2025 PI Fiyat Tahmini: PI Network’ün Dijital Parasının Piyasa Trendleri ve Gelecekteki Değer Potansiyeli Analizi

Giriş: PI’nin Piyasa Konumu ve Yatırım Değeri

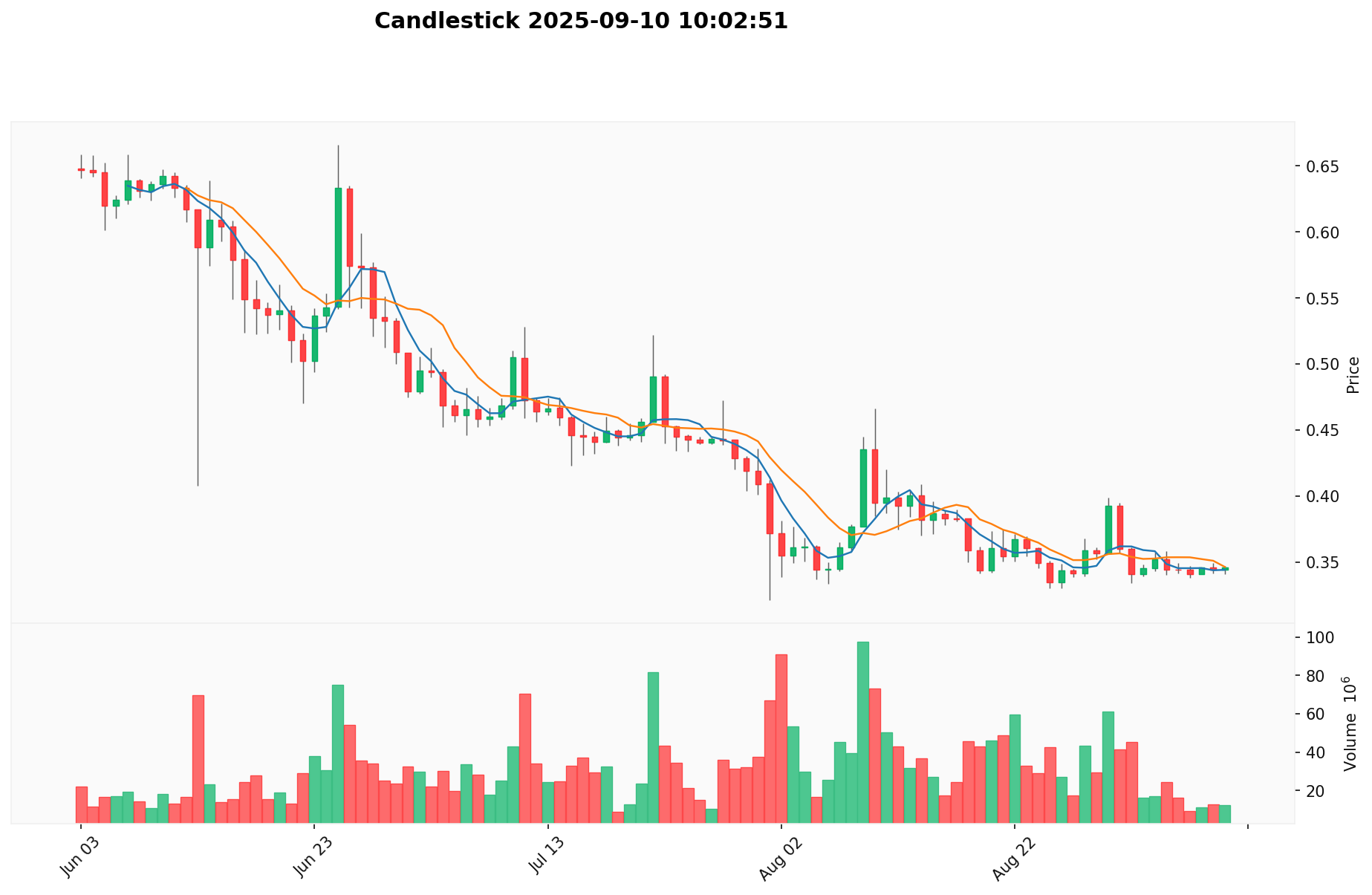

Pi Network (PI), mobil cihaz üzerinden madenciliği mümkün kılan ilk dijital para birimi olarak sektöre öncülük etmiştir. 2025 yılı itibarıyla Pi Network’ün piyasa değeri 2,76 milyar dolara ulaşmış; dolaşımdaki coin adedi yaklaşık 8,04 milyar olarak kaydedilmiş ve fiyatı 0,34 dolar seviyesinde sabitlenmiştir. Mobil madencilik öncüsü olarak bilinen bu varlık, kripto varlıklara erişimi demokratikleştirme yolunda her geçen gün daha önemli bir rol üstlenmektedir.

Bu makale, Pi Network’ün 2025-2030 dönemine ilişkin fiyat eğilimlerini, geçmiş fiyat davranışları, arz-talep dengesi, ekosistem büyümesi ve makroekonomik ortam çerçevesinde kapsamlı biçimde analiz edecek; yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. PI Fiyat Geçmişi ve Mevcut Durum

PI Fiyat Gelişim Süreci

- 2025: Ana ağın devreye alınmasıyla fiyat önemli dalgalanmalar yaşadı

