2025 ANIME Fiyat Tahmini: Yükselen Kripto Varlığının Gelecekteki Değerine Dair Öngörüler

Giriş: ANIME'nin Piyasa Konumu ve Yatırım Potansiyeli

Animecoin (ANIME), küresel anime endüstrisinin kültürel tokenı olarak, 2025'teki çıkışından bu yana anime sektörünü topluluk temelli bir yaratıcı ağ haline dönüştürmektedir. 2025 yılı itibarıyla ANIME'nin piyasa değeri 50.412.379 USD'ye ulaşmış olup, yaklaşık 5.538.604.656 adet dolaşımdaki token bulunmakta ve fiyatı 0,009102 USD civarında seyretmektedir. "Anime'nin Kültür Coin'i" olarak anılan ANIME, küresel anime topluluğu için dijital ekonominin oluşmasında giderek daha kritik bir rol üstlenmektedir.

Bu makalede, ANIME'nin 2025-2030 dönemindeki fiyat eğilimleri; tarihsel fiyat hareketleri, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte detaylı biçimde incelenecek; yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. ANIME Fiyat Geçmişi ve Mevcut Piyasa Durumu

ANIME Tarihsel Fiyat Seyri

- 2025: Proje lansmanı, fiyat 0,12 USD ile zirve yaptı

- 2025: Piyasa düzeltmesi, fiyat tüm zamanların en düşük seviyesi olan 0,00509 USD'ye geriledi

- 2025: Toparlanma dönemi, fiyat yaklaşık 0,009 USD seviyesinde dengelendi

ANIME Güncel Piyasa Durumu

23 Ekim 2025 itibarıyla ANIME 0,009102 USD'den işlem görmektedir. Token son 24 saatte %3,23 değer kaybederken, işlem hacmi 1.150.949,93 USD olarak gerçekleşmiştir. ANIME'nin piyasa değeri 50.412.379,58 USD olup, kripto para piyasasında 605. sırada yer almaktadır. Dolaşımdaki miktar 5.538.604.656 ANIME olup, bu rakam toplam arzın (10 milyar token) %55,39'una karşılık gelmektedir. Son dönemdeki aşağı yönlü hareketlere rağmen, ANIME son bir saatte %0,27'lik kısmi bir toparlanma göstermiştir. Ancak, token uzun vadede ciddi kayıplar yaşamış; son 30 günde %34,86, son bir yılda ise %93,43 oranında değer kaybetmiştir.

Mevcut ANIME piyasa fiyatını görüntüleyin

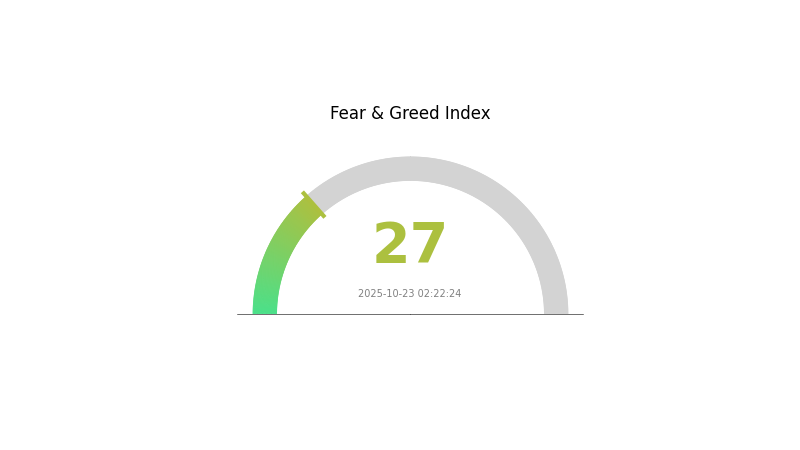

ANIME Piyasa Duyarlılığı Endeksi

23 Ekim 2025 Korku ve Açgözlülük Endeksi: 27 (Korku)

Mevcut Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık temkinli seyretmektedir; Korku ve Açgözlülük Endeksi'nin 27 seviyesinde olması, piyasanın korku eğiliminde olduğunu göstermektedir. Bu, yatırımcıların tedbirli hareket ettiğini ve büyük pozisyon almaktan kaçındığını gösterir. Bu dönemlerde güncel kalmak ve ani kararlar vermemek önemlidir. Piyasa döngüleri doğaldır; korku dönemleri, uzun vadeli bakış açısına sahip yatırımcılar için fırsatlar yaratabilir. Yatırım kararlarınızı vermeden önce kapsamlı araştırma yapın ve risk toleransınızı dikkate alın.

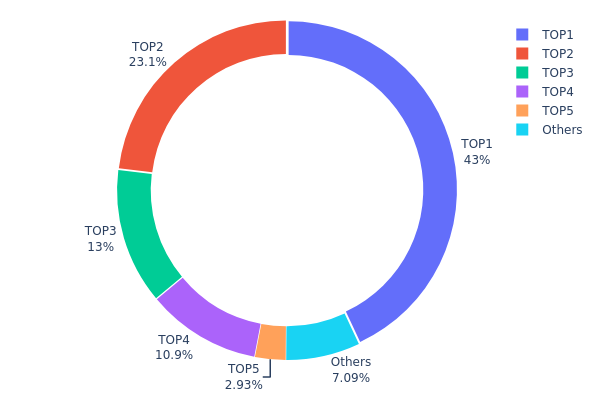

ANIME Varlık Dağılımı

Adres bazlı dağılım verileri, ANIME tokenlarında aşırı yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres toplam arzın %43,01'ini elinde tutarken, sonraki dört büyük adres birlikte %49,87'yi kontrol ediyor. Yani, en büyük beş adres toplamda ANIME tokenlarının %92,88'ini elinde bulunduruyor.

Böylesine yoğun bir dağılım, piyasa manipülasyonu ve volatilite risklerini gündeme getiriyor. Tokenların büyük kısmının az sayıda adreste toplanması, bu sahiplerin alım ya da satım kararlarıyla fiyatlarda ani dalgalanmalara yol açabilir. Aynı zamanda düşük merkeziyetsizlik seviyesi, token'ın dayanıklılığı ve genel piyasa istikrarı üzerinde olumsuz etki yaratabilir.

Bu dağılım, ANIME'nin piyasa yapısının birkaç büyük oyuncunun hareketlerine oldukça açık olduğunu gösteriyor. Bu durum, fiyat dalgalanmasının artmasına ve token'ın geniş, çeşitli bir kullanıcı tabanı oluşturma potansiyelinin sınırlanmasına neden olabilir. Yatırımcılar, ANIME'yi portföylerine dahil ederken bu yoğunlaşma risklerine dikkat etmelidir.

Mevcut ANIME Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xcee2...97180d | 4.301.382,48K | 43,01% |

| 2 | 0x1a14...540415 | 2.305.781,37K | 23,05% |

| 3 | 0x6ae7...a7040a | 1.300.000,00K | 13,00% |

| 4 | 0x2d87...ffe258 | 1.090.789,22K | 10,90% |

| 5 | 0xf977...41acec | 292.714,51K | 2,92% |

| - | Diğerleri | 709.332,41K | 7,12% |

II. ANIME'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Makroekonomik Ortam

-

Para Politikası Etkisi: Merkez bankalarının politikaları ANIME fiyatını önemli ölçüde etkileyecektir. Faiz oranlarında veya niceliksel gevşemede yaşanacak değişiklikler, yatırımcı duyarlılığını ve kripto piyasasına sermaye akışını doğrudan etkileyebilir.

-

Enflasyona Karşı Koruma Özelliği: Enflasyonist dönemlerde ANIME, diğer kripto varlıklar gibi para biriminin değer kaybına karşı bir koruma aracı olarak değerlendirilebilir. Yüksek enflasyon zamanlarındaki performansı, gelecekteki fiyat seyrine yön verebilir.

-

Jeopolitik Faktörler: Uluslararası gerilimler ve küresel ekonomik belirsizlikler, ANIME gibi kripto varlıklara olan ilgiyi artırabilir veya azaltabilir; bu, token'ın istikrarı ve değer saklama özelliğine duyulan güvene bağlıdır.

Teknolojik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: ANIME blokzinciri üzerinde geliştirilen DApp'ler ve diğer projeler, token'ın kullanım alanını ve talebini artırabilir. Bu uygulamaların başarısı ve benimsenmesi, ANIME'nin değer ve fiyatını doğrudan etkiler.

III. ANIME 2025-2030 Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,00705 USD - 0,00916 USD

- Tarafsız tahmin: 0,00916 USD - 0,00989 USD

- İyimser tahmin: 0,00989 USD - 0,01 USD (olumlu piyasa havası ve proje gelişmeleri gerektirir)

2027-2028 Görünümü

- Piyasa evresi: Artan benimseme ile büyüme dönemi bekleniyor

- Fiyat aralığı tahmini:

- 2027: 0,0079 USD - 0,01475 USD

- 2028: 0,01121 USD - 0,01384 USD

- Temel katalizörler: Proje kilometre taşları, piyasa trendleri ve genel kripto benimsemesi

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,0152 USD (istikrarlı büyüme ve piyasa istikrarı ile)

- İyimser senaryo: 0,01885 USD (güçlü proje performansı ve olumlu piyasa koşulları ile)

- Dönüştürücü senaryo: 0,02 USD - 0,025 USD (çığır açan yenilikler ve kitlesel benimseme ile)

- 31 Aralık 2030: ANIME 0,01885 USD (yılın potansiyel zirvesi)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00989 | 0,00916 | 0,00705 | 0 |

| 2026 | 0,01371 | 0,00952 | 0,006 | 4 |

| 2027 | 0,01475 | 0,01162 | 0,0079 | 27 |

| 2028 | 0,01384 | 0,01318 | 0,01121 | 44 |

| 2029 | 0,01689 | 0,01351 | 0,00784 | 48 |

| 2030 | 0,01885 | 0,0152 | 0,01155 | 66 |

IV. ANIME'de Profesyonel Yatırım Stratejisi ve Risk Yönetimi

ANIME Yatırım Stratejileri

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: Yüksek risk toleransına sahip ve anime endüstrisinin büyümesine inanan yatırımcılar

