2025 HBAR Fiyat Tahmini: Hedera Hashgraph, Kripto Piyasasında Yeni Zirvelere Ulaşabilir mi?

Giriş: HBAR’ın Piyasadaki Konumu ve Yatırım Değeri

Hedera (HBAR), hızlı ve güvenli bir halka açık defter ağı olarak kuruluşundan bu yana önemli dönüm noktalarına ulaşmıştır. 2025 yılı itibarıyla Hedera’nın piyasa değeri 9,86 milyar dolara ulaşmış, dolaşımda yaklaşık 42,39 milyar token bulunmakta ve fiyatı yaklaşık 0,23 dolar seviyesinde seyretmektedir. Genellikle “kurumsal düzeyde halka açık ağ” olarak nitelendirilen bu varlık, merkeziyetsiz uygulamalar ve mikro ödeme sistemlerinde giderek daha kritik bir rol üstlenmektedir.

Bu makalede, Hedera’nın 2025’ten 2030’a kadar olan fiyat eğilimleri; tarihsel gelişimi, piyasa arz-talep dengesi, ekosistem büyümesi ve makroekonomik koşullar çerçevesinde kapsamlı biçimde analiz edilerek yatırımcılar için profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. HBAR Fiyat Geçmişi ve Güncel Piyasa Durumu

HBAR Tarihsel Fiyat Gelişimi

- 2020: HBAR, 3 Ocak’ta 0,00986111 dolar ile tarihinin en düşük seviyesini gördü

- 2021: 15 Eylül’de 0,569229 dolar ile tüm zamanların en yüksek fiyatına ulaştı

- 2024: Yıl boyunca %371,05’lik güçlü bir fiyat artışı gerçekleşti

HBAR Güncel Piyasa Görünümü

9 Eylül 2025 itibarıyla HBAR, 0,23252 dolardan işlem görmekte olup kripto para sıralamasında 24. sırada yer almaktadır. Son 24 saatte %4,75’lik değer kazanımı gösterirken, işlem hacmi 5.791.977 dolardır. HBAR’ın toplam piyasa değeri 9.857.203.477 dolara ulaşarak tüm kripto piyasasının %0,28’ini oluşturmaktadır.

HBAR fiyatı farklı zaman dilimlerinde dalgalı bir seyir izlemiştir. Son 1 saatte %0,069, son 30 günde ise %8,88 oranında değer kaybederken; son 1 haftada %6,84 artış kaydetmiştir. Dolaşımdaki arzı 42.392.927.395 HBAR olup, bu rakam 50.000.000.000 maksimum arzın %84,79’una tekabül etmektedir.

HBAR, tüm zamanların en yüksek fiyatının altında olmasına rağmen dirençli bir görünüm sergilemekte ve piyasadaki etkisini sürdürmektedir. Son haftalardaki pozitif fiyat performansı, artan ilgiyi ve potansiyel bir toparlanma beklentisini ortaya koymaktadır.

Güncel HBAR piyasa fiyatını görmek için tıklayın

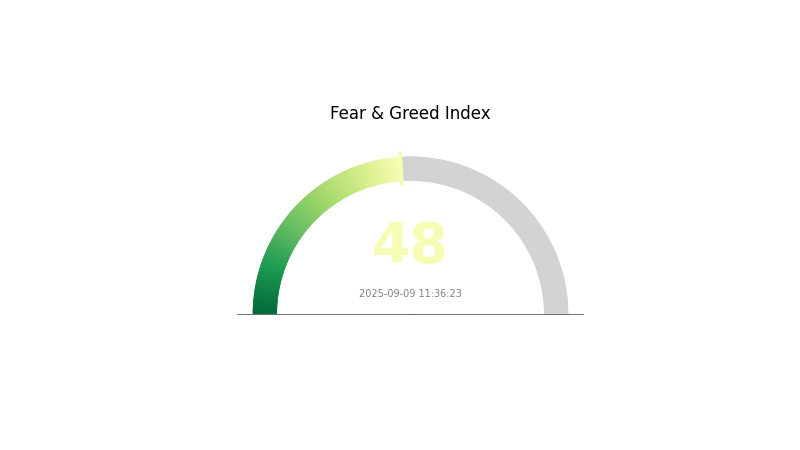

HBAR Piyasa Duyarlılığı Göstergesi

09 Eylül 2025 Korku ve Açgözlülük Endeksi: 48 (Nötr)

HBAR piyasasında duyarlılık nötr seviyede olup, Korku ve Açgözlülük Endeksi 48 olarak ölçülmüştür. Yatırımcılar ne aşırı çekimser ne de aşırı hevesli davranmaktadır. Bu dönem stratejilerin yeniden değerlendirilmesi ve detaylı piyasa analizi için uygundur. Nötr görünüm istikrar işaretidir; yine de olası piyasa hareketlerine karşı dikkatli olunmalıdır. Yatırımcılar HBAR’ın performansını ve genel kripto trendlerini yakından takip etmelidir. Başarılı yatırım için kripto piyasasında çeşitlendirme ve risk yönetimi temel unsurlardır.

HBAR Varlık Dağılımı

HBAR adreslerine göre varlık dağılımı verisi şu anda bulunmamaktadır. Bu durum, HBAR’ın merkezileşme veya merkezsizleşme seviyesini kapsamlı biçimde analiz etmeyi olanaksız kılmaktadır. Normalde bu tür veriler, HBAR varlıklarının farklı adresler arasında nasıl paylaşıldığına dair net içgörüler sunarak hem merkezileşme riskini hem de piyasa üzerindeki muhtemel etkileri değerlendirmeye olanak tanır.

En büyük sahipler ve paylarına dair güncel veri olmadan, piyasada HBAR’ın aşırı yoğunlaşmasını veya fiyat dalgalanmasına yönelik olası etkileri net biçimde belirlemek güçleşmektedir. Aynı şekilde, bu eksiklik zincir üstü yapıdaki istikrar ile merkezsizleşme derecesinin değerlendirilmesini de zorlaştırır.

HBAR’ın piyasa davranışı ve sahiplik yapısını daha hassas şekilde değerlendirmek için, doğrulanmış güncel verilere güvenilir kaynaklardan veya doğrudan blockchain explorer üzerinden ulaşılması gerekir.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. HBAR’ın Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Sabit Arz: HBAR, maksimum 50 milyar tokenlık bir arz sınırına sahiptir.

- Mevcut Durum: Dolaşımdaki 42.392.927.395 HBAR, maksimum arza yaklaştıkça fiyat dinamiklerini etkileyebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Hedera, kurumsal uygulamalar için tercih edilen bir platform olmayı hedefliyor, bu da HBAR’a olan talebi artırabilir.

Makroekonomik Koşullar

- Enflasyona Karşı Koruma Özelliği: HBAR, kripto varlık olarak enflasyona karşı korunma potansiyeli ile görülüp yüksek enflasyon dönemlerinde fiyatını etkileyebilmektedir.

Teknolojik Gelişim ve Ekosistem İnşası

- Hashgraph Konsensüs Algoritması: Hedera’nın benzersiz hashgraph algoritması, klasik blockchain’lere kıyasla daha hızlı işlem ve yüksek verimlilik sunmayı amaçlamaktadır.

- Yapay Zeka Entegrasyonu: AI Studio aracı ile Hedera’nın yapay zeka alanındaki kabiliyetleri genişlemektedir.

- Oyun Sektörü Açılımı: OneWave gibi platformlarla yapılan iş birliği, özellikle Güneydoğu Asya mobil oyun pazarında Hedera’nın etkisini artırmaktadır.

- Ekosistem Uygulamaları: Hedera, AI, oyun ve çevresel sürdürülebilirlik dahil olmak üzere farklı sektörlerde merkeziyetsiz uygulama (dApp) geliştirmeye odaklanmaktadır.

“Yapay zeka geliştirme araçlarının, oyun sektörü iş birliğinin ve çevre dostu uygulamaların sisteme entegre edilmesi, Hedera’nın blockchain benimsemesinde çok sektörlü bir yaklaşım benimsediğini gösteriyor.”

III. HBAR Fiyat Tahmini 2025-2030

2025 Görünümü

- Ihtiyatlı tahmin: 0,12 – 0,20 dolar

- Nötr tahmin: 0,20 – 0,25 dolar

- İyimser tahmin: 0,25 – 0,28 dolar (pozitif piyasa hissiyatı ve artan benimseme gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa fazı beklentisi: Benimsemenin arttığı potansiyel bir büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,21 – 0,30 dolar

- 2027: 0,25 – 0,32 dolar

- Temel katalizörler: Kullanım alanında genişleme, teknik iyileştirmeler ve piyasa toparlanması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,31 – 0,38 dolar (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,38 – 0,45 dolar (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,45 – 0,54 dolar (çığır açan uygulamalar ve kitlesel benimseme ile)

- 31 Aralık 2030: HBAR 0,54492 dolar (aşırı boğa senaryosunda olası zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,28374 | 0,23257 | 0,12094 | 0 |

| 2026 | 0,30204 | 0,25815 | 0,21943 | 10 |

| 2027 | 0,32491 | 0,2801 | 0,25489 | 20 |

| 2028 | 0,3872 | 0,3025 | 0,28435 | 29 |

| 2029 | 0,41727 | 0,34485 | 0,28278 | 47 |

| 2030 | 0,54492 | 0,38106 | 0,31628 | 63 |

IV. HBAR için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

HBAR Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Yüksek risk iştahına sahip, uzun vadeli yatırımcılar

- Yöntemler:

- Fiyat düşüşlerinde HBAR biriktirin

- Fiyat hedefleri belirleyip portföyünüzü belirli aralıklarla yeniden dengeleyin

- HBAR varlıklarınızı güvenli donanım cüzdanı veya donanım cüzdanlarında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve potansiyel giriş/çıkış noktalarını yakalamada kullanılır

- Göreceli Güç Endeksi (RSI): Aşırı alım/aşırı satım seviyelerini takip edin

- Kısa ve orta vadeli al-sat için öneriler:

- Hedera ağındaki güncellemeleri ve yeni ortaklıkları izleyin

- Olası fiyat patlamaları için işlem hacmini yakından takip edin

HBAR Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Korumacı yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yaklaşımları

- Çeşitlendirme: Yatırımlarınızı farklı kripto paralar ve geleneksel varlıklar arasında dağıtın

- Zarar durdur emri: Olası kayıpları sınırlamak için önceden belirlenmiş çıkış seviyeleri belirleyin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli güvenlik için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirilmeli, güçlü şifreler kullanılmalı, özel anahtarlar çevrimdışı tutulmalıdır

V. HBAR için Potansiyel Riskler ve Zorluklar

HBAR Piyasa Riskleri

- Fiyat oynaklığı: Kripto para piyasalarında yüksek dalgalanma riski

- Rekabet: Diğer blockchain platformları Hedera’dan daha iyi performans gösterebilir

- Benimseme hızı: Kurumsal adaptasyonun yavaş olması HBAR’ın değerini olumsuz etkileyebilir

HBAR Düzenleyici Riskleri

- Düzenleyici belirsizlikler: Mevzuattaki değişiklikler HBAR’ın kullanımı ve değerine etki edebilir

- Uyum sorunları: Farklı ülkelerde yasal zorluklar doğabilir

- Vergi etkileri: Kripto varlık işlemlerine getirilecek yeni vergilendirme yaklaşımları

HBAR Teknik Riskleri

- Ağ güvenliği: Hedera ağına dair potansiyel güvenlik açıkları

- Ölçeklenebilirlik sorunları: Artan işlem hacminde beklenmedik aksaklıklar

- Akıllı sözleşme riskleri: Hedera ekosisteminde geliştirilen akıllı sözleşmelerde hata veya açık riski

VI. Sonuç ve Eylem Önerileri

HBAR Yatırım Değeri Analizi

Hedera (HBAR), hızlı, güvenli ve şeffaf halka açık defter altyapısı ile özgün bir değer önerisi taşımaktadır. Uzun vadede kurumsal adaptasyon ve teknolojik ilerleme potansiyeli sunarken, kısa vadede piyasadaki oynaklık ve düzenleyici belirsizlikler önemli riskler olarak öne çıkmaktadır.

HBAR Yatırım Önerileri

✅ Yeni başlayanlar: Öncelikle piyasayı tanımak için küçük ve düzenli yatırımlar yapın

✅ Deneyimli yatırımcılar: Hem uzun vadeli tutma hem de stratejik işlemlere yer veren dengeli bir yaklaşım benimseyin

✅ Kurumsal yatırımcılar: Hedera’nın teknolojisini uygun entegrasyon ve uzun vadeli değer açısından değerlendirin

HBAR İşlem Katılım Yöntemleri

- Spot işlem: Gate.com’da HBAR alım satım yapabilirsiniz

- Staking: HBAR staking programlarına katılarak pasif gelir elde edin

- DeFi entegrasyonu: HBAR ile merkeziyetsiz finans alanındaki fırsatları değerlendirin

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırım kararlarınızı risk toleransınıza göre dikkatli şekilde vermelisiniz. Profesyonel finansal danışmanlık almanız önerilir. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

HBAR 10 dolara ulaşabilir mi?

HBAR’ın, 7-14 yıl içinde 10 dolara ulaşma olasılığı bulunmakta; 10 yıl sonrasında bu ihtimal %16,4’tür. Bu öngörü, kurumsal adaptasyon ölçümleri ve Monte Carlo simülasyonları temel alınarak yapılmıştır.

2025’te HBAR’ın değeri ne olacak?

Piyasa trendleri ve uzman değerlendirmelerine göre, 2025 yılında HBAR’ın 0,225 ile 0,54 dolar aralığında işlem görmesi beklenmektedir.

Hedera 5 dolara çıkabilir mi?

Evet, Hedera’nın 5 dolara ulaşması mümkündür. Benimseme oranı artarsa ve piyasa büyürse önümüzdeki yıllarda bu seviyeye çıkabilir.

2030’da 1 HBAR kaça satılır?

Mevcut öngörülere göre, 1 HBAR’ın 2030 yılında yaklaşık 0,29 dolar değerinde olması beklenmektedir. Bu tahmin, Hedera teknolojisinin büyüme potansiyelini ve piyasa genişlemesini yansıtır.

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

2025 CFX Fiyat Tahmini: Conflux Network İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 SMARTPrice Tahmini: Yatırım Portföyü Optimizasyonu İçin Gelişmiş Yapay Zekâ Destekli Piyasa Analitikleri

2025 DOT Fiyat Tahmini: Polkadot, Artan Benimsenmeyle 100 Dolar Seviyesine Ulaşacak mı?

2025 NANO Fiyat Tahmini: Dijital Para Birimi İçin Piyasa Analizi ve Büyüme Potansiyeli

2025 FTN Fiyat Tahmini: Piyasa Trendleri, Tokenomik ve FTN’nin Gelecek Boğa Döngüsündeki Büyüme Potansiyeli Analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak