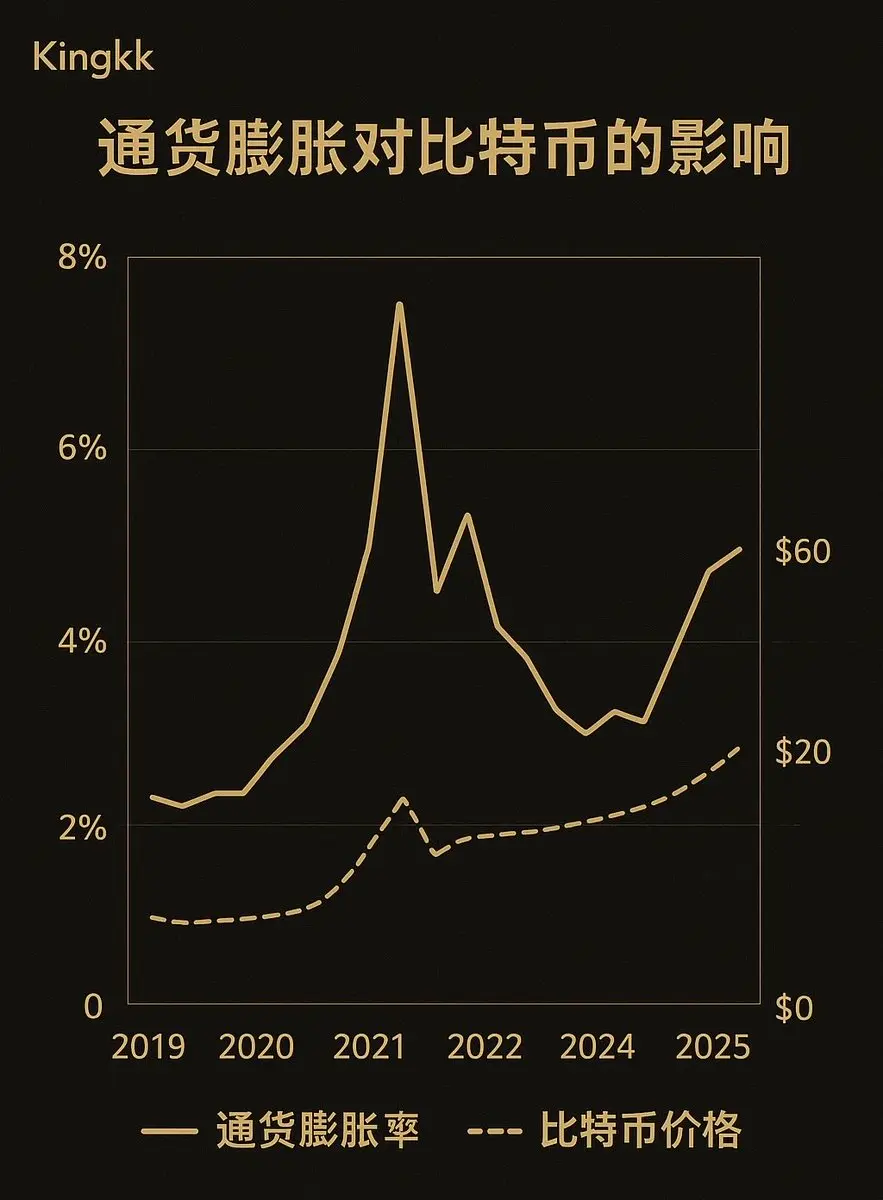

The Ether bull-bear watershed is 4181, currently suppressed at the daily chart level, with support at 4000. If 4000 can hold (due to news of interest rate cuts), the 4365 level is a strong resistance on the daily chart. If the 4000 level holds as an entity, it may reach 4365.

The strong resistance at the 4-hour level is 4235, and the rebound is basically about done. If it goes further down from here, it will hit 4000, which means a range of oscillation between 4235 and 4000. If it can stay suppressed in the short term, it will likely drop to 3900, 3700, and ultimately it will have to reach 350

The strong resistance at the 4-hour level is 4235, and the rebound is basically about done. If it goes further down from here, it will hit 4000, which means a range of oscillation between 4235 and 4000. If it can stay suppressed in the short term, it will likely drop to 3900, 3700, and ultimately it will have to reach 350

ETH0,19%