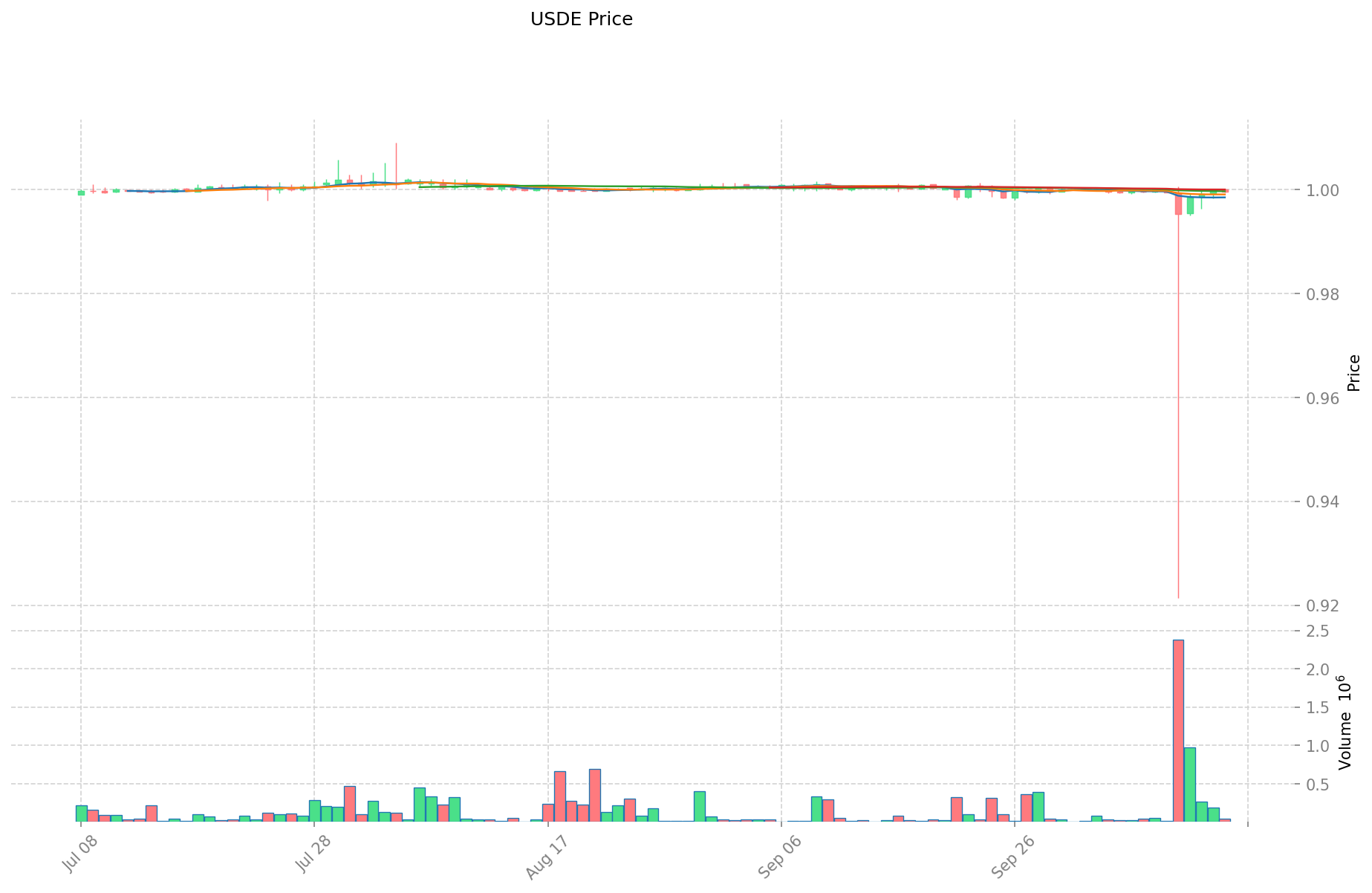

USDE, kripto para dünyasında öne çıkan bir varlık olarak, piyasaya sürülmesinden itibaren stabilcoin sektöründe kayda değer başarılara imza atmıştır. 2025 yılı itibarıyla USDE, 12.496.971.493 $ piyasa değerine, yaklaşık 12.503.223.105 token dolaşımdaki arza ve yaklaşık 0,9995 $ seviyesinde bir fiyata sahiptir. “Sansür direncine sahip, ölçeklenebilir ve kripto tabanlı ilk istikrarlı para çözümü” olarak konumlanan USDE, “Ethena USDe (USDE) iyi bir yatırım mı?” sorusunu düşünen yatırımcıların ilgisini giderek daha fazla çekmektedir. Bu yazıda, USDE’nin yatırım değerini, tarihsel seyrini, gelecek fiyat tahminlerini ve yatırım risklerini kapsamlı biçimde analiz ederek yatırımcılar için bir referans sunulacaktır.

I. Ethena USDe (USDE) Fiyat Geçmişi ve Güncel Yatırım Değeri

USDE Tarihsel Fiyat Eğilimleri ve Yatırım Getirileri (Ethena USDe(USDE) yatırım performansı)

- 2024: Ethena USDe’nin piyasaya çıkışı → İlk yatırımcı getirileri farklılık gösterdi

- 2025: Piyasa dalgalanmaları → USDE fiyatında oynaklık görüldü

Güncel USDE Yatırım Piyasa Durumu (Ekim 2025)

- USDE güncel fiyat: 0,9995 $

- 24 saatlik işlem hacmi: 33.043,54 $

- Dolaşımdaki arz: 12.503.223.105 USDE

- Piyasa değeri: 12.496.971.493 $

Gerçek zamanlı USDE piyasa fiyatını görmek için tıklayın

II. Ethena USDe (USDE) Yatırımının Cazibesini Belirleyen Temel Faktörler

Arz Mekanizması ve Kıtlık (USDE yatırımı açısından kıtlık)

- Tam teminatlandırılmış ve zincir üstü şeffaf yönetim → Fiyatı ve yatırım değerini etkiler

