2025 LCAT Fiyat Tahmini: Yeni Nesil Kripto Para Birimi İçin Potansiyel Büyüme ve Piyasa Trendlerinin Analizi

Giriş: LCAT’in Piyasadaki Konumu ve Yatırım Değeri

Binance Smart Chain üzerinde öncü meme token Lion Cat (LCAT), kurulduğu günden bu yana dikkat çekici bir büyüme sergiledi. 2025 yılı itibarıyla LCAT’in piyasa değeri 4.509.537 $’a ulaşırken, dolaşımdaki arzı yaklaşık 494.250.000 token ve fiyatı 0,009124 $ civarındadır. “Yapay zekâ destekli meme token” olarak bilinen bu varlık, kripto para alım satımında ve kripto yatırımcılarına yönelik yapay zekâ tabanlı araçlarda giderek daha önemli bir rol üstleniyor.

Bu makale, LCAT’in 2025-2030 dönemindeki fiyat eğilimlerini; geçmiş performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etmenler ışığında kapsamlı şekilde analiz ederek yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. LCAT Fiyat Geçmişi ve Güncel Piyasa Durumu

LCAT Tarihsel Fiyat Seyri

- 2025 (Şubat): 0,12806 $ ile tüm zamanların en yüksek seviyesi, LCAT’in fiyat tarihinde zirve noktası

- 2025 (Eylül): LCAT, 0,00703 $ ile tüm zamanların en düşük seviyesine inerek belirgin bir piyasa düzeltmesi yaşadı

- 2025 (Ekim): LCAT, 0,009124 $ seviyesinden işlem görerek toparlanma aşamasına geçti

LCAT Güncel Piyasa Durumu

12 Ekim 2025 tarihi itibarıyla LCAT, 0,009124 $ fiyatından işlem görmekte ve son 24 saatte %2,46’lık bir değer artışı göstermektedir. Token’ın piyasa değeri 4.509.537 $ olup, global kripto sıralamasında 1.789. basamaktadır. LCAT, tüm zamanların zirvesine oranla geçtiğimiz yıl %-90,52’lik bir düşüş yaşamıştır. Ancak kısa vadede, son 24 saatlik %2,46’lık artışla toparlanma işaretleri göstermektedir. Son 24 saatteki işlem hacmi 35.329,195163 $ olarak ölçülmüş olup, bu orta düzeyde bir piyasa aktivitesini gösterir. Dolaşımdaki toplam 494.250.000 LCAT ile, toplam arzın 600.000.000 olması, dolaşım oranının %82,375 olduğunu ortaya koymaktadır.

Güncel LCAT piyasa fiyatını görüntülemek için tıklayın

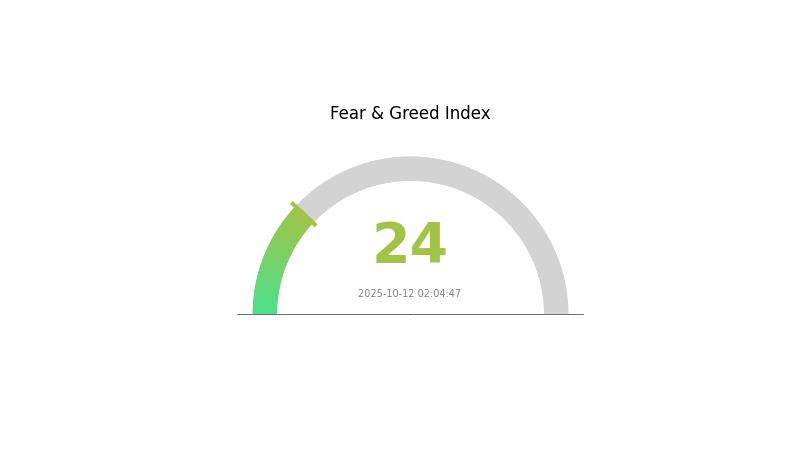

LCAT Piyasa Duyarlılık Göstergesi

2025-10-12 Korku ve Açgözlülük Endeksi: 24 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında bugün aşırı korku hâkim. Duyarlılık endeksi 24’e kadar düştü. Bu kadar yüksek kötümserlik düzeyi, genellikle karşıt görüşlü yatırımcılar için fırsat doğurabilir. Ancak volatilite sürebilir; yatırımcılar, ortalama maliyetle alım ve detaylı araştırma yapmayı düşünmelidir. Unutmayın, piyasa döngüleri doğaldır ve aşırı duyarlılık nadiren kalıcıdır. Bilgili olun ve bu belirsiz dönemde riskinizi kontrollü yönetin.

