EyeOnChain

No content yet

EyeOnChain

- Reward

- like

- Comment

- Repost

- Share

Two wallets, one vibe -- and a massive ETH bet shaking Hyperliquid!

Interesting and it's really very hard to ignore. Two addresses have slowly and aggressively piled into $ETH longs totaling more than 95,000 ETH, roughly $190 million combined. That puts them at TOP1 and TOP2 for ETH longs on the platform right now. Big size, bold timing… maybe a little too bold.

One of them, 0x6C8512516Ce5669d35113A11Ca8B8DE322fD84F6, moved fast. Over the last three hours, it bridged in $21.798M USDC as margin, then slammed open a 40,000 ETH long at 20× leverage, worth about $80.39M, entering around $2,039.43.

Interesting and it's really very hard to ignore. Two addresses have slowly and aggressively piled into $ETH longs totaling more than 95,000 ETH, roughly $190 million combined. That puts them at TOP1 and TOP2 for ETH longs on the platform right now. Big size, bold timing… maybe a little too bold.

One of them, 0x6C8512516Ce5669d35113A11Ca8B8DE322fD84F6, moved fast. Over the last three hours, it bridged in $21.798M USDC as margin, then slammed open a 40,000 ETH long at 20× leverage, worth about $80.39M, entering around $2,039.43.

- Reward

- 1

- Comment

- Repost

- Share

Painfully early… and painfully wrong again🥶.

Really painful, About two weeks back, this guy went in heavy .. grabbed up 100,000 $SOL , roughly $12.4M, around the $124 area. then he staked it and settled in, probably thinking time was on his side.

and today in past 6 hours … that patience snapped. He unloaded the entire bag, locking in a loss north of $3.6M. Oof. And the worst part? This wasn’t even his first bruise. Before this move, he’d already burned more than $6.6M on #sol in earlier trades.

Sometimes it’s not about timing the market… it’s about knowing when to stop trying to outsmart it.

Really painful, About two weeks back, this guy went in heavy .. grabbed up 100,000 $SOL , roughly $12.4M, around the $124 area. then he staked it and settled in, probably thinking time was on his side.

and today in past 6 hours … that patience snapped. He unloaded the entire bag, locking in a loss north of $3.6M. Oof. And the worst part? This wasn’t even his first bruise. Before this move, he’d already burned more than $6.6M on #sol in earlier trades.

Sometimes it’s not about timing the market… it’s about knowing when to stop trying to outsmart it.

- Reward

- like

- Comment

- Repost

- Share

Bitmine Keeps Swinging, Even While the Red Gets Deeper😁.

#Bitmine didn’t slow down last week -- if anything, they leaned in harder. Another 40,613 ETH quietly grabbed up, about $82.8M worth, just added to the pile. That brings their total stash to a massive 4.32 million $ETH … yeah, billions on billions when you zoom out.

The catch? Their average entry sits way up around $3,847. At today’s prices, that mountain of ETH is staring at a drawdown north of $7.8 billion. Not a typo.

Still, no panic moves, no sudden exits showing up. Just a giant position, sitting heavy, absorbing the pain. Whether

#Bitmine didn’t slow down last week -- if anything, they leaned in harder. Another 40,613 ETH quietly grabbed up, about $82.8M worth, just added to the pile. That brings their total stash to a massive 4.32 million $ETH … yeah, billions on billions when you zoom out.

The catch? Their average entry sits way up around $3,847. At today’s prices, that mountain of ETH is staring at a drawdown north of $7.8 billion. Not a typo.

Still, no panic moves, no sudden exits showing up. Just a giant position, sitting heavy, absorbing the pain. Whether

ETH-5,5%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

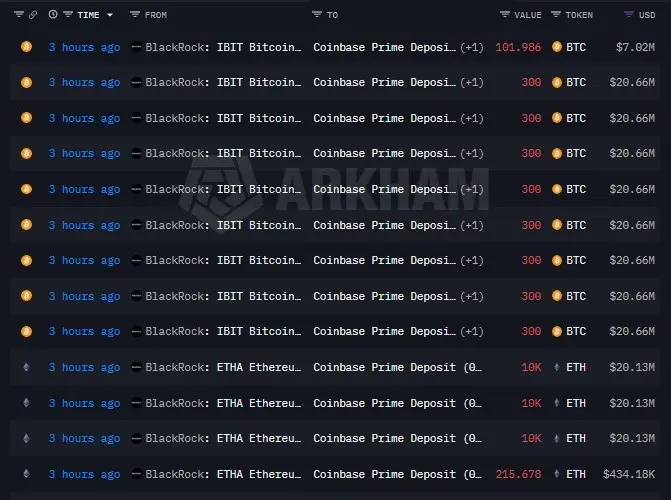

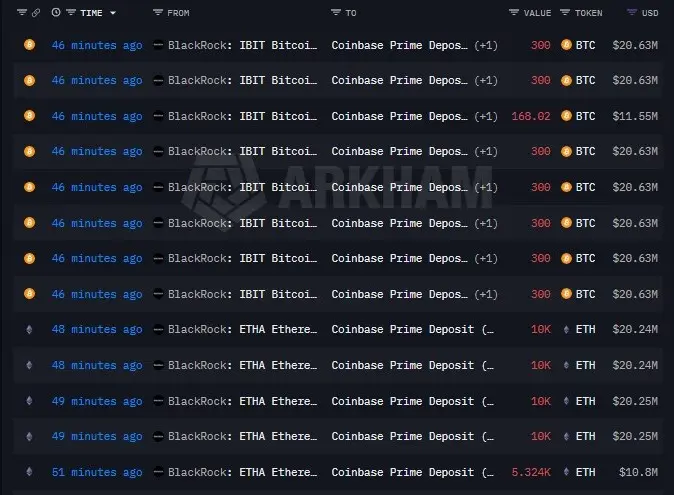

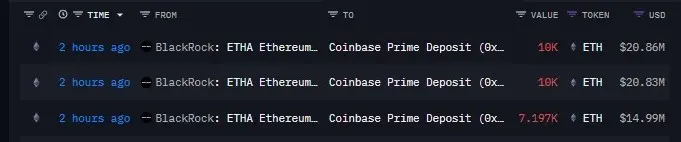

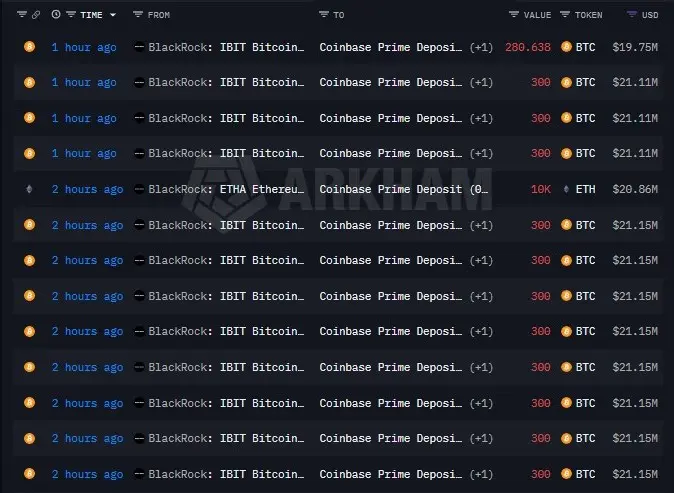

#blackRock Just Did Another Shuffle🥶. yup, it happened. In the last couple of hours, BlackRock slid 5,081 BTC and 27,197 ETH into Coinbase Prime.WHAT it\'s Mean 👇!Could be housekeeping, could be setting things up for later… hard to say. But whenever BlackRock moves this much crypto around and doesn’t bother explaining, people usually start paying attention anyway.Address: $BTC $ETH

- Reward

- like

- Comment

- Repost

- Share