- Geçmişte: Arz değişimleri USDE fiyat istikrarına katkı sağladı

- Yatırım önemi: Kıtlık, uzun vadeli yatırım için kritik bir unsur

Kurumsal Yatırım ve Ana Akım Benimseme (USDE’ye kurumsal yatırım)

- Kurumsal elde tutma eğilimi: Sınırlı veri bulunuyor

- Önde gelen şirketler tarafından benimsenmesi → Yatırım değerini artırıyor

- Ulusal politikaların USDE’nin yatırım perspektifine etkisi

Makroekonomik Koşulların USDE Yatırımına Etkisi

- Para politikası ve faiz oranı değişiklikleri → Yatırım cazibesini etkiler

- Enflasyonist ortamlarda koruma işlevi → “Dijital dolar” konumu

- Jeopolitik belirsizlikler → USDE’ye olan talebi artırabilir

Teknoloji ve Ekosistem Gelişimi (USDE yatırımı için teknoloji ve ekosistem)

- Delta-hedging ile stake edilmiş Ethereum teminatı: Ağ performansını iyileştirir → Yatırım cazibesini artırır

- Serbest bileşenlik: Ekosistemin uygulama alanlarını genişletir → Uzun vadeli değeri destekler

- DeFi uygulamaları yatırım değerini yükseltiyor

III. USDE Gelecek Yatırım Tahminleri ve Fiyat Beklentileri (Ethena USDe(USDE) 2025-2030 arasında yatırıma değer mi?)

Kısa Vadeli USDE Yatırım Beklentisi (2025)

- Ihtiyatlı tahmin: 0,95 $ - 1,00 $

- Tarafsız tahmin: 0,99 $ - 1,01 $

- İyimser tahmin: 1,00 $ - 1,05 $

Orta Vadeli Ethena USDe(USDE) Yatırım Tahmini (2027-2028)

- Piyasa görünümü: İstikrar ve potansiyel büyüme

- Yatırım getirisi tahmini:

- 2027: 1,00 $ - 1,40 $

- 2028: 1,25 $ - 1,57 $

- Ana katalizörler: DeFi’de yaygın kullanım, piyasa istikrarının artması

Uzun Vadeli Yatırım Beklentisi (USDE uzun vadede iyi bir yatırım mı?)

- Temel senaryo: 1,50 $ - 2,00 $ (Dengeli büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 2,00 $ - 2,50 $ (Geniş çaplı benimseme ve olumlu piyasa koşullarıyla)

- Riskli senaryo: 0,80 $ - 1,20 $ (Yoğun piyasa dalgalanması veya düzenleyici baskı durumunda)

USDE’nin uzun vadeli yatırım ve fiyat tahminini görmek için tıklayın: Fiyat Tahmini

2025-10-15 - 2030 Uzun Vadeli Beklenti

- Temel senaryo: 1,50 $ - 2,00 $ (Düzenli ilerleme ve ana akım uygulamalarda iyileşme)

- İyimser senaryo: 2,00 $ - 2,68 $ (Kapsamlı benimseme ve olumlu piyasa koşulları)

- Dönüştürücü senaryo: 3,00 $ üzeri (Ekosistemde atılım ve ana akım popülarite gerçekleşirse)

- 2030-12-31 tahmini zirve: 2,68 $ (İyimser gelişme senaryosuna göre)

Yasal Uyarı: Bu tahminler öngörü niteliğindedir ve finansal tavsiye olarak görülmemelidir. Kripto para piyasaları son derece dalgalı ve öngörülemezdir. Her zaman yatırım öncesi kendi araştırmanızı yapmanız gerekmektedir.

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1,25937 | 0,9995 | 0,729635 | 0 |

| 2026 | 1,6715638 | 1,129435 | 0,91484235 | 13 |

| 2027 | 1,736619256 | 1,4004994 | 1,12039952 | 40 |

| 2028 | 2,16461187264 | 1,568559328 | 1,2548474624 | 56 |

| 2029 | 2,0719100163552 | 1,86658560032 | 1,3439416322304 | 86 |

| 2030 | 2,678177019339136 | 1,9692478083376 | 1,358780987752944 | 97 |

IV. USDe Yatırım Yöntemleri

USDe Yatırım Stratejisi

- USDe elde tutmak (HODL): İstikrarlı kripto varlık arayan muhafazakar yatırımcılar için uygundur

- Aktif al-sat: Teknik analiz ve kısa vadeli fiyat hareketlerine dayalıdır

USDe Yatırımında Risk Yönetimi

- Varlık dağılım oranı:

- Muhafazakar: Portföyün %5-10’u

- Saldırgan: Portföyün %15-25’i

- Profesyonel: Uygun risk yönetimiyle portföyün %40’ına kadar

- Riskten korunma: Birden fazla stabilcoin ve geleneksel varlıkla çeşitlendirme

- Güvenli saklama: Güvenilir borsalar tercih edilmeli, yüksek meblağlar için donanım cüzdanları değerlendirilmelidir

V. Stabilcoin Yatırımının Riskleri

- Piyasa riski: Denge kaybı (depegging) olasılığı

- Düzenleyici risk: Farklı ülkelerde stabilcoin regülasyonları konusundaki belirsizlik

- Teknik risk: Akıllı sözleşme açıkları, delta-hedging mekanizmasında sorunlar

VI. Sonuç: USDe İyi Bir Yatırım mı?

- Yatırım değeri özeti: USDe, stake edilmiş Ethereum teminatının delta-hedging ile yönetilmesi sayesinde stabilcoin piyasasında özgün bir yaklaşım sunuyor; bu yapı uzun vadeli istikrar ve sansür direnci potansiyeli sağlar.

- Yatırımcıya öneriler: ✅ Yeni başlayanlar: Küçük oranlarla başlayıp teknolojiyi anlamaya odaklanmalı ✅ Deneyimli yatırımcılar: USDe’yi çeşitlendirilmiş bir stabilcoin portföyüne dahil etmeli ✅ Kurumsal yatırımcılar: USDe’yi hazine yönetimi stratejilerine entegre etme olasılığını değerlendirmeli

⚠️ Uyarı: Kripto para yatırımları yüksek risk içerir. Bu makale yalnızca bilgilendirme amaçlıdır, yatırım tavsiyesi değildir.

VII. SSS

S1: Ethena USDe (USDE) nedir ve diğer stabilcoin’lerden farkı nedir? C: Ethena USDe (USDE), sansür direncine sahip, ölçeklenebilir ve istikrarlı bir stabilcoin’dir. Stake edilmiş Ethereum teminatı ve delta-hedging mekanizmasıyla geleneksel itibari para teminatlı veya algoritmik stabilcoin’lerden ayrılır.

S2: USDE, 2025’te iyi bir yatırım mı? C: Ekim 2025 itibarıyla USDE, yaklaşık 0,9995 $ ile istikrar göstermektedir. Dijital bir stabil varlık olarak potansiyel sunar; ancak yatırımcılar risk seviyelerini dikkate almalı ve kapsamlı araştırma yapmalıdır.

S3: USDE’ye yatırım yapmanın başlıca riskleri nelerdir? C: Başlıca riskler; piyasa riski (denge kaybı), düzenleyici risk (belirsiz stabilcoin regülasyonları) ve teknik risk (akıllı sözleşme açıkları veya delta-hedging mekanizmasında sorunlar) olarak öne çıkar.

S4: USDE’ye nasıl yatırım yapabilirim? C: USDE, tokeni listeleyen kripto para borsalarında satın alınarak yatırım yapılabilir. Yatırım stratejileri arasında USDe’yi istikrarlı bir varlık olarak tutmak veya piyasa hareketlerine göre aktif işlem yapmak bulunur.

S5: USDE için uzun vadeli fiyat tahmini nedir? C: 2030 yılına kadar USDE için temel senaryo 1,50 $ - 2,00 $; iyimser senaryo ise 2,00 $ - 2,68 $ aralığındadır. Ancak bu tahminler öngörüye dayalıdır ve yatırım tavsiyesi teşkil etmez.

S6: Portföyümden ne kadarını USDE’ye ayırmalıyım? C: Dağılım, risk tercihinize bağlıdır. Muhafazakar yatırımcılar portföylerinin %5-10’unu, daha agresif yatırımcılar %15-25’ini ayırabilir. Profesyonel yatırımcılar uygun risk yönetimiyle %40’a kadar ayırabilir.

S7: Gelecekte USDE’nin benimsenmesini ve değerini hangi faktörler etkileyebilir? C: DeFi uygulamalarında daha yaygın kullanım, piyasa istikrarının artması, kurumsal benimseme ve belirli ekonomik ortamlarda enflasyona karşı koruma işlevi USDE’nin benimsenmesi ve değerini artırabilecek başlıca unsurlardır.

Dai (DAI) iyi bir yatırım mı?: Lider Stablecoin'in İstikrarı ve Potansiyelinin Değerlendirilmesi

2025 USDE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Dinamiklerinin Analizi

2025 DAI Fiyat Tahmini: Stablecoin, Piyasa Dalgalanmaları Karşısında Sabit Değerini Koruyabilecek mi?

2025 RAI Fiyat Tahmini: Reflexer Token’ın Potansiyel Büyümesi ve Piyasa Faktörlerinin Analizi

crvUSD (CRVUSD) yatırım için uygun mu?: Curve’ün stablecoin’inin potansiyeli ve riskleri üzerine analiz

2025 COOK Fiyat Tahmini: Merkeziyetsiz Finans Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak