2025 G Fiyat Tahmini: Piyasa Trendleri ve Gelecekteki Değerleri Etkileyen Faktörlerin Analizi

Giriş: G'nin Piyasa Konumu ve Yatırım Değeri

Gravity (G), hem Gravity ağının yerel token’ı hem de Gravity ile Galxe ekosistemlerinde fayda token’ı olarak blokzincir sektöründe başrol oyuncularından biri haline gelmiştir. 2025 itibarıyla, Gravity’nin piyasa değeri 52.249.024 ABD Doları’na ulaşırken, dolaşımdaki arzı yaklaşık 7.232.700.000 token ve fiyatı 0,007224 ABD Doları civarındadır. “Çift ekosistemli fayda token’ı” unvanını alan bu varlık, hem Gravity hem de Galxe platformlarında işlemlerin yürütülmesi, ağ güvenliğinin sağlanması ve yönetişimin desteklenmesinde giderek daha belirleyici bir rol üstleniyor.

Bu makale, 2025-2030 yılları arasında Gravity’nin fiyat hareketlerini; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında analiz ederek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. G Fiyat Geçmişi ve Güncel Piyasa Durumu

G Tarihsel Fiyat Gelişimi

- 2024: G, 25 Temmuz’da 0,05764 ABD Doları ile tarihinin en yüksek seviyesini görerek önemli bir dönemeç yaşadı.

- 2025: Piyasada aşağı yönlü bir seyir gözlenirken, G’nin fiyatı 10 Ekim’de 0,00528 ABD Doları ile en düşük seviyesine indi.

G Güncel Piyasa Durumu

23 Ekim 2025 itibarıyla G, 0,007224 ABD Doları’ndan işlem görüyor; bu, zirveye kıyasla yüzde 87,46’lık bir değer kaybı anlamına geliyor. Token’ın piyasa değeri 52.249.024,80 ABD Doları ve küresel kripto para piyasasında 590. sırada. Son 24 saatte G’nin fiyatı yüzde 2,53 gerilerken, işlem hacmi 23.137,32 ABD Doları seviyesinde. Mevcut fiyat, en düşük seviyenin yüzde 36,82 üzerinde olup kısmi bir toparlanmayı yansıtıyor. Ancak, token hâlâ güçlü bir düşüş baskısı altında; haftalık bazda yüzde 7,10, son 30 günde ise yüzde 28,1 oranında değer kaybı yaşandı.

G’nin güncel piyasa fiyatını görmek için tıklayın

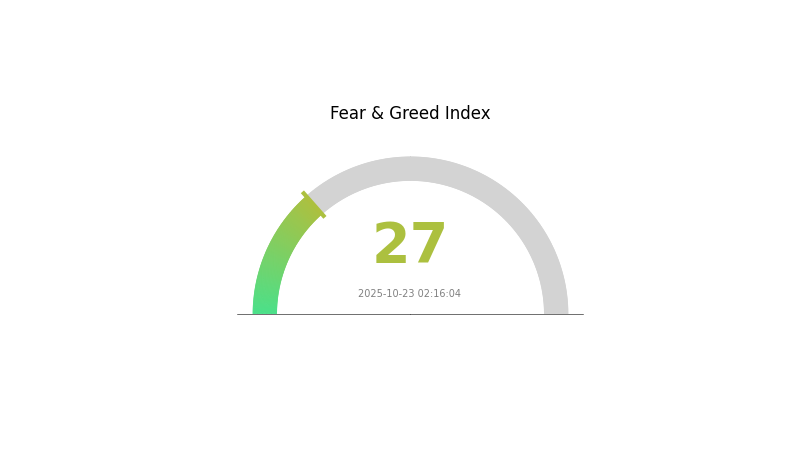

G Piyasa Duyarlılık Endeksi

23 Ekim 2025 Korku ve Açgözlülük Endeksi: 27 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto para piyasasında şu anda korku hâkim; Korku ve Açgözlülük Endeksi 27 seviyesinde. Bu durum, yatırımcıların temkinli davrandığını ve kalabalığın tersine hamle yapmak isteyenler için potansiyel alım fırsatları oluştuğunu gösteriyor. Ancak, piyasa koşullarının hızla değişebileceği unutulmamalı. Yatırımcılar kapsamlı araştırma yapmalı, portföylerini çeşitlendirmeli ve Gate.com’un gelişmiş işlem araçlarından yararlanarak belirsiz ortamda yön bulmalıdır. Her zaman olduğu gibi, kripto piyasasında kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

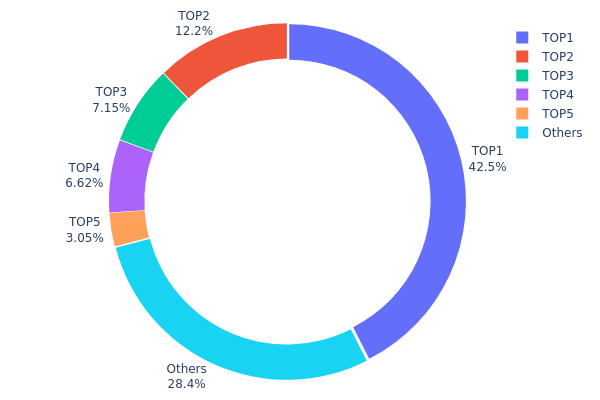

G Varlık Dağılımı

Adres bazlı dağılım verileri, G token’larının büyük bölümünün birkaç adreste toplandığını gösteriyor. En büyük adres, toplam arzın yüzde 42,52’sine sahipken, ilk 5 adres G token’larının yüzde 71,56’sını kontrol ediyor. Bu yoğunlaşma, merkezi bir sahiplik yapısına işaret ediyor ve piyasa dinamiklerini etkileyebilir.

Böyle bir dağılım, piyasada manipülasyon ve fiyat dalgalanması riskini artırıyor. Tek bir adresin arzın yüzde 40’ından fazlasını elinde tutması, büyük miktarda token hareketi veya satışı halinde piyasada ciddi sarsıntılar yaşanabileceği anlamına geliyor. Ayrıca bu merkezileşme, kripto paraların temel ilkesi olan merkeziyetsizliğe ters düşerek yatırımcı güvenini ve token’ın uzun vadeli istikrarını zedeleyebilir.

Yine de, G token’larının yüzde 28,44’ü diğer adreslerde bulunuyor; bu da kısmen daha geniş bir katılım olduğu anlamına geliyor. Mevcut dağılım yapısı, G piyasasında birkaç büyük sahipten kaynaklı fiyat oynaklığı ve piyasa verimsizliği riskinin devam ettiğini gösteriyor.

Güncel G Varlık Dağılımını görmek için tıklayın

| Üst | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x7983...364c42 | 4.901.858,94K | 42,52% |

| 2 | 0x1a70...1e8800 | 1.411.046,94K | 12,24% |

| 3 | 0xbd6e...fbfb6d | 824.607,98K | 7,15% |

| 4 | 0xf977...41acec | 762.747,73K | 6,61% |

| 5 | 0xec9f...a8226b | 351.259,99K | 3,04% |

| - | Diğerleri | 3.275.035,69K | 28,44% |

II. G’nin Gelecekteki Fiyatına Etki Eden Temel Unsurlar

Makroekonomik Ortam

-

Para Politikası Etkisi: ABD Merkez Bankası’nın faiz oranı kararları belirleyici olmaya devam ediyor. Yüksek faiz oranları, G’yi elde tutmanın fırsat maliyetini artırarak fiyatları baskılıyor. 2025’te önde gelen merkez bankalarının ayrışan politikaları hâlâ gündemde.

-

Enflasyona Karşı Koruma Özelliği: G, geleneksel olarak enflasyona karşı bir koruma aracı olarak kabul ediliyor. Enflasyon beklentileri veya gerçekleşen enflasyon arttığında, yatırımcılar değer koruma amacıyla G’ye yöneliyor ve bu da fiyatı destekliyor.

-

Jeopolitik Etmenler: G’nin “güvenli liman” konumu, jeopolitik belirsizlik dönemlerinde öne çıkıyor. Bölgesel çatışmalar, ticaret gerilimleri ve büyük seçimler, piyasalarda panik ve belirsizlik yaratarak sermayenin G’ye akmasına neden olabilir.

Teknik Gelişim ve Ekosistem Yapılanması

- Arz Mekanizması: Yatırım talebi baskın olsa da, arz-talep dinamikleri hâlâ önemini koruyor. Küresel madencilik üretimi, çıkarım maliyetleri ve merkez bankalarının net altın alım/satımlarına odaklanmak gerekiyor.

III. 2025-2030 Arası için G Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,00529 - 0,00725 ABD Doları

- Tarafsız tahmin: 0,00725 - 0,00848 ABD Doları

- İyimser tahmin: 0,00848 - 0,00971 ABD Doları (olumlu piyasa havası gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa evresi: Büyüme dönemi potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,00628 - 0,00979 ABD Doları

- 2028: 0,00895 - 0,01342 ABD Doları

- Temel katalizörler: Artan kullanıcı benimsemesi ve teknolojik ilerlemeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01127 - 0,01296 ABD Doları (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,01296 - 0,01892 ABD Doları (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,01892 ABD Doları’nın üzerinde (çığır açan yenilikler ve toplu benimseme halinde)

- 2030-12-31: G 0,01892 ABD Doları (olası zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00971 | 0,00725 | 0,00529 | 0 |

| 2026 | 0,01 | 0,00848 | 0,00585 | 17 |

| 2027 | 0,00979 | 0,00924 | 0,00628 | 27 |

| 2028 | 0,01342 | 0,00952 | 0,00895 | 31 |

| 2029 | 0,01445 | 0,01147 | 0,00677 | 58 |

| 2030 | 0,01892 | 0,01296 | 0,01127 | 79 |

IV. G İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

G Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Yüksek risk toleranslı, uzun vadeli yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde G biriktirin

- Fiyat hedefleri belirleyin, portföyü periyodik olarak gözden geçirin

- Token’ları güvenli donanım cüzdanlarında saklayın

(2) Aktif İşlem Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım veya aşırı satım koşullarını belirler

- Kısa vadeli al-sat için önemli noktalar:

- Fiyat patlamaları için işlem hacmini izleyin

- Risk yönetimi için zarar-durdur emirleri kullanın

G Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Daha agresif yatırımcılar: %5-10

- Profesyoneller: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Stratejileri

- Diversifikasyon: Yatırımları birden çok kripto paraya yaymak

- Stablecoin kullanımı: Yüksek dalgalanma dönemlerinde G’nin bir kısmını stablecoin’e çevirmek

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı kullanımı

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifreler kullanımı

V. G İçin Potansiyel Riskler ve Zorluklar

G Piyasa Riskleri

- Yüksek fiyat dalgalanması: G’nin fiyatında büyük değişimler olabilir

- Düşük likidite: Büyük işlemler zorlaşabilir

- Piyasa duyarlılığı: Genel kripto piyasası eğilimlerine bağlılık

G Regülasyon Riskleri

- Belirsiz düzenleyici ortam: G’nin kullanım alanını etkileyebilecek yeni regülasyonlar

- Ülke bazında uyum: Farklı bölgelerde farklı regülasyonlar

- Vergilendirme: Kripto işlemlerde değişen vergi kuralları

G Teknik Riskleri

- Akıllı sözleşme açıkları: Temel kodda potansiyel istismarlar

- Ağ yoğunluğu: Yüksek trafik dönemlerinde işlem gecikmeleri

- Teknolojik eskime: Yeni blokzincir teknolojileriyle yarışta geride kalma riski

VI. Sonuç ve Eylem Önerileri

G Yatırım Değeri Analizi

G, Gravity ve Galxe ekosistemlerinde yüksek riskli fakat yüksek potansiyele sahip bir yatırım olanağı sunar. Her iki platformda da fayda sağlar ancak yatırımcılar, fiyat oynaklığı ve yasal belirsizliklerin farkında olmalıdır.

G Yatırım Önerileri

✅ Yeni başlayanlar: Küçük tutarlarla başlayın, teknolojiyi öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Dengeli yaklaşım ve düzenli portföy ayarlaması yapın ✅ Kurumsal yatırımcılar: Derinlemesine inceleme ve güçlü risk yönetimi uygulayın

G İşlem Katılım Yöntemleri

- Spot al-sat: Gate.com üzerinden G token işlemleri

- Staking: Uygun olduğunda staking programlarıyla pasif gelir elde edin

- DeFi entegrasyonu: Gravity ekosisteminde merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli hareket etmeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Gravity kripto paranın geleceği var mı?

Evet, Gravity kripto para gelecek vaat ediyor. Piyasa eğilimleri büyüme potansiyelini gösteriyor ve süregelen teknolojik gelişmeler benimsenme ile değerini yükseltebilir.

2025’te hangi kripto para 1 ABD Doları’na ulaşacak?

Bitcoin Hyper, Maxi Doge, PEPENODE, Snorter Bot ve Best Wallet Token’ın 2025’te 1 ABD Doları’na ulaşması bekleniyor.

2025 için GRT fiyat tahmini nedir?

Mevcut piyasa eğilimlerine göre, GRT’nin 20 Kasım 2025’te 0,06838 ABD Doları’na ulaşması bekleniyor. Bu tahmin, The Graph fiyatında yaklaşık yüzde 9,95’lik bir artış anlamına geliyor.

Hamster Kombat coin 1 ABD Doları’na ulaşır mı?

Mevcut tahminler, Hamster Kombat coin’in 2028’de 1 ABD Doları’na ulaşabileceğini gösteriyor. Piyasa eğilimleri ve blokzincir oyunlarının yaygın kabulü takip edilmesi gereken ana etkenlerdir.

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

2025 HBAR Fiyat Tahmini: Hedera Hashgraph, Kripto Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 CFX Fiyat Tahmini: Conflux Network İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 SMARTPrice Tahmini: Yatırım Portföyü Optimizasyonu İçin Gelişmiş Yapay Zekâ Destekli Piyasa Analitikleri

2025 DOT Fiyat Tahmini: Polkadot, Artan Benimsenmeyle 100 Dolar Seviyesine Ulaşacak mı?

2025 NANO Fiyat Tahmini: Dijital Para Birimi İçin Piyasa Analizi ve Büyüme Potansiyeli

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi