Gaspieldsd

No content yet

Gaspieldsd

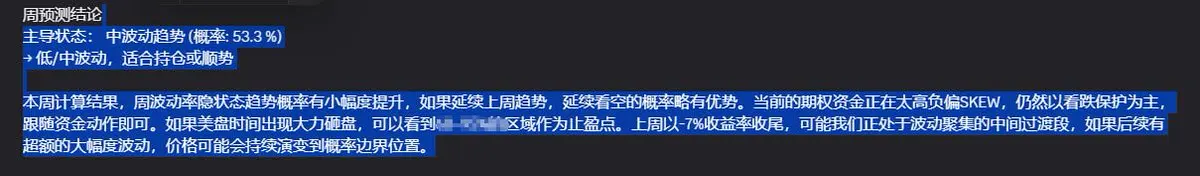

This week's in-depth data report is as expected, published weekly. Calculate the weekly 'market condition.' Beginner traders trade based on 'surface data,' while advanced traders trade based on 'market volatility.' If the condition favors the bears, then regardless of the settlement probability, it will ultimately favor one side, which is the trading approach of the controller. Not 'going with the flow.'

View Original

- Reward

- like

- Comment

- Repost

- Share

Cryptocurrency Circle Critical Condition Notice

Patient Name: Missing Blockchain

Symptoms: Liquidity anemia, poor immunity to external shocks, weakness, emptiness of value

Treatment Recommendations: Systemic malignant transformation, no treatment plan

Diagnostic Advice: Recommend family members of retail investors to spend more time with them

View OriginalPatient Name: Missing Blockchain

Symptoms: Liquidity anemia, poor immunity to external shocks, weakness, emptiness of value

Treatment Recommendations: Systemic malignant transformation, no treatment plan

Diagnostic Advice: Recommend family members of retail investors to spend more time with them

- Reward

- like

- Comment

- Repost

- Share

Programmers dying suddenly, every time I see such tragedies, it makes people feel heartbroken.\nA large part of the reason is the collective subconscious harm of East Asian culture:\n\nThe belief that resources are always scarce, and the culture of constantly "competing" with others is the real harm.\n\nAs long as East Asians do not resist this subconscious, it is difficult to escape the tragedy of exchanging life and high costs for emptiness.

View Original- Reward

- like

- Comment

- Repost

- Share

The perception in the crypto circle: It seems we can win in the long run

Result: By 2025, Bitcoin and Ethereum will have an annualized negative return

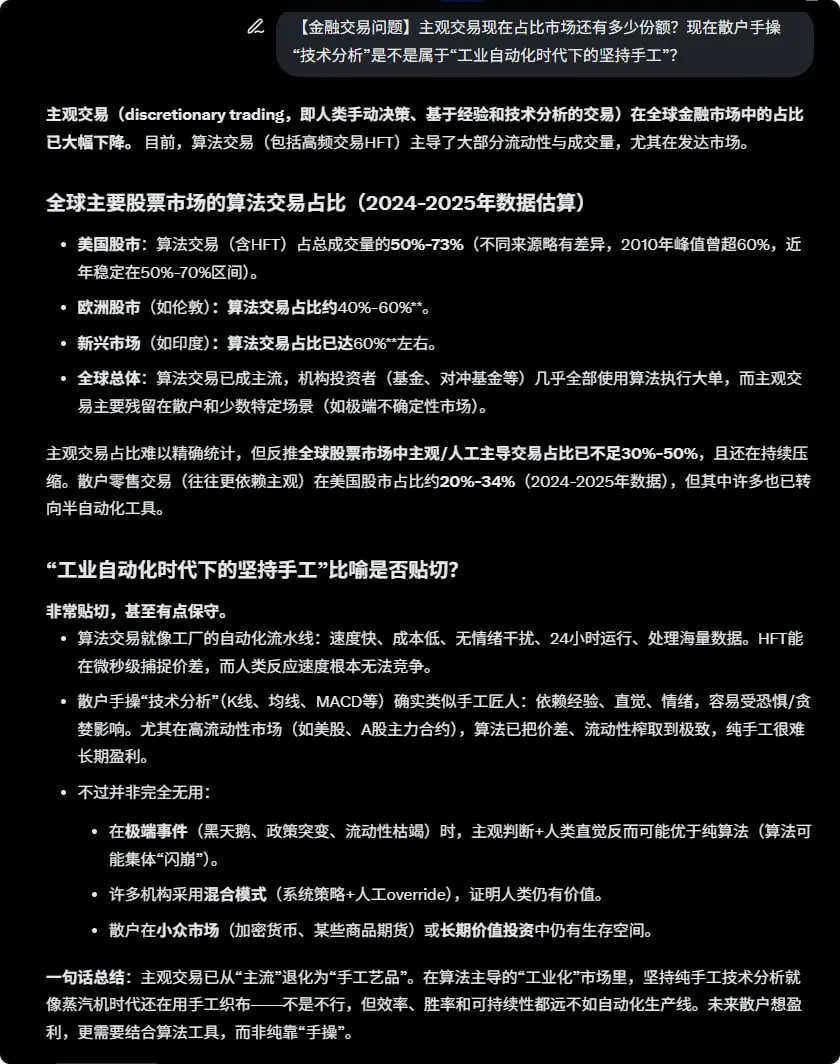

Only by improving your competitiveness to the same level as those using AI can you deserve a seat at the table.

Instead of "changing the time cycle," change the "target"; all financial assets worldwide are traded with AI algorithm models. What are you trading with?

Result: By 2025, Bitcoin and Ethereum will have an annualized negative return

Only by improving your competitiveness to the same level as those using AI can you deserve a seat at the table.

Instead of "changing the time cycle," change the "target"; all financial assets worldwide are traded with AI algorithm models. What are you trading with?

ETH-3,84%

- Reward

- like

- Comment

- Repost

- Share

Sometimes I discuss the "primitive" traders in the crypto world, and it's not actually a joke.

Human civilization's brilliance began over three hundred years ago, from the spinning wheel and automobiles to AI. In fact, the human brain has not yet fully adapted to modern paradigms.

On the contrary, without special training, engaging in market trading likely triggers the "default neural response" that has evolved over tens of thousands of years. (Primitive mode)

The modern paradigm is: high rationality, complexity, and systematization.

View OriginalHuman civilization's brilliance began over three hundred years ago, from the spinning wheel and automobiles to AI. In fact, the human brain has not yet fully adapted to modern paradigms.

On the contrary, without special training, engaging in market trading likely triggers the "default neural response" that has evolved over tens of thousands of years. (Primitive mode)

The modern paradigm is: high rationality, complexity, and systematization.

- Reward

- like

- Comment

- Repost

- Share

2025 Year-End Summary:

Looking back at myself in 2024, 2025 has become stronger and more stable.

Many of this year's operations can be said to be the realization of years of accumulated knowledge.

January to April: Renovating a villa left no time for trading, passively avoiding market crashes.

May to August: Return to the market, riding the bullish trend, ETH reached 4,500 before exiting and reversing to short, a highlight of the operation.

September to November: Using a risk model, exiting 10-11 days in advance, catching the short-term wave.

Maintain the advantage, success will follow.

Looking back at myself in 2024, 2025 has become stronger and more stable.

Many of this year's operations can be said to be the realization of years of accumulated knowledge.

January to April: Renovating a villa left no time for trading, passively avoiding market crashes.

May to August: Return to the market, riding the bullish trend, ETH reached 4,500 before exiting and reversing to short, a highlight of the operation.

September to November: Using a risk model, exiting 10-11 days in advance, catching the short-term wave.

Maintain the advantage, success will follow.

ETH-3,84%

- Reward

- like

- Comment

- Repost

- Share

#BTC Why can it always get a head start?

No matter how much analysis or nonsense,

There is an AI that can directly calculate how strong the "high-dimensional output signal" is🤣🤣

No matter how much analysis or nonsense,

There is an AI that can directly calculate how strong the "high-dimensional output signal" is🤣🤣

BTC-0,34%

- Reward

- like

- Comment

- Repost

- Share

GPT Annual Report, the description is too precise😂😂

View Original

- Reward

- like

- Comment

- Repost

- Share

From the perspective of AI's word vector space, information cocoons are actually composed of a set of adjacent word clusters and emotional clusters, which gradually shape our cognition by continuously reinforcing specific viewpoints and emotions.

Many people are not unaware of the existence of information cocoons, but rather they are surrounded by a huge cluster of words, making it too difficult to break free, and they may even feel isolated and uneasy due to reverse thinking.

View OriginalMany people are not unaware of the existence of information cocoons, but rather they are surrounded by a huge cluster of words, making it too difficult to break free, and they may even feel isolated and uneasy due to reverse thinking.

- Reward

- like

- Comment

- Repost

- Share

Being a KOL in the crypto world is a worse investment than going all in on altcoins.

The same amount of time and energy spent on improving one's returns is N times that of being a KOL.🤡

View OriginalThe same amount of time and energy spent on improving one's returns is N times that of being a KOL.🤡

- Reward

- like

- Comment

- Repost

- Share

American retail investors are already semi-automated, while Chinese retail investors are still studying the Elliott Wave Theory with half-baked knowledge.

View Original

- Reward

- like

- Comment

- Repost

- Share

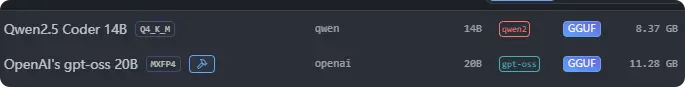

Open AI 20B open-source model is not only small in size but also extremely effective. It’s perfect for local processing of sensitive financial data, reviewing and auditing code, and writing and organizing documents—simply unbeatable.

View Original

- Reward

- like

- Comment

- Repost

- Share

IQ50 no longer works in the crypto world, either brain-dead or a god.

The former trades some functional impairments for a minimal parameter network,

The latter uses extreme mental effort layered with mechanical armor to exhaust parameter networks.

Both may reveal the ultimate underlying market patterns.

#BTC #ETH

View OriginalThe former trades some functional impairments for a minimal parameter network,

The latter uses extreme mental effort layered with mechanical armor to exhaust parameter networks.

Both may reveal the ultimate underlying market patterns.

#BTC #ETH

- Reward

- like

- Comment

- Repost

- Share

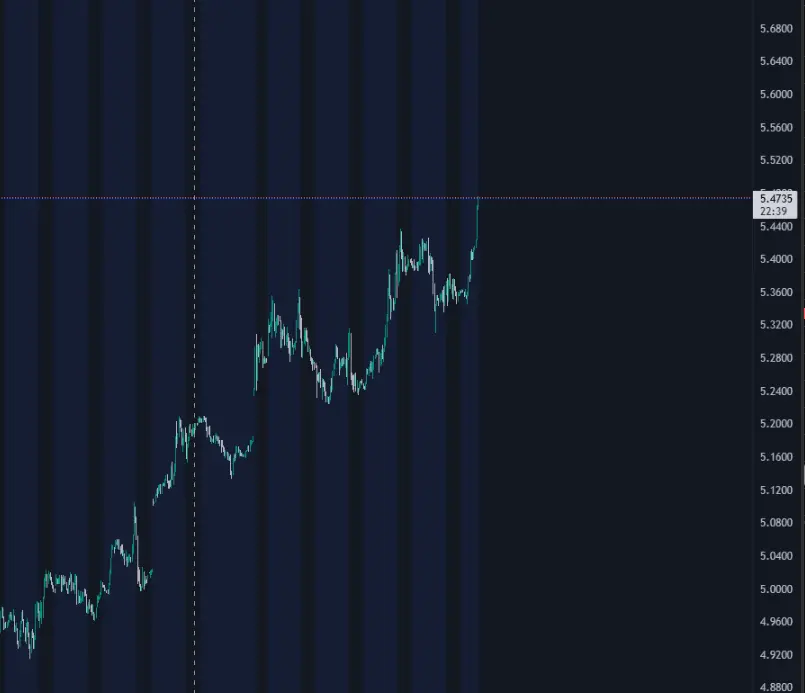

Copper futures hit a new high.

Trend traders need to learn to find markets with trends, rather than searching for alpha in impotent trend markets.

View OriginalTrend traders need to learn to find markets with trends, rather than searching for alpha in impotent trend markets.

- Reward

- like

- Comment

- Repost

- Share

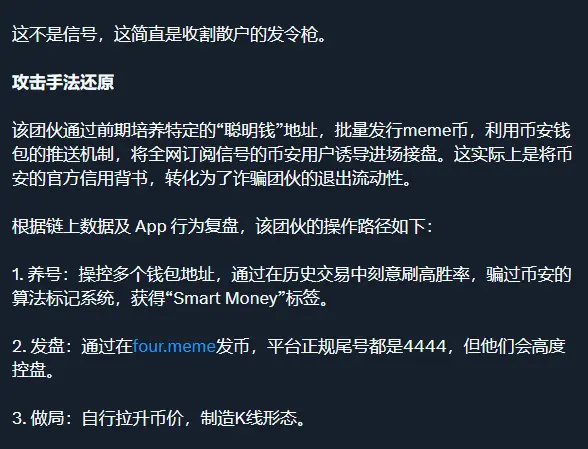

Haha, are we still looking at on-chain data for smart money?

Essentially, on-chain data pollution has become more severe.

This situation will not happen just once or twice.

Only the cryptocurrencies that have sufficient trading volume across multiple exchanges' order flows are fully contested.

The only fair and safe way for retail investors to harvest from the opponent's pool (as long as your understanding is higher than the opponent's) that is legal and has sufficient liquidity is only #BTC/#ETH/#SOL.

View OriginalEssentially, on-chain data pollution has become more severe.

This situation will not happen just once or twice.

Only the cryptocurrencies that have sufficient trading volume across multiple exchanges' order flows are fully contested.

The only fair and safe way for retail investors to harvest from the opponent's pool (as long as your understanding is higher than the opponent's) that is legal and has sufficient liquidity is only #BTC/#ETH/#SOL.

- Reward

- like

- Comment

- Repost

- Share

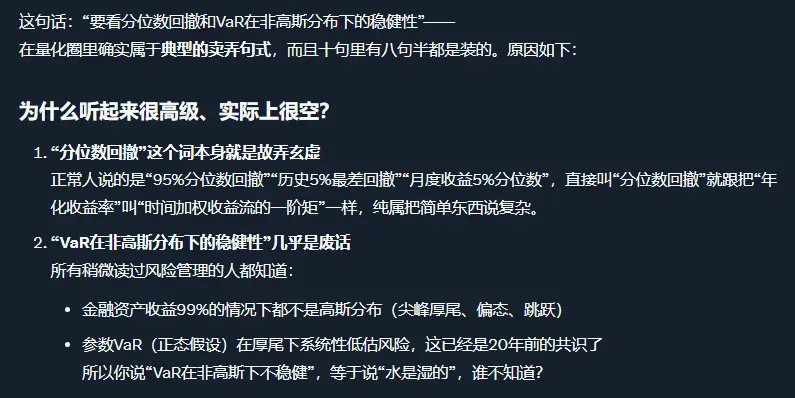

A certain KOL who claims to have "stable profits" through Technical Analysis

With common performance evaluation metrics like "maximum drawdown" and "Sharpe ratio" failing to meet standards, they start to flaunt percentile drawdown.

Even more showy than professional quantitative traders, impressive.

The logic of this fool is not to "prove that their strategy has a solid profit capacity," but to "try to intimidate you with something more powerful."

But the industry really doesn't do this, children lack the sense of recognition of having no milk to drink, desperately looking for proof?

View OriginalWith common performance evaluation metrics like "maximum drawdown" and "Sharpe ratio" failing to meet standards, they start to flaunt percentile drawdown.

Even more showy than professional quantitative traders, impressive.

The logic of this fool is not to "prove that their strategy has a solid profit capacity," but to "try to intimidate you with something more powerful."

But the industry really doesn't do this, children lack the sense of recognition of having no milk to drink, desperately looking for proof?

- Reward

- like

- Comment

- Repost

- Share

#BTC To excel in trading, the first task is to clarify the issues and definitions.

Stability can only be achieved after defining specific boundaries.

Sometimes I feel that trend trading is very simple, because it becomes simple once the definitions are clear.

If the problem is not clearly defined, the unresolved issues will keep recurring, leading to a situation in actual trading where one encounters "cognitive dissonance of being unable to understand and unable to make decisions".

Stability can only be achieved after defining specific boundaries.

Sometimes I feel that trend trading is very simple, because it becomes simple once the definitions are clear.

If the problem is not clearly defined, the unresolved issues will keep recurring, leading to a situation in actual trading where one encounters "cognitive dissonance of being unable to understand and unable to make decisions".

BTC-0,34%

- Reward

- like

- Comment

- Repost

- Share

The market is approaching 4 o'clock, and options expiration volatility often occurs. The market has changed.

It's now 😂, just hitting you. Do we still need to pick a day?

#BTC

It's now 😂, just hitting you. Do we still need to pick a day?

#BTC

BTC-0,34%

- Reward

- like

- Comment

- Repost

- Share

Next year is a big year for precious metals, and we will start preparing an AI model for gold to create trend + reversal options trading strategies.

At that time, the bear market in your circle + tightening regulations will come, and you can avoid natural disasters.😆

View OriginalAt that time, the bear market in your circle + tightening regulations will come, and you can avoid natural disasters.😆

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More21.75K Popularity

35.4K Popularity

356.35K Popularity

34.46K Popularity

51.97K Popularity

Pin