Bitcoin Price Prediction: BTC Holds Strong at $100K, Consolidation Could Spark Next Rally

BTC Market Enters a New Phase

Market analysts note that Bitcoin’s price has started to decouple from its previous correlation with the M2 money supply. Since the Federal Reserve is not expected to inject new liquidity until next year, this decoupling may persist for some time. In the near term, BTC price fluctuations will be driven more by market structure and investor sentiment than by macro monetary policy.

BTC Price Stability Range

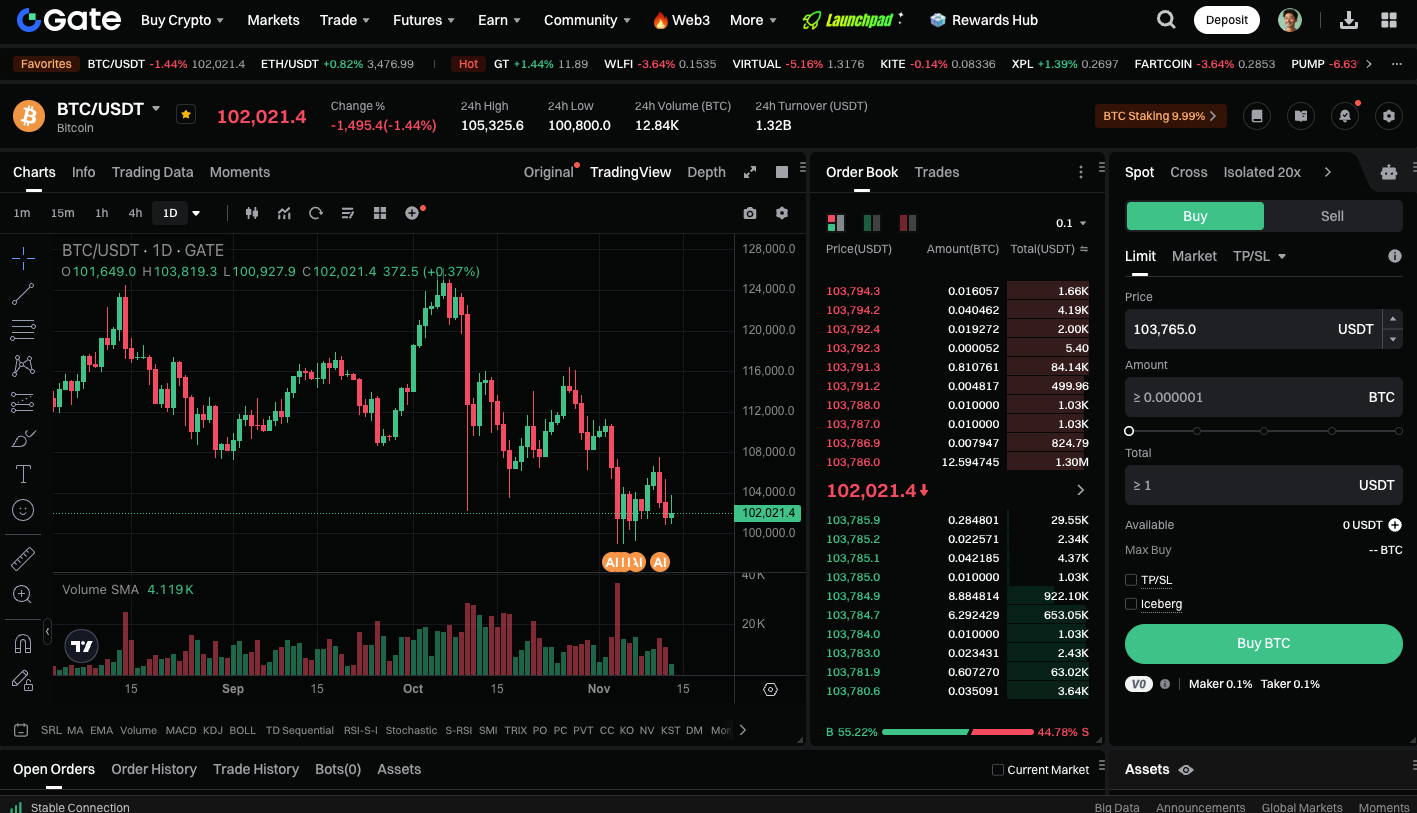

As of press time, Bitcoin is trading in a broad range between $90,000 and $120,000, with $100,000 forming a crucial support zone that has repeatedly attracted buyers. On the weekly chart, BTC approaches long-term support levels, including the 55-week moving average and RSI regions, which have supported the price multiple times. These technical signals show that while the market remains calm, the support level remains robust.

Technical Analysis

Currently, BTC’s technical structure is best described as overextended but stable. The weekly RSI sits in its support zone, indicating the price correction could be ending. The Stochastic RSI is nearing its bottom, which has often preceded reversals in previous cycles. These signals together indicate that the market is building a base, potentially benefiting patient investors.

Key Price Levels to Watch

In the short term, Bitcoin is consolidating between $103,000 and $112,000:

- A breakout above $112,000 could trigger a short-term rally;

- A breakdown below $103,000 may lead to a test of the next support at $99,000.

Although volatility has been low recently, sideways movement often precedes significant price action. As long as BTC stays above $100,000, market confidence remains strong at this level.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Although this period of consolidation may seem uneventful, it likely represents a phase of market accumulation. A decisive breakout in either direction will set the stage for Bitcoin’s next trend. If momentum builds, a push above $120,000 is well within reach; if support fails, the market could retest the $90,000–$99,000 range. During this quiet phase, Bitcoin remaining above $100K is not just a psychological milestone; it may also signal the beginning of the next major move.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data