# Cryptoobservers

171.23K

GateUser-cc27e448

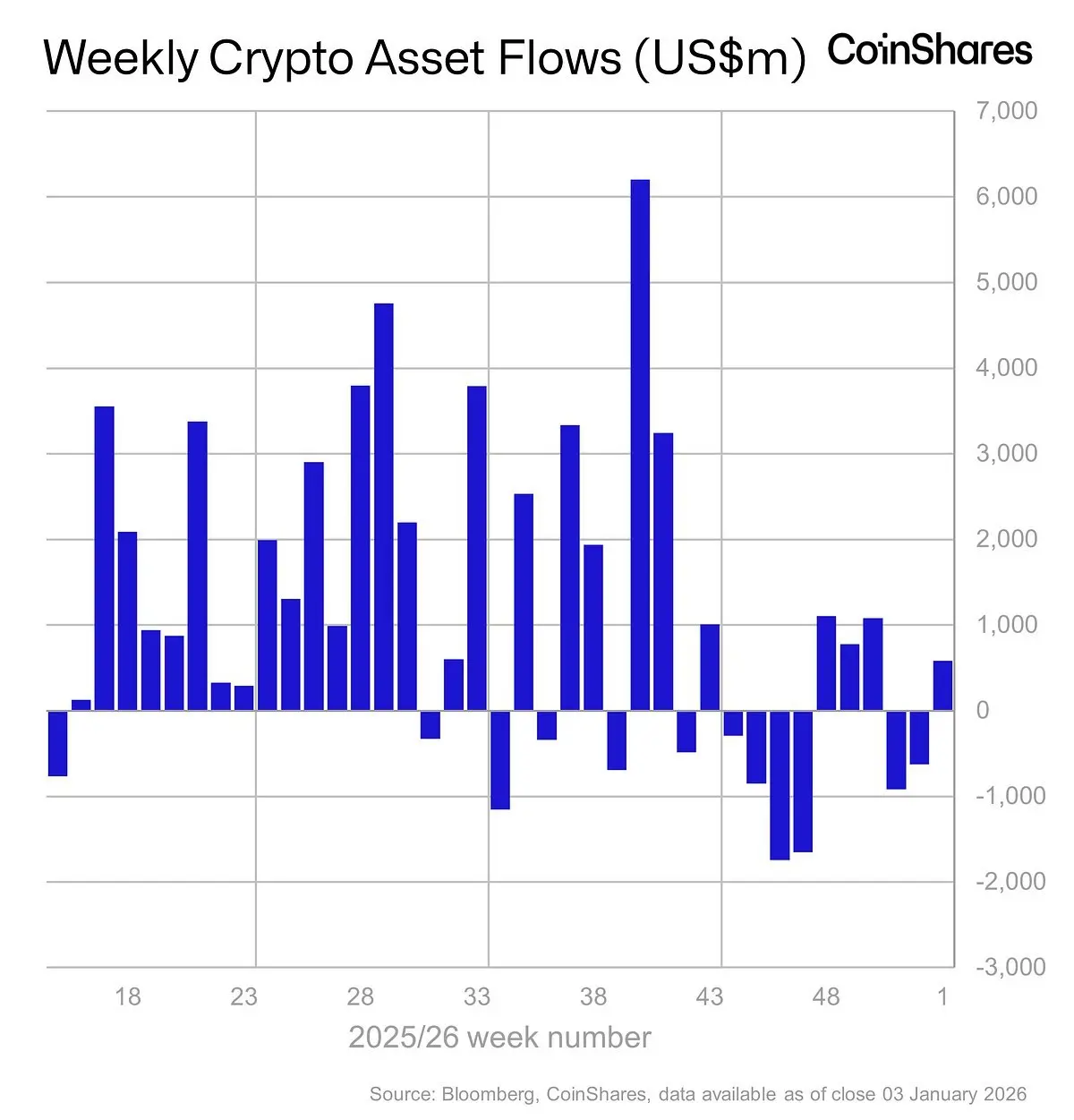

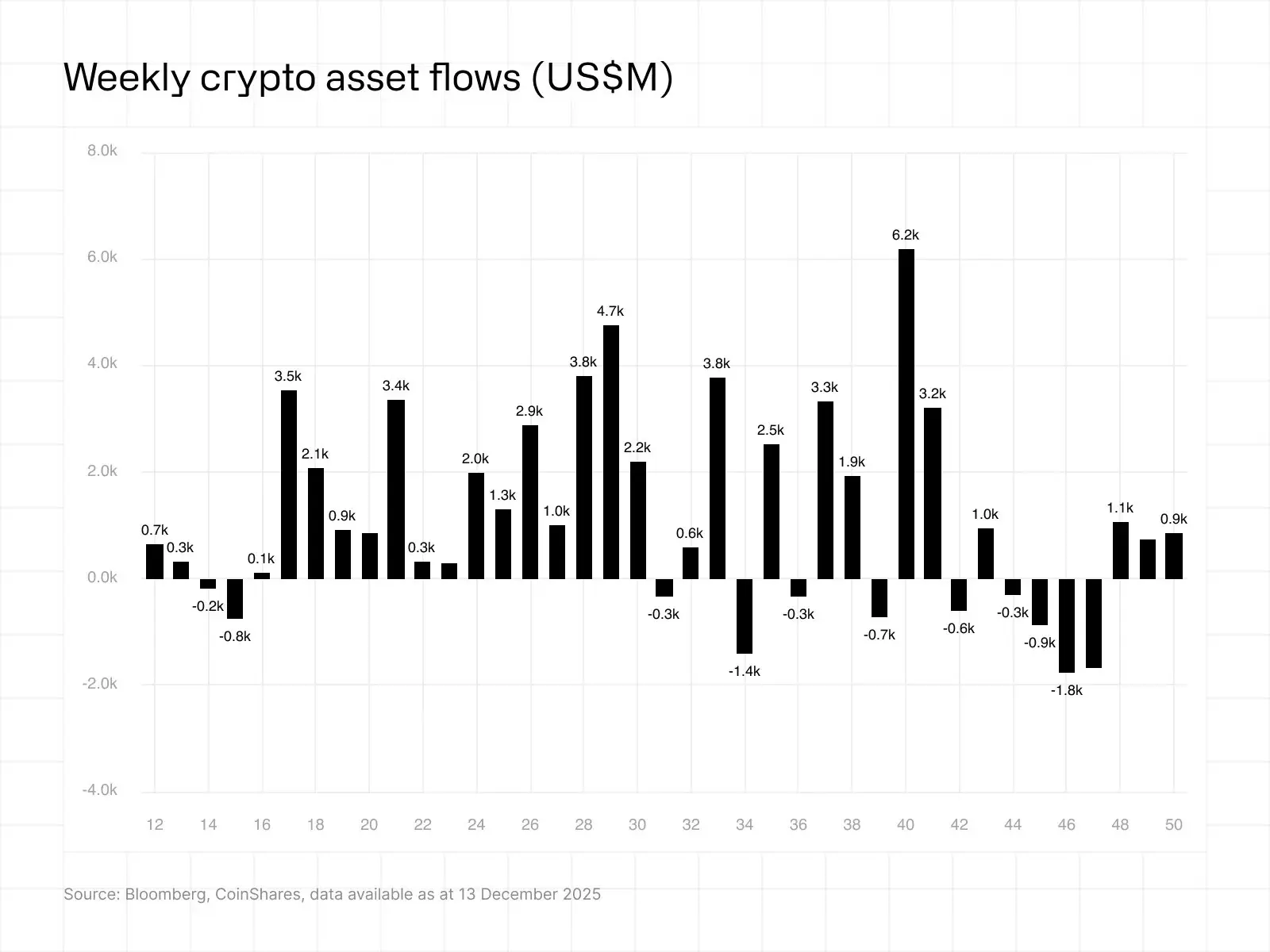

Digital asset products saw $446m in weekly outflows, taking total post-October 10th outflows to $3.2bn and indicating sentiment has yet to fully recover👀

#CryptoObservers

#CryptoObservers

- Reward

- 1

- Comment

- Repost

- Share

Global digital asset inflows reached $47.2bn in 2025, just shy of the 2024 record, with the year starting strongly despite midweek volatility👀

#CryptoObservers

#CryptoObservers

- Reward

- 1

- Comment

- Repost

- Share

Digital asset investment products saw $952m in outflows, the first in four weeks, driven by delays to the US Clarity Act, prolonging regulatory uncertainty, and concerns over whale selling👀

#CryptoObservers #GateChristmasGiveaway

#CryptoObservers #GateChristmasGiveaway

- Reward

- 1

- Comment

- Repost

- Share

Digital asset investment products saw inflows totalling $864m last week, marking the third week of modest inflows overall, reflecting a cautious yet increasingly optimistic investor base👀

#CryptoObservers #GateChristmasGiveaway

#CryptoObservers #GateChristmasGiveaway

- Reward

- 1

- Comment

- Repost

- Share

Gold-backed stablecoins now exceed $4 billion in market capitalization, having nearly tripled from $1.3 billion at the start of 2025.

Tether Gold dominates this sector, leading the market with approximately $2.2 billion, which accounts for 50% of the total👀

#CryptoObservers #GateChristmasGiveaway

Tether Gold dominates this sector, leading the market with approximately $2.2 billion, which accounts for 50% of the total👀

#CryptoObservers #GateChristmasGiveaway

XAUT-0,26%

- Reward

- like

- Comment

- Repost

- Share

White House considers pulling its support for crypto market structure bill amid Coinbase standoff👀

#CryptoObservers

#CryptoObservers

- Reward

- like

- Comment

- Repost

- Share

Visa offers stablecoin settlement for US banks using Circle’s USDC👀

#CryptoObservers #GateChristmasGiveaway

#CryptoObservers #GateChristmasGiveaway

USDC-0,02%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin has decoupled from stocks. The S&P 500 closed at a record earlier this month and is up 16% for the year. Tech stocks, with which Bitcoin has often tended to move in sync, have done even better👀

#CryptoObservers #GateChristmasGiveaway

#CryptoObservers #GateChristmasGiveaway

BTC0,77%

- Reward

- like

- Comment

- Repost

- Share

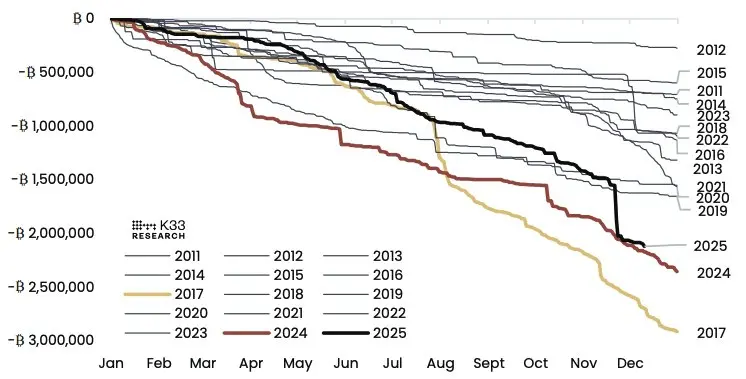

2024 and 2025 is the second and third-largest years for long-term supply reactivation in Bitcoin's history, surpassed only by 2017👀

#CryptoObservers #GateChristmasGiveaway

#CryptoObservers #GateChristmasGiveaway

BTC0,77%

- Reward

- like

- Comment

- Repost

- Share

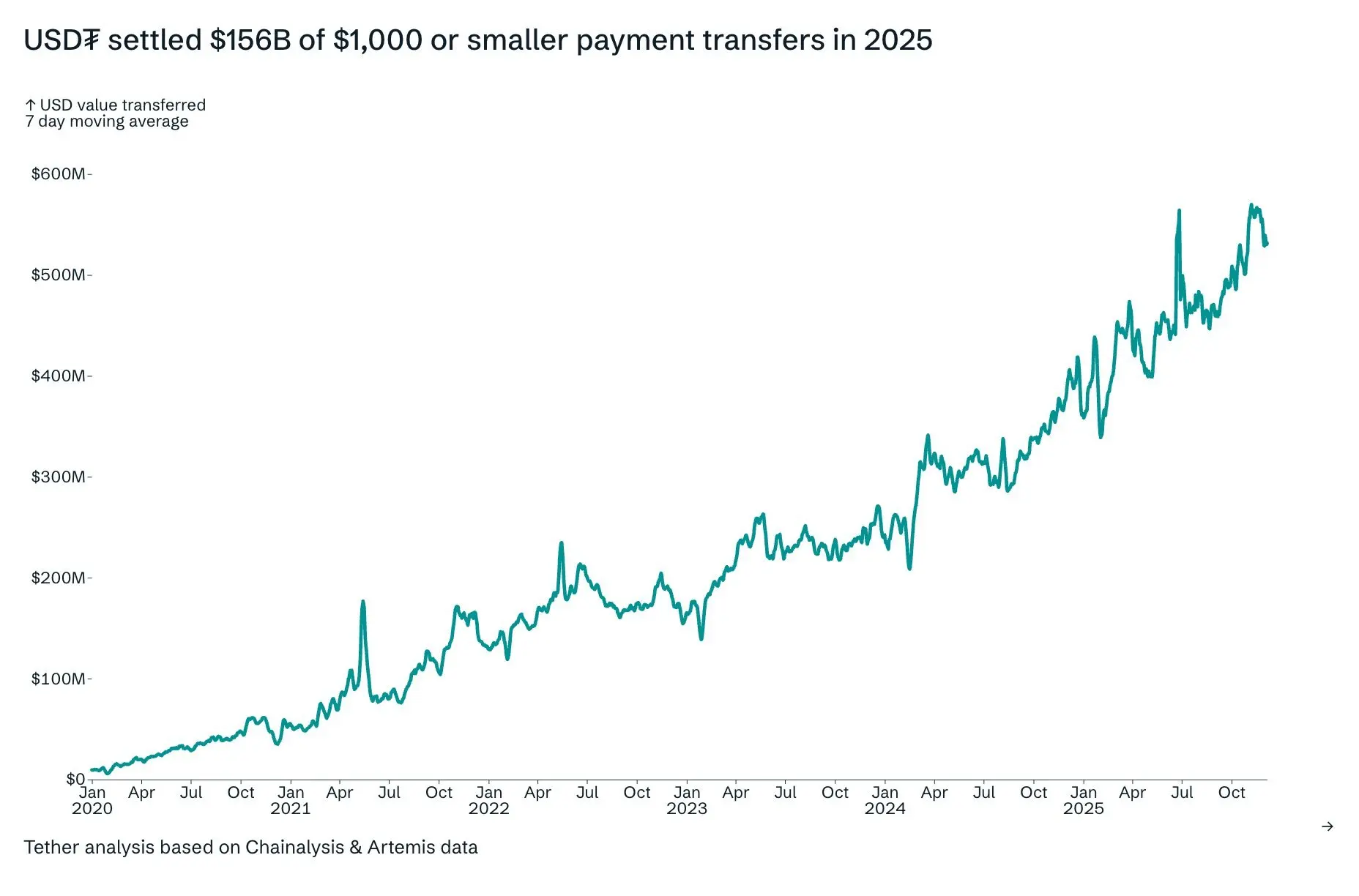

USDT settled $156B of $1,000 or smaller payment transfers in 2025👀

#CryptoObservers #GateChristmasGiveaway

#CryptoObservers #GateChristmasGiveaway

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

34.99K Popularity

805 Popularity

543 Popularity

107 Popularity

89 Popularity

96 Popularity

100 Popularity

64 Popularity

67.6K Popularity

108.85K Popularity

76.05K Popularity

19.1K Popularity

42.86K Popularity

36.16K Popularity

192.13K Popularity

News

View MoreData: 6,267 ETH transferred out from Stake.com, then relayed to another anonymous address

1 m

Data: 128.94 BTC transferred from an anonymous address, worth approximately $11.52 million

2 m

"Lightning Reverse" whale simultaneously shorts BTC and ETH with unrealized losses exceeding 1 million USD

6 m

BTR (Bitlayer) 24-hour increase of 35.97%

7 m

Is the digital euro entering the countdown? ECB officials promote "cash-level" CBDC, making European payment sovereignty the focus

8 m

Pin