2025 ARIO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: ARIO's Market Position and Investment Value

The AR.IO Network (ARIO), as the first decentralized permanent cloud network, has been ensuring universal, censorship-resistant access to data, storage, and domains since its inception. As of 2025, ARIO's market capitalization has reached $2,557,135, with a circulating supply of approximately 475,834,748 tokens, and a price hovering around $0.005374. This asset, hailed as the "backbone of the permanent web," is playing an increasingly crucial role in providing open and permanent digital infrastructure.

This article will comprehensively analyze ARIO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

I. ARIO Price History Review and Current Market Status

ARIO Historical Price Evolution

- 2025: Project launch, price peaked at $0.0601 on March 19

- 2025: Market correction, price dropped to $0.004783 on September 23

- 2025: Consolidation phase, price fluctuating between $0.004783 and $0.0601

ARIO Current Market Situation

As of October 15, 2025, ARIO is trading at $0.005374, experiencing a 1.39% decrease in the last 24 hours. The token has shown a negative trend over the past week and month, with a 5.59% decline in the last 7 days and an 18.96% drop over the past 30 days. The current price is significantly below its all-time high of $0.0601, recorded on March 19, 2025, but slightly above its all-time low of $0.004783, reached on September 23, 2025.

ARIO's market capitalization stands at $2,557,135.94, ranking it 2196th in the cryptocurrency market. The token's 24-hour trading volume is $17,501.82, indicating moderate market activity. With a circulating supply of 475,834,748.59 ARIO tokens, representing 29.75% of the total supply, the project has room for further token distribution.

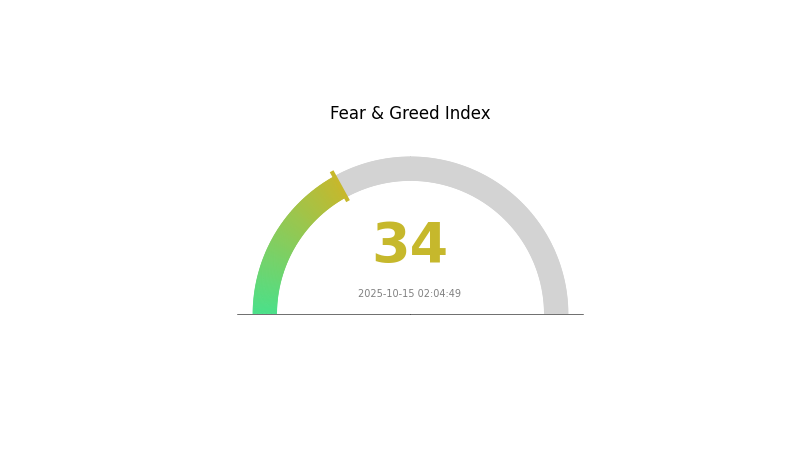

The current market sentiment for ARIO appears cautious, as reflected in its recent price performance and the overall cryptocurrency market's fear index of 34.

Click to view the current ARIO market price

ARIO Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of fear, with the Fear and Greed Index registering at 34. This suggests investors are cautious and potentially looking for buying opportunities. During times of fear, it's crucial to stay informed and make rational decisions. Remember, market sentiment can shift quickly, and what seems like a setback today could be an opportunity tomorrow. Stay vigilant, do your research, and consider diversifying your portfolio to mitigate risks in this uncertain climate.

ARIO Holdings Distribution

The address holdings distribution data for ARIO reveals an interesting pattern in token ownership. This metric provides insights into the concentration of tokens among different addresses, offering a glimpse into the project's decentralization and potential market dynamics.

Based on the provided data, it appears that there is no significant concentration of ARIO tokens in any particular address. This suggests a relatively decentralized distribution, which is generally considered a positive indicator for the project's health and stability. The absence of large holders, often referred to as "whales," reduces the risk of market manipulation and sudden price fluctuations caused by individual actions.

This distribution pattern may contribute to a more stable market structure for ARIO, potentially reducing volatility and enhancing liquidity. It also indicates a higher level of decentralization, which aligns with the principles of many blockchain projects. However, it's important to note that this snapshot represents a moment in time, and token distributions can change over time as the market evolves.

Click to view the current ARIO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting ARIO's Future Price

Market Sentiment

- Investor Confidence: Investor sentiment and confidence directly impact ARIO's price movements. Positive news about ARIO's widespread adoption or significant technological breakthroughs can drive prices up.

Technological Development and Ecosystem Building

- Technical Iterations: Implementation of scaling solutions and other technological advancements can significantly influence ARIO's future development.

- Ecosystem Applications: The growth and adoption of major DApps and ecosystem projects built on ARIO's network can drive its value.

Macroeconomic Environment

- Global Regulatory Trends: The clarification of global regulatory frameworks for cryptocurrencies will play a crucial role in ARIO's future price movements.

Institutional and Large Holder Dynamics

- Institutional Adoption: The level of acceptance and integration of ARIO by institutional investors can greatly affect its price and market position.

III. ARIO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00467 - $0.00537

- Neutral forecast: $0.00537 - $0.00666

- Optimistic forecast: $0.00666 - $0.00795 (requires positive market sentiment and project developments)

2026-2027 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.00626 - $0.00899

- 2027: $0.00470 - $0.00806

- Key catalysts: Project milestones, market trends, and broader crypto adoption

2028-2030 Long-term Outlook

- Base scenario: $0.00795 - $0.00851 (assuming steady market growth)

- Optimistic scenario: $0.00851 - $0.01183 (with favorable market conditions and project success)

- Transformative scenario: $0.01183+ (with breakthrough innovations and mass adoption)

- 2030-12-31: ARIO $0.01183 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00795 | 0.00537 | 0.00467 | 0 |

| 2026 | 0.00899 | 0.00666 | 0.00626 | 23 |

| 2027 | 0.00806 | 0.00783 | 0.0047 | 45 |

| 2028 | 0.00842 | 0.00795 | 0.00493 | 47 |

| 2029 | 0.00884 | 0.00818 | 0.00499 | 52 |

| 2030 | 0.01183 | 0.00851 | 0.00775 | 58 |

IV. ARIO Professional Investment Strategies and Risk Management

ARIO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in decentralized cloud networks

- Operation suggestions:

- Accumulate ARIO tokens during market dips

- Stake tokens to earn rewards and participate in network governance

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor AR.IO network growth metrics for fundamental analysis

ARIO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance ARIO with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for ARIO

ARIO Market Risks

- High volatility: ARIO price may experience significant fluctuations

- Limited liquidity: Low trading volume could lead to slippage

- Competition: Other decentralized cloud networks may emerge

ARIO Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of decentralized networks

- Legal classification: Risk of ARIO being classified as a security

- Cross-border compliance: Varying regulations across jurisdictions

ARIO Technical Risks

- Network scalability: Potential challenges in handling increased adoption

- Smart contract vulnerabilities: Risk of exploits or bugs in the protocol

- Dependency on Arweave: Issues with the underlying blockchain could impact AR.IO

VI. Conclusion and Action Recommendations

ARIO Investment Value Assessment

ARIO presents a unique value proposition in the decentralized cloud network space. Long-term potential exists if AR.IO achieves widespread adoption, but short-term volatility and regulatory uncertainties pose significant risks.

ARIO Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Evaluate ARIO as part of a diversified crypto portfolio, focusing on network growth metrics

ARIO Trading Participation Methods

- Spot trading: Buy and sell ARIO tokens on Gate.com

- Staking: Participate in network validation and earn rewards

- Domain purchases: Invest in AR.IO domains for potential future value

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Arista stock in 2025?

Arista stock (ANET) is predicted to be priced between $121.49 and $295.22 in 2025, based on current market trends and analysis.

Which AI is best for stock price prediction?

LSTM and RNN models are often best for stock price prediction due to their ability to handle time-series data and provide accurate forecasts based on historical trends.

How much is the $ario token?

The $ario token is currently priced at $0.006506. Its market cap stands at $2,970,047, with a circulating supply of 460 million tokens.

What is the price prediction for Aero in 2040?

Experts predict Aero could reach $660, with a potential high of $770 by 2040, representing a significant increase from current levels.

Share

Content