WLFI Price Prediction: Trump’s Crypto Empire Earns Over $1 Billion, WLFI Could Rise to $0.1359

The Trump Family’s Crypto Empire

Former U.S. President Donald Trump was once skeptical of cryptocurrencies, but he and his family have now fully embraced Web3. Over the past year, they have amassed more than $1 billion in profits through a range of digital asset ventures. They have created a comprehensive ecosystem that spans NFTs, meme coins, stablecoins, and DeFi platforms.

Data from Wu Blockchain shows the Trump family’s crypto-related revenue primarily comes from three main segments: TRUMP and MELANIA tokens, the WLFI token, and the USD1 stablecoin.

WLFI: The Leading Revenue Driver

Since the WLFI token began trading publicly in September 2025, its price has dropped around 70% from its peak, yet it has still generated approximately $550 million in net profit. WLFI serves as the core asset of the World Liberty Financial (WLF) platform, founded by the Trump family at the end of 2023 to merge traditional finance with DeFi models. Donald Trump, his sons Donald Jr. and Eric, and business partner Steve Witkoff collectively own about 60% of WLF shares. The platform’s major income streams include token sales, staking, and lending.

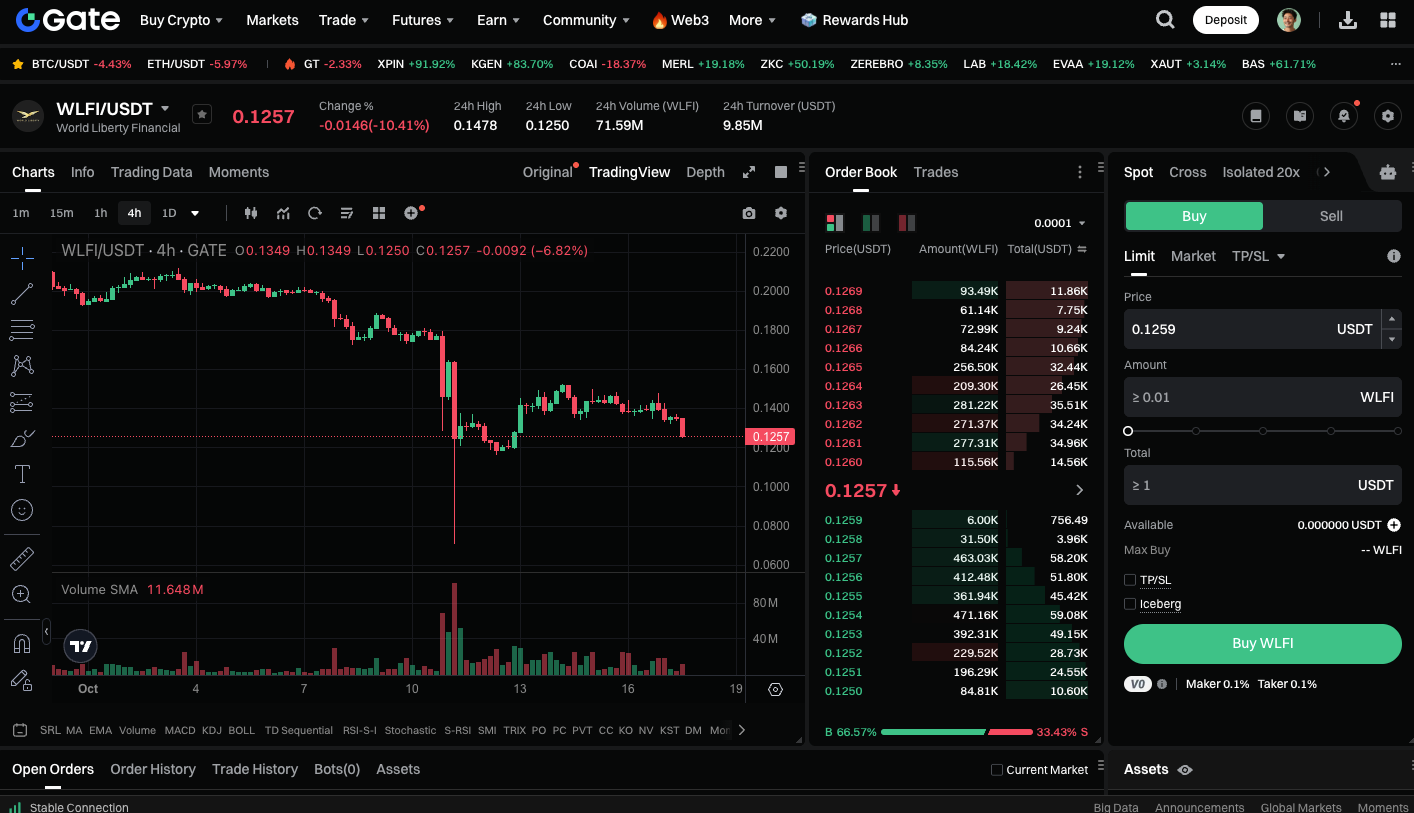

Coincodex’s latest forecast predicts WLFI will trade between $0.0949 and $0.1359, with an average price near $0.1073—which represents an estimated annualized return of 7.40%.

USD1 Stablecoin: A Market Standout

In addition to WLFI, the Trump family’s USD1 stablecoin has quickly become a focal point. Just months after its launch, sales have surpassed $2.7 billion as its political branding has attracted a large user base and sparked a new trend of segmentation in the stablecoin market. The TRUMP and MELANIA tokens have also delivered more than $427 million in revenue as community engagement and trading volume soared, further solidifying the Trump family’s position in the crypto industry.

Trump’s Reach Extends to Mining and Financial Markets

Beyond DeFi, the Trump family invested in American Bitcoin Corp. (ABTC), a Bitcoin mining company established by Trump’s sons and business allies. ABTC went public on Nasdaq in May 2025, with its stock price surging over 110% post-listing—resulting in hundreds of millions of dollars in unrealized gains for the family trust. This move placed Trump among the top U.S. crypto asset investors, alongside figures like Michael Saylor and the Winklevoss twins.

You can trade WLFI spot at: https://www.gate.com/trade/WLFI_USDT

Summary

The Trump family’s involvement makes WLFI a key example of the intersection between politics and blockchain. While market fluctuations remain significant, its robust community and strong capital backing position it for long-term growth. If WLFI reaches its projected price of $0.1359, it could become one of the most prominent assets of 2025.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article