2025 TRX Fiyat Tahmini: TRON’un Yerel Kripto Parası İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Giriş: TRX’in Piyasadaki Konumu ve Yatırım Potansiyeli

TRON (TRX), merkeziyetsiz uygulamalar için önde gelen blokzincir platformlarından biri olarak, 2017’deki kuruluşundan bu yana sektörde önemli başarılara imza attı. 2025 yılı itibarıyla TRON’un piyasa değeri 31,9 milyar dolara ulaşmış, yaklaşık 94,66 milyar adet dolaşımdaki arzı ile fiyatı 0,33 dolar seviyesinde seyretmektedir. “Web 3.0 altyapısı” olarak bilinen bu varlık, merkeziyetsiz finans ve dijital içerik sunumunda giderek daha kritik bir rol üstlenmektedir.

Bu makalede, TRON’un 2025-2030 yılları arasındaki fiyat hareketleri; tarihsel performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında detaylı olarak incelenerek yatırımcılara profesyonel fiyat projeksiyonları ve uygulanabilir stratejiler sunulacaktır.

I. TRX Fiyat Geçmişi ve Güncel Piyasa Durumu

TRX’in Tarihsel Fiyat Gelişimi

- 2017: İlk çıkış, başlangıç fiyatı 0,00180434 dolar

- 2018: Boğa piyasası zirvesi, fiyat 0,30 dolara ulaştı

- 2019-2020: Konsolidasyon dönemi, fiyat 0,01-0,04 dolar aralığında dalgalandı

- 2021: Güçlü boğa sezonu, tüm zamanların en yüksek seviyesi olan 0,1791 dolara ulaşıldı

- 2022: USDD stabilcoin’in piyasaya sürülmesiyle fiyat 0,06-0,08 dolar aralığında dengelendi

- 2024: 4 Aralık’ta yeni rekor — 0,431288 dolar

TRX’in Güncel Piyasa Durumu

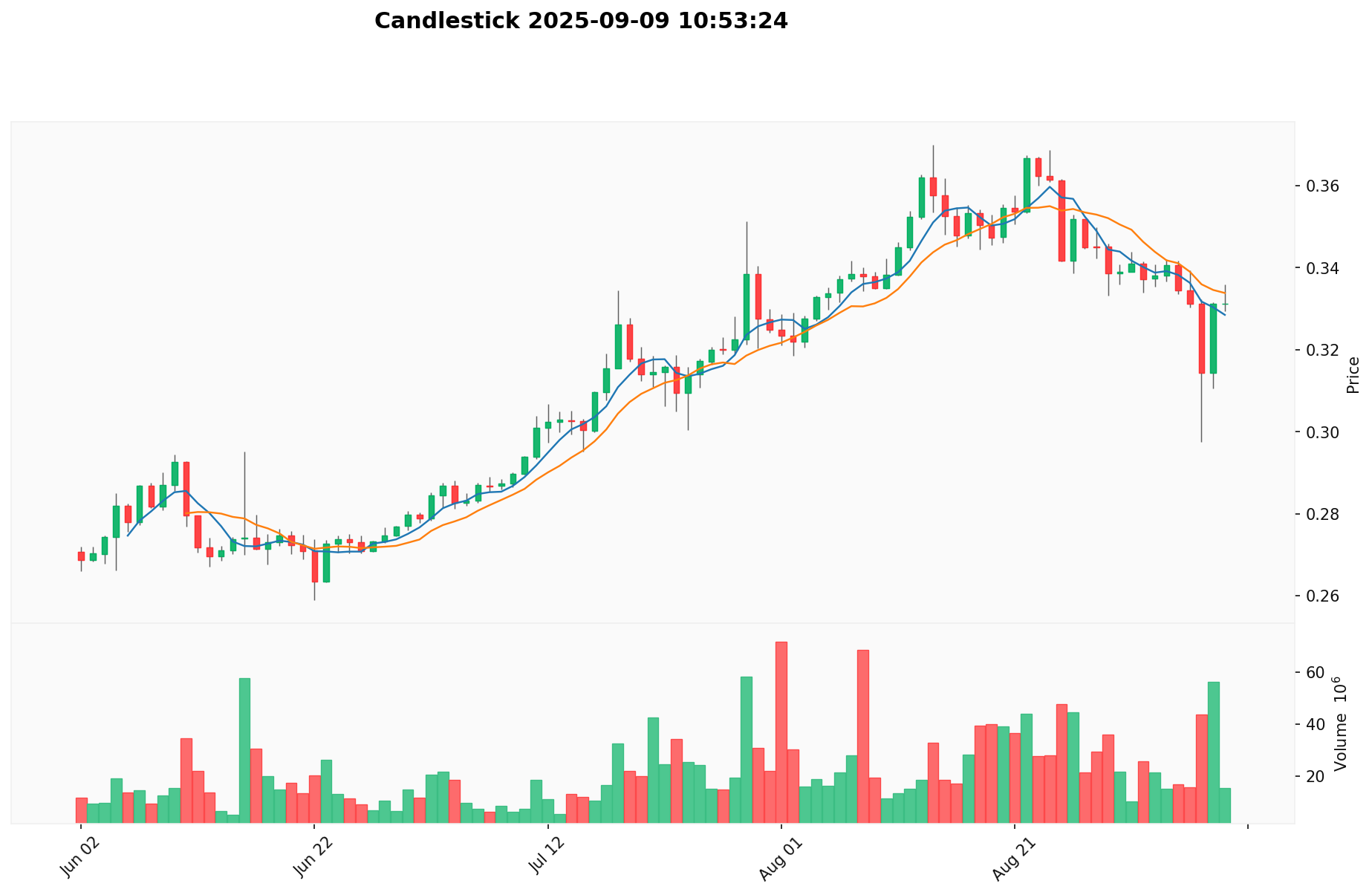

9 Eylül 2025 itibarıyla TRX 0,33707 dolardan işlem görüyor ve 31,91 milyar dolarlık piyasa değeriyle küresel kripto piyasasında 12. sırada yer alıyor. 24 saatlik işlem hacmi 6.061.732 dolar ile aktif piyasa hareketliliği gözleniyor. TRX, son 24 saatte %1,23 oranında değer kazanarak kısa vadeli yükseliş ivmesi gösterdi. Buna karşın son 7 gün ve 30 günlük performansta sırasıyla -%0,77 ve -%0,89’luk hafif gerileme mevcut olup, yakın zamanda aşağı yönlü baskı gözlemlendi. Mevcut fiyat, 4 Aralık 2024’teki zirve olan 0,431288 doların %21,85 altında; ancak 12 Kasım 2017’deki en düşük seviyesi olan 0,00180434 doların çok üzerindedir. Dolaşımdaki 94.663.831.418 TRX, toplam arzın %99,99’una denk gelerek tokenların neredeyse tamamının piyasada dolaştığını göstermektedir.

Güncel TRX piyasa fiyatına ulaşmak için tıklayın

TRX Piyasa Duyarlılığı Endeksi

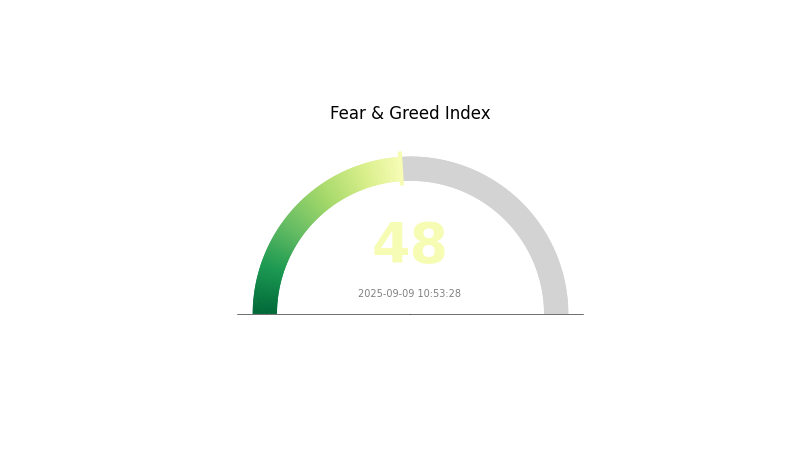

9 Eylül 2025 Korku ve Açgözlülük Endeksi: 48 (Nötr)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında bugün, Korku ve Açgözlülük Endeksi 48 ile dengede — yatırımcılar ne aşırı korku ne de aşırı açgözlülük gösteriyor. Bu denge, dikkatli işlem kararları almak için genellikle iyi bir ortam sunar. Trader’lar, piyasa trendlerini ve güncel haber akışını yakından izlemeli; zira önemli gelişmeler psikolojik dengeyi korku ya da açgözlülük yönünde değiştirebilir. Her zaman olduğu gibi, riskinizi göz önünde bulundurmalı ve kapsamlı araştırma yapmalısınız; kripto piyasasında oynaklık yüksektir.

TRX Varlık Dağılımı

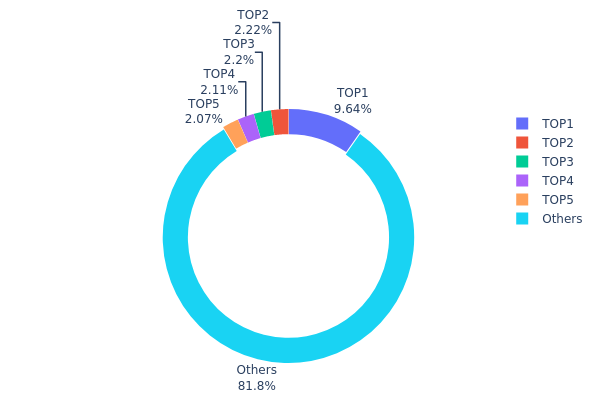

TRX adres dağılım verileri, en büyük yatırımcılarda belirgin bir yoğunlaşma olduğunu gösterir. En büyük tek adres, toplam arzın %9,64'ünü elinde bulundururken, ilk 5 adres birlikte tüm TRX'in %18,22’sine sahip. Bu merkezileşme, piyasa hareketlerinde önemli etkiler doğurabilir.

Yoğunlaşma piyasa istikrarı ve fiyat oynaklığı açısından riskler içerir. “Balina” olarak adlandırılan büyük yatırımcılar, yüklü alım-satım emirleriyle fiyatları ciddi biçimde etkileyebilir. Bununla birlikte, TRX tokenlerinin %81’inden fazlası diğer adresler arasında paylaşıldığı için, ağda geniş bir katılımcı kitlesi görülmektedir.

Mevcut dağılım aşırı merkezileşmiş olmasa da, sahiplik yapılarını düzenli takip etmek gerekmektedir. Büyük yatırımcılar ile topluluk arasındaki denge, TRX’in uzun vadeli piyasa davranışında ve merkeziyetsiz ekosistemi korumasında kritik rol oynayacaktır.

Güncel TRX Varlık Dağılımı için tıklayın

| İlk | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | TU3kjF...yuSLQ5 | 9.127.652,77K | 9,64% |

| 2 | TT2T17...EWkU9N | 2.098.904,27K | 2,21% |

| 3 | TE2Rzo...oxvRwP | 2.078.488,47K | 2,19% |

| 4 | TNPdqt...jLeHAF | 1.999.998,98K | 2,11% |

| 5 | TPcnRb...ZPpdGb | 1.964.182,49K | 2,07% |

| - | Diğerleri | 77.394.191,85K | 81,78% |

II. TRX’in Gelecekteki Fiyatını Belirleyebilecek Ana Etkenler

Makroekonomik Ortam

-

Enflasyona Karşı Dayanıklılık: TRX’in enflasyon dönemlerinde gösterdiği performans, yatırımcılar için koruma aracı olabilme potansiyelini öne çıkarıyor.

-

Jeopolitik Etkenler: Küresel jeopolitik gelişmeler TRX’in fiyatını etkileyebilir; belirsizlikler yatırımcıların alternatif varlıklara yönelmesine neden olabilir.

Teknolojik Gelişim ve Ekosistem İnşası

-

TRON Blokzincir Altyapısı: TRON’un blokzincir altyapısında önümüzdeki yıllarda gerçekleşecek ilerlemeler, TRX fiyatını destekleyecektir.

-

Ekosistem Uygulamaları: TRON ekosistemindeki DApp’lerin ve projelerin büyümesi, TRX’in benimsenmesini ve fiyat potansiyelini artırır.

-

Tron Builder Tour: Tron DAO ve BitTorrent Chain’in geliştiricilere yönelik küresel teşvik ve tanıtım programı olan Tron Builder Tour, ekosistemin genişlemesine ve TRX’in dolaylı biçimde değer kazanmasına katkı sağlayabilir.

III. 2025-2030 Dönemi TRX Fiyat Tahminleri

2025 Öngörüsü

- Temkinli tahmin: 0,17865 – 0,25 dolar

- Nötr tahmin: 0,25 – 0,33707 dolar

- İyimser tahmin: 0,33707 – 0,41797 dolar (güçlü piyasa toparlanması koşulunda)

2027 Orta Vadede Beklenti

- Piyasa dönemi: Konsolidasyon ve büyüme olasılığı

- Fiyat aralığı tahmini:

- 2026: 0,33977 – 0,4719 dolar

- 2027: 0,25482 – 0,47143 dolar

- Kilit tetikleyiciler: TRON ağının benimsenmesinin artması, DeFi ekosisteminin gelişimi

2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,44807 – 0,59252 dolar (istikrarlı piyasa büyümesi varsayımı ile)

- İyimser senaryo: 0,59252 – 0,81768 dolar (blokzincir teknolojisinin yaygın benimsenmesi ile)

- Dönüştürücü senaryo: 0,81768+ dolar (TRON’da devrim niteliğinde kullanım örnekleri)

- 2030-31 Aralık: TRX 0,81768 dolar (iyimser projeksiyona göre potansiyel zirve)

| Yıl | Öngörülen En Yüksek Fiyat | Öngörülen Ortalama Fiyat | Öngörülen En Düşük Fiyat | Fiyat Artış Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,41797 | 0,33707 | 0,17865 | 0 |

| 2026 | 0,4719 | 0,37752 | 0,33977 | 12 |

| 2027 | 0,47143 | 0,42471 | 0,25482 | 26 |

| 2028 | 0,59145 | 0,44807 | 0,38982 | 32 |

| 2029 | 0,66529 | 0,51976 | 0,27027 | 54 |

| 2030 | 0,81768 | 0,59252 | 0,33774 | 75 |

IV. TRX İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

TRX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: İstikrarlı ve sürdürülebilir büyüme arayışındaki muhafazakâr yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde TRX biriktirin

- Uzun vadeli fiyat hedefleri belirleyin ve hedefinize sadık kalın

- TRX varlıklarınızı donanım cüzdanlarında saklayarak güvenliği en üst düzeye çıkarın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit etmek için

- RSI (Göreli Güç Endeksi): Aşırı alım veya satım bölgelerini belirlemeye yardımcı olur

- Dalgalı işlemde dikkat edilecek noktalar:

- TRON ağındaki gelişmeleri ve önemli kilometre taşlarını takip edin

- Genel piyasa duyarlılığına ve Bitcoin fiyat hareketlerine özen gösterin

TRX Risk Yönetimi Prensipleri

(1) Varlık Dağılımı Kuralları

- Muhafazakâr yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün %15’ine kadar

(2) Riskten Korunma Stratejileri

- Çeşitlendirme: Varlıkları farklı kripto paralar ve klasik finansal enstrümanlar arasında dağıtarak riski azaltın

- Zarar durdur emirleri: Muhtemel kayıpları sınırlandırmak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı olarak Gate Web3 Wallet kullanılabilir.

