Ethereum Price Analysis in USD: Current Market Trends and Investment Outlook

ETH: The Core of the Crypto Market

In the cryptocurrency world, Ethereum (ETH) is not just the second-largest crypto asset after Bitcoin—it’s the foundation of the entire Web3 ecosystem. Ethereum powers DeFi, NFTs, Layer 2 solutions, and countless decentralized applications.

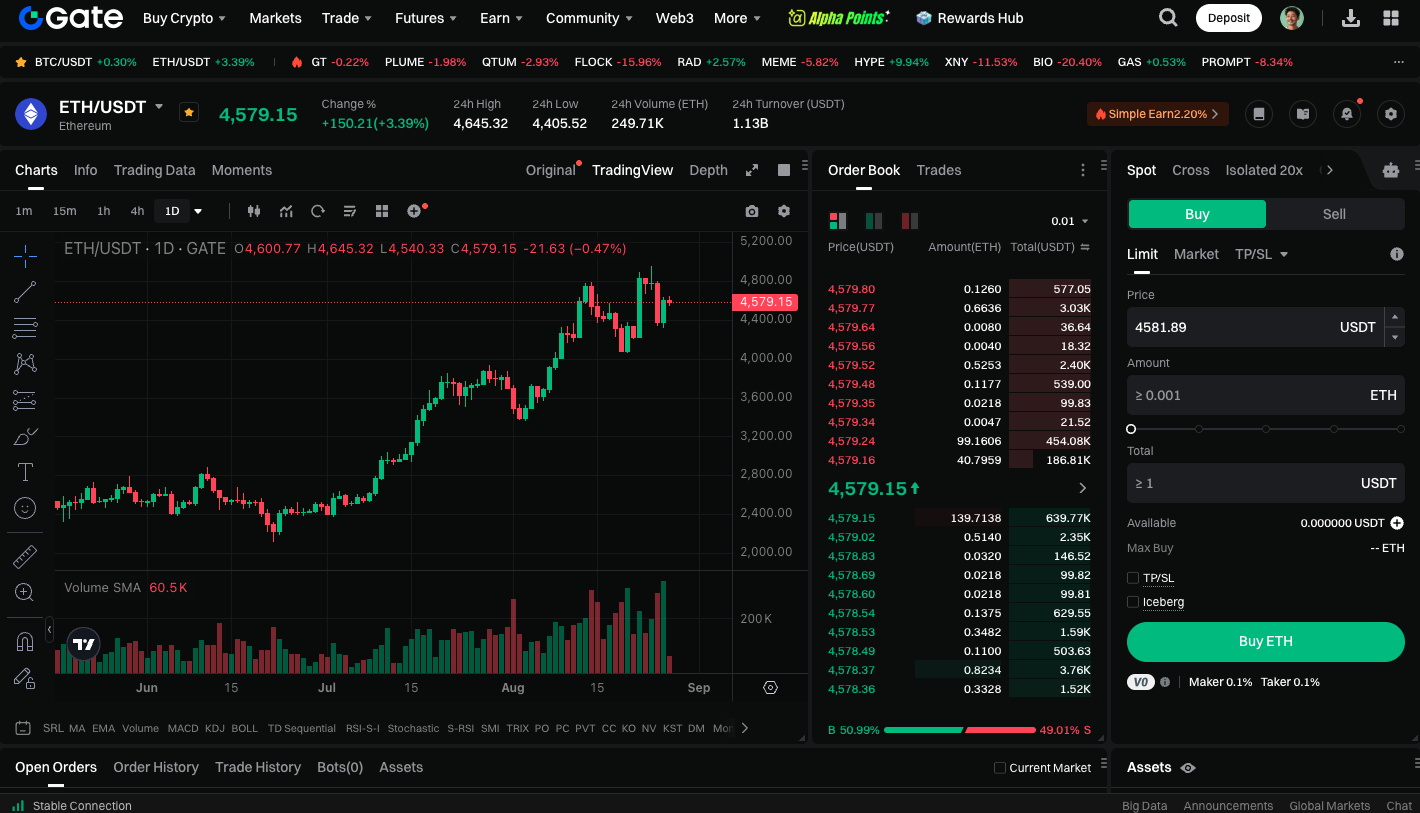

As of this writing, 1 ETH ≈ $4,568. This price both reflects current market sentiment and indicates potential future trends.

