2025 HTX Fiyat Tahmini: Dijital Varlık Borsası Token’ı Üzerine Piyasa Trendleri ve Büyüme Potansiyeli Analizi

Giriş: HTX’in Piyasa Konumu ve Yatırım Potansiyeli

HTX (HTX), HTX DAO’nun felsefesini bünyesinde barındıran bir token olarak, kuruluşundan bu yana HTX DAO ekosisteminde öne çıkan, dikkat çekici bir rol üstlenmiştir. 2025 itibarıyla HTX’in piyasa değeri 2.050.379.496 $’a ulaşırken, yaklaşık 999.990.000.000.000 adet dolaşımdaki token ile fiyatı 0,0000020504 $ civarında seyretmektedir. “Ekosistem likiditesinin en büyük sağlayıcısı” olarak bilinen bu varlık, HTX DAO ekosistemindeki önemini giderek artırmaktadır.

Bu makalede, 2025’ten 2030’a kadar HTX’in fiyat eğilimleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam faktörleriyle birlikte analiz edilecek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

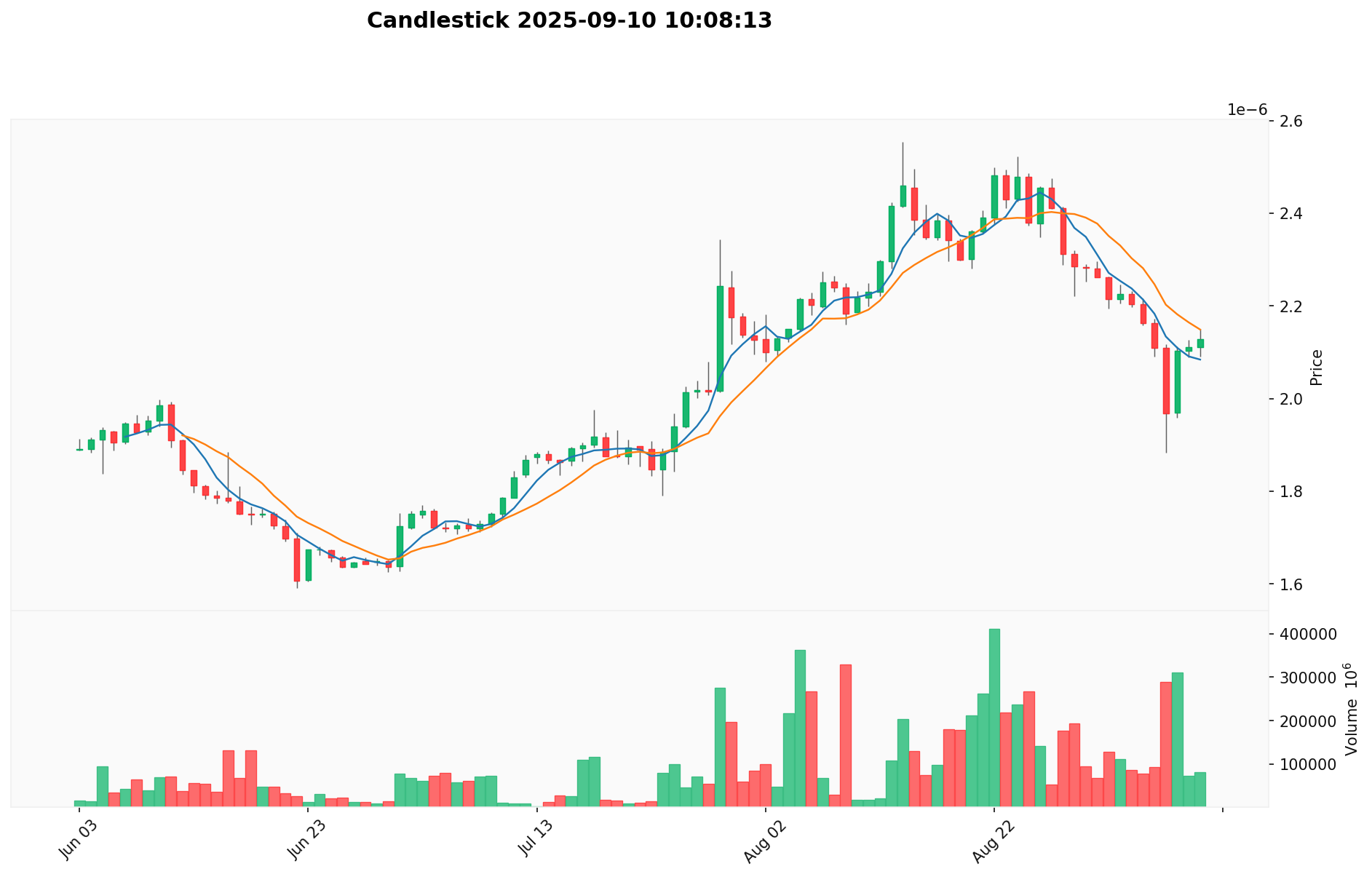

I. HTX Fiyat Geçmişi ve Güncel Piyasa Görünümü

HTX Tarihsel Fiyat Seyri

- 2024: 2 Şubat’ta tüm zamanların en düşük seviyesi olan 0,00000029 $’a inerek HTX’in fiyat tarihinde belirleyici bir dönüm noktası yaşandı.

- 2024: 4 Aralık’ta tüm zamanların en yüksek seviyesi olan 0,0000040025 $’a ulaşarak güçlü bir değer artışı sergilendi.

- 2025: Fiyat dalgalanmaları devam etti ve 10 Eylül’de 0,0000020504 $ seviyesinden işlem görüyor.

HTX’in Güncel Piyasa Durumu

10 Eylül 2025 itibarıyla, HTX 0,0000020504 $ seviyesinde fiyatlanıyor ve piyasa değeri 2.050.379.496 $’a ulaşmış durumda. Son 24 saatte 496.701,74 $’lık işlem hacmi gerçekleşti. Token, son 24 saatte %4,21 oranında değer kaybederken, kısa vadede zayıf eğilim gözlemleniyor. Yıl bazında ise %75,16 artışla güçlü bir performans öne çıkıyor. Mevcut fiyat, zirve seviyesinin %48,73 altında ve en düşük seviyenin %607,03 üzerinde bulunuyor; bu da HTX’in fiyat tarihinin orta bandında yer aldığını gösteriyor. Toplam arz ile dolaşımdaki arzın eşit olduğu (999.990.000.000.000 HTX token) projede, token’ların tamamı piyasada dolaşımdadır.

Güncel HTX piyasa fiyatını görmek için tıklayın

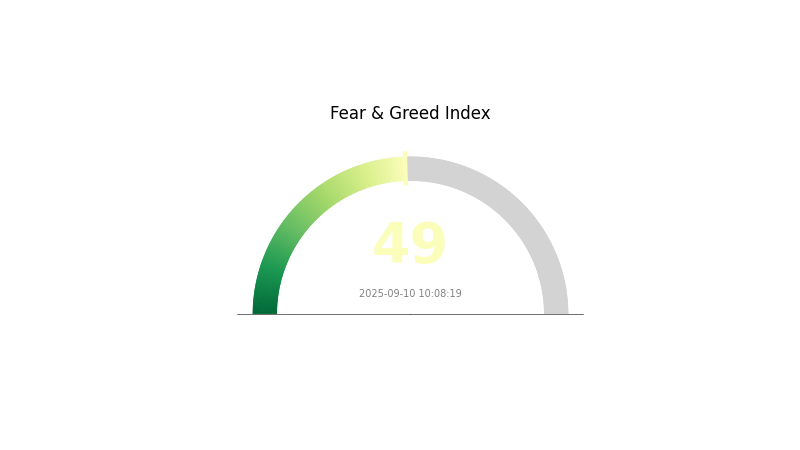

HTX Piyasa Duyarlılık Göstergesi

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku & Açgözlülük Endeksine göz atmak için tıklayın

Bugün kripto para piyasasında duyarlılık denge noktasında bulunuyor ve Korku ve Açgözlülük Endeksi 49 ile nötr seviyede. Bu durum, yatırımcıların mevcut piyasa koşullarında ne fazla kötümser ne de aşırı iyimser olduğuna işaret ediyor. Yatırımcılar yatırım kararlarını verirken mutlaka detaylı araştırma yapmalı ve temkinli yaklaşmalıdır. Portföyünüzü çeşitlendirmek ve etkin risk yönetimi uygulamak, dalgalı piyasada yol almanızı sağlar. Piyasa duyarlılığındaki değişimler için anahtar göstergeleri takip etmeyi ihmal etmeyin.

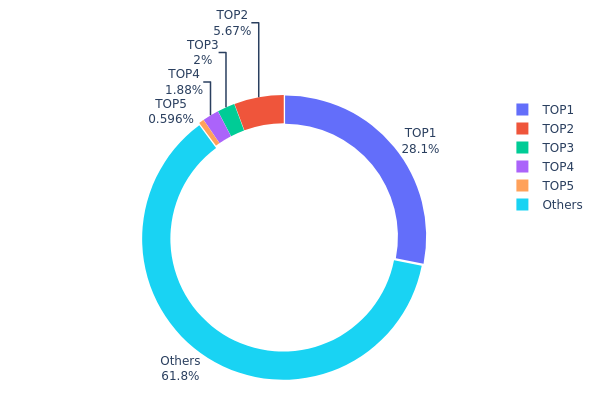

HTX Varlık Dağılımı

Cüzdan adreslerindeki varlık dağılımı verileri, HTX token’ın sahiplik yoğunluğuna dair kritik bilgiler sunar. Analizler, en büyük adresin toplam arzın %28,07’sine sahip olduğunu, ilk 5 adresin ise toplamda %38,2 oranında HTX bulundurduğunu gösteriyor. Bu durum, token sahipliğinde belirgin bir merkezileşmeye işaret ediyor.

Böylesi bir yoğunlaşmanın, potansiyel piyasa manipülasyonu ve fiyat oynaklığı risklerini artırdığı unutulmamalıdır. Tek bir adresin toplam arzın dörtte birinden fazlasını elinde bulundurması, piyasadaki fiyat hareketlerine önemli etki etme potansiyeli taşır. Bununla birlikte, tokenların %61,8’i diğer adreslerde tutulduğundan, küçük yatırımcılar arasında kısmi bir dağılım olduğu da gözlenmektedir.

Bu dağılım yapısı, HTX ekosisteminde orta düzeyde bir merkezileşmeye işaret eder. Merkezileşme bazı yönlerden istikrarı güçlendirse de, piyasa bütünlüğüne yönelik riskler oluşturabilir ve token’ın uzun vadeli değer teklifini etkileyebilir. HTX ağının merkeziyetsizlik ve genel sağlığının izlenmesi için varlık dağılımındaki zaman içindeki değişimler yakından takip edilmelidir.

Güncel HTX Varlık Dağılımını incelemek için tıklayın

| Sıra | Adres | Varlık (Adet) | Varlık (%) |

|---|---|---|---|

| 1 | TDToUx...u2ivA4 | 280.710.322.341,76K | 28,07% |

| 2 | T9yD14...LxmGkn | 56.720.760.235,83K | 5,67% |

| 3 | TUtyDz...Ve3AAs | 19.999.800.000,00K | 2,00% |

| 4 | TRaQus...TJj3EB | 18.774.914.048,71K | 1,87% |

| 5 | TU1Cmp...JNYLJe | 5.960.389.369,16K | 0,59% |

| - | Diğerleri | 617.823.814.004,54K | 61,8% |

II. HTX’in Gelecekteki Fiyatını Belirleyen Temel Etkenler

Arz Mekanizması

- Tarihsel Eğilimler: Geçmişteki arz değişimleri, HTX’in fiyat hareketleri üzerinde belirgin etkiler bırakmıştır.

- Güncel Etki: Toplam 999.990.000.000.000 adetlik HTX arzı, gelecekteki fiyat dinamiklerinde önemli rol oynayabilir.

Kurumsal ve Büyük Yatırımcı (Balina) Dinamikleri

- Kurumların Benimsemesi: Önde gelen şirketlerin HTX’i benimsemeleri fiyatı yukarıya çekebilir.

- Ulusal Politikalar: Devletlerin kripto paralara yönelik politikaları HTX’in değerini doğrudan etkileyebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özellikleri: HTX’in enflasyonist ortamlardaki performansı fiyat hareketleri açısından belirleyici olabilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler, genel piyasa ile birlikte HTX’in fiyatını da etkileyebilir.

Teknik Gelişim ve Ekosistem Yatırımları

- Küresel Büyüme: Avrupa ve Asya’daki yerelleştirme dahil HTX’in küresel stratejisi, rekabet gücü ve fiyat potansiyeli için kritik önemdedir.

- Ekosistem Uygulamaları: HTX ağı üzerindeki DApp’ler ile ekosistem projelerinin gelişimi, değer artışını tetikleyebilir.

III. 2025-2030 Dönemi HTX Fiyat Tahmini

2025 Beklentisi

- İhtiyatlı tahmin: 0,80 $ – 1,00 $

- Dengeli tahmin: 1,00 $ – 1,20 $

- İyimser tahmin: 1,20 $ – 1,40 $ (olumlu piyasa havası ve ekosistem büyümesi gerektirir)

2027-2028 Beklentisi

- Piyasa fazı: Olası bir boğa piyasası evresi

- Fiyat tahmin aralığı:

- 2027: 1,40 $ – 1,70 $

- 2028: 1,90 $ – 2,40 $

- Kritik katalizörler: HTX ekosisteminin yaygınlaşması, olumlu düzenleyici ortam

2030 Uzun Vadeli Görünüm

- Başat senaryo: 2,50 $ – 3,00 $ (istikrarlı büyüme ve piyasa istikrarı varsayımıyla)

- İyimser senaryo: 3,00 $ – 3,50 $ (ekosistem büyümesi ve pazar liderliğiyle)

- Dönüştürücü senaryo: 3,50 $ – 4,00 $ (büyük inovasyonlar ve kitlesel benimseme durumunda)

- 31 Aralık 2030: HTX 3,44 $ (2025 seviyesine kıyasla %72 artış)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 14 |

| 2027 | 0 | 0 | 0 | 19 |

| 2028 | 0 | 0 | 0 | 41 |

| 2029 | 0 | 0 | 0 | 63 |

| 2030 | 0 | 0 | 0 | 72 |

IV. HTX için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

HTX Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Risk toleransı yüksek, uzun vadeli yatırımcılara uygundur

- Uygulama önerileri:

- Piyasa geri çekilmelerinde HTX biriktirmek

- Hedef fiyatlar belirleyip portföyünüzü düzenli olarak gözden geçirmek

- Token’ları güvenli soğuk cüzdanlarda saklamak

(2) Aktif Al-Sat Stratejisi

- Kullanılabilecek teknik analiz araçları:

- Hareketli Ortalamalar: Piyasa trendi ve giriş/çıkış noktaları belirlemede yararlıdır

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım durumlarını tespit etmek için kullanılır

- Salınımlı işlem için önemli noktalar:

- HTX ekosistemindeki gelişme ve duyuruları yakından izleyin

- Riskten korunmak için zararı durdur emirleri kullanın

HTX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: %1–3

- Agresif yatırımcılar: %5–10

- Profesyonel yatırımcılar: %10–15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı kripto paralara yatırım yaparak riski dağıtmak

- Zararı durdur emirleri: Potansiyel kayıpları sınırlandırmak için kullanmak

(3) Güvenli Saklama Alternatifleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdanı

- Soğuk depolama: Uzun vadeli tutumda donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulamayı etkinleştirip özgün şifreler kullanmak

V. HTX’in Karşılaşabileceği Potansiyel Riskler ve Zorluklar

HTX Piyasa Riskleri

- Volatilite: Kripto para piyasaları yüksek ölçüde dalgalanabilir

- Rekabet: DAO ve token ekosisteminde artan rekabet

- Likidite: Stresli dönemlerde potansiyel likidite sıkıntıları

HTX’e Yönelik Düzenleyici Riskler

- Düzenleyici belirsizlik: Kripto paralara yönelik küresel mevzuatlar sürekli değişkenlik gösteriyor

- Uyum zorlukları: Yeni regülasyonlara adapte olma gerekliliği

- Hukuki durum: HTX’in hukuki sınıfında olası değişiklikler

HTX Teknik Riskleri

- Akıllı sözleşme açıkları: Token sözleşmesinde oluşabilecek hatalar veya istismarlar

- Ağ yoğunluğu: TRX ağında yaşanacak sıkışıklık HTX işlemlerini etkileyebilir

- Teknolojik eskime: Blokzincir alanındaki hızlı inovasyonlar

VI. Sonuç ve Eylem Önerileri

HTX’in Yatırım Değerine İlişkin Değerlendirme

HTX, HTX DAO ekosisteminde benzersiz bir yatırım seçeneği sunarken, piyasa oynaklığı ve düzenleyici belirsizlikler nedeniyle önemli riskler de barındırır. Uzun vadeli büyüme potansiyeli mevcut; ancak kısa vadede dalgalanmalar muhtemeldir.

HTX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Düşük miktarla başlayın, bilgi edinin ve risk yönetimine odaklanın

✅ Deneyimli yatırımcılar: Portföyünüzü düzenli aralıklarla dengeleyerek dengeli yaklaşımı benimseyin

✅ Kurumsal yatırımcılar: Kapsamlı araştırma yapın ve ileri düzey risk yönetimi stratejileri uygulayın

HTX Alım-Satıma Katılım Yöntemleri

- Spot alım-satım: Gate.com’da HTX token alım satımı yapabilirsiniz

- Staking: Uygunsa HTX DAO staking programlarına katılabilirsiniz

- DeFi: HTX ekosistemi içerisindeki merkeziyetsiz finans fırsatlarını inceleyin

Kripto para yatırımları büyük risk içerir, bu yazı yatırım tavsiyesi değildir. Kendi risk toleransınızı göz önünde bulundurarak karar verin ve profesyonel finansal danışmanlardan görüş alın. Katlanabileceğinizden fazla tutarı asla yatırmayın.

SSS

2030’da HTX’in fiyatı ne olur?

Mevcut piyasa trendlerine göre, HTX’in 2030’da 1,84 $ seviyelerine ulaşacağı tahmin ediliyor. Bu, bugünkü fiyata kıyasla %25 oranında potansiyel negatif getiri anlamına gelmektedir.

2050’de HTX coin için fiyat tahmini nedir?

Yıllık %5 büyüme projeksiyonuna göre, HTX coin’in 2050 yılında 0,00007313 $ seviyesine ulaşacağı öngörülüyor. Bu tahmin, mevcut piyasa seyrinin korunması varsayımıyla yapılmıştır.

HTX güvenilir bir kripto borsası mı?

HTX, birçok yatırımcının tercih ettiği, köklü ve güvenilir bir kripto borsasıdır. Geniş token yelpazesi ve geçmişteki başarılı performansı ile öne çıkar. Kullanımı kolay arayüzü ve yüksek güvenilirliğiyle iyi bir tercih olarak öne çıkmaktadır.

2025’te Huobi token için fiyat beklentisi nedir?

Mevcut projeksiyonlara göre, Huobi Token (HT), 2025’te 0,88 $ ile 6,03 $ arasında işlem görebilir ve analistlerin çoğu fiyat potansiyeli konusunda temkinli bir iyimserlik taşımaktadır.

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

2025 HBAR Fiyat Tahmini: Hedera Hashgraph, Kripto Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 CFX Fiyat Tahmini: Conflux Network İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 LTC Fiyat Tahmini: Litecoin’in Piyasa Trendleri ve Olası Büyüme Dinamiklerinin Analizi

2025 SMARTPrice Tahmini: Yatırım Portföyü Optimizasyonu İçin Gelişmiş Yapay Zekâ Destekli Piyasa Analitikleri

2025 DOT Fiyat Tahmini: Polkadot, Artan Benimsenmeyle 100 Dolar Seviyesine Ulaşacak mı?

Kripto Piyasalarında Yükselen Kama Formasyonunu Etkin Şekilde Kullanmak

Kripto paralarda arz kavramının ne olduğunu anlamak

Merkeziyetsiz Blockchain Teknolojisinin Temel İlkelerini Anlamak

Ethereum'da Gas Ücretleri: Ayrıntılı Bir Rehber

Bored Ape NFT Koleksiyonu Üzerine İnceleme: Detaylı Bir Kılavuz