TundetheeOnchainAnalyst

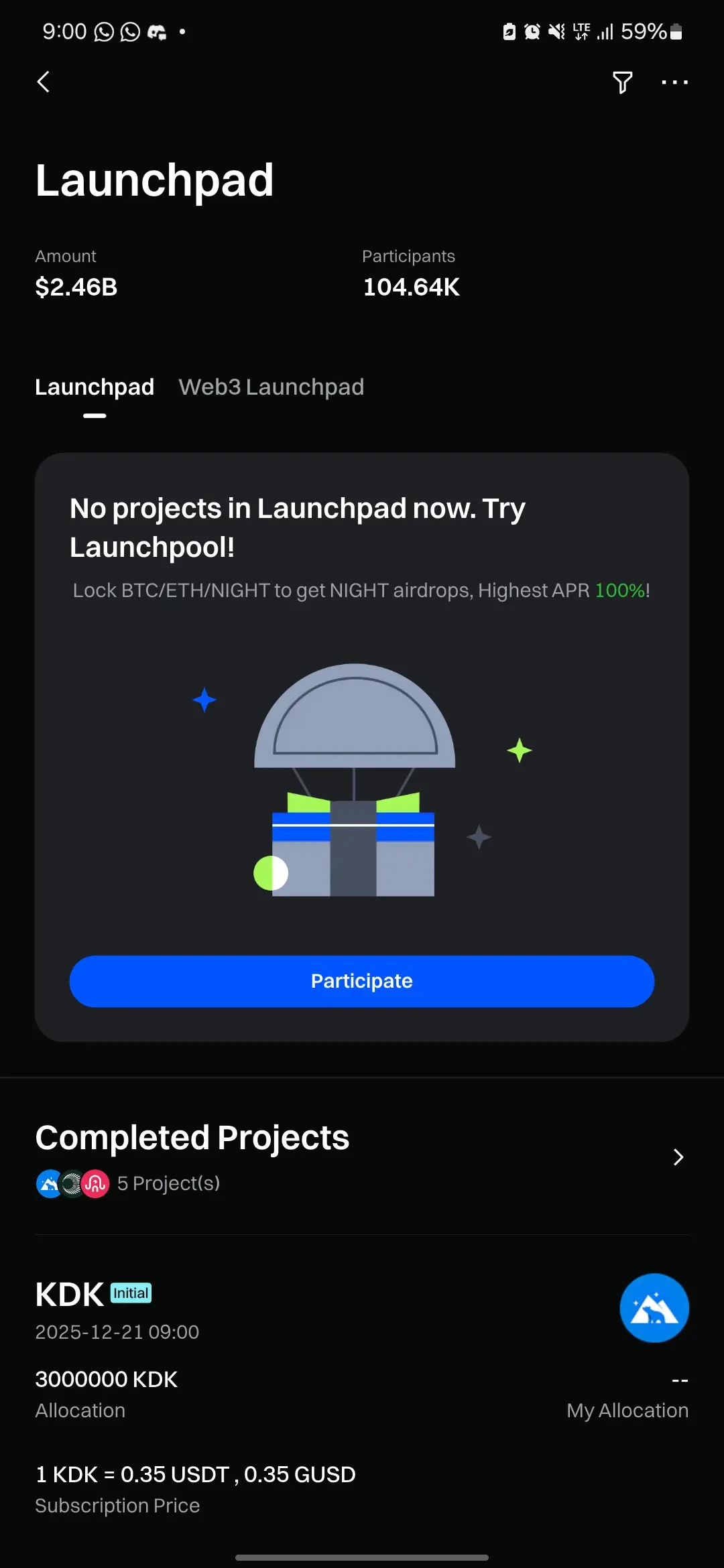

What really matters for KDK going forward:

• Trading volume: Sustained volume confirms real demand, not just short-term speculation.

• Liquidity depth: Healthy order books reduce extreme volatility and support price stability.

• Community engagement: Active discussion and participation often translate into stronger post-listing interest.

• Project execution: Roadmap delivery and product updates matter more than early price spikes.

• Market conditions: BTC and overall market sentiment will influence KDK’s momentum.

• Utility adoption: Real use cases are the strongest driver of long-term value.

• Trading volume: Sustained volume confirms real demand, not just short-term speculation.

• Liquidity depth: Healthy order books reduce extreme volatility and support price stability.

• Community engagement: Active discussion and participation often translate into stronger post-listing interest.

• Project execution: Roadmap delivery and product updates matter more than early price spikes.

• Market conditions: BTC and overall market sentiment will influence KDK’s momentum.

• Utility adoption: Real use cases are the strongest driver of long-term value.