Latest ETH Price in USD

Current ETH pricing:

1 ETH ≈ $4,568

ETH’s market cap consistently ranks second among cryptocurrencies, behind only Bitcoin.

Daily trading volume is stable and consistently exceeds several billion dollars.

What does this price mean for market participants?

Investors should pay close attention to ETH’s high volatility, as sharp price swings are possible in the short term.

For DeFi users, ETH’s price fluctuations directly affect borrowing costs and liquidity mining returns, as ETH is used as collateral.

In the NFT space, ETH is the main medium for art and digital asset transactions—price movement is fundamental to the market.

Key Drivers of ETH Price

Macroeconomic Environment

The Federal Reserve’s interest rate policy and the U.S. Dollar Index (DXY) have a direct impact on ETH’s dollar price. When the dollar weakens, risk assets—including crypto—tend to attract more capital.Ethereum Network Upgrades

With The Merge transitioning ETH to Proof of Stake (PoS), inflation has decreased. The long-term supply of ETH is becoming scarcer. The EIP-1559 burn mechanism continues to support the “ultrasound money” narrative for ETH.DeFi and NFT Ecosystem

ETH is the backbone of DeFi, serving as collateral for lending, powering DEX liquidity pools, and derivatives markets. Demand for ETH directly drives its price upward, and another NFT bull run would further boost ETH demand.Competing chains & Layer 2

Competing blockchains like Solana and Avalanche, and Layer 2 solutions such as Arbitrum and Optimism, create both competition and synergy for Ethereum. If the Layer 2 ecosystem expands rapidly, it could actually raise the value of ETH, both as gas and as collateral.Institutional and ETF Momentum

With U.S. regulators gradually opening to the idea, an ETH ETF is becoming more plausible. Institutional capital inflows could trigger a fresh wave of investment and potentially send ETH to new all-time highs.

Strategic Perspectives

Short-Term Trading

Given ongoing volatility, investors should consider a dollar-cost averaging approach rather than going all-in at a single price point.Long-Term Holding

ETH’s value is tightly bound to the Ethereum network and is powered not just by speculation, but by real application demand. Long-term investors can treat ETH as a key fuel for the decentralized digital economy.Risk Disclaimer

- Regulatory policy: National regulations on cryptocurrencies remain a key factor.

- Technical risk: Smart contract bugs or Layer 2 security incidents could trigger short-term shocks to ETH.

- Market sentiment: Major whale sell-offs or on-chain liquidity shifts can trigger significant volatility.

Outlook

- Mid-term (2025-2027)

- If capital inflows rise significantly, ETH could break the $5,000 mark.

- Mass adoption of Layer 2 may drive even higher transaction volumes and burn rates for ETH gas fees.

- Long-term (around 2030)

- Some analysts predict that, if the Ethereum ecosystem continues to expand, ETH could surpass $10,000.

- VanEck has noted that ETH, as the central asset for decentralized finance and the networked economy, could potentially see its total market cap surpass a portion of gold’s market cap.

Start trading ETH on the spot market now: https://www.gate.com/trade/ETH_USDT

Summary

At the time of writing, 1 ETH is approximately $4,568. This number is more than just a ticker—it’s a snapshot of global digital economic and decentralized network development. ETH’s price impacts the decisions of long-term investors, DeFi users, and NFT collectors alike. As the Ethereum ecosystem continues to evolve, ETH is more than just a digital asset—it’s the key fuel powering the future networked economy.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution