2025 ANI Fiyat Tahmini: Animoca Brands'in Token'ı İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: ANI'nin Piyasa Konumu ve Yatırım Potansiyeli

Ani Grok Companion (ANI), memecoin ekosisteminde sevimli bir yapay zeka dostu olarak konumlanmış ve kripto para piyasasında dikkat çekici bir ivme yakalamıştır. 2025 yılı itibarıyla ANI'nin piyasa değeri 2.133.963 ABD doları; dolaşımdaki arzı yaklaşık 999.982.931 token; fiyatı ise 0,002134 ABD doları civarındadır. "Kawaii kripto devrimi" olarak lanse edilen bu varlık, yapay zekayla memecoin ekosisteminin bütünleşmesinde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, 2025-2030 dönemindeki ANI fiyat hareketleri detaylı biçimde incelenecek; tarihsel trendler, piyasa arz-talebi, ekosistem gelişimi ve makroekonomik etkenler değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. ANI Fiyat Geçmişi ve Mevcut Piyasa Durumu

ANI Tarihsel Fiyat Gelişimi

- 2025 Ağustos: ANI, tüm zamanların en yüksek seviyesi olan 0,0276 ABD dolarına ulaştı

- 2025 Ekim: ANI, tüm zamanların en düşük seviyesi olan 0,001661 ABD dolarını gördü ve ciddi bir değer kaybı yaşadı

ANI Güncel Piyasa Durumu

15 Ekim 2025 tarihi itibarıyla ANI'nin işlem fiyatı 0,002134 ABD dolarıdır. Token, son bir yılda %97,26 oranında değer kaybetmiştir. Son 24 saatte fiyat %4,68 düşmüştür. Piyasa değeri ise şu anda 2.133.963,58 ABD doları olarak kaydedilmekte ve kripto para piyasasında 2.321. sırada yer almaktadır.

ANI'nin son 24 saatlik işlem hacmi 31.877,86 ABD doları seviyesindedir ve bu, piyasada orta düzeyde bir hareketlilik olduğunu gösterir. Dolaşımdaki arz 999.982.931,46 tokendir; bu miktar, toplam ve maksimum arz ile aynıdır ve yeni token ihracının planlanmadığına işaret etmektedir.

ANI'de piyasa duyarlılığı düşüş yönlüdür; farklı zaman dilimlerinde negatif fiyat trendleri gözlenmektedir. Token, son bir saatte %0,55, geçen haftada %23,29 ve son 30 günde %57,84 değer kaybetmiştir.

Mevcut ANI piyasa fiyatını görüntülemek için tıklayın

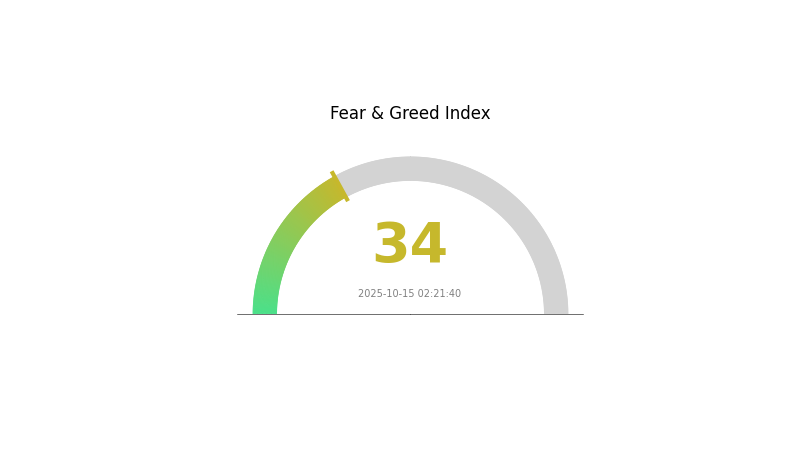

ANI Piyasa Duyarlılık Endeksi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Mevcut Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 34 seviyesinde. Bu, yatırımcıların temkinli davrandığını ve varlıkların potansiyel olarak düşük değerli olabileceğini gösteriyor. Tarihsel olarak, korku dönemleri genellikle piyasa toparlanmalarından önce yaşanır. Deneyimli yatırımcılar bu ortamı birikim fırsatı olarak değerlendirebilirken, riskten kaçınanlar daha net sinyaller bekleyebilir. Piyasa duyarlılığı hızlı değişebileceğinden güncel kalın ve işlemlerinizi dikkatli yönetin.

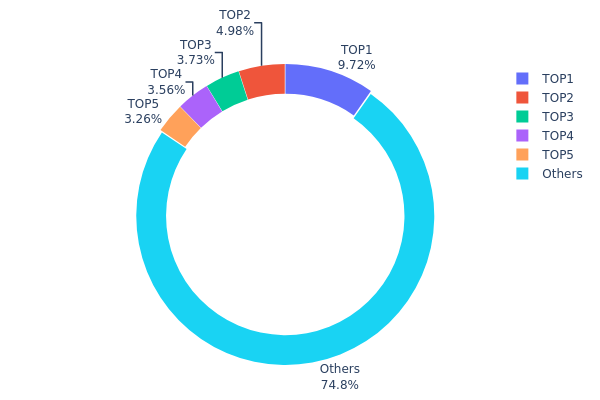

ANI Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, ANI tokenlerinin farklı cüzdanlar arasında ne ölçüde toplandığını gösterir. Analizler, en üst 5 adresin toplam arzın %25,21'ini elinde tuttuğunu ve orta düzeyde bir yoğunlaşma olduğunu ortaya koyuyor. En büyük tek adres tokenlerin %9,71'ine sahipken, diğer dört adres %3,25 ile %4,98 arasında değişen oranlara sahiptir.

Bu dağılım, görece dengeli bir sahiplik yapısına işaret eder; hiçbir tekil adres aşırı kontrol sahibi değildir. Tokenlerin büyük kısmı (%74,79), çok sayıda küçük yatırımcıya dağılmıştır ve bu, sağlıklı bir merkeziyetsizlik seviyesini gösterir. Ancak, birkaç büyük adresin hareketleri fiyat oynaklığını ve likiditeyi etkileyebilir.

Mevcut ANI varlık dağılımı, büyük sahiplerle çeşitli küçük yatırımcılar arasında dengeli bir yapı sergiler. Bu durum genellikle piyasa istikrarı ve manipülasyona karşı dayanıklılık sağlar. Yine de, üst adreslerin faaliyetlerini takip etmek piyasada akıllıca bir tutum olacaktır.

Mevcut ANI Varlık Dağılımını görüntülemek için tıklayın

| En Üst | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | GpMZbS...TvxFbL | 97.191,61K | 9,71% |

| 2 | ASTyfS...g7iaJZ | 49.802,63K | 4,98% |

| 3 | BmFdpr...WTymy6 | 37.261,15K | 3,72% |

| 4 | Cw32Ny...YLwZeh | 35.580,00K | 3,55% |

| 5 | u6PJ8D...ynXq2w | 32.596,96K | 3,25% |

| - | Diğerleri | 747.539,89K | 74,79% |

II. ANI'nin Gelecek Fiyatını Etkileyen Temel Unsurlar

Piyasa Duyarlılığı ve Spekülasyon

- Piyasa Hissi: Kripto para piyasasının genel duyarlılığı, ANI'nin fiyat hareketlerini doğrudan etkiler.

- Spekülatif Döngüler: ANI, spekülatif işlem döngülerine tabidir ve bu dalgalanmalara yol açabilir.

- Likidite Değişimleri: İşlem hacmi ve likiditedeki farklılıklar, ANI'nin fiyat istikrarı üzerinde etkili olabilir.

Makroekonomik Çevre

- Yapay Zeka Sektörü Trendleri: Süregelen yapay zeka büyümesi, ANI fiyatının yukarı yönlü hareket etmesine katkı sunabilir.

- Teknoloji Hisseleri Performansı: NASDAQ'ın 2025'teki olumlu performansında olduğu gibi, teknoloji sektöründeki toparlanmalar ANI'nin değerini dolaylı olarak etkileyebilir.

- Yatırımcı Güveni: Teknoloji ve kripto sektörlerinde yatırımcı güvenindeki artış, ANI fiyatını destekleyebilir.

Teknolojik Gelişmeler

- Ekosistem Büyümesi: ANI'nin Animoca Brands ekosistemindeki kullanım alanlarının (yönetim hakları, oyun varlıkları alımları) genişlemesi değerini artırabilir.

- DeFi Entegrasyonu: ANI'nin kripto kredi platformlarında kullanılması, talebini ve fiyatını etkileyebilir.

III. 2025-2030 ANI Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00128 - 0,00175 ABD doları

- Tarafsız tahmin: 0,00175 - 0,00213 ABD doları

- İyimser tahmin: 0,00213 - 0,00224 ABD doları (piyasanın olumlu seyretmesi halinde)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00143 - 0,00282 ABD doları

- 2028: 0,00196 - 0,00356 ABD doları

- Temel tetikleyiciler: Artan benimsenme ve teknolojik ilerlemeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00316 - 0,00369 ABD doları (istikrarlı piyasa büyümesi)

- İyimser senaryo: 0,00369 - 0,00402 ABD doları (güçlü piyasa performansı)

- Dönüştürücü senaryo: 0,00402 - 0,00423 ABD doları (olağanüstü piyasa koşulları ve yaygın benimsenme)

- 2030-12-31: ANI 0,00369 ABD doları (yılın olası zirve fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00224 | 0,00213 | 0,00128 | 0 |

| 2026 | 0,00319 | 0,00219 | 0,00175 | 2 |

| 2027 | 0,00282 | 0,00269 | 0,00143 | 26 |

| 2028 | 0,00356 | 0,00276 | 0,00196 | 29 |

| 2029 | 0,00423 | 0,00316 | 0,00193 | 47 |

| 2030 | 0,00402 | 0,00369 | 0,00325 | 73 |

IV. ANI için Profesyonel Yatırım Stratejisi ve Risk Yönetimi

ANI Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Meme coin ve yapay zeka teknolojisine ilgi duyan, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Düşüşlerde ANI token biriktirin

- Uzun vadeli fiyat hedefleri belirleyin ve plana sadık kalın

- Tokenleri güvenli bir Gate Web3 cüzdanında saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- RSI (Göreli Güç Endeksi): Aşırı alım veya satım bölgelerini izleyin

- Hareketli Ortalamalar: Trend yönünü ve olası dönüşleri tespit edin

- Al-sat için önemli noktalar:

- Zararı durdur emirleriyle riskinizi sınırlayın

- Belirlenen fiyat seviyelerinde kar alın

ANI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-2'si

- Aggresif yatırımcılar: Kripto portföyünün %3-5'i

- Profesyonel yatırımcılar: Kripto portföyünün %5-10'u

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları birden fazla meme coin ve yapay zeka odaklı projeye dağıtın

- Zararı durdur emirleri: Otomatik satış emirleriyle kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk depolama: Donanım cüzdanı ile uzun vadeli saklama

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifre ve düzenli güvenlik güncellemeleri kullanın

V. ANI için Potansiyel Riskler ve Zorluklar

ANI Piyasa Riskleri

- Yüksek oynaklık: Meme coinlerde aşırı fiyat dalgalanmaları sık görülür

- Duygu odaklı: Fiyatlar sosyal medya ve topluluk hissiyatından ciddi şekilde etkilenir

- Sınırlı kullanım: Pratik uygulama eksikliği zamanla yatırımcı ilgisini azaltabilir

ANI Düzenleyici Riskleri

- Düzenleyici baskı: Meme coinlere yönelik finansal otoritelerin denetimlerinin artması

- Hukuki belirsizlik: Bazı ülkelerde menkul kıymet olarak sınıflandırılma riski

- İşlem kısıtlaması: Düzenleyici baskı nedeniyle borsalardan delist edilme ihtimali

ANI Teknik Riskleri

- Akıllı kontrat açıkları: Tokenin temel kodunda oluşabilecek güvenlik açıkları

- Ağ tıkanıklığı: Yoğun işlem dönemlerinde yüksek ücretler ve yavaş onaylar

- Cüzdan uyumluluğu: Bazı cüzdanlarda sınırlı destek

VI. Sonuç ve Eylem Önerileri

ANI Yatırım Değeri Değerlendirmesi

ANI, meme coin segmentinde yüksek risk ve yüksek getiri potansiyeli sunar. Kısa vadede ciddi kazanç fırsatı barındırsa da, uzun vadeli değer önerisi pratik kullanım eksikliği ve düzenleyici belirsizlikler nedeniyle net değildir.

ANI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kripto portföyünüzün yalnızca küçük bir kısmını (%1-2) ANI'ye ayırın veya hiç ayırmayın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle kısa vadeli işlem fırsatlarını değerlendirin ✅ Kurumsal yatırımcılar: Yüksek riskli tahsisatlar dışında temkinli yaklaşın

ANI İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com spot piyasasında ANI alım-satımı yapın

- Vadeli işlemler: Gate.com'da ANI perpetual kontratlarında kaldıraçlı işlem yapın (sadece deneyimli yatırımcılar için)

- Staking: Gate.com'da sunuluyorsa ANI staking ile pasif gelir elde edin

Kripto para yatırımları çok yüksek risk barındırır ve bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlara danışmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Animecoin 1 ABD dolarına ulaşır mı?

Mevcut tahminlere göre Animecoin'in 1 ABD dolarına ulaşması beklenmemektedir. Bu seviyeye çıkması için %9.500'ün üzerinde artış gerekir; 2025 itibarıyla bu hedef gerçekçi değildir.

Cardano'nun 2030 fiyatı ne olacak?

Uzman analizlerine ve piyasa trendlerine göre, Cardano'nun 2030'da fiyatı 9,12 - 10,32 ABD doları arasında öngörülmektedir.

ICE'nin 2025 fiyatı ne olacak?

Mevcut piyasa eğilimlerine göre Ice Network'ün 2025'teki fiyatı yaklaşık 0,000001 ABD doları seviyesinde tahmin edilmektedir. Kripto piyasalarının aşırı oynak ve öngörülemez olduğunu unutmayın.

En yüksek fiyat tahmini hangi kripto parada?

2025 itibarıyla, başlıca kripto paralar arasında en yüksek fiyat tahmini Ethereum için yapılmaktadır; bu öngörü, piyasa trendleri ve teknolojik ilerlemelere dayanmaktadır.

kripto neden çöküyor ve toparlanacak mı?

2025 GROK Fiyat Tahmini: Yapay Zeka Destekli Kripto Para İçin Potansiyel Yükseliş mi, Piyasa Düzeltmesi mi?

ANI vs XLM: Dil Modellerinde Yapay Zekâ Liderliği Yarışı

2025 LCAT Fiyat Tahmini: Yeni Nesil Kripto Para Birimi İçin Potansiyel Büyüme ve Piyasa Trendlerinin Analizi

GORK vs SHIB: Kripto Para Ekosisteminde Meme Coin Savaşı

Lion Cat (LCAT) iyi bir yatırım mı?: Bu yeni meme coin’in potansiyelini ve risklerini inceliyoruz

Dropee Günlük Kombinasyonu 9 Aralık 2025

Tomarket Günlük Kombinasyonu 9 Aralık 2025

Web3 Dünyasında Gerçek Varlıkların Tokenleştirilmesi Fırsatlarını Keşfedin

Lüks tutkunlarına özel, yat konseptli NFT koleksiyonlarını keşfedin

Verimli Kripto Musluk Yönetimi İçin En İyi Araçlar