- İşlem önerileri:

- Piyasa düzeltmelerinde ANIME token biriktirin

- Dalgalanmalara karşı en az 2-3 yıl tutun

- Tokenları güvenli, saklama hizmeti olmayan bir cüzdanda bulundurun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit edin

- RSI: Aşırı alım ve aşırı satım seviyelerini izleyin

- Dalgalı alım-satım için ana noktalar:

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

- Potansiyel zararlar için stop-loss emirleri kullanın

ANIME Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyoneller: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: ANIME'yi diğer kripto varlıklar ve geleneksel yatırımlarla dengeleyin

- Maliyet Ortalaması: Zamanlama riskini azaltmak için düzenli, küçük tutarlarda yatırım yapın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama kullanın, güçlü şifreler oluşturun ve özel anahtarları asla paylaşmayın

V. ANIME'de Potansiyel Riskler ve Zorluklar

ANIME Piyasa Riskleri

- Yüksek volatilite: Anime token fiyatlarında büyük dalgalanmalar yaşanabilir

- Piyasa duyarlılığı: Kripto piyasasının genel havası ANIME'yi etkileyebilir

- Rekabet: Yeni anime tabanlı tokenlar piyasaya girerek pazar payı için rekabet edebilir

ANIME Düzenleyici Riskleri

- Belirsiz mevzuat: Kripto düzenlemelerinin değişmesi ANIME'nin kullanımını ve işlem görmesini etkileyebilir

- Sınır ötesi kısıtlamalar: Uluslararası düzenleyici farklar küresel yayılımı sınırlayabilir

- Vergi etkileri: Farklı ülkelerde kripto varlıklara ilişkin belirsiz veya değişen vergi mevzuatı

ANIME Teknik Riskleri

- Akıllı sözleşme açıkları: Temel kodda istismar riski bulunabilir

- Ağ sıkışıklığı: Ethereum veya Arbitrum üzerinde yüksek işlem hacmi gecikmelere neden olabilir

- Güncelleme zorlukları: Blokzincir güncellemeleri token göçü veya teknik güncellemeler gerektirebilir

VI. Sonuç ve Eylem Önerileri

ANIME Yatırım Potansiyeli Değerlendirmesi

ANIME, büyüyen anime endüstrisinde benzersiz bir fırsat sunuyor; ancak kısa vadede yüksek volatilite ve düzenleyici belirsizlikler söz konusu. Benimsenme artar ve proje anime ekosistemiyle güçlü bir entegrasyon sağlarsa, uzun vadeli potansiyel barındırmaktadır.

ANIME Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, proje ve piyasa dinamiklerini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif al-sat stratejilerini birlikte değerlendirin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın ve ANIME'yi çeşitlendirilmiş bir kripto portföyünde değerlendirin

ANIME Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden ANIME token alıp satabilirsiniz

- Staking: Staking programları mevcutsa pasif gelir elde etmek için katılın

- DeFi entegrasyonu: ANIME için sunulacak merkeziyetsiz finans seçeneklerini değerlendirin

Kripto para yatırımları yüksek risk taşır; bu içerik yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli karar vermeli, profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

ANIME coin 1 dolara ulaşır mı?

Mevcut piyasa trendleri ve tahminler doğrultusunda, ANIME coin'in yakın gelecekte 1 USD seviyesine ulaşması oldukça düşük bir ihtimaldir. Bunun için ciddi büyüme ve benimseme gerekmektedir.

ANIME coin için fiyat öngörüsü nedir?

ANIME'nin 19 Kasım 2025'te 0,007062 USD seviyesine ulaşması beklenmektedir; bu, mevcut seviyeye göre %25,16 düşüş anlamına gelir.

API3'nin gelecek potansiyeli var mı?

Evet, API3'nin gelecek vadettiği düşünülüyor. Yenilikçi oracle modeli ve blokzincir teknolojisinin artan kullanımı, uzun vadeli büyüme ve başarı için güçlü bir temel sunuyor.

2025'te hangi memecoin 1 dolara ulaşır?

DOGE'nin 2025'te 1 USD seviyesine ulaşma potansiyeli en yüksektir; ardından SHIB ve PEPE gelmektedir. Ancak memecoin fiyatları son derece değişken ve öngörülemezdir.

2025 KASTA Fiyat Tahmini: Piyasa Analizi ve Bu Yükselen Kripto Para Birimi İçin Gelecek Perspektifi

2025 MMT Fiyat Tahmini: Benimsenme Artışı ve Piyasa Olgunlaşmasıyla Yükseliş Eğilimi

2025 ARIO Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 PUSH Fiyat Tahmini: Merkeziyetsiz İletişim Token’ının Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 NVG8 Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Gelecek Perspektiflerinin Analizi

2025 OKB Fiyat Tahmini: Kripto Ekosisteminde OKB Token’ın Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak