RSI Heatmap Explained: Understanding Crypto Market Sentiment

What Is the RSI Heatmap?

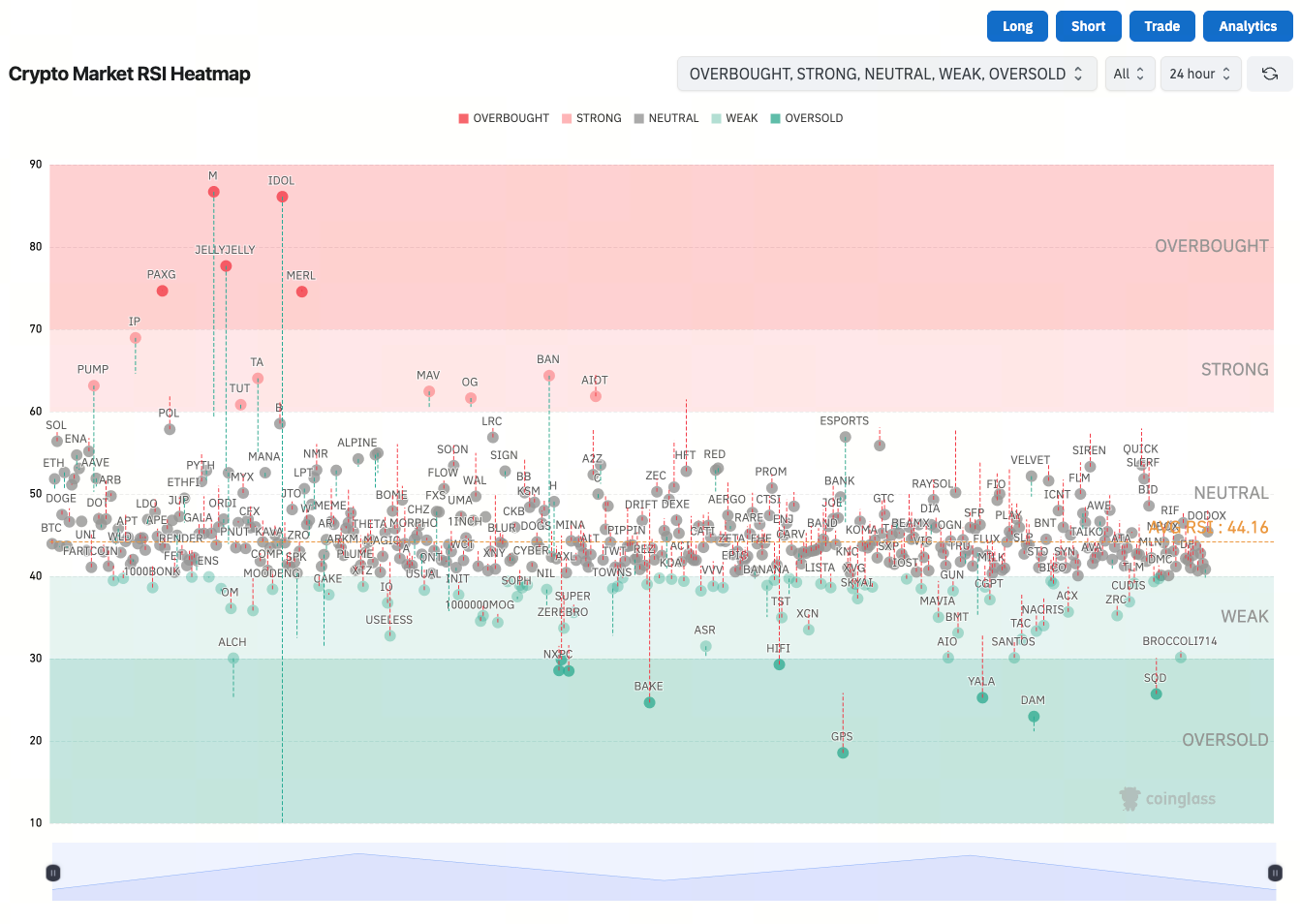

The RSI Heatmap provides a visual display of the Relative Strength Index (RSI) values across multiple assets, presenting this information in a heatmap format.

- When the RSI is high (for example, above 70), the heatmap typically uses red or orange to indicate a potential overbought condition.

- When the RSI is low (for example, below 30), blue or green is used to signal that the market may be experiencing heavy selling pressure.

This visualization enables investors to instantly identify which cryptocurrencies are overheating or possibly undervalued—eliminating the need to check individual technical indicators for each asset.

How the RSI Heatmap Works

The RSI formula is: RSI = 100 - (100 / (1 + RS))

Where RS stands for Average Gain divided by Average Loss. The standard calculation period is 14 days, though this can be adjusted based on specific needs. On the heatmap, RSI values are mapped to different colors, enabling investors to quickly spot trends. For example:

- RSI above 70 → Indicates that the market may be overheated and approaching a potential overbought zone.

- RSI below 30 → Indicates that the market may be oversold and entering a potential buying opportunity.

Crypto Market RSI Heatmap: Use Cases

In the cryptocurrency space, the RSI Heatmap is especially valuable due to the sector’s high volatility, 24/7 trading activity, and wide range of investment options. For example, a Crypto Market RSI Heatmap can simultaneously reveal:

- Whether Bitcoin (BTC) is nearing overbought territory, alerting investors to the potential for a price correction.

- Whether Ethereum (ETH) has dropped to oversold levels, presenting long-term entry opportunities.

- The aggregate sentiment in altcoins—showing whether the market is caught in a speculative buying spree or a panic-driven sell-off.

(Source: coinglass)

With this broad, real-time perspective, investors can manage portfolios more efficiently and reduce emotion-driven decisions.

Key Advantages of the RSI Heatmap

- Highly intuitive: Colors are easier to interpret than raw numbers, making the heatmap ideal for short-term traders.

- Broad coverage: Enables simultaneous tracking of dozens of coins to gauge overall market sentiment.

- Sentiment signals: Helps determine if the market is in a panic or greed phase.

- Strategic support: Combines well with other technical indicators (e.g., MACD, Bollinger Bands) for sharper decision-making.

Limitations and Risks of the RSI Heatmap

While the RSI Heatmap offers a user-friendly overview, investors should remain aware of its limitations:

- Signals may be too simplistic: Colors are visually clear but do not capture every technical nuance.

- Potential for misleading signals: Solely relying on RSI can lead to oversight of fundamental or news-driven factors.

- Sensitive to short-term volatility: Crypto markets are often influenced by sudden events, which can instantly distort RSI readings.

As a result, the RSI Heatmap should be used as a supplementary tool—not as the sole basis for investment decisions.

For more in-depth Web3 content, click to register: https://www.gate.com/

Summary

The RSI Heatmap is a powerful market sentiment analysis tool, particularly well-suited for volatile environments like cryptocurrency. By leveraging its intuitive color-coding, investors can rapidly gauge whether assets are overheated or oversold, supporting more rational investment decisions. However, the RSI Heatmap is not a standalone solution—it works best as part of a holistic strategy that includes fundamental analysis, macroeconomic trends, and additional technical indicators. As the digital asset market continues to mature into 2025, tools like the Crypto Market RSI Heatmap will be indispensable for investors, providing reliable guidance in a rapidly changing landscape.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution