2025 RAI Fiyat Tahmini: Reflexer Token’ın Potansiyel Büyümesi ve Piyasa Faktörlerinin Analizi

Giriş: RAI'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Rai Reflex Index (RAI), sabit değere endekslenmemiş, ETH teminatlı bir stabil varlık olarak 2021 yılından bu yana DeFi sektöründe önemli bir ivme kazanmıştır. 2025 yılı itibarıyla RAI'nin piyasa değeri 2.784.229 $ seviyesine ulaşmış olup, dolaşımdaki token adedi yaklaşık 613.942 ve fiyatı 4,535 $ civarındadır. "ETH teminatlı stabilcoin" olarak da adlandırılan bu varlık, merkeziyetsiz finans ve stabil varlık yönetimi alanında giderek daha kritik bir pozisyon edinmektedir.

Bu makalede, RAI'nin 2025-2030 yılları arasındaki fiyat hareketleri; tarihsel trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında incelenerek yatırımcılar için profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. RAI Fiyat Geçmişi ve Güncel Piyasa Durumu

RAI Fiyat Geçmişinin Seyri

- 2021: RAI, 17 Şubat’ta piyasaya sürüldü; ilk fiyatı yaklaşık 3,38 $ oldu

- 2023: 8 Ekim’de tüm zamanların en düşük seviyesi olan 2,44 $ görüldü

- 2025: 25 Ağustos’ta rekor seviye olan 5,8 $’a ulaştı

RAI Güncel Piyasa Görünümü

14 Ekim 2025 tarihinde RAI, 4,535 $ seviyesinden işlem görüyor. Token son bir ayda %205,58 oranında yüksek bir değer artışı kaydetti. Ancak kısa vadede düşüş yaşandı; son 24 saatte %4, son bir haftada %8,30 geriledi. Güncel fiyat, yaklaşık iki ay önceki 5,8 $’lık zirvenin %21,81 altında olsa da, en düşük tarihsel seviyenin %85,86 üzerinde.

RAI'nin piyasa değeri 2.784.229 $ ve kripto paralar arasında 2.153'üncü sırada. Toplam arz ve dolaşımdaki arz 613.942 RAI ve eşit. 24 saatlik işlem hacmi ise 21.070 $; bu rakam piyasa değerine göre likiditenin düşük olduğunu gösteriyor.

Güncel RAI piyasa fiyatını incelemek için tıklayın

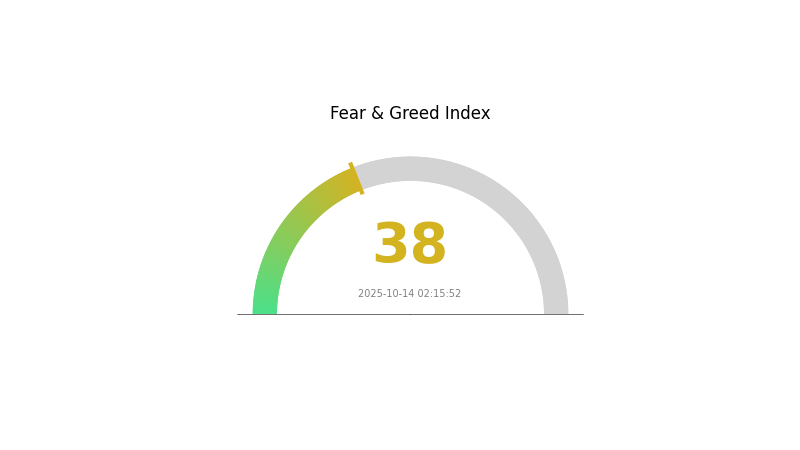

RAI Piyasa Duyarlılık Endeksi

14 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksini incelemek için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 38 seviyesinde. Bu, yatırımcıların temkinli davrandığını ve piyasa koşullarına karşı karamsar olduğunu gösteriyor. Bu gibi dönemlerde, yatırım kararlarını almadan önce kapsamlı araştırma yapmak ve temkinli davranmak önem taşır. Korku, bazı yatırımcılar için alım fırsatı sunabilir; ancak piyasaya iyi planlanmış bir strateji ve etkili risk yönetimiyle yaklaşmak gerekir. Piyasa duyarlılığı hızla değişebilir, bu nedenle güncel gelişmeleri takip edip stratejinizi buna göre revize etmelisiniz.

