2025 OKB Fiyat Tahmini: Kripto Ekosisteminde OKB Token’ın Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Giriş: OKB’nin Piyasadaki Konumu ve Yatırım Değeri

OKB (OKB), kripto para ekosisteminde küresel bir fayda token’ı olarak 2019’dan bu yana dikkat çekici başarılara imza atmıştır. 2025 yılı itibarıyla OKB’nin piyasa değeri 4.012.470.000 USD’ye ulaşmış; dolaşımdaki arzı yaklaşık 21.000.000 token, fiyatı ise 191,07 USD civarındadır. OKB, platform yönetimi ile kullanıcı teşviklerinde önemli bir rol üstlenmektedir.

Bu makalede, 2025-2030 arası OKB fiyat trendleri, geçmiş piyasa hareketleri, arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar bir arada değerlendirilerek yatırımcılara profesyonel fiyat öngörüleri ve işlevsel yatırım stratejileri sunulacaktır.

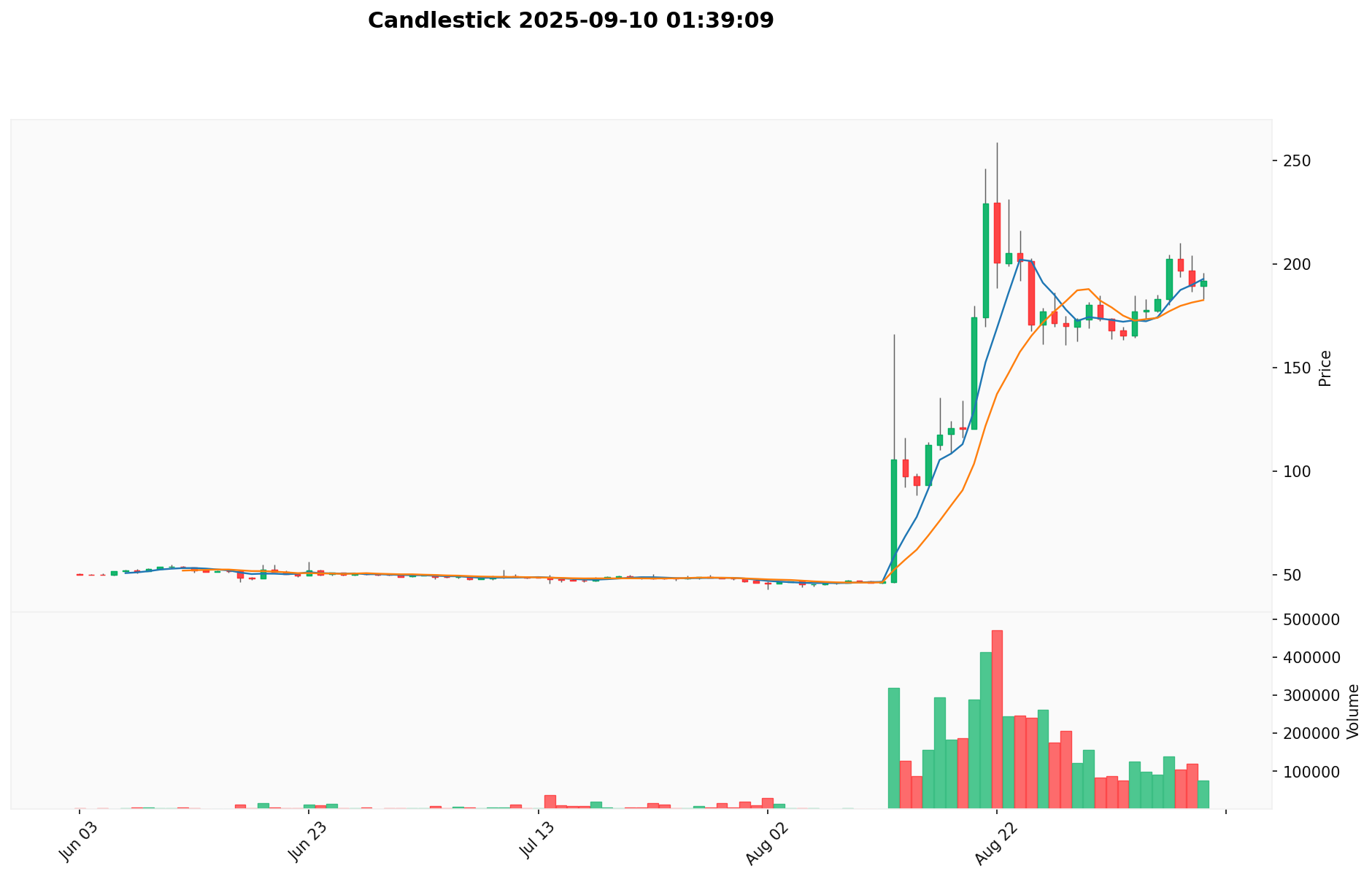

I. OKB Fiyat Tarihi ve Güncel Piyasa Durumu

OKB’nin Tarihsel Fiyat Gelişimi

- 2019: İlk çıkışı; 14 Ocak’ta tüm zamanların en düşük seviyesi olan 0,580608 USD’ye geriledi

- 2022: Hızlı büyüme dönemi; fiyat 30 USD’yi aştı

- 2025: 22 Ağustos’ta tüm zamanların en yüksek seviyesi olan 255,5 USD’ye ulaştı

OKB’nin Güncel Piyasa Görünümü

10 Eylül 2025 itibarıyla OKB, 191,07 USD seviyesinden işlem görmekte ve kripto para piyasasında 43. sırayı almaktadır. Son bir yılda %410,09 oranında güçlü bir yükseliş göstermiştir. Son 24 saatlik süreçte %3 değer kazanırken, haftalık bazda %15,50 artış kaydedilmiştir. Son 30 günlük performans ise %309,92’lik etkileyici bir yükselişe işaret etmektedir.

OKB’nin piyasa değeri 4.012.470.000 USD’dir. Toplam kripto piyasasının %0,097’sine karşılık gelir. Dolaşımdaki arzı 21.000.000 OKB’dir ve bu sayı aynı zamanda maksimum arz olduğundan ilave enflasyon riski yoktur. 24 saatlik işlem hacmi ise 14.286.049,1981 USD ile piyasanın orta düzeyde likidite sunduğunu göstermektedir.

OKB’nin güncel piyasa fiyatını görüntülemek için buraya tıklayın

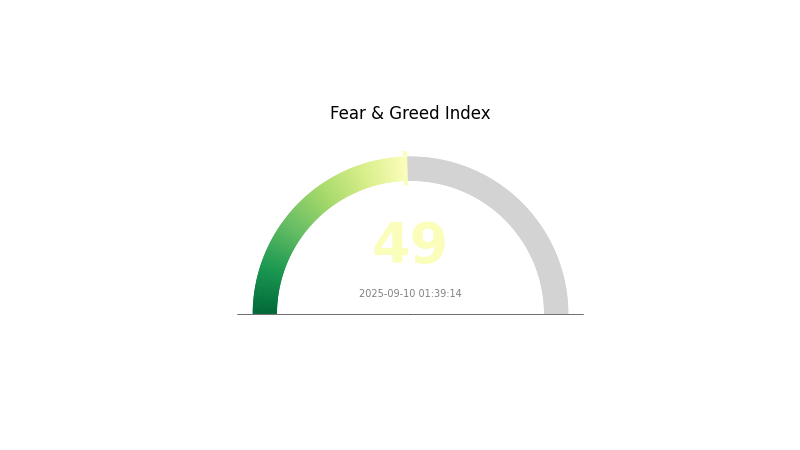

OKB Piyasa Duyarlılığı Endeksi

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

OKB’nin mevcut Korku & Açgözlülük Endeksi’ni görmek için tıklayın

Bugün OKB için piyasa duyarlılığı dengede seyrediyor; Korku ve Açgözlülük Endeksi 49 ile nötr bölgededir. Yatırımcılar piyasa koşulları karşısında ne aşırı iyimser ne de kötümserdir. Dikkatli olunması gerekir; nötr hava, hem alıcılar hem de satıcılar için fırsatlar sunabilir. Yatırımcılar işlem yapmadan önce trendleri yakından takip etmeli ve kapsamlı araştırma yapmalıdır.

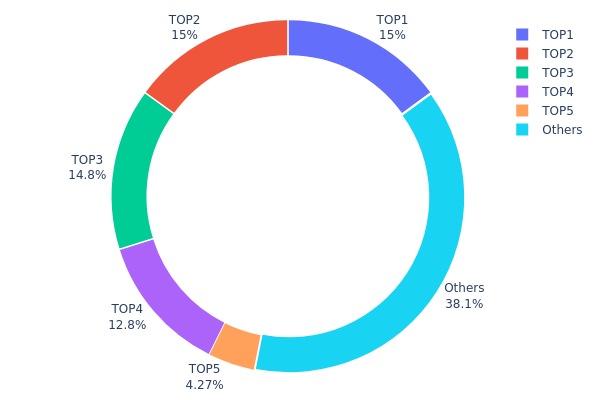

OKB Varlık Dağılımı Analizi

Adres bazında varlık dağılımı verileri, OKB’nin sahiplik yapısındaki yoğunlaşmayı ortaya koymaktadır. Analizler, OKB’nin oldukça merkezileşmiş bir dağılıma sahip olduğunu gösteriyor: En büyük beş adres toplam arzın %61,91’ini elinde tutarken, en büyük üç adresin her biri yaklaşık %15’lik paya sahiptir. Bu yoğunlaşma, potansiyel piyasa manipülasyonu ve fiyat oynaklığı riski oluşturur.

Böyle bir yapı, OKB’nin piyasa dinamikleri üzerinde ciddi etkiler yaratabilir. Birkaç adresin büyük miktarlarda OKB bulundurması, olası büyük satışlar veya alımlarda fiyatların ciddi şekilde dalgalanmasına neden olabilir. Ayrıca, bu merkezileşme, OKB’nin beklenen merkeziyetsizliğiyle çelişebilir ve mülkiyetin daha fazla dağıtıldığı projelere öncelik veren yatırımcıların ilgisini azaltabilir.

Bu denli yoğun sahiplik, OKB’nin zincir üzerindeki yapısının yaygın benimsenmiş kriptolara göre daha az istikrarlı olabileceğine işaret eder. Düşük merkeziyetsizlik seviyesi, uzun vadeli sürdürülebilirlik ve merkezî etkiye karşı direnç açısından risk oluşturabilir.

| Sıra | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0x9e76...680fd2 | 100,10K | 15,01% |

| 2 | 0xe5f3...1cc293 | 100,00K | 15,00% |

| 3 | 0x91d4...c8debe | 98,92K | 14,83% |

| 4 | 0x2c8f...d5a161 | 85,33K | 12,80% |

| 5 | 0xc0bf...c49c9e | 28,49K | 4,27% |

| - | Diğerleri | 253,76K | 38,09% |

II. OKB’nin Gelecek Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Token Yakımı: OKB, arzı azaltmak için düzenli olarak token yakımı gerçekleştirir

- Tarihsel Etki: Geçmişteki yakımlar, OKB fiyatını yukarı taşımıştır

- Güncel Durum: Son dönemde dolaşımdaki arzın %5’inin yakılması, fiyatta güçlü bir yükselişe yol açmıştır

Kurumsal ve Büyük Yatırımcı (Whale) Etkileri

- Kurumsal Portföyler: Önde gelen kurumlar OKB’ye giderek daha fazla ilgi göstermektedir

- Kurumsal Entegrasyon: Şirketler, OKB’yi çeşitli kullanım alanlarında entegre etmeyi araştırıyor

- Regülatif Gelişmeler: Bazı bölgelerdeki düzenleyici açıklık, OKB için olumlu bir ortam yarattı

Makroekonomik Koşullar

- Para Politikalarının Etkisi: Merkez bankalarının kararları, kripto piyasasında genel hissiyatı ve OKB’yi etkiler

- Enflasyona Karşı Koruma: OKB, kısmen enflasyona karşı koruma potansiyeline sahiptir

- Jeopolitik Unsurlar: Küresel ekonomik belirsizlikler, OKB gibi kripto paralara ilgiyi artırıyor

Teknolojik Gelişim ve Ekosistem Büyümesi

- X Layer Yükseltmesi: OKB’nin işlevselliğini ve ağ kabiliyetlerini artırır

- Ekosistem Genişlemesi: OKB ekosistemi üzerinde artan DApp ve proje sayısı

- Ekosistem Uygulamaları: OKB ağında DeFi, NFT ve yönetişim alanlarında çoğalan kullanım örnekleri

III. 2025-2030 Dönemi İçin OKB Fiyat Tahminleri

2025 Beklentisi

- Temkinli tahmin: 133,64 USD - 180,00 USD

- Nötr tahmin: 180,00 USD - 190,91 USD

- İyimser tahmin: 190,91 USD - 200,46 USD (devam eden piyasa büyümesi gerekli)

2027-2028 Beklentisi

- Piyasa dönemi: Olası boğa piyasası

- Fiyat aralığı tahmini:

- 2027: 149,15 USD - 255,97 USD

- 2028: 132,68 USD - 256,21 USD

- Temel katalizörler: Blockchain’in yaygınlaşması, regülasyonların olumlu seyri

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 242,49 USD - 281,29 USD (istikrarlı bir piyasa büyümesiyle)

- İyimser senaryo: 281,29 USD - 320,09 USD (kripto benimsemesi yaygınlaşırsa)

- Dönüştürücü senaryo: 320,09 USD - 350,00 USD (devrimsel blockchain uygulamalarıyla)

- 2030-31 Aralık: OKB 306,60 USD (yıl sonu düzeltmesi öncesi olası zirve)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 200,46 | 190,91 | 133,64 | 0 |

| 2026 | 207,42 | 195,68 | 99,7982 | 2 |

| 2027 | 255,97 | 201,55 | 149,15 | 5 |

| 2028 | 256,21 | 228,76 | 132,68 | 19 |

| 2029 | 320,09 | 242,49 | 189,14 | 26 |

| 2030 | 306,6 | 281,29 | 171,58 | 47 |

IV. OKB için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

OKB Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: Yüksek risk iştahına sahip uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde OKB biriktirin

- Kar almak için hedef fiyatlar belirleyin

- Token’larınızı donanım cüzdanlarında saklayın

(2) Aktif Al-Sat Stratejisi

- Kullanılacak analiz araçları:

- Hareketli Ortalamalar: Eğilimleri ve olası dönüş noktalarını belirler

- RSI: Aşırı alım/satım durumunu ölçer

- Dalgalı işlem için ipuçları:

- OKB’nin genel kripto piyasasıyla korelasyonunu izleyin

- Risk yönetimi için zarar-durdur emirleri kullanın

OKB Risk Yönetimi

(1) Portföy Dağılımı Esasları

- Temkinli yatırımcılar: Kripto varlıkların %1-3’ü arası

- Orta riskli yatırımcılar: %3-5 arası

- Agresif yatırımcılar: %5-10 arası

(2) Riskten Korunma Stratejileri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara yaymak

- Zarar durdur: Potansiyel kayıpları sınırlandırmak için kullanmak

(3) Güvenli Saklama Opsiyonları

- Sıcak cüzdan: Gate Web3 Cüzdan kullanılabilir

- Soğuk depolama: Donanım cüzdanları kullanın

- Güvenlik önlemleri: İki faktörlü doğrulamayı aktif edin ve güçlü şifre kullanın

V. OKB için Olası Riskler ve Zorluklar

Piyasa Riskleri

- Volatilite: Kripto para piyasalarında büyük fiyat dalgalanmaları yaygındır

- Likidite: Aşırı piyasa koşullarında işlem zorluğu oluşabilir

- Rekabet: Yeni borsa token’ları OKB’nin piyasadaki konumunu tehdit edebilir

Regülatif Riskler

- Yasal belirsizlik: Küresel kripto regülasyonlarının değişkenliği

- Uyumluluk gereklilikleri: OKB’nin değerini ve kullanımını etkileyebilir

- Uluslararası kısıtlamalar: OKB’nin küresel erişimini sınırlayabilir

Teknik Riskler

- Akıllı sözleşme açıkları: Sözleşmede güvenlik zaafı ihtimali

- Blockchain ölçeklenebilirlik sınırları

- Teknolojik eskişme: Yeni nesil blockchain çözümlerine karşı geri kalma riski

VI. Sonuç ve Eylem Önerileri

OKB’nin Yatırım Değeri Yorumu

OKB, platformunun başarısına dayalı yüksek riskli ve yüksek getirili bir yatırım imkanı olarak öne çıkıyor. Uzun vadeli değer, ekosistemdeki büyümeye bağlıyken, kısa vadede yüksek fiyat oynaklığı ciddi risk oluşturuyor.

OKB Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ve uzun vadeli bir pozisyonla çeşitlendirilmiş portföye dahil edebilirsiniz

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle birlikte ortalama maliyetleme uygulayın

✅ Kurumsal yatırımcılar: Geniş kapsamlı durum tespitiyle, OKB’yi toplam kripto varlık stratejinize entegre değerlendirin

OKB ile Yatırıma Katılma Yolları

- Spot alım-satım: Gate.com platformunda doğrudan OKB alım-satım işlemleri

- Staking: OKB stake programlarına dahil olarak pasif gelir elde edebilirsiniz

- OKB tabanlı ürünler: OKB bağlantılı yatırım ürünlerini kullanın

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar risklerine uygun hareket etmeli ve profesyonel finans danışmanlarına danışmalıdır. Yatırım tutarınızı dikkatli belirleyin.

Sıkça Sorulan Sorular

OKB coin’in geleceği nasıl?

OKB’nin geleceği parlak görülüyor ve 2026 yılında yaklaşık 278 USD seviyesine ulaşması bekleniyor. Bu büyüme, ekosistemdeki artan benimsenme ve kullanım alanlarını yansıtıyor.

OKB neden yükseliş gösteriyor?

OKB’deki yükseliş; büyük token yakımları, OKT token’larının taşınması, yeni bir blockchain’in devreye alınması ve halka arz (IPO) söylentilerinden kaynaklanmaktadır.

OKB bir kripto para mı?

Evet, OKB bir kripto paradır. OKX platformunda işlem ücretlerinde ve pasif gelir fonksiyonlarında kullanılan ERC-20 tabanlı bir fayda token’ıdır.

OKB’nin tüm zamanların en düşük fiyatı nedir?

OKB’nin en düşük fiyatı, 12 Haziran 2021’de kaydedilen 1,95 USD’dir. Ancak, fiyatlar o tarihten sonra değişmiş olabilir.

pi fiyat tahmini

SYS vs ICP: Ağ Güvenliği Sistemleri ile Altyapı Kontrol Protokollerinin Karşılaştırmalı Analizi

ATA ve QNT: Kurumsal Çözümlere Yönelik İki Önde Gelen Blockchain Protokolünün Karşılaştırılması

GRND ve CRO: Dijital pazarlamada başarıya ulaşmak için yer tabanlı stratejiler ile Dönüşüm Oranı Optimizasyonu stratejilerinin karşılaştırılması

NS ve FLOW: Modern Trafik Yönetim Sistemleri için Ağ Simülasyon Araçlarına Yönelik Karşılaştırmalı Bir Analiz

TSTBSC ve XTZ: Dijital varlık piyasasında yükselen iki kripto paranın karşılaştırmalı analizi

Dijital Varlık Alım Satımı İçin En İyi Platformlar - Kapsamlı Rehber

Yönlendirilmiş Asiklik Grafikler (DAG) Hakkında Her Şey: Kapsamlı Bir Kılavuz

Özel Anahtarları Anlamak: Kriptonuzu Güvende Tutmak İçin Temel İpuçları

Yeni Başlayanlara Yönelik En İyi DeFi Girişimleri

Güvenli varlık yönetimi için önde gelen kripto saklama çözümleri