STETH nedir: Likit Staking Türev Tokeni ve Ethereum Ekosistemindeki Yeri

Lido Staked Ether’ın Konumu ve Önemi

2020’de Lido Finance, Lido Staked Ether’ı (STETH) ETH 2.0 staking’inde yaşanan likidite ve hareket kısıtlılığı sorunlarına çözüm sağlamak için tanıttı.

Öncü bir likit staking çözümü olan Lido Staked Ether, DeFi ve Ethereum staking ekosistemlerinde temel bir rol oynamaktadır.

2025 itibarıyla Lido Staked Ether, piyasa değeriyle 9. en büyük kripto para konumunda olup, 542.506 sahibi ve dinamik bir geliştirici topluluğuna sahiptir. Bu yazıda STETH’in teknik mimarisini, piyasa performansını ve gelecek potansiyelini inceleyeceğiz.

Köken ve Gelişim Süreci

Arka Plan

Lido Staked Ether, 2020 yılında Lido Finance tarafından ETH 2.0 staking likidite sorununun çözümü için hayata geçirildi. Bu çözüm, Ethereum 2.0’a geçiş ve DeFi patlaması sırasında geliştirildi ve kullanıcıların varlıklarını kilitlemeden veya teknik altyapı gereksinimi olmadan ETH stake etmelerine olanak tanıdı. Lido Staked Ether, Ethereum sahipleri ve DeFi kullanıcıları için yeni fırsatlar sundu.

Önemli Dönüm Noktaları

- 2020: Ethereum ana ağında başlatılarak ETH 2.0 için likit staking sağladı.

- 2021: Birden fazla Ethereum doğrulayıcı desteği getiren büyük bir yükseltme gerçekleşti.

- 2022: Çeşitli DeFi protokollerinde benimsenerek fiyatı 4.000 $’ın üzerine taşıdı.

- 2023: Ekosistem büyüdü ve çok sayıda DeFi uygulamasına stETH entegrasyonu eklendi.

Lido DAO ve topluluk desteğiyle Lido Staked Ether, teknolojisini, güvenliğini ve gerçek dünyadaki kullanım alanlarını sürekli olarak geliştiriyor.

Lido Staked Ether Nasıl Çalışır?

Merkeziyetsiz Kontrol

Lido Staked Ether, merkeziyetsiz Ethereum doğrulayıcıları ağı üzerinde çalışır, merkezi bir otoriteye tabi değildir. Bu doğrulayıcılar, staking ödüllerinin işlenmesi ve sistemin şeffaflığı ile güvenliğini sağlamak için birlikte çalışır; böylece kullanıcıya daha fazla özerklik ve ağın dayanıklılığını sunar.

Blokzincir Temeli

Lido Staked Ether, Ethereum blokzincirini herkese açık, değiştirilemez bir dijital defter olarak kullanır ve tüm staking/unstaking işlemlerini kayda alır. İşlemler bloklarda gruplanır ve kriptografik hash’lerle birbirine bağlanarak güvenli bir zincir oluşturulur. Kayıtlar şeffaftır ve aracısız güven sağlar. Beacon Chain ve yaklaşan Ethereum yükseltmeleri performansı artırır.

Adil İşleyişin Sağlanması

Lido Staked Ether, Ethereum’un Proof-of-Stake (PoS) konsensüsünü kullanarak işlemleri doğrular ve sahtecilik risklerini engeller. Doğrulayıcılar ETH stake edip node çalıştırarak ağı güvence altına alır, karşılığında stETH ödülü kazanır. Bu yapı, kilitlenmeden likit staking ve yüksek sermaye verimliliği sağlar.

Güvenli İşlemler

Lido Staked Ether, Ethereum’un açık–özel anahtar şifreleme altyapısı ile işlemleri korur:

- Özel anahtarlar (kişisel şifre gibi) işlemleri imzalar

- Açık anahtarlar (hesap numarası gibi) sahipliği doğrular

Bu sistem fonları güvende tutar ve işlemler takma adlı olarak gerçekleşir. Ek güvenlik için akıllı sözleşme denetimleri ve çoklu imzalı yönetişim uygulanır.

