2025 COOK Fiyat Tahmini: Merkeziyetsiz Finans Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: COOK’un Piyasadaki Konumu ve Yatırım Potansiyeli

Piyasadaki ilk tam dikey entegre staking ve yeniden staking protokolü olan mETH Protocol (COOK), kuruluşundan bu yana önemli ilerlemeler kaydetmiştir. 2025 yılı itibarıyla COOK’un piyasa değeri 15.230.400 $’a ulaşırken, dolaşımdaki arz yaklaşık 960.000.000 token ve fiyatı 0,015865 $ civarında seyretmektedir. “Sermaye verimliliği artırıcısı” olarak tanımlanan bu varlık, Ethereum staking ve getiri birikiminde giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, COOK’un 2025-2030 dönemi fiyat seyri; tarihsel fiyat hareketleri, arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler eşliğinde kapsamlı biçimde analiz edilerek, yatırımcılara profesyonel fiyat öngörüleri ile uygulamaya dönük yatırım stratejileri sunulacaktır.

I. COOK Fiyat Geçmişi ve Mevcut Piyasa Durumu

COOK Tarihsel Fiyat Seyri

- 2024: COOK, 9 Kasım 2024’te 0,04584 $ ile tüm zamanların en yüksek seviyesine ulaşarak kritik bir kilometre taşına imza atmıştır.

- 2025: Token, 20 Nisan 2025’te 0,0064 $ ile tarihindeki en düşük fiyatı görerek ciddi bir değer kaybı yaşamıştır.

- 2025: COOK, son 30 gün içinde fiyatında %46,56 artışla yeniden yükseliş eğilimi göstermiştir.

COOK Güncel Piyasa Durumu

06 Ekim 2025 tarihi itibarıyla COOK, 0,015865 $ fiyatla işlem görmektedir ve son 24 saatte %13,34 yükselmiştir. Token’ın piyasa değeri 15.230.400 $; tamamen seyreltilmiş değeri ise 79.325.000 $’dır. COOK’un dolaşımdaki arzı 960.000.000 olup, toplam arzın %19,2’sini (5.000.000.000) oluşturur. Son 24 saatteki işlem hacmi 128.613,22 $ seviyesindedir ve bu, piyasada orta düzeyde bir faaliyet olduğunu göstermektedir. COOK, son haftada %29,54 ve son ayda %46,56 artış ile kısa vadede güçlü performans sergileyerek yatırımcı ilgisinin ve piyasa iyimserliğinin arttığını göstermektedir.

Güncel COOK piyasa fiyatını görüntüleyin

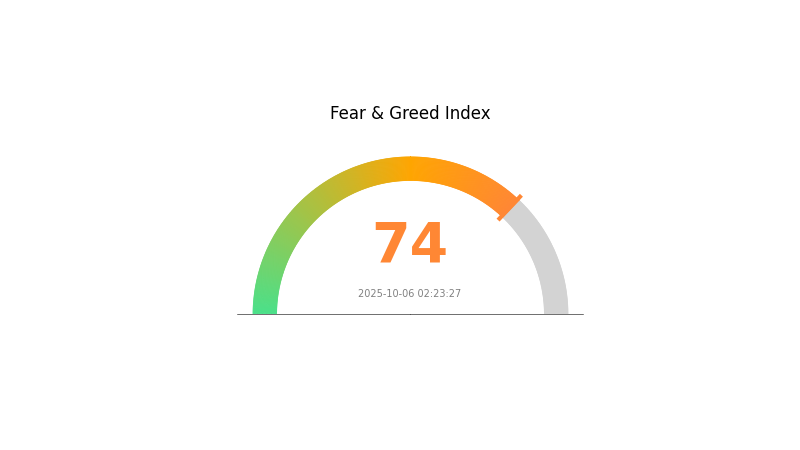

COOK Piyasa Duyarlılık Göstergesi

06 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi’ni inceleyin

Kripto para piyasasında açgözlülük hakim ve Korku ve Açgözlülük Endeksi 74 seviyesinde. Bu durum, yatırımcıların aşırı iyimser olduğunu ve piyasanın ısındığını gösteriyor. Boğa eğilimleri fiyatları yukarı çekebilir; ancak aşırı açgözlülük, profesyoneller için genellikle kâr realizasyonu veya pozisyon gözden geçirme sinyali olarak değerlendirilir. Her zaman olduğu gibi, detaylı analiz yapmak ve dengeli portföy yönetimi ile riskleri kontrol altında tutmak önemlidir.

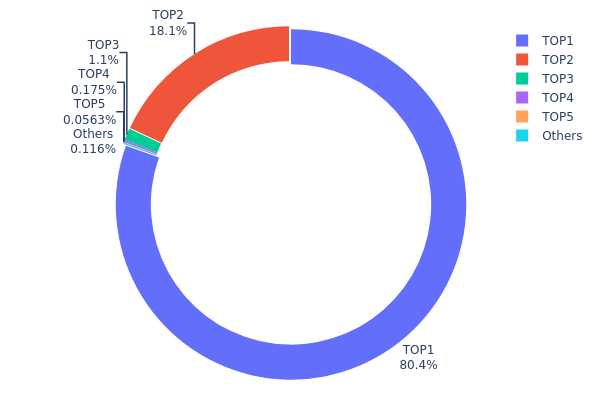

COOK Varlık Dağılımı

COOK’un adres bazlı varlık dağılımı, oldukça yoğunlaşmış bir sahiplik yapısına işaret etmektedir. En büyük adres toplam arzın %80,43’ünü yani 4.021.928,66K COOK tokenı elinde tutarken, ikinci adres %18,11’lik paya sahiptir. Bu iki cüzdan, tüm tokenların %98,54’ünü kontrol ederek aşırı merkeziyetçi bir yapı ortaya koymaktadır.

Böylesine yüksek yoğunlaşma, piyasa manipülasyonu ve fiyat dalgalanması riskini artırır. Tokenların neredeyse tamamının iki adreste olması, bu cüzdanlardan yapılacak işlemlerin COOK’un piyasa dinamiklerini ciddi şekilde etkileyebileceği anlamına gelir. Bu merkezileşme, düşük düzeyde merkeziyetsizlik göstermekte ve birçok kripto projesinin temel ilkeleriyle çelişebilir.

Mevcut sahiplik yapısı, küçük yatırımcılar için ek riskler doğurabilir ve piyasanın likiditesini etkileyebilir. Aynı zamanda, projenin yönetim ve karar süreçlerinde bu büyük sahiplerin belirleyici rol oynayabileceği anlamına gelir.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xc144...0bdca9 | 4.021.928,66K | 80,43% |

| 2 | 0x0035...20cb6a | 905.736,95K | 18,11% |

| 3 | 0xf89d...5eaa40 | 54.976,83K | 1,09% |

| 4 | 0x0d07...b492fe | 8.753,01K | 0,17% |

| 5 | 0x2943...970c40 | 2.814,47K | 0,05% |

| - | Diğerleri | 5.790,08K | 0,15% |

II. COOK’un Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Fiyat Tahmini: Gate.com tahminlerine göre COOK’un 2025 yılı ortalama fiyatı ¥0,000987; dalgalanma aralığı ise ¥0,0008587 ile ¥0,001075 arasında öngörülmektedir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: DeFi sektörü hızla gelişirken, COOK birçok rakiple yoğun bir rekabet ortamında yer almaktadır.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Kripto para olarak COOK’un fiyatı, genel piyasa oynaklığından etkilenebilir ve yatırımcıların dikkatli olması gerekmektedir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: COOK, yenilikçi finansal uygulamaları ve protokolleri ile bilinen DeFi ekosisteminde faaliyet göstermektedir.

III. COOK 2025-2030 Fiyat Tahminleri

2025 Görünümü

- Temkinli: 0,01146 $ - 0,01591 $

- Tarafsız: 0,01591 $ - 0,02053 $

- İyimser: 0,02053 $ - 0,02500 $ (güçlü piyasa ivmesi ile)

2027-2028 Görünümü

- Piyasa evresi: Büyüme potansiyeli

- Fiyat tahmini:

- 2027: 0,01192 $ - 0,02076 $

- 2028: 0,01199 $ - 0,02659 $

- Büyümenin ana tetikleyicileri: Benimsenme oranının artması, teknolojik ilerlemeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,02003 $ - 0,02748 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,02748 $ - 0,03351 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,03351 $ - 0,04000 $ (çığır açıcı yenilikler varsayımıyla)

- 31 Aralık 2030: COOK 0,03351 $ (potansiyel zirve)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,02053 | 0,01591 | 0,01146 | 0 |

| 2026 | 0,02022 | 0,01822 | 0,0164 | 14 |

| 2027 | 0,02076 | 0,01922 | 0,01192 | 21 |

| 2028 | 0,02659 | 0,01999 | 0,01199 | 25 |

| 2029 | 0,02748 | 0,02329 | 0,02003 | 46 |

| 2030 | 0,03351 | 0,02538 | 0,01675 | 59 |

IV. COOK Profesyonel Yatırım Stratejileri ve Risk Yönetimi

COOK Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli yatırımcılar ve Ethereum staking savunucuları

- Operasyon önerileri:

- Piyasa düşüşlerinde COOK biriktirin

- COOK tokenları mETH Protocol platformunda stake edin

- Tokenları güvenli, saklama hizmeti olmayan cüzdanlarda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için

- Relative Strength Index (RSI): Aşırı alım ve aşırı satım seviyelerini takip etmek için

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Ethereum staking getirilerini izleyin; COOK fiyatını etkileyebilir

- DeFi piyasasındaki genel duyarlılığı takip edin

COOK Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15’i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı DeFi protokollerine yatırım yapın

- Stop-loss emirleri: Zararları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik: İki faktörlü kimlik doğrulama kullanın, güçlü parolalar tercih edin

V. COOK Potansiyel Riskler ve Zorluklar

COOK Piyasa Riskleri

- Oynaklık: Kripto piyasasında yüksek fiyat dalgalanmaları

- Likidite: Büyük hacimli işlemlerde likidite kısıtları

- Rekabet: Yeni staking protokolleri COOK’un pazar payını etkileyebilir

COOK Düzenleyici Riskler

- Düzenleyici belirsizlik: DeFi protokolleri üzerinde değişen mevzuat etkisi

- Uyum zorlukları: Küresel düzenleyici standartlara uyumda potansiyel engeller

- Vergilendirme: Bazı ülkelerde staking ödüllerinin vergi statüsü belirsizdir

COOK Teknik Riskler

- Akıllı kontrat açıkları: Hatalar veya güvenlik açıkları riski

- Ölçeklenebilirlik sorunları: Ağ yükü arttığında performans düşebilir

- Birlikte çalışabilirlik: Zincirler arası entegrasyonda teknik zorluklar

VI. Sonuç ve Eylem Önerileri

COOK Yatırım Değeri Analizi

COOK, Ethereum staking ekosisteminde uzun vadeli büyüme potansiyeli sunan özgün bir projedir. Bununla birlikte, yatırımcılar kısa vadede yüksek oynaklık ve regülasyon belirsizliği risklerinin farkında olmalıdır.

COOK Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük yatırımla başlayın, staking süreçlerini öğrenin ✅ Deneyimli yatırımcılar: Portföyünüzde COOK’a pay ayırın, piyasa trendlerini yakından takip edin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, COOK’u çeşitlendirilmiş bir DeFi portföyünde değerlendirin

COOK İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden COOK token alıp satın

- Staking: mETH Protocol ile staking getirisi elde edin

- DeFi entegrasyonu: COOK token ile verim çiftçiliği fırsatlarını değerlendirin

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli ve profesyonel finans danışmanları ile görüşmelidir. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

COOK’un 2025 için hisse fiyatı tahmini nedir?

Mevcut projeksiyonlara göre COOK’un hisse fiyatı 2025’te ortalama 2,04 $’a ulaşabilir; potansiyel en yüksek değer 4,06 $ ve en düşük değer 0,02 $ olarak öngörülmektedir.

COOK iyi bir hisse mi?

COOK hissesi için görünüm karmaşıktır. Analistlerin %20’si kesin alım önerirken, çoğunluk elde tutmayı tavsiye etmektedir. Kendi risk toleransınızı ve yatırım hedeflerinizi değerlendirin.

COOK token için fiyat tahmini nedir?

COOK token fiyatı için 2025 sonunda 0,15 $, 2026’da 0,25 $, 2027’de 0,40 $ ve 2030’da 1 $ öngörülmektedir; bu tahminler piyasa analizleri ve büyüme trendlerine dayanmaktadır.

COOK için hedef fiyat nedir?

COOK için hedef fiyat 1,785 $’dır; Wall Street analistlerinin tahmin aralığı 1,263 $ ila 3,15 $ arasında değişmektedir.

Dai (DAI) iyi bir yatırım mı?: Lider Stablecoin'in İstikrarı ve Potansiyelinin Değerlendirilmesi

2025 USDE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Dinamiklerinin Analizi

2025 DAI Fiyat Tahmini: Stablecoin, Piyasa Dalgalanmaları Karşısında Sabit Değerini Koruyabilecek mi?

Ethena USDe (USDE) iyi bir yatırım mı?: Bu yeni stablecoin’in potansiyeli ve riskleri üzerine analiz

2025 RAI Fiyat Tahmini: Reflexer Token’ın Potansiyel Büyümesi ve Piyasa Faktörlerinin Analizi

crvUSD (CRVUSD) yatırım için uygun mu?: Curve’ün stablecoin’inin potansiyeli ve riskleri üzerine analiz

NFT İşlem Maliyetlerini Anlamak ve Azaltmak

Benzersiz NFT'ler oluşturmak için en iyi yapay zekâ araçlarını seçme rehberi

Bitcoin Analizi İçin Stock-to-Flow Modelinin Yeniden Ele Alınması

İşletmeler için En İyi Kripto Ödeme Çözümleri

NFT Değerini Açığa Çıkarmak: Nadirlik Puanları ve Değerlendirme Sürecinde Uzmanlaşmak