- Şubat 2025: Fiyat, 3,00 dolar ile tarihinin en yüksek seviyesine çıktı

- Eylül 2025: Piyasa düzeltmesiyle fiyat 0,34311 dolara geriledi

PI’nin Güncel Piyasa Görünümü

PI, şu an 0,34311 dolardan işlem görürken; 24 saatlik işlem hacmi 3.692.599,93 dolar seviyesindedir. Token, son 24 saatte yüzde 0,85 oranında değer kaybı yaşamıştır. PI’nin piyasa değeri 2.759.166.487 dolar olup, kripto piyasasında 55. sırada yer almaktadır. Dolaşımdaki arz miktarı 8.041.638.213,51 PI, toplam arz 12.371.751.097,71 ve maksimum arz 100.000.000.000’dur.

PI, son bir haftada yüzde 0,48’lik hafif bir gerileme göstermiştir; 30 günlük performansta ise yüzde 15,28 oranında daha belirgin bir düşüş kaydedilmiştir. Yıl başından bugüne bakıldığında, yüzde 79,80’lik ciddi bir düşüş izlenmektedir. Tüm bu aşağı yönlü hareketlere rağmen, PI halen 20 Şubat 2025’te görülen 0,049 dolarlık tarihsel dip seviyesinin oldukça üzerinde seyretmektedir.

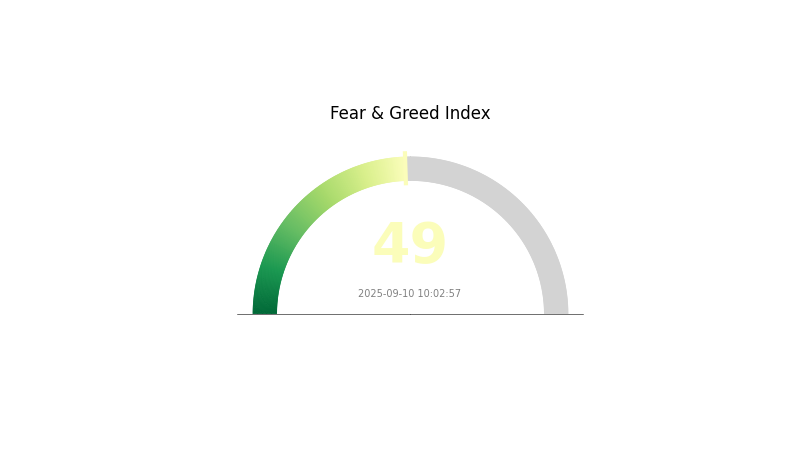

Mevcut piyasa hissiyatı nötr düzeyde olup, Korku ve Açgözlülük Endeksi 49’dur. Bu, piyasada ne aşırı alım ne de aşırı satım eğilimi olduğunu göstermektedir.

PI Piyasa Duyarlılık Endeksi

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Bugün kripto piyasasında duyarlılık dengede seyretmektedir; Korku ve Açgözlülük Endeksi’nin 49 olması, yatırımcılar arasında ne stresli ne de aşırı iyimser bir atmosfer bulunduğunu gösterir. Böyle denge dönemlerinde büyük piyasa hareketleri görülebilir; dolayısıyla yatırımcıların fırsat ve riskleri dikkatli şekilde tartıp, kararlarını kapsamlı analizlerle vermeleri gerekir. Gate.com, değişken piyasa koşullarında doğru kararlar almanız için kapsamlı veri sunar.

PI Varlık Dağılımı

Adreslere göre varlık dağılımı grafiği, PI tokenlarının ağ genelindeki dağılımını ortaya koymaktadır. Sunulan verilere göre PI arzında belirleyici yoğunluğa sahip bir adres yok. Bu da PI’lerin ağa yaygın ve merkeziyetsiz biçimde dağıtıldığını gösterir.

Kayda değer oranlarda PI tutan hakim adreslerin olmaması, tokenlerin sağlıklı şekilde dağıldığını ve büyük oyuncuların fiyatlar üzerinde manipülasyon yapmasının zorlaştığını gösterir. Böyle bir yapı, piyasa istikrarına ve direncine katkı sunar; ayrıca PI ekosisteminin merkeziyetsizlik hedeflerine ulaştığını gösterir ki, bu uzun vadeli sürdürülebilirlik ve adil piyasa açısından olumlu bir göstergedir.

Sonuç olarak, PI’nin mevcut adres dağılımı; volatilite risklerini azaltan ve fiyat manipülasyonu olasılığını düşüren dengeli bir piyasa yapısı olarak öne çıkmaktadır. Bu dağılım, daha demokratik ve merkeziyetsiz bir ağ vizyonuna hizmet etmekte ve blok zinciri ekosisteminin temel ilkeleriyle örtüşmektedir.

Güncel PI Varlık Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. PI’nin Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Deflasyonist Model: PI’nin ihraç eğrisi, kademeli olarak azalan bir seviyede ilerliyor; madencilik hızı Mart 2019’da saatte 1,57 PI iken, 2021’de saatte 0,1 PI’ye düşmüş durumda.

- Tarihsel Eğilim: Deflasyonist model, teorik olarak fiyatlarda yükselişi destekler.

- Güncel Etki: 100 milyar PI’lik toplam arzın yalnızca yüzde 6,3’ü dolaşımda bulunuyor; bu sınırlı arz, talepte artış olması halinde fiyatları yukarı çekecek potansiyele sahiptir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: En büyük yüzde 10’luk madenci grubu, yaklaşık 25,9 milyar PI ile toplam arzın yüzde 10’una hakim.

- Ulusal Politikalar: Yasal düzenlemelerde sağlanacak netlik, PI’nin uzun vadeli değerinde ve benimsenmesinde belirleyici olacaktır.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Potansiyeli: PI, görece yeni bir varlık olduğu için enflasyonist ortamlardaki performansı henüz sınanmamıştır.

- Jeopolitik Etkenler: Küresel ekonomik durumlar ve kriptoya yönelik düzenleyici yaklaşımlar, PI’nin adaptasyonu ve değerini doğrudan etkileyecektir.

Teknik Gelişim ve Ekosistem İnşası

- Ana ağ (mainnet) lansmanı: PI Network’ün ana ağı Şubat 2025’te kullanıma açılmış; kapalı test ortamından açık blok zincirine geçilmiştir.

- Stellar Consensus Protocol: PI, merkeziyetsiz doğrulama için Stellar Consensus Protocol (SCP) kullanmakta ve binlerce işlemi saniyede gerçekleştirebilmektedir.

- Ekosistem Uygulamaları: PI, merkeziyetsiz ödemeler, Web3 ekonomisi ve DeFi alanlarına odaklanan çeşitli uygulama ekosistemi inşa etmektedir.

III. 2025-2030 Dönemi PI Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,25426 – 0,30000 dolar

- Nötr tahmin: 0,30000 – 0,40000 dolar

- İyimser tahmin: 0,40000 – 0,51195 dolar (kripto piyasasında genel bir toparlanma olması halinde)

2027-2028 Öngörüleri

- Piyasa evresi beklentisi: Artan benimsenmeyle büyüme dönemine girilmesi

- Fiyat aralığı tahmini:

- 2027: 0,28199 – 0,57719 dolar

- 2028: 0,47327 – 0,74299 dolar

- Kritik katalizörler: Teknolojik yenilikler, kullanım alanlarının artışı ve düzenleyici netlik

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,62594 – 0,68854 dolar (ekosistem büyümesinin istikrarı varsayımıyla)

- İyimser senaryo: 0,75113 – 0,86067 dolar (yaygın piyasa benimsemesi ve güçlü iş birlikleri ile)

- Radikal senaryo: 0,90000 – 1,00000 dolar (blok zincirinde büyük bir sıçrama veya önemli kurumsal destek durumunda)

- 31 Aralık 2030: PI 0,86067 dolar (mevcut projeksiyonlara göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,51195 | 0,34359 | 0,25426 | 0 |

| 2026 | 0,45344 | 0,42777 | 0,35505 | 24 |

| 2027 | 0,57719 | 0,4406 | 0,28199 | 28 |

| 2028 | 0,74299 | 0,5089 | 0,47327 | 48 |

| 2029 | 0,75113 | 0,62594 | 0,46946 | 82 |

| 2030 | 0,86067 | 0,68854 | 0,54394 | 100 |

IV. PI Yatırımı için Profesyonel Stratejiler ve Risk Yönetimi

PI Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluğu: Yüksek risk toleranslı, uzun vadeli bakış açısına sahip yatırımcılar

- Operasyonel öneriler:

- Piyasa geri çekilmelerinde PI biriktirin

- Kâr almak için ara hedef fiyatlar belirleyin

- PI’leri güvenli cüzdanlarda saklayıp periyodik güvenlik denetimleri yapın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Fiyat trendlerini ve dönüş noktalarını tespit edin

- RSI: Aşırı alım veya satım durumunu gözlemleyin

- Swing al-sat için ipuçları:

- PI’nin genel kripto trendleriyle ilişkisini izleyin

- Zararları sınırlamak için kesin stop-loss emirleri belirleyin

PI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyünün yüzde 1-3’ü PI olabilir

- Orta dereceli yatırımcılar: Portföyün yüzde 3-7’si

- Agresif yatırımcılar: Portföyün yüzde 7-15’i

(2) Risk Koruma Çözümleri

- Çeşitlendirme: Yatırımlar farklı varlıklara bölünmeli

- Opsiyon stratejileri: Düşüş riskine karşı satım opsiyonlarından yararlanılabilir

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Cüzdan kullanılması önerilir

- Soğuk depolama: Yüklü meblağlar için donanım cüzdanları kullanılmalı

- Güvenlik önlemleri: İki adımlı doğrulamayı etkinleştirin, güçlü ve eşsiz şifreler kullanın

V. PI’nin Karşılaşabileceği Riskler ve Zorluklar

PI Piyasa Riskleri

- Volatilite: Kripto piyasalarda sık görülen yüksek fiyat oynaklığı

- Likitide: Sınırlı işlem çiftleri, alış-satış işlemlerini zorlaştırabilir

- Piyasa duyarlılığı: Yatırımcı hissiyatındaki ani değişimlere karşı hassasiyet

PI Regülasyon Riskleri

- Yasal belirsizlik: Değişen uluslararası kripto mevzuatı PI’yi doğrudan etkileyebilir

- Uyum zorlukları: Gelecekteki düzenlemelere uyumda zorluklar yaşanabilir

- Sınır ötesi kısıtlamalar: Farklı ülkelerdeki değişken yasal durumlar

PI Teknik Riskleri

- Ağ güvenliği: PI blok zincirinde ortaya çıkabilecek güvenlik açıkları

- Ölçeklenebilirlik: Yükselen işlem hacmiyle başa çıkmada yaşanacak sorunlar

- Akıllı kontrat riskleri: Uygulanırsa, kontratlarda hata veya açık olasılığı

VI. Sonuçlar ve Eylem Önerileri

PI’nin Yatırım Değeri Değerlendirmesi

PI, mobil cihazlardan madenciliğe olanak tanıyan yenilikçi yaklaşımıyla kripto dünyasında erişimi demokratikleştirme potansiyeline sahiptir. Ancak, piyasa adaptasyonu, yasal netlik ve teknik altyapı açısından çözülmesi gereken önemli sorunlarla karşı karşıyadır. Uzun vadeli değer hala belirsiz ve kısa vadeli riskler oldukça yüksektir.

PI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: PI ekosistemini tanımak için küçük ve ulaşılabilir miktarlarla başlayın ✅ Tecrübeli yatırımcılar: Kripto portföyünüzün küçük bir kısmını PI’ye ayırıp dengeli bir strateji izleyin ✅ Kurumsal yatırımcılar: Ayrıntılı analiz ve araştırma yaparak PI’yi çeşitlendirilmiş bir kripto stratejisinin unsuru olarak değerlendirin

PI İşlemlerine Katılım Yöntemleri

- Spot alım-satım: Gate.com’un spot piyasasında PI alıp satın

- Staking: Mümkünse PI staking programlarına katılın

- DeFi entegrasyonu: PI tokenlarını içeren merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları oldukça yüksek risk içerir, bu metin yatırım tavsiyesi olarak değerlendirilmemelidir. Yatırımcılar, risk toleranslarını göz önünde bulundurarak karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

2025’te PI’nin fiyatı ne olacak?

Güncel piyasa analizlerine göre, PI’nin 2025’te yaklaşık 0,35 dolar seviyelerinde olması beklenmektedir. Bu öngörü, kriptonun ılımlı bir yükseliş seyri izleyeceğine işaret eder.

PI 1.000 dolara ulaşabilir mi?

PI’nin potansiyeli olsa da, mevcut yüksek arzı ve piyasa dinamikleri nedeniyle 1.000 dolara ulaşması gerçekçi değildir. Uzun vadede daha makul bir hedef, 1 ila 10 dolar aralığı olabilir.

PI’nin değeri olacak mı?

2025 yılı itibarıyla PI borsalarda listelenmemiş ve piyasadaki hacmi çok düşüktür. Şu anda değeri çok düşük olsa da, gelecekteki potansiyeli belirsizliğini korumaktadır.

2050’de PI’nin değeri ne kadar olur?

Uzun vadeli benimseme ve kullanım senaryolarına dayanarak, Pi Coin’in 2050’de 7,71 ila 18,31 dolar aralığında olması öngörülüyor.

2025 OKB Fiyat Tahmini: Kripto Ekosisteminde OKB Token’ın Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

pi fiyat tahmini

2025 SUI Fiyat Tahmini: Blockchain’in Yeni Gözdesinin Gelecekteki Gelişimi ve Yatırım Değeri Analizi

2025 CFX Fiyat Tahmini: Conflux Network Token’ın Büyüme Potansiyeli ve Piyasa Dinamiklerinin Analizi

2025 GRT Fiyat Tahmini: Graph Protocol'un gelecekteki değer eğrisinin ve piyasa potansiyelinin detaylı analizi

2025 XLM Fiyat Öngörüsü: Stellar'ın Değişen Kripto Ekosistemindeki Potansiyel Yükselişi

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi