MingDragonX

No content yet

MingDragonX

#GateHKEventsKickOff GateHKEventsKickOff Hong Kong is the current hub of crypto activity as Consensus Hong Kong 2026 runs at full speed and Gate hosts a series of exclusive events bringing together top blockchain innovators

Gate’s Global CEO Dr Han speaks on the Frontier Stage sharing insights on Gate’s Web3 infrastructure global expansion strategies and compliance initiatives highlighting how Gate bridges blockchain innovation with mainstream finance

Consensus Hong Kong 2026 runs February 11–12 at Hong Kong Convention and Exhibition Centre HKCEC featuring thousands of attendees developer pane

Gate’s Global CEO Dr Han speaks on the Frontier Stage sharing insights on Gate’s Web3 infrastructure global expansion strategies and compliance initiatives highlighting how Gate bridges blockchain innovation with mainstream finance

Consensus Hong Kong 2026 runs February 11–12 at Hong Kong Convention and Exhibition Centre HKCEC featuring thousands of attendees developer pane

- Reward

- 5

- 7

- 1

- Share

MrThanks77 :

:

2026 GOGOGO 👊View More

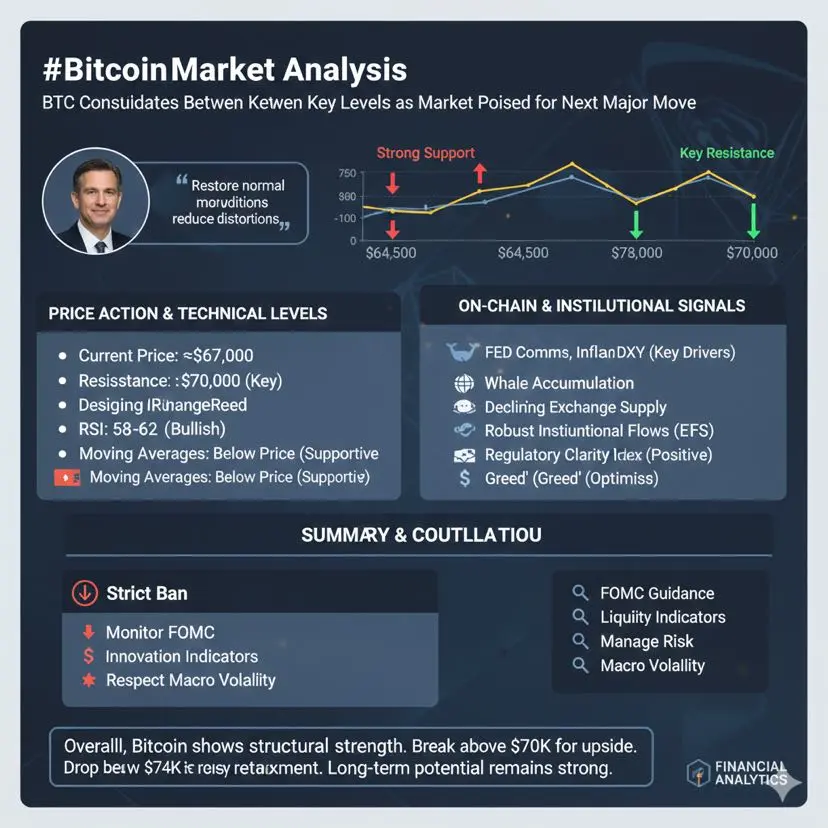

#BitcoinMarketAnalysis BitcoinMarketAnalysis BTC consolidates between key levels as market awaits next directional move

Bitcoin BTC continues to trade around 67000–68000 USD showing resilience structural strength and steady participation from both retail and institutional investors

After recent bullish momentum and reclaiming critical psychological levels BTC now balances between buyers and profit taking sellers creating a dynamic environment for short term traders and long term holders

Support has held near 64500 USD while immediate resistance is around 70000 USD forming the current range whe

Bitcoin BTC continues to trade around 67000–68000 USD showing resilience structural strength and steady participation from both retail and institutional investors

After recent bullish momentum and reclaiming critical psychological levels BTC now balances between buyers and profit taking sellers creating a dynamic environment for short term traders and long term holders

Support has held near 64500 USD while immediate resistance is around 70000 USD forming the current range whe

BTC-2,35%

- Reward

- 4

- 7

- Repost

- Share

MrThanks77 :

:

To The Moon 🌕View More

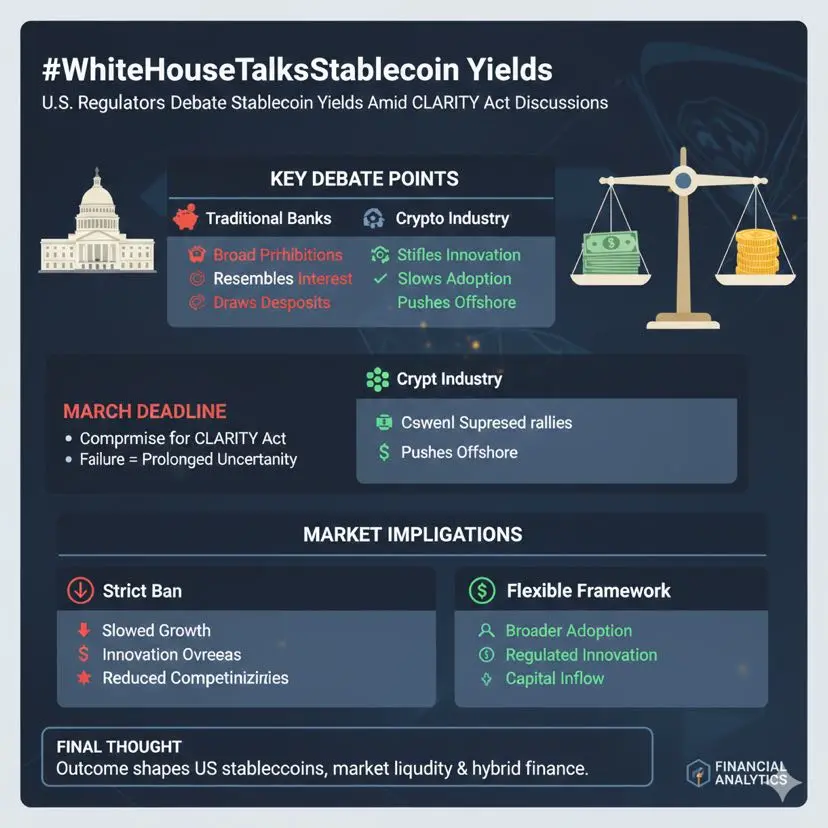

#WhiteHouseTalksStablecoinYields WhiteHouseTalksStablecoinYields U.S. regulators are evaluating whether stablecoin issuers should offer yields as part of ongoing CLARITY Act deliberations

Recent discussions at the White House brought together senior officials executives from major banks and leading crypto firms to explore policy frameworks for payment stablecoins

Banking representatives emphasized broad prohibitions citing that yield offerings could resemble interest payments and divert deposits from traditional financial institutions while crypto industry participants warned that strict restr

Recent discussions at the White House brought together senior officials executives from major banks and leading crypto firms to explore policy frameworks for payment stablecoins

Banking representatives emphasized broad prohibitions citing that yield offerings could resemble interest payments and divert deposits from traditional financial institutions while crypto industry participants warned that strict restr

- Reward

- 6

- 6

- 1

- Share

MrThanks77 :

:

To The Moon 🌕View More

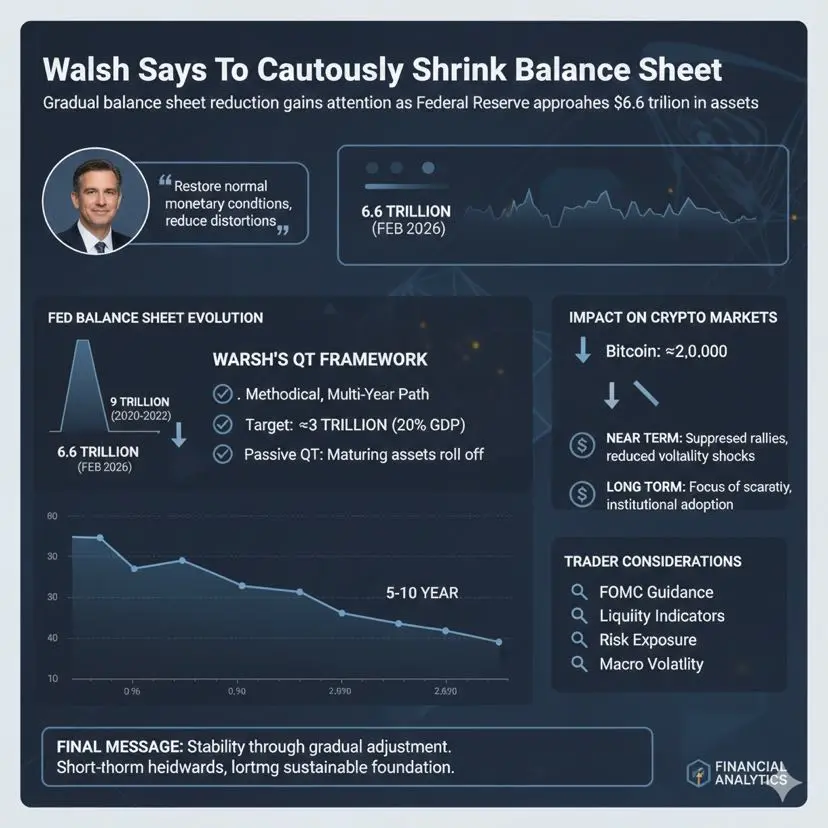

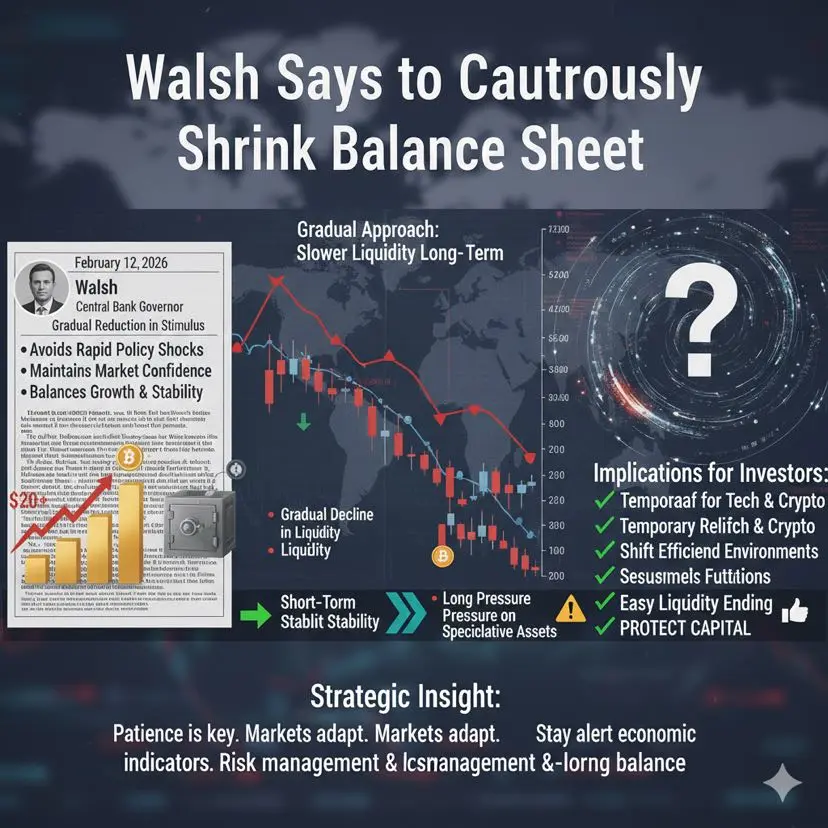

WalshSaysToCautiouslyShrinkBalanceSheet Gradual balance sheet reduction gains attention as the Federal Reserve approaches 6.6 trillion dollars in assets

Former Federal Reserve Governor Kevin Warsh has repeatedly argued for a slow and disciplined reduction of the Federal Reserve balance sheet in order to restore more normal monetary conditions reduce structural market distortions and limit prolonged central bank dominance across financial markets

As of early February 2026 the Fed balance sheet stands near 6.6 trillion dollars down significantly from its peak near 9 trillion during prior crisis

Former Federal Reserve Governor Kevin Warsh has repeatedly argued for a slow and disciplined reduction of the Federal Reserve balance sheet in order to restore more normal monetary conditions reduce structural market distortions and limit prolonged central bank dominance across financial markets

As of early February 2026 the Fed balance sheet stands near 6.6 trillion dollars down significantly from its peak near 9 trillion during prior crisis

- Reward

- 5

- 6

- Repost

- Share

MrThanks77 :

:

2026 GOGOGO 👊View More

#YiLihuaExitsPositions YiLihuaExitsPositions Understanding the significance of exiting positions in crypto markets

In cryptocurrency trading exiting a position means closing an existing trade whether by selling spot holdings closing margin exposure or settling futures contracts and this stage is where profits are secured or losses are controlled making it central to risk management and capital preservation

Traders exit positions for multiple structured reasons including profit taking once predefined targets are reached stop loss execution to protect capital during adverse price movement volati

In cryptocurrency trading exiting a position means closing an existing trade whether by selling spot holdings closing margin exposure or settling futures contracts and this stage is where profits are secured or losses are controlled making it central to risk management and capital preservation

Traders exit positions for multiple structured reasons including profit taking once predefined targets are reached stop loss execution to protect capital during adverse price movement volati

- Reward

- 3

- 4

- Repost

- Share

Yunna :

:

Wishing you great wealth in the YeaView More

#USIranNuclearTalksTurmoil USIranNuclearTalksTurmoil Markets on edge as U.S.–Iran nuclear negotiations face renewed uncertainty

Geopolitical tension has returned to the forefront as developments around the nuclear discussions between the United States and Iran create hesitation across global markets

Whenever negotiations stall or negative headlines dominate investor psychology shifts quickly toward defensive positioning

Energy markets respond first with oil experiencing sharp swings while traditional safe haven assets such as gold and the U.S. dollar attract capital inflows

At the same time ri

Geopolitical tension has returned to the forefront as developments around the nuclear discussions between the United States and Iran create hesitation across global markets

Whenever negotiations stall or negative headlines dominate investor psychology shifts quickly toward defensive positioning

Energy markets respond first with oil experiencing sharp swings while traditional safe haven assets such as gold and the U.S. dollar attract capital inflows

At the same time ri

BTC-2,35%

- Reward

- 6

- 7

- Repost

- Share

MrThanks77 :

:

LFG 🔥View More

#CelebratingNewYearOnGateSquare 50000 USDT Red Envelope Rain is live now on Gate.io Gate Plaza

Start 2026 with speed strength and measurable rewards

The Year of the Horse opens a real opportunity to convert daily activity into structured crypto earnings

Event Highlights

Total rewards pool exceeds 50000 USDT

Platform Gate.io Gate Plaza

Duration Feb 9 17:00 to Feb 23 24:00 UTC+8

Post engage win and repeat consistently

How To Earn

Post on Gate Plaza and each post increases your probability of receiving GT rewards

New users receive guaranteed reward eligibility with up to 28 GT per post

Update the

Start 2026 with speed strength and measurable rewards

The Year of the Horse opens a real opportunity to convert daily activity into structured crypto earnings

Event Highlights

Total rewards pool exceeds 50000 USDT

Platform Gate.io Gate Plaza

Duration Feb 9 17:00 to Feb 23 24:00 UTC+8

Post engage win and repeat consistently

How To Earn

Post on Gate Plaza and each post increases your probability of receiving GT rewards

New users receive guaranteed reward eligibility with up to 28 GT per post

Update the

GT-2,74%

- Reward

- 7

- 6

- 1

- Share

Topinvest :

:

Hold tight 💪View More

#CelebratingNewYearOnGateSquare Happy New Year — May Wealth Follow You All Year Long

Start the Year of the Horse with powerful momentum on Gate.io Gate Plaza

The 50000 USDT Red Envelope Rain is now live bringing real crypto rewards to active creators

50000+ in rewards available

First come first served distribution

Platform Gate Plaza

How to join: Post on Gate Plaza stay active and engage with the community update the app to version 8.8.0 or above

New Users Bonus: 100 percent winning chance up to 28 GT per post

Triple New Year Events

1. 50000 USDT Red Envelope Rain with instant rewards for act

Start the Year of the Horse with powerful momentum on Gate.io Gate Plaza

The 50000 USDT Red Envelope Rain is now live bringing real crypto rewards to active creators

50000+ in rewards available

First come first served distribution

Platform Gate Plaza

How to join: Post on Gate Plaza stay active and engage with the community update the app to version 8.8.0 or above

New Users Bonus: 100 percent winning chance up to 28 GT per post

Triple New Year Events

1. 50000 USDT Red Envelope Rain with instant rewards for act

GT-2,74%

- Reward

- 6

- 7

- Repost

- Share

Yunna :

:

Wishing you great wealth in the YeaView More

#GateSpringFestivalHorseRacingEvent GateSpringFestivalHorseRacingEvent 📊 When Celebration Becomes Strategy

The Gate.io Spring Festival Horse Racing Event may appear seasonal on the surface, but strategically it reflects something deeper: structured engagement during traditionally low-liquidity periods. Holiday windows often bring thinner volume, reduced focus, and fragmented attention. By introducing an interactive campaign during this phase, Gate reduces disengagement risk and maintains consistent user touchpoints. This is not short-term marketing — it is retention architecture designed to s

The Gate.io Spring Festival Horse Racing Event may appear seasonal on the surface, but strategically it reflects something deeper: structured engagement during traditionally low-liquidity periods. Holiday windows often bring thinner volume, reduced focus, and fragmented attention. By introducing an interactive campaign during this phase, Gate reduces disengagement risk and maintains consistent user touchpoints. This is not short-term marketing — it is retention architecture designed to s

- Reward

- 6

- 6

- Repost

- Share

Peacefulheart :

:

LFG 🔥View More

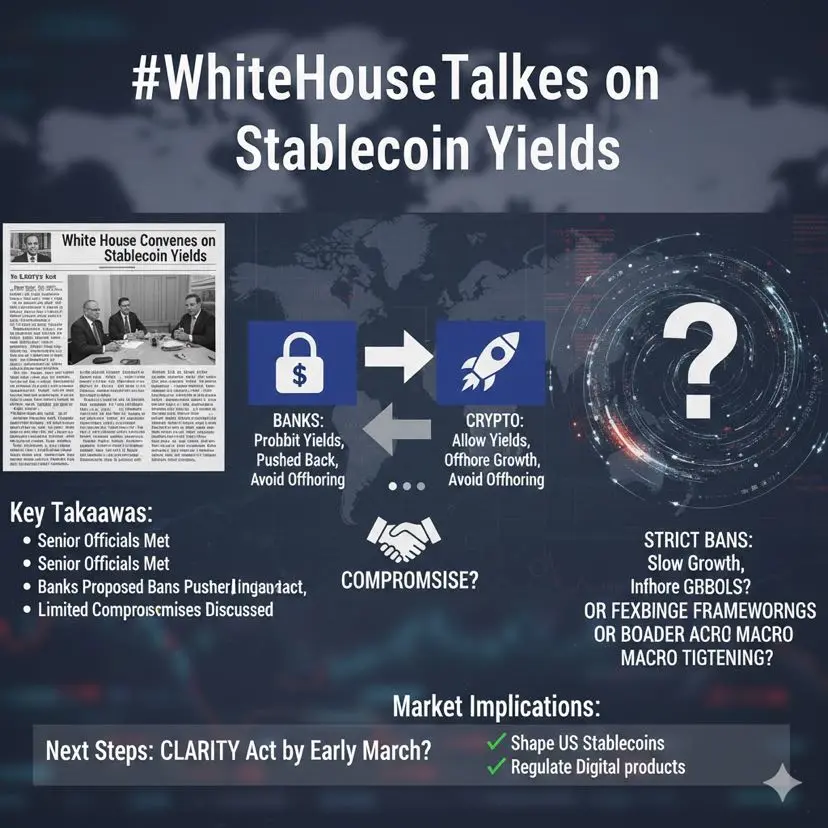

#WhiteHouseTalksStablecoinYields The White House has convened high-level discussions on whether stablecoin issuers should be permitted to offer yields or rewards on payment stablecoins. The talks are part of broader efforts to finalize the stalled CLARITY Act — legislation designed to establish clearer regulatory rules for digital assets while safeguarding consumers and the financial system.

Key Takeaways:

• Senior officials met with major banks and leading crypto firms to negotiate policy boundaries around stablecoin yield mechanisms.

• Traditional banks advocated for broad prohibitions on yi

Key Takeaways:

• Senior officials met with major banks and leading crypto firms to negotiate policy boundaries around stablecoin yield mechanisms.

• Traditional banks advocated for broad prohibitions on yi

- Reward

- 6

- 6

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

#WalshSaysToCautiouslyShrinkBalanceSheet On February 12, 2026, markets reacted to remarks from Christopher Waller regarding “cautiously shrinking” financial support measures. His message emphasized a gradual, measured reduction in stimulus rather than aggressive tightening — aiming to balance economic growth with long-term monetary stability.

Key Takeaways:

• Gradual approach: Designed to avoid market shocks that can result from rapid balance sheet contraction, preserving confidence and liquidity stability.

• Data-driven policy: Central bank decisions remain tied to inflation data, labor marke

Key Takeaways:

• Gradual approach: Designed to avoid market shocks that can result from rapid balance sheet contraction, preserving confidence and liquidity stability.

• Data-driven policy: Central bank decisions remain tied to inflation data, labor marke

- Reward

- 6

- 6

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

#YiLihuaExitsPositions YiLihuaExitsPositions 📉 Market Signal or Personal Strategy?

Yi Li Hua, a high-profile crypto trader, is exiting positions—closing trades to lock in profits or reduce exposure. Moves like this rarely stay “personal” in crypto. When a known whale adjusts exposure, liquidity, sentiment, and short-term volatility often react quickly.

Why Exits Matter:

🔹 Profit-Taking: Secures gains at strategic resistance or after extended rallies, preventing paper profits from evaporating.

🔹 Risk Management: Reduces downside exposure during unstable or headline-driven volatility.

🔹 Mark

Yi Li Hua, a high-profile crypto trader, is exiting positions—closing trades to lock in profits or reduce exposure. Moves like this rarely stay “personal” in crypto. When a known whale adjusts exposure, liquidity, sentiment, and short-term volatility often react quickly.

Why Exits Matter:

🔹 Profit-Taking: Secures gains at strategic resistance or after extended rallies, preventing paper profits from evaporating.

🔹 Risk Management: Reduces downside exposure during unstable or headline-driven volatility.

🔹 Mark

- Reward

- 6

- 6

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

#USIranNuclearTalksTurmoil USIranNuclearTalksTurmoil 🌍 Markets on Edge

Geopolitical tension always moves faster than fundamentals. When negotiations between the United States and Iran turn uncertain, markets don’t wait for clarity — they price in risk immediately. Headlines alone can shift billions in capital within minutes.

📉 Impact on Crypto & Global Markets:

• Oil spikes first – Any instability involving Iran instantly impacts energy expectations. Even the risk of supply disruption pushes crude higher.

• Safe-haven rotation – Capital flows into Gold and the U.S. Dollar as defensive positi

Geopolitical tension always moves faster than fundamentals. When negotiations between the United States and Iran turn uncertain, markets don’t wait for clarity — they price in risk immediately. Headlines alone can shift billions in capital within minutes.

📉 Impact on Crypto & Global Markets:

• Oil spikes first – Any instability involving Iran instantly impacts energy expectations. Even the risk of supply disruption pushes crude higher.

• Safe-haven rotation – Capital flows into Gold and the U.S. Dollar as defensive positi

BTC-2,35%

- Reward

- 6

- 6

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

Join the horse racing predictions at the Gate 2026 Spring Festival Celebration by completing tasks to earn horse racing tickets, participate in daily million Gift Coins giveaways, and compete for a share of the 100,000 USDT prize pool, all designed to reward engagement and fun while celebrating the Year of the Horse with the Gate community, with full details and participation available here: https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLJMB14JUQ

If you want, I can also make a more hype/viral version to grab extra attention 🚀.

If you want, I can also make a more hype/viral version to grab extra attention 🚀.

- Reward

- 6

- 6

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow? BuyTheDipOrWaitNow 🧠 Market Reality Check Cycle and Structure in 2026 The crypto market entering early 2026 is behaving more like a distribution to consolidation phase rather than a fresh reversal as Bitcoin rebounds from major support around the 60K to 70K zone following a sharp correction from late 2025 highs while momentum remains shallow and volatility elevated, suggesting the market is still probing for durable lows instead of confidently trending higher, with technical breadth playing a critical role as BTC has reclaimed part of its losses but dip-buying volume has

- Reward

- 6

- 5

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

#GoldRebounds #GoldRebounds Gold is showing renewed strength, bouncing back from recent lows as traders rotate into safe-haven assets amid heightened market volatility. The rebound highlights investor caution, with macroeconomic data and risk sentiment supporting this move. As equities and crypto markets experience uncertainty, gold often benefits from a “flight-to-safety” rotation, signaling that market participants are positioning defensively rather than aggressively.

Analysts are closely watching key levels to assess whether this rebound can continue. Support lies near recent lows, while re

Analysts are closely watching key levels to assess whether this rebound can continue. Support lies near recent lows, while re

- Reward

- 5

- 6

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

#WalshSaysToCautiouslyShrinkBalanceSheet #WalshSaysToCautiouslyShrinkBalanceSheet Walsh’s recent comments on cautiously shrinking the balance sheet signal a more measured and responsible tone from policymakers after years of aggressive monetary intervention. Rather than pointing toward abrupt tightening, this language reflects an awareness of how sensitive modern markets remain to liquidity shifts — and how quickly confidence can be undermined by poorly timed policy moves. In today’s interconnected financial system, even subtle changes in central bank posture can have outsized effects.

Balance

Balance

- Reward

- 5

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#CelebratingNewYearOnGateSquare 🎉🧧 #CelebratingNewYearOnGateSquare 🧧🎉 Gate.io kicks off 2026 with one of its biggest community celebrations ever as the $50,000 Red Packet Rain Carnival goes live on Gate Square from February 9 to February 23, 2026, rewarding creators, traders, and crypto enthusiasts with GT tokens, Position Vouchers, exclusive merchandise, gift boxes, and cash-equivalent prizes without requiring large deposits or high-volume trading, making creativity and engagement the core assets of participation where all you need is original content, the correct hashtag, and active comm

GT-2,74%

- Reward

- 4

- 2

- Repost

- Share

Yunna :

:

2026 gogoView More

#BitMineBuys40KETH BitMineBuys40KETH Institutional Confidence and the Implications for Ethereum’s Ecosystem BitMine’s acquisition of 40,000 ETH represents one of the most significant institutional purchases of the year and signals renewed confidence in Ethereum’s long-term trajectory, reflecting a strategic commitment that goes far beyond short-term speculation and highlights how Ethereum has evolved from a simple smart contract platform into a multi-layered digital infrastructure supporting DeFi, NFTs, staking, and advanced programmable finance, with institutions increasingly viewing ETH not

ETH-2,54%

- Reward

- 4

- 2

- Repost

- Share

MrThanks77 :

:

Happy New Year! 🤑View More

#BitMineBuys40KETH BitMineBuys40KETH Institutional Confidence and the Implications for Ethereum’s Ecosystem BitMine’s acquisition of 40,000 ETH represents one of the most significant institutional purchases of the year and signals renewed confidence in Ethereum’s long-term trajectory, reflecting a strategic commitment that goes far beyond short-term speculation and highlights how Ethereum has evolved from a simple smart contract platform into a multi-layered digital infrastructure supporting DeFi, NFTs, staking, and advanced programmable finance, with institutions increasingly viewing ETH not

ETH-2,54%

- Reward

- 4

- 1

- Repost

- Share

Yunna :

:

hold tightTrending Topics

View More207.48K Popularity

11.69K Popularity

44.74K Popularity

85.59K Popularity

849.15K Popularity

Pin