ElCryptoChapo

No content yet

ElCryptoChapo

Countries with the strictest crypto regulations will produce the most valuable projects in the next cycle.

When compliance is mandatory, the scammers can't compete.

Russia's about to block unregistered exchanges.

The US is politicizing clarity.

Meanwhile the projects that built compliance infra from day one are positioning for the only market that matters: institutional capital.

Regulation doesn't kill innovation. It kills extraction.

Which side are you building for..?

When compliance is mandatory, the scammers can't compete.

Russia's about to block unregistered exchanges.

The US is politicizing clarity.

Meanwhile the projects that built compliance infra from day one are positioning for the only market that matters: institutional capital.

Regulation doesn't kill innovation. It kills extraction.

Which side are you building for..?

- Reward

- 1

- Comment

- Repost

- Share

Hot take: AI agents will be crypto's first real users..

Not because they're smarter...they just don't have a choice!

20k AI agents registered on ERC-8004. $108k in fees in 7 days.

These are agents that need onchain identity, payments, & execution to survive.

Humans want convenience. Agents need infra.

Agents don't care about seed phrases or gas optimization. They just need rails that work autonomously.

The chains building for agent native activity are positioning for a market that doesn't fully exist yet, but will be worth trillions...

The infra play isn't super obvious yet, but it's the bigg

Not because they're smarter...they just don't have a choice!

20k AI agents registered on ERC-8004. $108k in fees in 7 days.

These are agents that need onchain identity, payments, & execution to survive.

Humans want convenience. Agents need infra.

Agents don't care about seed phrases or gas optimization. They just need rails that work autonomously.

The chains building for agent native activity are positioning for a market that doesn't fully exist yet, but will be worth trillions...

The infra play isn't super obvious yet, but it's the bigg

- Reward

- 1

- Comment

- Repost

- Share

gm

Some Wednesday wisdom for ya'll: your timeline is full of people posting bullish GM posts while their bags are down 90% & institutional money is at historic bearish levels on the dollar.

The disconnect between what people post & what they're actually holding is the real alpha. Most everyone's faking confidence while quietly bleeding..

Don't fall into the illusions you see on ct..you'll be less stressed.

Some Wednesday wisdom for ya'll: your timeline is full of people posting bullish GM posts while their bags are down 90% & institutional money is at historic bearish levels on the dollar.

The disconnect between what people post & what they're actually holding is the real alpha. Most everyone's faking confidence while quietly bleeding..

Don't fall into the illusions you see on ct..you'll be less stressed.

- Reward

- 1

- Comment

- Repost

- Share

The market's 'bad?' LOL. That's what they WANT you to think.

85% of 2025 launches underwater? Good riddance. We needed a cleanse.

VC money drying up finally?

The 'raise, launch, dump' playbook is dying..

Now, builders compete with REAL projects, not 100 VC backed zombies.

Honestly..way better odds. bullish

85% of 2025 launches underwater? Good riddance. We needed a cleanse.

VC money drying up finally?

The 'raise, launch, dump' playbook is dying..

Now, builders compete with REAL projects, not 100 VC backed zombies.

Honestly..way better odds. bullish

- Reward

- like

- Comment

- Repost

- Share

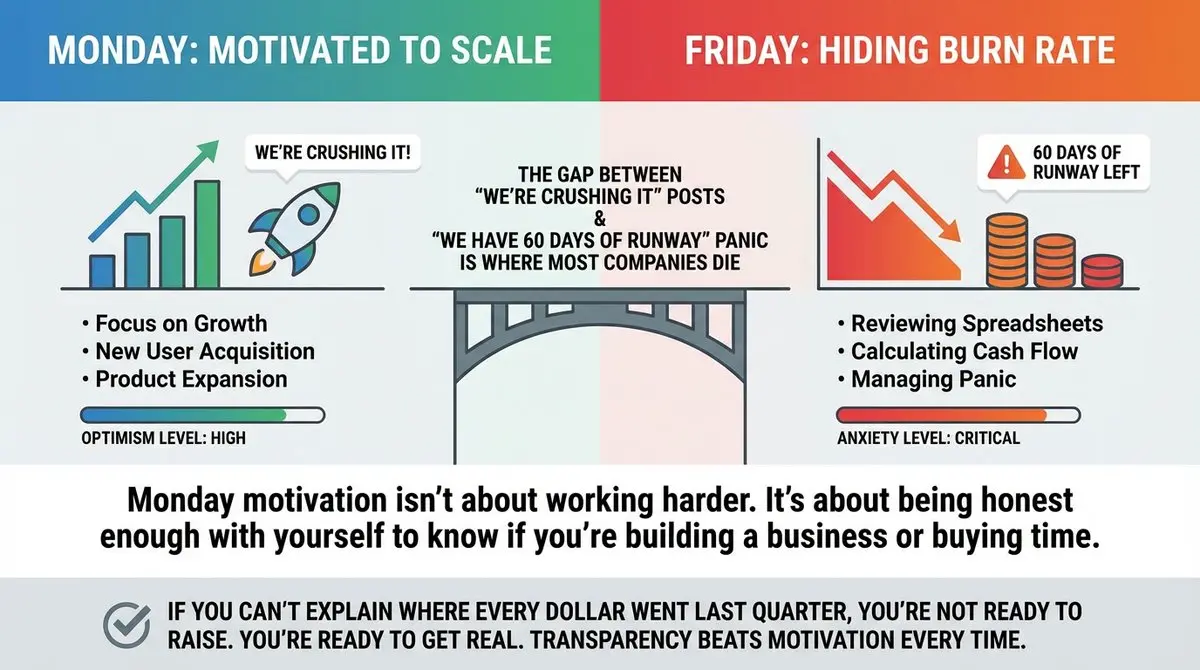

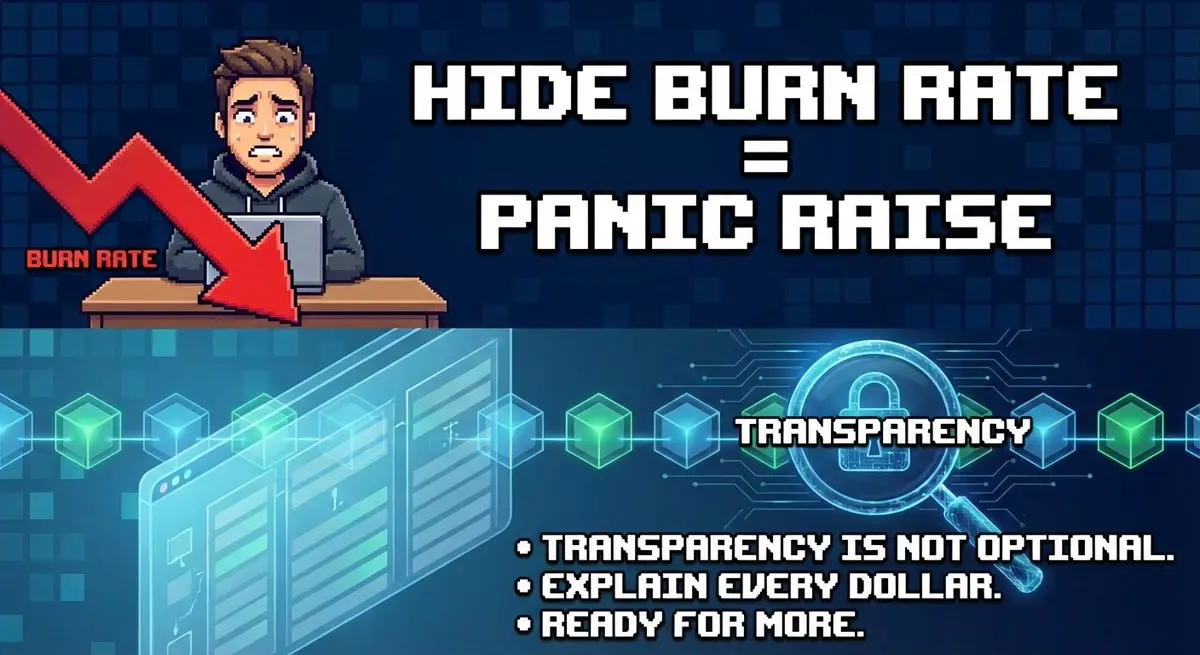

Most founders start Monday motivated to "scale."

By Friday they're hiding burn rate spreadsheets from their co founder.

The gap between "we're crushing it" posts & "we have 60 days of runway" panic is where most companies die.

Monday motivation isn't about working harder. It's about being honest enough with yourself to know if you're building a business or buying time.

If you can't explain where every dollar went last quarter, you're not ready to raise. You're ready to get real.

Transparency beats motivation every time.

By Friday they're hiding burn rate spreadsheets from their co founder.

The gap between "we're crushing it" posts & "we have 60 days of runway" panic is where most companies die.

Monday motivation isn't about working harder. It's about being honest enough with yourself to know if you're building a business or buying time.

If you can't explain where every dollar went last quarter, you're not ready to raise. You're ready to get real.

Transparency beats motivation every time.

- Reward

- like

- Comment

- Repost

- Share

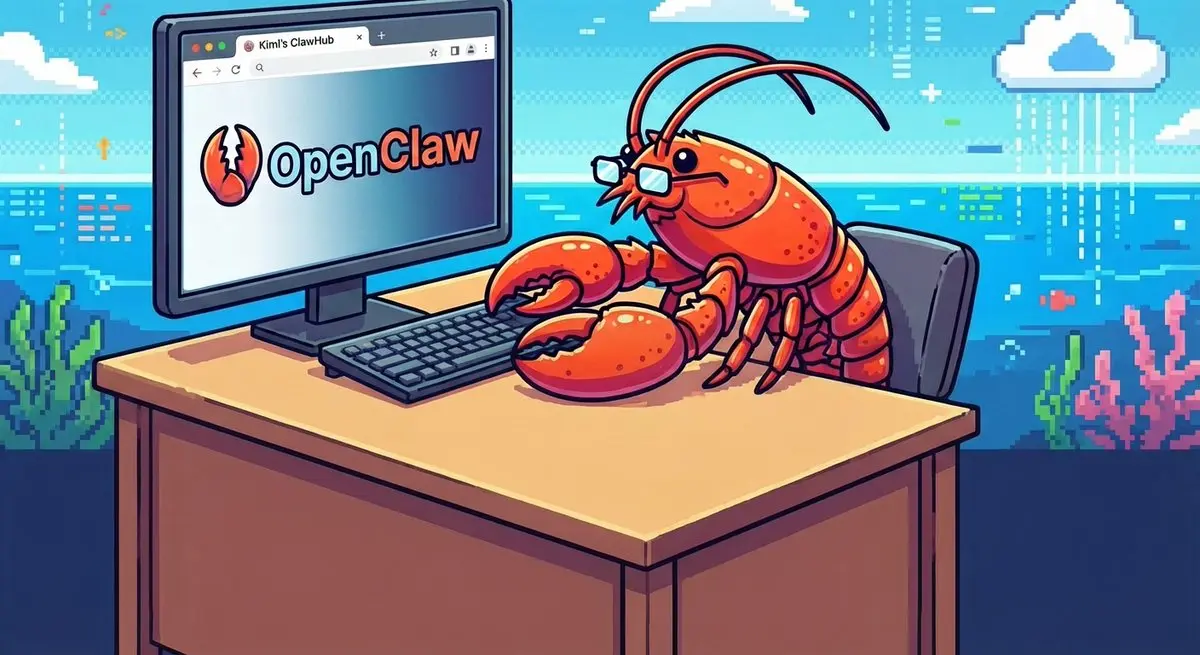

Kimi wrapped OpenClaw into a browser tab.

No Docker. No local hosting. No terminal commands. Just open & go.

The bottleneck/ friction wasn't the tool. It was the setup. 90% of people hit a wall at installation & quit.

Kimi deleted that wall entirely.

5,000+ skills from ClawHub, cloud storage, live data access, all running in a browser.

The intelligence gap on this is still wide open. Most businesses don't know this exists yet..

But they will. 🦞

No Docker. No local hosting. No terminal commands. Just open & go.

The bottleneck/ friction wasn't the tool. It was the setup. 90% of people hit a wall at installation & quit.

Kimi deleted that wall entirely.

5,000+ skills from ClawHub, cloud storage, live data access, all running in a browser.

The intelligence gap on this is still wide open. Most businesses don't know this exists yet..

But they will. 🦞

- Reward

- 1

- 1

- Repost

- Share

Jeremytrader :

:

That is very useful for research.How TF is it that my openclaw was the first to wish me a happy Valentine’s Day? 🦞

- Reward

- like

- Comment

- Repost

- Share

Dead weight got sucked out of crypto. The tourists & those who don't believe left.

Financial institutions are (still) coming in.

Teams like Hyperliquid, LayerZero, etc building talent heavy operations.

Signal to noise ratio is improving. Projects that verify legitimacy & ship real products are the ones still standing strong..

Accountability becomes your moat when everyone else is explaining why they deserve trust.

Financial institutions are (still) coming in.

Teams like Hyperliquid, LayerZero, etc building talent heavy operations.

Signal to noise ratio is improving. Projects that verify legitimacy & ship real products are the ones still standing strong..

Accountability becomes your moat when everyone else is explaining why they deserve trust.

- Reward

- like

- Comment

- Repost

- Share

What's the first thing a new chain needs to attract users?

A breakout money making scheme.

Memes, ponzis, NFTs, whatever gets early adopters to actually bridge & explore the eco.

Without that, there's no incentive to overcome the initial laziness..

A breakout money making scheme.

Memes, ponzis, NFTs, whatever gets early adopters to actually bridge & explore the eco.

Without that, there's no incentive to overcome the initial laziness..

- Reward

- like

- Comment

- Repost

- Share

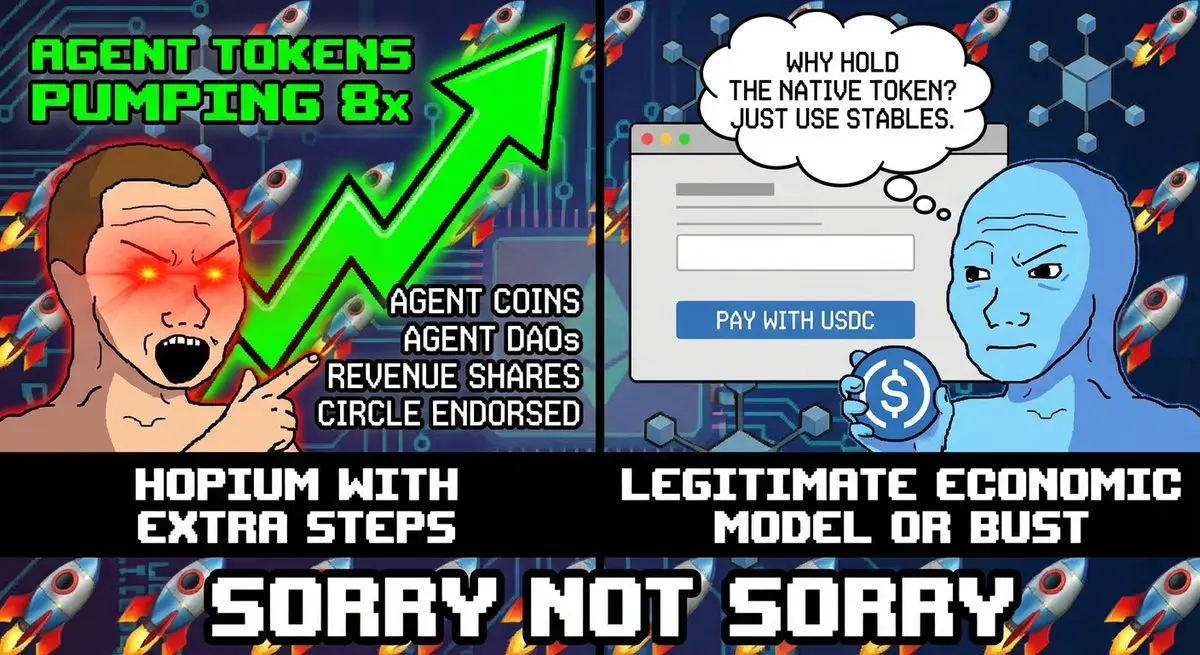

agent tokens pumping 8x because Circle endorsed their commerce platform.

everyone's launching agent coins, agent DAOs, agent revenue shares.

but here's the uncomfortable question: why would anyone hold your agent's token when they can just use $USDC to access every service?

we've made it insanely easy to speculate onchain with stables while abstracting away the complicated bits. no need to hold the native token anymore.

your agent better have a legitimate economic model or massive buybacks baked into protocol revenue, because "agents will create value" isn't a tokenomics strategy.

it's hopium

everyone's launching agent coins, agent DAOs, agent revenue shares.

but here's the uncomfortable question: why would anyone hold your agent's token when they can just use $USDC to access every service?

we've made it insanely easy to speculate onchain with stables while abstracting away the complicated bits. no need to hold the native token anymore.

your agent better have a legitimate economic model or massive buybacks baked into protocol revenue, because "agents will create value" isn't a tokenomics strategy.

it's hopium

AGENT1,87%

- Reward

- like

- Comment

- Repost

- Share

Most founders hide their burn rate until they're 60 days from zero.

Then they panic raise at whatever terms they can get..

The uncomfortable truth: if you can't explain where every dollar went last quarter, you're not ready to ask for more.

Transparency isn't optional there.

Lesson in that for many.

Then they panic raise at whatever terms they can get..

The uncomfortable truth: if you can't explain where every dollar went last quarter, you're not ready to ask for more.

Transparency isn't optional there.

Lesson in that for many.

- Reward

- like

- Comment

- Repost

- Share

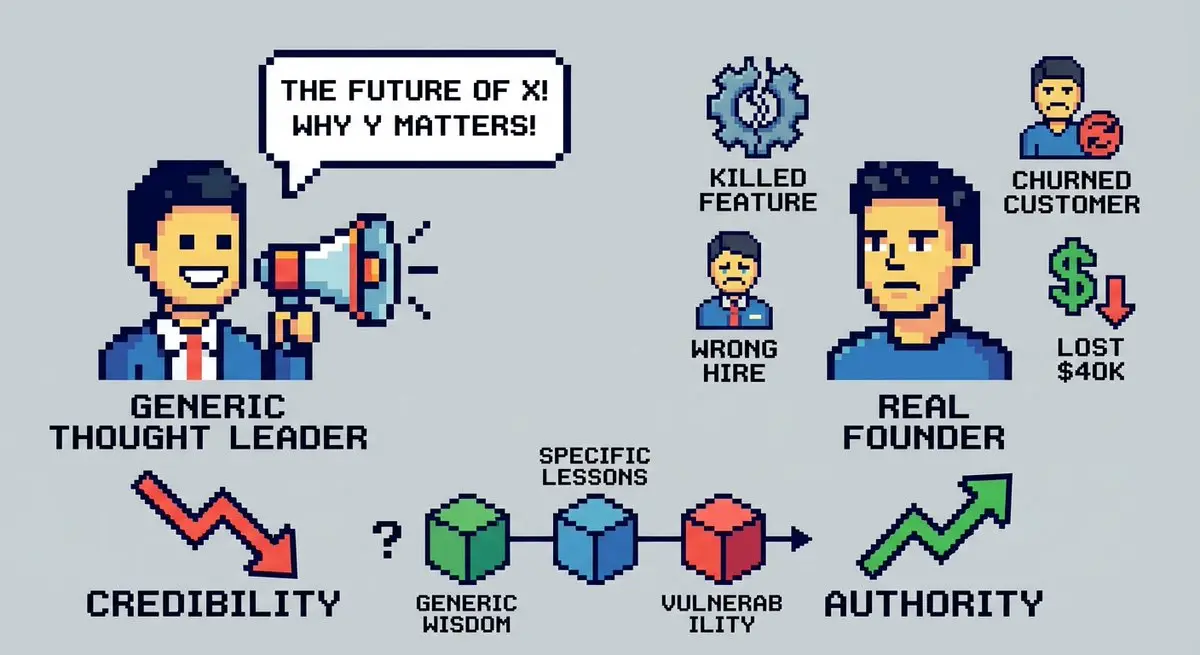

Uncomfortable founder advice nobody wants to hear:

Your 'thought leadership' is killing your credibility.

Posting generic takes about the future of X or 'why Y matters' makes you sound like every other founder trying to sound smart.

Here's what actually builds authority:

Share the specific problem you couldn't solve last week.

The feature you killed after spending $40K building it.

The customer who churned & exactly why.

The hire you made that turned out wrong.

Vulnerability isn't weakness. It's proof you're actually building something REAL.

Generic wisdom is free. Specific lessons cost money

Your 'thought leadership' is killing your credibility.

Posting generic takes about the future of X or 'why Y matters' makes you sound like every other founder trying to sound smart.

Here's what actually builds authority:

Share the specific problem you couldn't solve last week.

The feature you killed after spending $40K building it.

The customer who churned & exactly why.

The hire you made that turned out wrong.

Vulnerability isn't weakness. It's proof you're actually building something REAL.

Generic wisdom is free. Specific lessons cost money

- Reward

- like

- Comment

- Repost

- Share

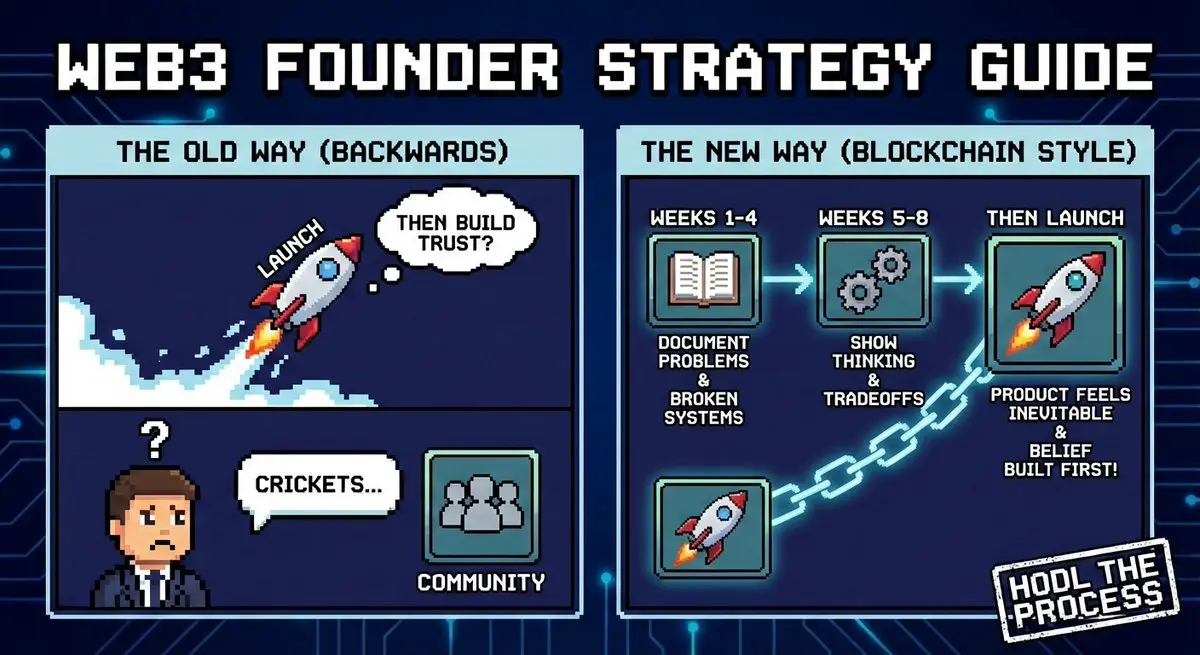

Founder content strategy most teams get backwards:

They launch, then try to build trust.

Here's what actually works if you're building in web3:

Weeks 1-4: Document the problems you're solving

Share the broken systems. The gaps nobody's addressing. The inefficiencies you keep seeing.

Don't pitch your solution yet. Just prove you understand the problem better than anyone scrolling.

Weeks 5-8: Show your thinking process

Walk through your approach. The tradeoffs you're weighing. The technical decisions you're debating.

This is where people start caring whether you succeed.

By the time you launch,

They launch, then try to build trust.

Here's what actually works if you're building in web3:

Weeks 1-4: Document the problems you're solving

Share the broken systems. The gaps nobody's addressing. The inefficiencies you keep seeing.

Don't pitch your solution yet. Just prove you understand the problem better than anyone scrolling.

Weeks 5-8: Show your thinking process

Walk through your approach. The tradeoffs you're weighing. The technical decisions you're debating.

This is where people start caring whether you succeed.

By the time you launch,

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin was $1 15 years ago today.

Everyone's posting charts. Nobody's posting what it actually means for crypto right now.

$1.25B left Bitcoin ETFs in 3 days. Blackrock saw its largest single day redemption ever.

Institutions bought at $100k & panic sold at $60k. Same playbook as retail, just with compliance departments..

Meanwhile alts vs stablecoin supply just hit 2022 bear lows. Money didn't leave crypto. It froze.

This is what maximum fear looks like when it's dressed up in institutional clothing.

COVID bottom: Fear index at 10. Bitcoin went $4k to $64k in 18 months.

FTX bottom: Fear inde

Everyone's posting charts. Nobody's posting what it actually means for crypto right now.

$1.25B left Bitcoin ETFs in 3 days. Blackrock saw its largest single day redemption ever.

Institutions bought at $100k & panic sold at $60k. Same playbook as retail, just with compliance departments..

Meanwhile alts vs stablecoin supply just hit 2022 bear lows. Money didn't leave crypto. It froze.

This is what maximum fear looks like when it's dressed up in institutional clothing.

COVID bottom: Fear index at 10. Bitcoin went $4k to $64k in 18 months.

FTX bottom: Fear inde

BTC-1,29%

- Reward

- like

- Comment

- Repost

- Share

Claude is making some MOVES ahead of the game later.Feels especially useful for prediction market purposes 🔥

- Reward

- like

- Comment

- Repost

- Share

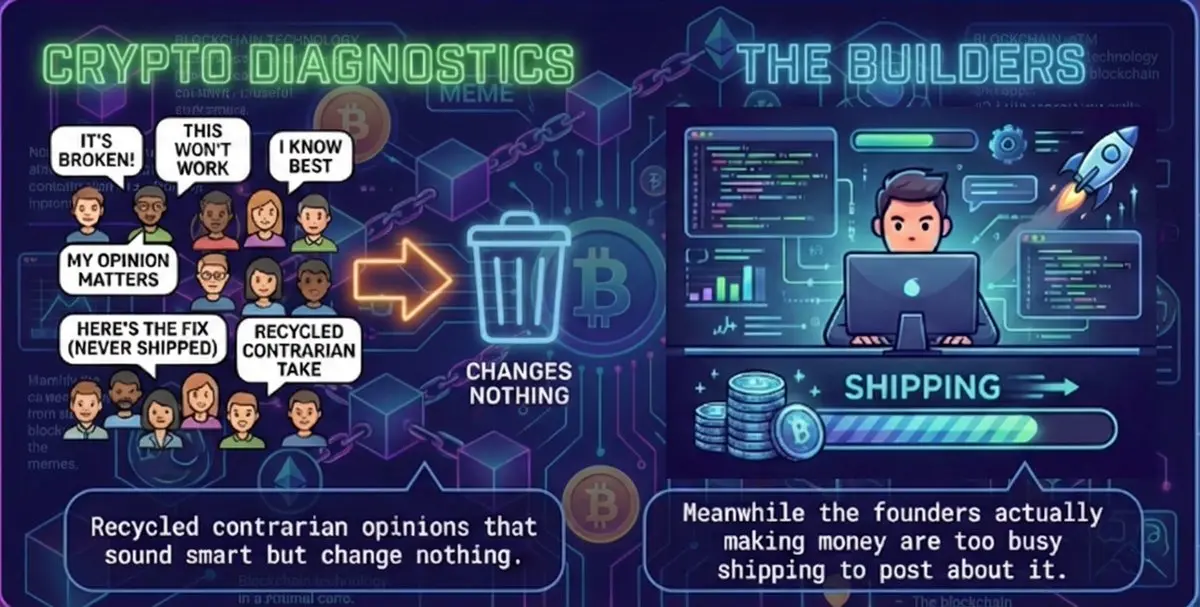

Friday hot take: your timeline is full of people diagnosing crypto problems they\'ll never solve.Recycled contrarian opinions that sound smart but change nothingMeanwhile the founders actually making money are too busy shipping to post about it.Lesson in that.

- Reward

- 1

- Comment

- Repost

- Share