Bitcoin Price Prediction: BTC Could Rise 25% Toward $150K if $120K Support Holds Strong

$120,000 Establishes Key Bullish Support

Analyst Skew reports that following Bitcoin’s rebound from $120,000, spot markets have seen a notable pickup in buying activity. The cumulative volume delta (CVD) on leading exchanges turned positive at this price, signaling renewed capital inflows. Additionally, buy orders for perpetual contracts have clustered within this range as open interest has edged lower, indicating short positions are closing and the market is moving into a brief rebalancing phase.

Key Indicators Point to Q4 Upside Potential

Despite ongoing short-term volatility, most analysts remain bullish on Q4 prospects. Market strategist Timo Oinonen highlights MVRV (Market Value to Realized Value ratio) as the primary indicator to monitor right now.

With MVRV at its current level, Bitcoin is still trading within a fair value range. If the structure remains intact, the price could climb 15% to 25% by year-end, targeting $140,000 to $150,000. In a stronger scenario—should the MVRV index break above 4.0, reviving the bullish momentum seen in 2021—BTC might even test the $170,000 to $200,000 range, potentially triggering another wave of market exuberance.

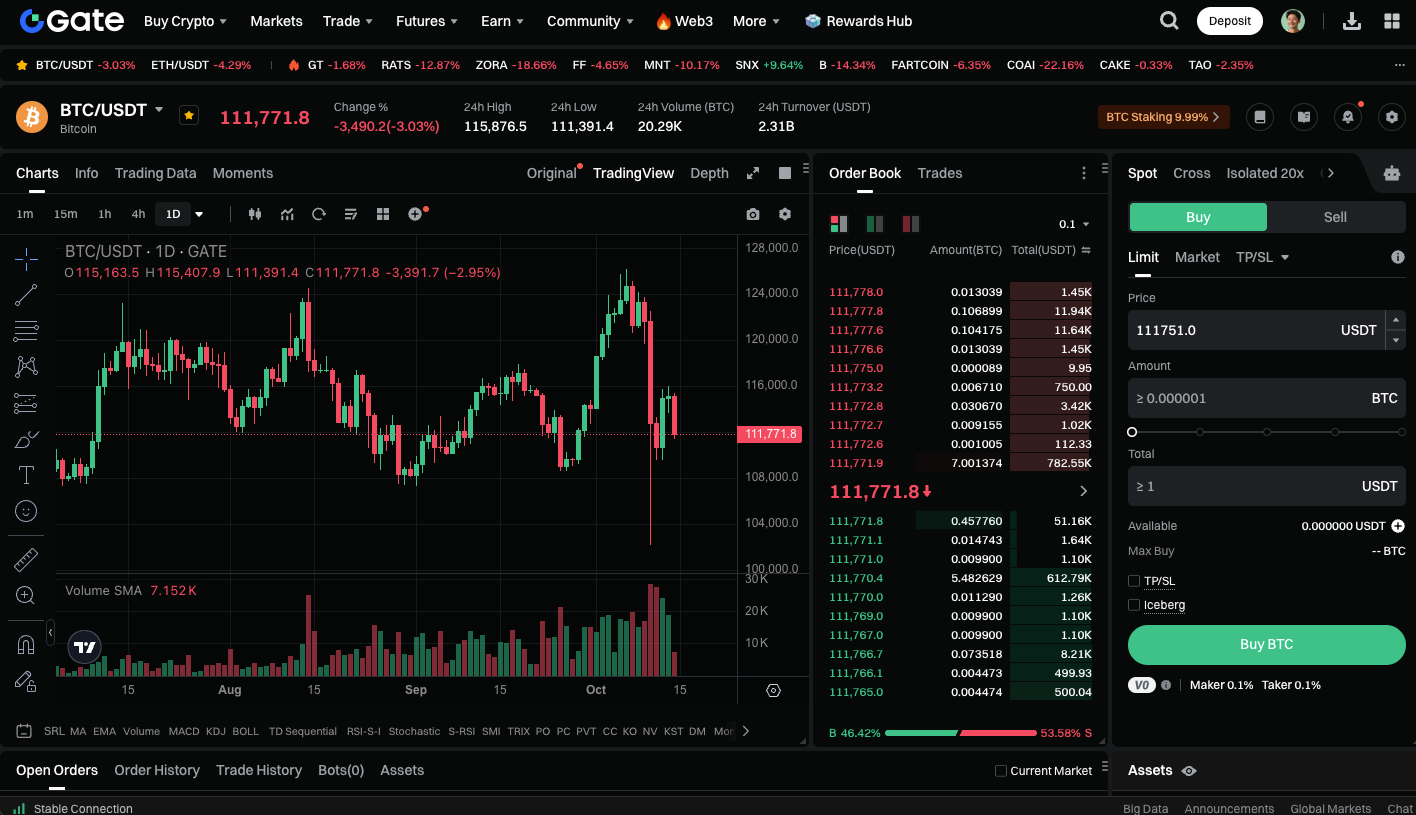

Start trading BTC spot instantly: https://www.gate.com/trade/BTC_USDT

Summary

Although the current consolidation phase appears subdued, it reflects the market’s ongoing leverage reset and token redistribution. If $120,000 holds as support and institutional plus long-term capital continues to accumulate, Bitcoin could stage another rally in Q4 and push toward the $150,000 target high.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article