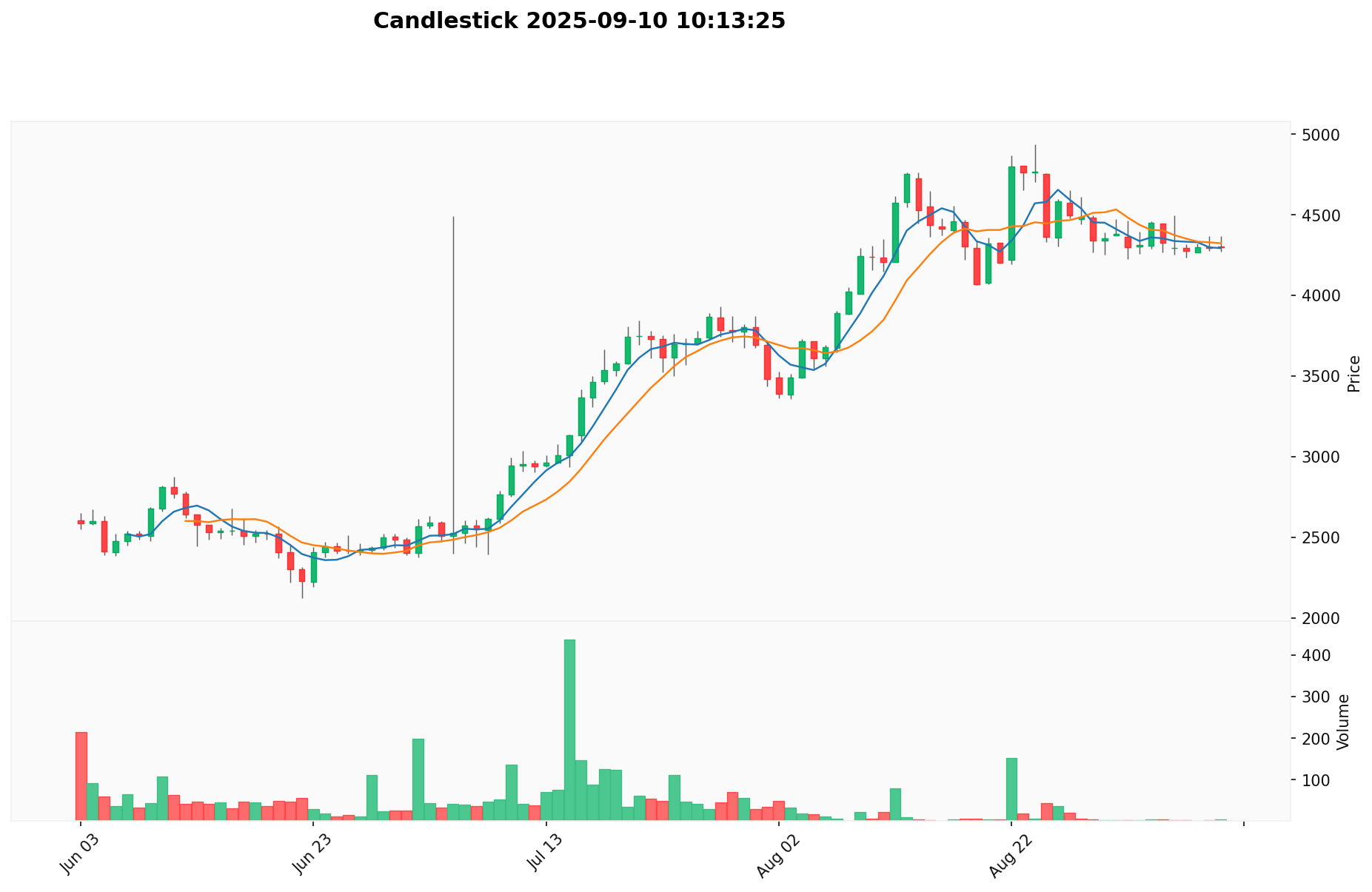

STETH Piyasa Performansı

Dolaşım Genel Durumu

10 Eylül 2025 itibarıyla STETH’in dolaşımdaki miktarı 8.674.699,885624625, toplam arzı ise 8.674.943,754594563 token’dır.

Yeni token’lar Ethereum ağı üzerinde staking ile piyasaya sürülür ve bu da arz-talep dengesini etkiler.

Fiyat Dalgalanmaları

STETH, 25 Ağustos 2025’te 4.932,89 $ ile rekor seviyeye ulaştı; bu yükselişte kripto piyasasındaki genel boğa trendi ve Ethereum staking’i kurumlarca benimsenmesi ana etkenler oldu.

En düşük fiyatı ise 22 Aralık 2020’de 482,9 $ olarak kaydedildi; bunda projenin erken aşamaları ve piyasa bilinirliğinin düşük olması etkiliydi.

Bu dalgalanmalar piyasa duyarlılığını, benimsenme eğilimlerini ve dışsal faktörleri yansıtmaktadır.

Güncel STETH piyasa fiyatını görüntüleyin

Zincir Üstü Göstergeler

- Günlük İşlem Hacmi: 20.046,33588 STETH (işlem hacmi)

- Aktif Adresler: 542.506 (aktif adres sayısı)

STETH Ekosistemi: Uygulamalar ve İş Birlikleri

Temel Kullanımlar

STETH ekosistemi farklı uygulamalara imkan tanır:

- DeFi: Lido Finance, likit staking çözümleri sağlar.

- Yield Farming: Birçok DeFi protokolünde maksimum getiri elde edilmesini sağlar.

Stratejik Ortaklıklar

STETH, Ethereum ekosistemindeki projelerle iş birlikleri yaparak teknik gücünü ve piyasadaki etkisini artırmıştır. Bu iş birlikleri, STETH’in ekosistem büyümesi için sağlam bir temel oluşturur.

Tartışmalar ve Zorluklar

STETH’in karşı karşıya kaldığı bazı başlıca sorunlar şunlardır:

- Teknik Sorunlar: Havuzlarda merkezileşme riski

- Düzenleyici Riskler: Likit staking türevlerinin belirsiz yasal konumu

- Rekabet Baskısı: Yeni likit staking çözümlerinin ortaya çıkması

Bu başlıklar, toplulukta ve piyasada tartışmalara yol açmakta ve STETH’in sürekli inovasyona yönelmesini sağlamaktadır.

STETH Topluluğu ve Sosyal Medya Ortamı

Topluluk Coşkusu

STETH’in topluluğu canlıdır, 540.000’in üzerinde sahibi bulunur.

X (eski Twitter) platformunda ilgili gönderiler ve #STETH gibi hashtag’ler sıkça gündem olur; aylık paylaşım hacmi yüksek seviyelere ulaşır.

Fiyat hareketleri ve Ethereum ağındaki güncellemeler topluluk ilgisini artırmaktadır.

Sosyal Medya Duygusu

X (eski Twitter) platformundaki yorumlar iki kutba ayrılır:

- Destekçiler, STETH’in likidite avantajlarını ve getiri potansiyelini övüp onu "anahtar bir DeFi varlığı" olarak görür.

- Eleştirmenler, merkezileşme riski ve Ethereum’un güvenliğine muhtemel etkiler üzerinde durur.

Son dönemde, Ethereum’un tamamen PoS’a geçişiyle genel olarak olumlu bir piyasa havası gözlemlenmektedir.

Gündemdeki Konular

X (eski Twitter) kullanıcıları, STETH’in Ethereum staking ekosistemindeki rolü, regülasyon belirsizlikleri ve getiri yöntemleri hakkında yoğun şekilde tartışmaktadır. Bu tartışmalar hem STETH’in dönüştürücü potansiyelini hem de ana akım benimsemede yaşanan zorlukları göstermektedir.

STETH Hakkında Daha Fazla Bilgi

- Resmi Web Sitesi: Lido Finance'in resmi web sitesi üzerinden özellikleri, kullanım alanlarını ve güncellemeleri inceleyebilirsiniz.

