SOFR breaking out above FFR upper limit (last happened in 2020 shutdown and before that in 2019 Repo Crisis) ⚠️

CJK111

No content yet

CJK111

What is bearish about this Bitcoin chart⁉️

NOTHING.

$BTC is business as usual

What's different is market sentiment?

It's the volatile human variable.

Fear & Greed index at MAX FEAR

And Bitcoin is flipping $100K from psychological resistance to support.

Seeing this at ~$100K makes me BULLISH

Not only sentiment BUT macro.

Rates going down.

QT ending.

QE on deck.

Powell replaced in May.

Rates much lower.

What comes next?

$BTC to price of Single Family Home

PAYtience! 🍊✌️🧡

NOTHING.

$BTC is business as usual

What's different is market sentiment?

It's the volatile human variable.

Fear & Greed index at MAX FEAR

And Bitcoin is flipping $100K from psychological resistance to support.

Seeing this at ~$100K makes me BULLISH

Not only sentiment BUT macro.

Rates going down.

QT ending.

QE on deck.

Powell replaced in May.

Rates much lower.

What comes next?

$BTC to price of Single Family Home

PAYtience! 🍊✌️🧡

BTC1.04%

- Reward

- like

- Comment

- Repost

- Share

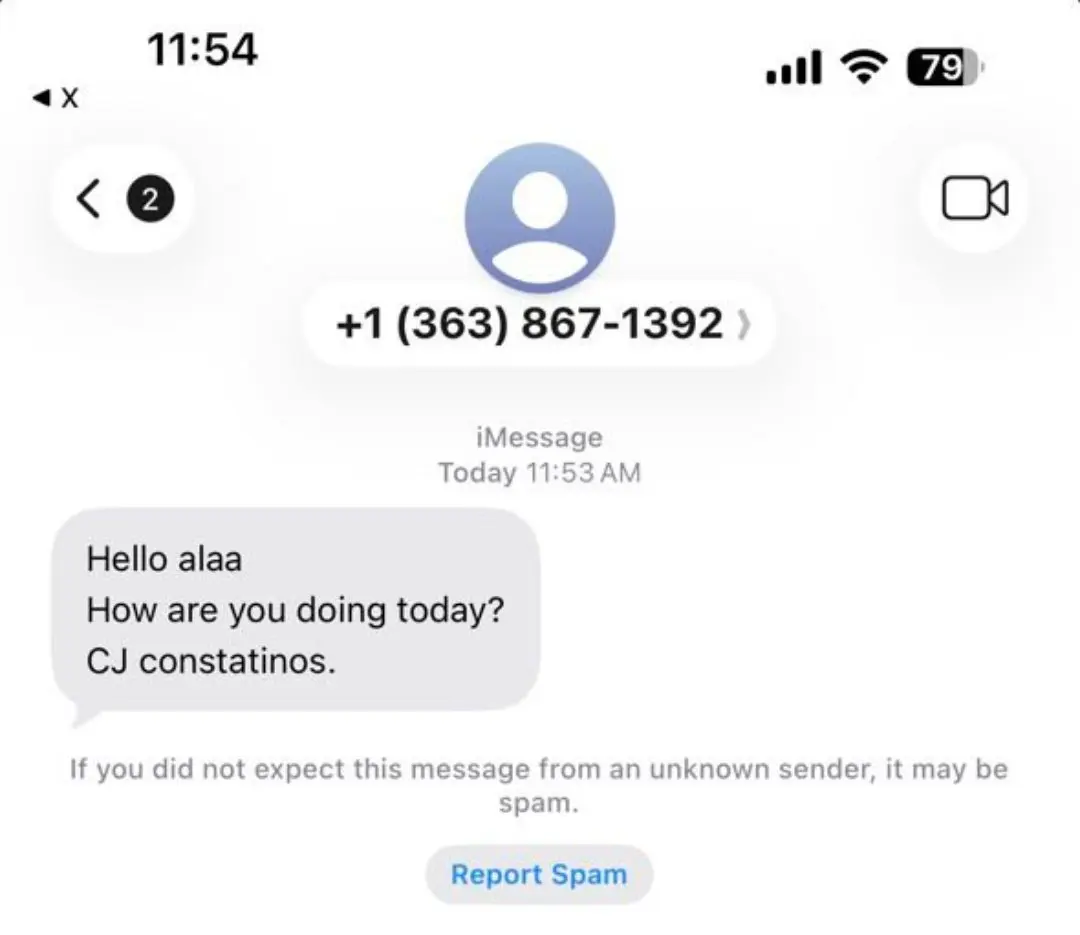

Got DMs that someone is sending iMessages claiming to be me ⚠️

I'll never reach out, pls report spam!

If you want to get in touch with me you can send an X DM or you can reach out via

Stay safe out there friends 🍊✌️🧡

I'll never reach out, pls report spam!

If you want to get in touch with me you can send an X DM or you can reach out via

Stay safe out there friends 🍊✌️🧡

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Interest Rate Going Lower

Inflation Rate Going Higher

Powell out of office May '26

Trump PRINTER installed

24% of Money printed since 2020

By 2030, it will be ~60% printed

$BTC poised for a super cycle

Macro lining up to be even more powerful catalyst for price discovery than a halving ⚡️

Got Bitcoin!?

Inflation Rate Going Higher

Powell out of office May '26

Trump PRINTER installed

24% of Money printed since 2020

By 2030, it will be ~60% printed

$BTC poised for a super cycle

Macro lining up to be even more powerful catalyst for price discovery than a halving ⚡️

Got Bitcoin!?

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin as pristine collateral is the advent of NEGATIVE RISK is credit markets.

Every other form of collateral can be diluted over the life of the loan ⚠️

$BTC's absolute digital scarcity means it can NOT be diluted.

This makes Bitcoin a type of auto-deleveraging mechanism, especially over longer timeframes.

TradFi credit is circulating (proof of promise) credit, there is no such thing as negative risk because a promise has no equity value.

BitFi credit is commodity (proof of work) credit, there is negative risk bc there is 24/7/365 liquidity backing the promise (credit).

Negative risk = lowe

Every other form of collateral can be diluted over the life of the loan ⚠️

$BTC's absolute digital scarcity means it can NOT be diluted.

This makes Bitcoin a type of auto-deleveraging mechanism, especially over longer timeframes.

TradFi credit is circulating (proof of promise) credit, there is no such thing as negative risk because a promise has no equity value.

BitFi credit is commodity (proof of work) credit, there is negative risk bc there is 24/7/365 liquidity backing the promise (credit).

Negative risk = lowe

- Reward

- like

- Comment

- Repost

- Share

Bitcoin transitioning from magic internet money to digital gold is the monetization of the asset class.

$BTC evolving from digital gold to pristine collateral is the financialization of the asset class.

I see an asset class that's on the brink of a major repricing event, prepare accordingly!

$BTC evolving from digital gold to pristine collateral is the financialization of the asset class.

I see an asset class that's on the brink of a major repricing event, prepare accordingly!

- Reward

- like

- Comment

- Repost

- Share

All the elites have a *Super Asset*

Elon Musk has Tesla shares

Jeff Bezos has Amazon stock

They can transform that equity into purchasing power, with no tax liability, by borrowing against it.

They then use cash flows to pay back the debt. At the end of it, they get the best of both worlds...

They have the asset they bought while they maintained ownership of the equities they used as collateral.

What about #WeThePeople

What's our *Super Asset*⁉️ Bitcoin‼️

It's engineered money strategically designed as savings technology.

The burden of the fiat denominated debt you take out against it will tre

Elon Musk has Tesla shares

Jeff Bezos has Amazon stock

They can transform that equity into purchasing power, with no tax liability, by borrowing against it.

They then use cash flows to pay back the debt. At the end of it, they get the best of both worlds...

They have the asset they bought while they maintained ownership of the equities they used as collateral.

What about #WeThePeople

What's our *Super Asset*⁉️ Bitcoin‼️

It's engineered money strategically designed as savings technology.

The burden of the fiat denominated debt you take out against it will tre

- Reward

- like

- Comment

- Repost

- Share

Market structure and dynamics are maturing with the monetization and now the ongoing financialization of the Bitcoin asset class.

What happens when higher $BTC prices only incentivize selling for those without access to financial tools⁉️

Humans have never seen price discovery of absolutely scarce money.

Bitcoin is engineered money, making it a savings technology

BUT when combined with the proper financial tools, it becomes the super asset of #WeThePeople

⚡️7.4.25⚡️

What happens when higher $BTC prices only incentivize selling for those without access to financial tools⁉️

Humans have never seen price discovery of absolutely scarce money.

Bitcoin is engineered money, making it a savings technology

BUT when combined with the proper financial tools, it becomes the super asset of #WeThePeople

⚡️7.4.25⚡️

- Reward

- like

- Comment

- Repost

- Share