- Soğuk saklama: Uzun vadeli tutum için kağıt cüzdan kullanımı

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama kullanılabilir, özel anahtarlar çevrimdışı saklanabilir

V. TRX İçin Potansiyel Riskler ve Zorluklar

TRX Piyasa Riskleri

- Aşırı oynaklık: Kripto para piyasalarında ani ve sert fiyat değişimleri sıkça yaşanır

- Rekabet: Diğer akıllı sözleşme platformlarının pazar payı kazanma riski

- Likidite: Ani büyük satışlar TRX fiyatında istikrarı bozabilir

TRX Regülasyon Riskleri

- Devlet müdahaleleri: Bazı ülkelerde yasaklama veya sıkı düzenleme potansiyeli

- Vergisel etkiler: Vergi düzenlemelerindeki değişimler TRX yatırımlarını değiştirebilir

- Menkul kıymet sınıflandırması: TRX’in bazı yargı alanlarında menkul kıymet olarak kabul edilme riski

TRX Teknik Riskleri

- Akıllı sözleşme güvenlik açıkları: TRON ekosisteminde kod hatalarına karşı dikkatli olunmalı

- Ağ tıkanıklığı: Yüksek işlem hacmi işlem sürelerini uzatabilir

- %51 saldırısı: Ağın kötü niyetli kişilerce kontrol edilmesi ihtimaline karşı önlemler alınmalı

VI. Sonuç ve Eylem Önerileri

TRX’in Yatırım Potansiyeline Bakış

TRON (TRX), güçlü ortaklıklar ve hızla büyüyen ekosistemiyle uzun vadede cazip bir akıllı sözleşme platformu olarak öne çıkıyor. Ancak kısa vadede yüksek oynaklık ve regülasyon belirsizlikleri ciddi riskler barındırıyor.

TRX Yatırım Önerileri

- Yeni yatırımcılar: Küçük ve düzenli yatırımlarla pozisyon oluşturun

- Tecrübeli yatırımcılar: Uzun vadeli tutum ile piyasa döngülerinde stratejik alım-satımı birleştirin

- Kurumsal yatırımcılar: TRON’un teknolojisi ve ekosistem büyümesini büyük ölçekli kullanım için değerlendirin

TRX İşlem Katılım Yöntemleri

- Spot alım-satım: TRX’i Gate.com’da doğrudan alıp satın

- Staking: TRON’un “Super Representative” oylamasına katılarak pasif getiri elde edin

- DeFi: TRON ekosisteminde merkeziyetsiz finans olanaklarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatlice vermeli ve gerekirse profesyonel danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

TRX 10 dolara ulaşabilir mi?

Kısa vadede düşük olasılık olsa da, TRX güçlü piyasa büyümesi ve yaygın benimsenme ile 10 dolara ulaşabilir. Mevcut piyasa trendleri, bu seviyenin uzun vadeli bir hedef olarak kaldığını göstermektedir.

2025’te TRX’in tahmini değeri nedir?

Mevcut analizlere göre, TRX’in 2025 sonunda yaklaşık 0,61 dolar civarında işlem göreceği öngörülmektedir.

TRX 5 dolara çıkabilir mi?

TRX, artan talep ve ekosistem büyümesi sayesinde 5 dolar seviyesine ulaşma potansiyeline sahip. Mevcut piyasa trendlerine göre, bu hedef önümüzdeki aylarda gerçekleşebilir.

TRX’in fiyatı yükselecek mi?

Evet, TRX’in yakın gelecekte değer kazanması bekleniyor. Piyasa eğilimleri ve yaklaşan gelişmeler, TRX’in fiyatında önemli bir artış olacağına işaret etmektedir.

HBAR'ın AUD Fiyat Performansı

Tron'un PKR Fiyat Güncellemesi

2025 XLM Fiyat Tahmini: Olgunlaşan Kripto Ekosisteminde Stellar Lumens’in Potansiyel Büyüme Yolu

2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

2025 DGB Fiyat Tahmini: DigiByte Kripto Para Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 NETMIND Fiyat Tahmini: Gelişen yapay zekâ ekosisteminde piyasa trendleri, teknolojiye adaptasyon ve büyüme potansiyeli üzerine analiz

Xenea Günlük Quiz Yanıtı 13 Aralık 2025

Polygon Ağına Varlık Transferi Kılavuzu

Polygon Ağını Kripto Cüzdanınıza Entegre Etme Kılavuzu

BEP2 ile Dijital Varlıkların Güvenli Saklanmasına Yönelik Yeni Başlayanlar İçin Rehber

Polygon PoS Ağı’na Varlık Aktarma Kılavuzu