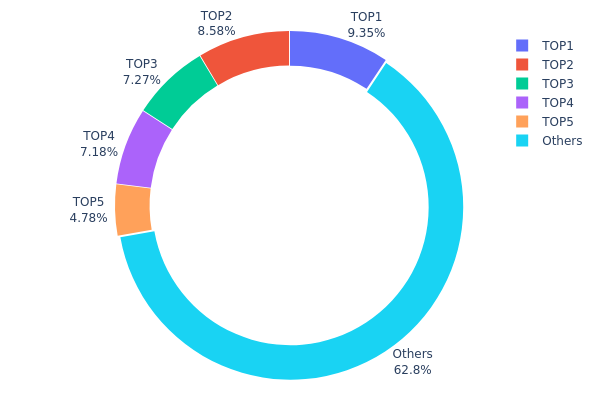

RAI Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, RAI tokenlerinin çeşitli adresler arasında nasıl bölündüğüne dair kritik bilgiler sunar. Analizler, en büyük sahipler arasında orta seviyede bir yoğunlaşma olduğunu gösteriyor. En büyük 5 adres toplam arzın %37,12’sini elinde bulundururken, en büyük tek adresin payı %9,34.

Bu dağılım, hiçbir adresin aşırı çoğunlukta token tutmadığını ve sahiplik yapısının dengeli olduğunu gösteriyor. Ancak üst sıralardaki sahiplerin varlığı, piyasa dinamiklerine etki edebilecek düzeyde. Kalan %62,88’lik token ise ilk 5 dışındaki adreslerde; bu, ekosistemde daha merkeziyetsiz bir yapı oluşturuyor.

Mevcut dağılım aşırı merkezileşme göstermese de, üst sıralardaki adreslerin varlıkları piyasa likiditesi ve fiyat dalgalanmasını etkileyebilir. Bu yapı, büyük transferlerin yakından izlenmesi gerekliliğine işaret ederken, aynı zamanda RAI ekosisteminin dayanıklılığını destekleyen çeşitli bir sahiplik tabanına işaret ediyor.

Güncel RAI Varlık Dağılımını incelemek için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xa9d1...1d3e43 | 57.380 | 9,34% |

| 2 | 0xc9bc...2a46af | 52.650 | 8,57% |

| 3 | 0x8ae7...48a3b1 | 44.660 | 7,27% |

| 4 | 0x535d...115270 | 44.060 | 7,17% |

| 5 | 0x752f...c7cafe | 29.340 | 4,77% |

| - | Diğerleri | 385.860 | 62,88% |

II. RAI'nin Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Algoritmik Stabilite: RAI, fiyat istikrarını korumak için algoritmik bir mekanizma uygular.

- Mevcut Etki: Arz değişimleri fiyatı en aza indirgemeye odaklanarak uzun vadeli istikrarı hedefler.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Bazı merkeziyetsiz finans (DeFi) protokolleri RAI’yi entegre etmiş olup, kurumsal ilginin artmasına zemin hazırlayabilir.

Makroekonomik Koşullar

- Enflasyona Karşı Koruma Özelliği: Stabilcoin alternatifi olarak RAI, enflasyon ortamlarında dikkat çekebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: RAI, borç verme ve alma platformları başta olmak üzere çeşitli DeFi uygulamalarında aktif olarak kullanılmaktadır.

III. 2025-2030 Dönemi RAI Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 4,26 $ - 4,53 $

- Tarafsız tahmin: 4,53 $ - 5,00 $

- İyimser tahmin: 5,00 $ - 5,62 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa aşaması: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 5,02 $ - 8,77 $

- 2028: 7,04 $ - 11,04 $

- Başlıca katalizörler: Benimseme artışı, teknolojik ilerlemeler ve genel kripto piyasa büyümesi

2030 Uzun Vadeli Görünüm

- Temel senaryo: 10,29 $ - 10,84 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 10,84 $ - 14,74 $ (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 14,74 $+ (olağanüstü piyasa koşulları ve yaygın benimseme)

- 2030-12-31: RAI 14,74 $ (iyimser tahmine göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 5,62836 | 4,539 | 4,26666 | 0 |

| 2026 | 7,01548 | 5,08368 | 3,8636 | 12 |

| 2027 | 8,77189 | 6,04958 | 5,02115 | 33 |

| 2028 | 11,04199 | 7,41073 | 7,0402 | 63 |

| 2029 | 12,45559 | 9,22636 | 7,19656 | 103 |

| 2030 | 14,74373 | 10,84098 | 10,29893 | 139 |

IV. RAI İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

RAI Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Yenilikçi DeFi varlıklarına ilgi duyan, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde RAI biriktirin

- Düzenli otomatik alımlar planlayın

- Güvenli, saklamasız cüzdanlarda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend takibi için 50 ve 200 günlük ortalamaları izleyin

- RSI (Göreli Güç Endeksi): Aşırı alım ve aşırı satım sinyalleri için kullanın

- Swing trade için ana noktalar:

- Destek ve direnç seviyelerini tespit edin

- RAI, ETH teminatlı olduğundan ETH fiyat değişimlerini takip edin

RAI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %15’e kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: RAI'yi diğer stabilcoinler ve klasik varlıklarla dengeleyin

- Stop-loss emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı seçeneği: Resmi Reflexer Finance cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü şifreler kullanın

V. RAI İçin Potansiyel Riskler ve Zorluklar

RAI Piyasa Riskleri

- Volatilite: Fiyat istikrarını sağlayan mekanizmalara rağmen RAI dalgalanmalar yaşayabilir

- Likidite riski: Sınırlı işlem çiftleri alım-satım kolaylığını azaltabilir

- ETH ile korelasyon: RAI'nin değeri Ethereum piyasasındaki hareketlerden etkilenebilir

RAI Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Stabilcoinlere yönelik denetimler artabilir

- Uluslararası kısıtlamalar: Farklı ülkelerde değişen yasal statü

- Uyum gereksinimi: Gelecekte DeFi protokolleri için KYC/AML düzenlemeleri gündeme gelebilir

RAI Teknik Riskler

- Akıllı kontrat açıkları: Protokoldeki açıklardan veya hatalardan kaynaklanabilecek riskler

- Oracle sorunları: Harici fiyat akışlarına bağımlılık doğruluk riskleri doğurabilir

- Ölçeklenebilirlik problemleri: Ethereum ağındaki yoğunluk, RAI işlemlerini etkileyebilir

VI. Sonuç ve Eylem Önerileri

RAI Yatırım Değerinin Değerlendirilmesi

RAI, stabilcoinlere yenilikçi bir yaklaşım getirmekte ve DeFi ekosisteminde uzun vadeli değer potansiyeli sunmaktadır. Ancak, deneysel yapısı ve karmaşık mekanizmaları nedeniyle kısa vadeli riskler barındırmaktadır.

RAI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Varlığın performansını anlamak için küçük miktarlarda yatırım yapın ✅ Tecrübeli yatırımcılar: RAI'yi çeşitlendirilmiş bir DeFi portföyünde değerlendirin ✅ Kurumsal yatırımcılar: RAI'yi ETH volatilitesine karşı koruma amacıyla analiz edin

RAI Katılım Yöntemleri

- Doğrudan alım: Gate.com üzerinden RAI satın alın

- Mint etme: Reflexer platformunda ETH teminatı ile token üretin

- Yield farming: RAI havuzlarında likidite sağlayarak getiri fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir; bu makaledeki bilgiler yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatle vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

2025 yılında kripto paralar için fiyat tahmini nedir?

Piyasa trendleri ve uzman analizlerine göre, kripto para piyasasının 2025’te ciddi bir büyüme göstermesi bekleniyor. Birçok analist, Bitcoin’in 100.000 $ - 150.000 $ seviyesine ulaşabileceğini ve büyük kripto paraların da önemli fiyat artışları kaydedebileceğini öngörüyor.

2030’da RARI kripto için fiyat tahmini nedir?

Piyasa trendleri ve potansiyel büyüme temelinde, RARI’nin 2030’da 50 $ - 75 $ seviyelerine çıkması; benimsemenin ve ekosistem gelişiminin etkisiyle mümkün olabilir.

RAI coin nedir?

RAI, sabit değere endekslenmemiş, ETH teminatlı bir stabilcoin’dir; algoritmik bir sistemle istikrarlı değer hedefler ve merkeziyetsiz stabilcoin alternatifi sunar.

2030’da Iris için fiyat tahmini nedir?

Piyasa trendleri ve potansiyel gelişim dikkate alındığında, Iris’in 2030’da 10 $ - 15 $ seviyelerine ulaşması ve kripto ekosisteminde ciddi benimseme ile teknolojik ilerlemeler göstermesi beklenmektedir.

Dai (DAI) iyi bir yatırım mı?: Lider Stablecoin'in İstikrarı ve Potansiyelinin Değerlendirilmesi

2025 USDE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Dinamiklerinin Analizi

2025 DAI Fiyat Tahmini: Stablecoin, Piyasa Dalgalanmaları Karşısında Sabit Değerini Koruyabilecek mi?

Ethena USDe (USDE) iyi bir yatırım mı?: Bu yeni stablecoin’in potansiyeli ve riskleri üzerine analiz

crvUSD (CRVUSD) yatırım için uygun mu?: Curve’ün stablecoin’inin potansiyeli ve riskleri üzerine analiz

2025 COOK Fiyat Tahmini: Merkeziyetsiz Finans Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak