GUSD: Transforming Stablecoins into Yield-Bearing Digital Assets

From Static Value Storage to Dynamic Yield

In the early days of blockchain, stablecoins served a straightforward purpose: they functioned as on-chain dollar equivalents, providing hedging and payment capabilities. As demand for capital efficiency and yield has increased, GUSD has redefined the stablecoin mandate—not only maintaining price stability but also delivering growth.

GUSD is designed so that holding tokens isn’t just passive storage; instead, it transforms into an on-chain, yield-bearing asset that generates cash flow. Holding GUSD is like owning a digital note that continuously accrues interest.

Yield Mechanism Backed by Real-World Assets (RWA)

GUSD’s yield is derived from some of the safest instruments in traditional finance, such as U.S. Treasury bills and other high-grade notes. These Real World Assets (RWA) offer stable, predictable interest returns, allowing GUSD to maintain its dollar peg while continually generating yield. Unlike legacy stablecoins backed solely by cash or bank reserves, GUSD brings traditional finance’s interest mechanisms on-chain, giving users price stability alongside a bond-like yield experience.

Flexible Access Options

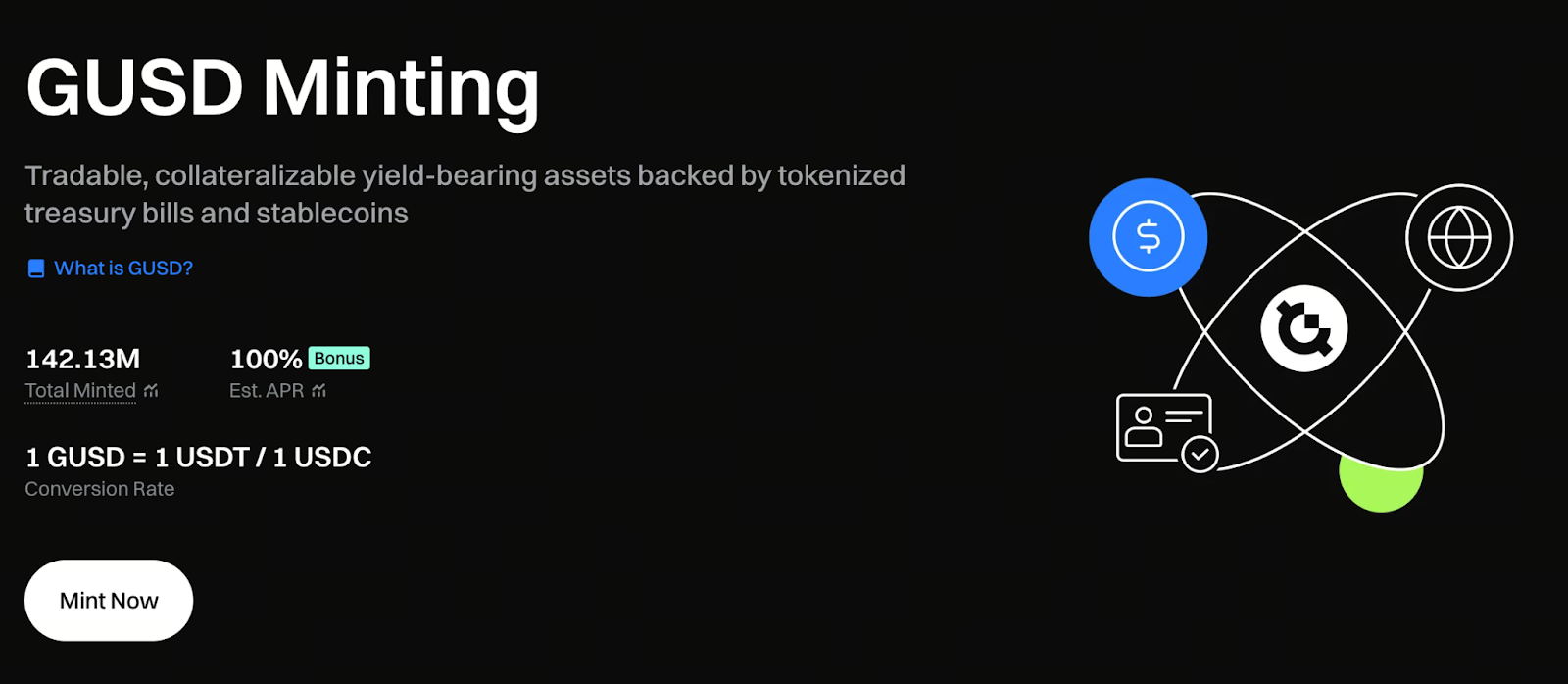

GUSD provides two main entry routes to accommodate diverse user needs:

- Exchange Swap: Instantly purchase GUSD with USDT or other stablecoins on the market. The process is straightforward and funds are settled immediately, ideal for short-term capital allocation.

- On-Chain Minting: If you already hold USDT or USDC, you can mint GUSD at a 1:1 ratio via smart contract, allocating capital directly into yield-generating RWA. This suits investors seeking long-term returns.

This dual-channel design delivers both flexibility and efficiency, empowering users to select the best fit for their investment horizon and liquidity requirements.

Start minting GUSD now and earn daily annualized yield: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

Yield Model

GUSD uses a cumulative interest accrual and maturity settlement framework. For example, if a user mints GUSD with 100 USDT and the underlying assets yield 20% annualized, the user can redeem about 120 USDC at maturity.

This mechanism mirrors the bond coupon model, allowing assets to appreciate with time and simplifying daily distributions. For users familiar with DeFi’s periodic returns, GUSD offers a more traditional finance-style, stable return experience.

Expanding Ecosystem Integration

To drive adoption, GUSD is integrating into the broader Web3 ecosystem. Across various platforms, holders can not only access stable yield but also participate in a range of value-added activities:

- Staking Rewards: Lock your tokens to earn additional yield.

- Limited-Time Airdrops and Events: Incentivize early adopters and increase community engagement.

- Multi-Scenario Application Integration: Lending, wealth management, Launchpool, margin trading, and more—GUSD functions as both a payment and investment vehicle.

These features make GUSD more than just a stablecoin; it’s a financial tool with broad, multi-scenario utility.

Three Major Advantages of GUSD

- Value Appreciation Over Time: Long-term holders can continuously accumulate yield, ideal for medium- and long-term asset allocation strategies.

- Diverse Liquidity Channels: Supports both minting and exchange for flexible, ample liquidity on entry and exit.

- Rich Use Cases: Can serve as trading margin, staking collateral, or a wealth management tool, enhancing capital efficiency.

Maintaining transparent, publicly available reserve and audit information will further strengthen GUSD’s market trust in the future.

Liquidity and Redemption Guidance

A core feature of GUSD’s design is seamless fund movement. Users can typically convert GUSD to USDC or USDT with minimal friction, though cross-chain or cross-platform transactions may involve small fees and delays. Always confirm current market liquidity and exchange rates before redeeming or converting.

Risk Disclosure

This material is for general information only and does not constitute investment advice or a solicitation. Before participating in GUSD or other yield-bearing stablecoins, users should thoroughly understand the product’s nature and risks and consult a professional financial advisor. Certain jurisdictions may restrict usage; please comply with platform policies.

User Agreement: https://www.gate.com/legal/user-agreement

Conclusion

By integrating RWA yield mechanisms with on-chain transparent settlement, GUSD bridges traditional finance and decentralized assets. As Web3 financial infrastructure evolves, yield-generating stablecoins like GUSD are setting the new standard for on-chain asset allocation. For users seeking stability, predictability, and growth, GUSD is pioneering a new era in crypto wealth management.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article