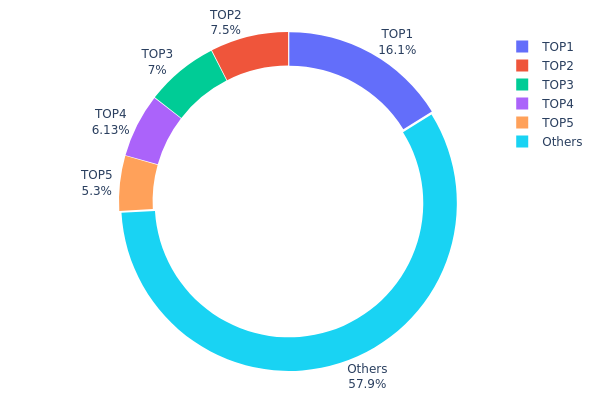

LCAT Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, LCAT token’larının hangi cüzdanlarda ne oranda toplandığına dair önemli bilgiler sunar. Analizler, orta seviyede yoğunlaşmış bir dağılıma işaret ediyor. En büyük adres toplam arzın %16,14’ünü elinde tutarken, ilk beş adres toplamda %42,06’lık bir paya sahiptir. Bu oran yüksek olsa da, aşırı merkezileşme söz konusu değildir.

Mevcut dağılım yapısı, fiyat istikrarı potansiyeline sahip dengeli bir piyasa profilini gösteriyor. Yine de, en büyük adreslerin önemli varlıkları, piyasa dinamiklerinde etkili olabilir. Tokenların %57,94’ü ise diğer cüzdanlara dağılmıştır; bu da, merkeziyeti dengelerken tek bir aktörün manipülasyon riskini düşürür.

Genel olarak LCAT token dağılımı, orta derece merkezileşmiş bir piyasa yapısı sunar. Bu durum, zincir üstü ekosistemde görece istikrar sağlayabilir ve büyük sahiplerle küçük yatırımcılar arasında denge kurar.

Güncel LCAT Varlık Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xe27d...825cfc | 96.870,83K | 16,14% |

| 2 | 0xd277...545833 | 45.000,00K | 7,50% |

| 3 | 0xd135...34cab3 | 42.000,00K | 7,00% |

| 4 | 0x5b95...243e4a | 36.750,00K | 6,12% |

| 5 | 0x8457...0666bc | 31.800,00K | 5,30% |

| - | Diğerleri | 347.579,17K | 57,94% |

II. LCAT’in Gelecekteki Fiyatına Etki Eden Temel Faktörler

Arz Mekanizması

- Piyasa Rekabeti: Düşük segmentte yoğun rekabet, fiyat düşüşleri ve kapasite fazlasına yol açtı.

- Mevcut Durum: Üst segment ürünlerde hâlen ithalata bağımlılık var; yerli ikame yavaş ilerlediği için üst segment arzında eksiklik mevcut.

Makroekonomik Ortam

- Para Politikası Etkisi: Makroekonomik eğilimler, LCAT’in itibari para birimleriyle kurunu belirgin şekilde etkiler.

- Jeopolitik Faktörler: Birleşmiş Milletler ve IMF gibi kuruluşların tahminleri ile küresel ticaret düzeyleri LCAT’in değerini etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Yapay Zekâ Entegrasyonu: Alım-satım sistemlerine AI modelleri entegre ediliyor; ancak aşırı piyasa koşullarında doğruluk için uzun vadeli testlere ihtiyaç var.

- Ekosistem Uygulamaları: Kripto piyasası doğası gereği riskli; bu durum ekosistem uygulamalarının gelişimini etkiliyor.

III. 2025-2030 Dönemi LCAT Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00785 $ - 0,00913 $

- Tarafsız tahmin: 0,00913 $ - 0,01114 $

- İyimser tahmin: 0,01114 $ - 0,01315 $ (olumlu piyasa duyarlılığı ve artan benimseme koşuluyla)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,01104 $ - 0,01472 $

- 2028: 0,00906 $ - 0,01546 $

- Ana katalizörler: Teknoloji yükseltmeleri, yeni ortaklıklar ve genel kripto piyasası eğilimleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01470 $ - 0,01654 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,01837 $ - 0,02232 $ (güçlü benimseme ve elverişli regülasyon ortamı koşuluyla)

- Dönüştürücü senaryo: 0,02232 $+ (büyük atılımlar veya yaygın entegrasyon durumunda)

- 2030-12-31: LCAT 0,02232 $ (iyimser projeksiyonlarda olası zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,01315 | 0,00913 | 0,00785 | 0 |

| 2026 | 0,01515 | 0,01114 | 0,00657 | 22 |

| 2027 | 0,01472 | 0,01314 | 0,01104 | 44 |

| 2028 | 0,01546 | 0,01393 | 0,00906 | 52 |

| 2029 | 0,01837 | 0,0147 | 0,01146 | 61 |

| 2030 | 0,02232 | 0,01654 | 0,01488 | 81 |

IV. LCAT İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

LCAT Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli yatırımcılar ve kripto meraklıları

- İşlem önerileri:

- Piyasa gerilemelerinde LCAT token biriktirin

- Proje gelişmelerini ve topluluk büyümesini takip edin

- Token’ları özel anahtar kontrolüne sahip güvenli cüzdanda saklayın

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüşleri belirleyin

- RSI (Göreli Güç Endeksi): Aşırı alım/satım seviyelerini tespit edin

- Dalgalı işlemde temel noktalar:

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

- Trend teyidi için işlem hacmini izleyin

LCAT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla kripto varlığa yatırım yapın

- Zarar kes emri: Potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- web3 cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama açın, güçlü şifre kullanın

V. LCAT için Potansiyel Riskler ve Zorluklar

LCAT Piyasa Riskleri

- Yüksek oynaklık: Meme token’lar ciddi fiyat dalgalanmalarına açıktır

- Piyasa duyarlılığı: Sosyal medya ve topluluk etkileşimiyle belirgin şekilde etkilenir

- Rekabet: Piyasadaki meme token sayısının artması

LCAT Regülasyon Riskleri

- Regülasyon belirsizliği: Meme token’lar için daha sıkı düzenlemeler olasılığı

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişken yasal statü

- Vergi etkileri: Meme token işlemlerinin vergilendirilmesine dair belirsizlik

LCAT Teknik Riskler

- Akıllı sözleşme açıkları: Token kontratında istismar veya hata ihtimali

- Blockchain tıkanıklığı: Yoğun işlem dönemlerinde yüksek ağ ücretleri

- Teknolojik eskime: Daha ileri projeler tarafından geri bırakılma riski

VI. Sonuç ve Eylem Önerileri

LCAT Yatırım Değeri Değerlendirmesi

LCAT, meme token kategorisinde yüksek risk-yüksek getiri potansiyeli sunar. Yapay zekâ tabanlı araçları ve güçlü topluluğu büyüme imkânı sağlasa da, yatırımcılar bu tür token’larda aşırı oynaklık ve regülasyon belirsizliği risklerinin farkında olmalıdır.

LCAT Yatırım Önerileri

✅ Yeni başlayanlar: Sadece kaybetmeyi göze alabileceğiniz küçük tutarlarla yatırım yapın; proje hakkında bilgi edinmeye odaklanın ✅ Deneyimli yatırımcılar: LCAT’i çeşitlendirilmiş kripto portföyünüzde değerlendirin; sıkı risk yönetimi uygulayın ✅ Kurumsal yatırımcılar: Temkinli yaklaşın; kapsamlı analiz ve regülasyonları dikkate alın

LCAT Alım Satıma Katılım Yöntemleri

- Spot alım satım: LCAT token’ı Gate.com’da alıp satın

- Staking: Proje tarafından sunuluyorsa staking programlarına katılın

- Topluluk katılımı: Güncellemeler ve muhtemel airdrop’lar için resmi sosyal medya kanallarına katılın

Kripto para yatırımları son derece risklidir ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırım kararlarınızı kendi risk iştahınıza göre verin ve bir finansal uzmana danışın. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

En yüksek fiyat tahminine sahip kripto hangisidir?

Bitcoin, 139.249 $’lık zirve fiyat tahminiyle en yüksek projeksiyona sahip. Chainlink ise 59,67 $’lık tahmini ile ikinci sırada.

Catzilla için 2025 fiyat tahmini nedir?

Catzilla’nın 2025 tahmini fiyatı, ön satış token hedefi temelinde 10 $’dır. Bu öngörü, güçlü meme odaklı talep ve fayda geliştirilmesi varsayımına dayanır.

2030’da LRC için fiyat tahmini nedir?

İstatistiksel modeller, LRC’nin 2030 ortasında 0,038 $’a ve yıl sonunda 0,041 $’a ulaşacağını öngörüyor.

2025’te Chainlink’in fiyatı ne olur?

Mevcut projeksiyonlara göre Chainlink’in fiyatı 2025’te yaklaşık 18,81 $’a ulaşacaktır; bu tahmin, son öngörülerden yıllık %5 büyüme varsayımına dayanıyor.

kripto neden çöküyor ve toparlanacak mı?

2025 GROK Fiyat Tahmini: Yapay Zeka Destekli Kripto Para İçin Potansiyel Yükseliş mi, Piyasa Düzeltmesi mi?

ANI vs XLM: Dil Modellerinde Yapay Zekâ Liderliği Yarışı

2025 ANI Fiyat Tahmini: Animoca Brands'in Token'ı İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

GORK vs SHIB: Kripto Para Ekosisteminde Meme Coin Savaşı

Lion Cat (LCAT) iyi bir yatırım mı?: Bu yeni meme coin’in potansiyelini ve risklerini inceliyoruz

Otomatik Piyasa Yapıcıları: Kripto Piyasalarında Nasıl Çalışırlar?

Arbitrum'da Test Amaçlı Ücretsiz ETH: Adım Adım Kılavuz

Hamster Kombat Günlük Kombinasyonu & Şifre Cevabı 12 Aralık 2025

Bondex Origin Exchange’in Açılış Tarihi Açıklandı

EGRAG Kripto Varlıkları kimdir ve onun Kripto Varlıklar tahminleri neden önemlidir?