- Whitepaper: STETH’in teknik ayrıntılarına Lido’nun dokümantasyonundan ulaşabilirsiniz.

- X Güncellemeleri: X (eski Twitter) üzerinde STETH güncellemeleri @LidoFinance hesabından paylaşılır; Eylül 2025’te takipçi sayısı 100.000’i aşmıştır. Protokol güncellemeleri, topluluk etkinlikleri ve ortaklık haberleriyle ilgili içerikler yoğun ilgi görmektedir.

STETH’in Gelecek Yol Haritası

- 2026: Protokol güvenliğini ve dayanıklılığını artırmak için daha fazla merkeziyetsizleşme adımı atmak

- Ekosistem Hedefleri: Önde gelen DeFi protokolleriyle entegrasyon ve zincirler arası yeteneklerin genişletilmesi

- Uzun Vadeli Vizyon: Ethereum ve ötesi için lider likit staking çözümü olmak

STETH’e Nasıl Katılırım?

- Satın Alma Kanalları: STETH’i Gate.com üzerinden satın alabilirsiniz

- Depolama Yöntemleri: Güvenli saklama için Web3 cüzdanları tercih edin

- Yönetişime Katılım: Lido’nun yönetişim forumu ve Snapshot üzerinde yapılan oylamalar ile sürece katılın

- Ekosisteme Katkı: Lido’nun geliştirici dokümantasyonunu inceleyerek STETH’i entegre edebilir veya protokole katkı sunabilirsiniz

Özet

STETH, likidite, getiri fırsatları ve ağ güvenliğine kolay katılım ile Ethereum staking’e yeni bir boyut katmaktadır. Aktif topluluğu, kapsamlı kaynakları ve güçlü piyasadaki yeriyle kripto dünyasında ön plana çıkıyor. Düzenleyici belirsizlikler ve merkezileşme endişelerine rağmen, STETH’in yenilikçi yaklaşımı ve net yol haritası, onu merkeziyetsiz finansın geleceğinde önemli bir konuma taşımaktadır. STETH, hem yeni hem de deneyimli kullanıcılar tarafından yakından takip edilmektedir.

Sıkça Sorulan Sorular

stETH ne işe yarar?

stETH; Ethereum’da staking ödülleri kazanmak, DeFi protokollerinde likidite sağlamak ve kredi teminatı olarak kullanılmak için tercih edilir; tüm bunlar ETH fiyat hareketlerine maruz kalmayı sürdürerek yapılır.

stETH nasıl çalışır?

stETH, Lido’da stake edilen Ether’i temsil eder ve her bir token, 1:1 oranında stake edilmiş ETH ile desteklenir. Klasik staking’den farklı olarak likit kalır; kullanıcı takas yapabilir veya DeFi’de kullanarak staking ödülü kazanabilir.

stETH, neden ETH’den daha düşük fiyatlanıyor?

stETH, piyasa koşulları ve likidite farkları nedeniyle ETH’den daha düşük işlem görebilir. Stake edilen ETH’yi temsil etse de, arz değişiklikleri ve piyasa risk algısı nedeniyle indirimli fiyatlanabilir.

Lido stETH nedir?

Lido stETH, Ethereum’u güvence altına almak için Lido üzerinden stake edilen ETH’yi temsil eden bir tokendır. 1:1 oranında ETH ile takas edilebilir; fakat likidite ve risk faktörleri sebebiyle bazen indirimli fiyatlanabilir. ETH stake edildiğinde karşılığında stETH alınır.

2025 STETH Fiyat Tahmini: Potansiyel Büyüme ve Gelecekteki Değerini Belirleyen Piyasa Dinamikleri

2025'te ETH Staking: Zincir Üstü Seçenekler ve En İyi Platformlar

Staking Nedir: Kripto Varlıklarda Pasif Gelir için Başlangıç Rehberi

ETH Staking: Yıllık Yüzde Oranı %6'yı aşıyor, IKA ödülleri artıyor

ETH'nizi maksimize edin: Gate'in on-chain Staking'i 2025'te %5.82 yıllık getirisi sunuyor.

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması