USDC ve APT: Kripto Piyasasında Stablecoin Üstünlüğü Savaşı

Giriş: USDC ve APT Yatırımı Karşılaştırması

Kripto para piyasasında USDC ve APT karşılaştırması, yatırımcılar için kaçınılmaz bir gündemdir. Bu iki kripto varlık; piyasa değeri sıralaması, kullanım alanları ve fiyat performansı açısından belirgin şekilde ayrışırken, aynı zamanda farklı kripto varlık türlerini temsil etmektedir.

USDC (USDC): 2018’de piyasaya sürülmesinden beri, ABD doları endeksli ve tamamen teminatlandırılmış stabilcoin kimliğiyle piyasanın güvenini kazanmıştır.

APT (APT): 2022’de piyasaya sürülen bu varlık, güvenlik ve ölçeklenebilirliğe odaklı yüksek performanslı Layer 1 blokzinciri olarak tanınmaktadır.

Bu makalede, USDC ve APT’nin yatırım değerleri; tarihsel fiyat hareketleri, arz mekanizmaları, kurumsal benimseme, teknik ekosistemler ve gelecek öngörüleri çerçevesinde kapsamlı şekilde analiz edilerek yatırımcıların en çok merak ettiği şu soruya yanıt aranacaktır:

"Şu anda hangisi daha iyi bir yatırım fırsatı?" Aşağıda, verilen şablon ve veriler temelinde analiz sunulmuştur:

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

USDC ve APT Tarihsel Fiyat Hareketleri

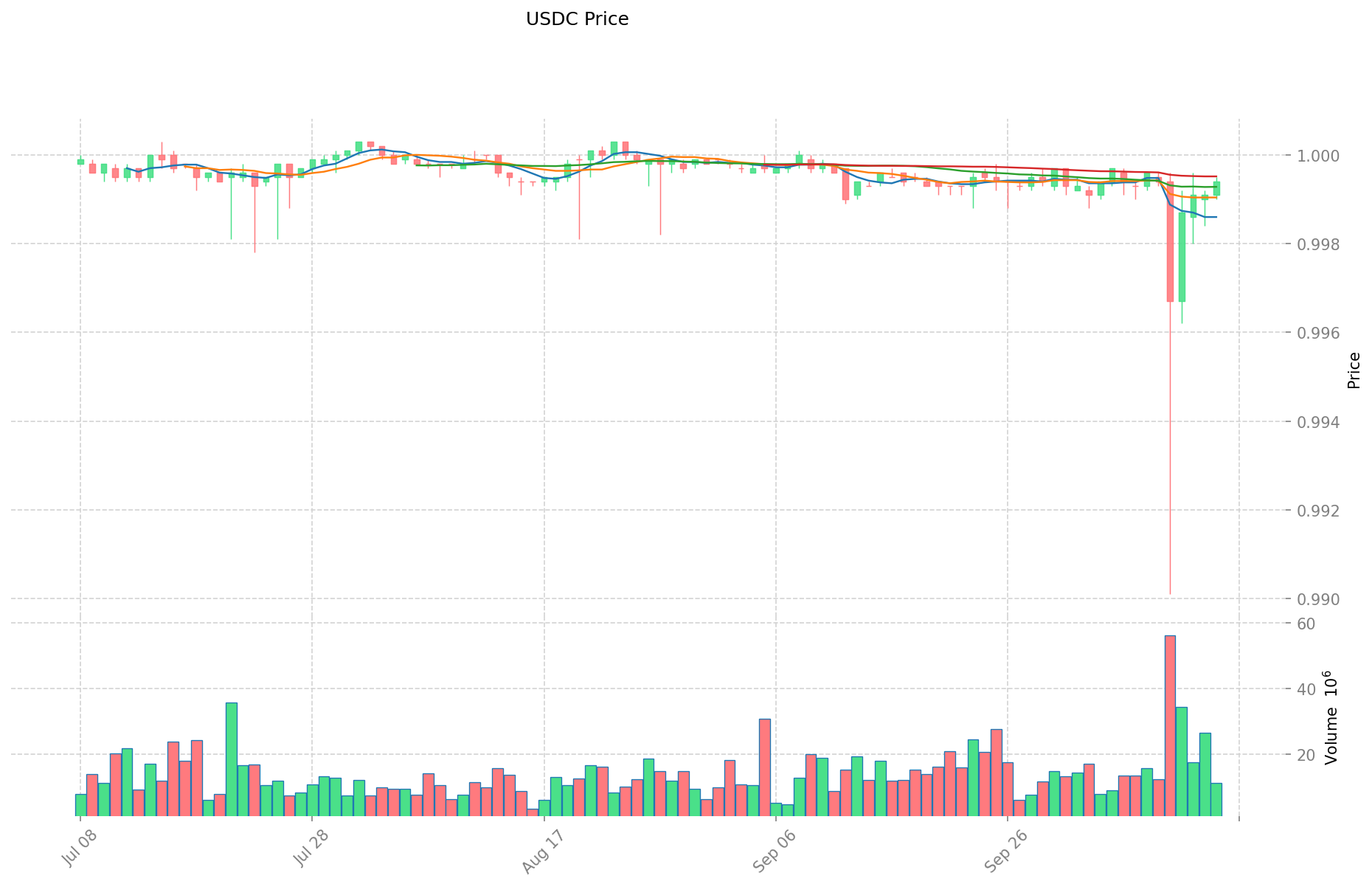

- 2023: USDC, bankacılık krizi nedeniyle dalgalanma yaşadı ve kısa süreyle $0,90’ın altına inse de ardından toparlandı.

- 2023: APT, Ocak ayında ekosistem büyümesi ve yaygınlaşan kullanım ile $19,92’lik tüm zamanların en yüksek seviyesine ulaştı.

- Karşılaştırmalı analiz: 2022-2023 kripto ayı piyasasında USDC, ufak dalgalanmalar dışında $1 sabitini korurken; APT ise zirveden $3-4 bandına geriledi.

Güncel Piyasa Durumu (15 Ekim 2025)

- USDC güncel fiyatı: $1,00

- APT güncel fiyatı: $3,643

- 24 saatlik işlem hacmi: USDC $10.369.955 | APT $2.610.481

- Piyasa Duyarlılığı Endeksi (Korku & Hırs Endeksi): 34 (Korku)

Gerçek zamanlı fiyatları görmek için tıklayın:

- USDC güncel fiyatı için Piyasa Fiyatı

- APT güncel fiyatı için Piyasa Fiyatı

II. USDC ve APT Yatırım Değerini Belirleyen Ana Faktörler

Arz Mekanizmaları Karşılaştırması (Tokenomik)

- USDC: Nakit ve ABD Hazine tahvillerinde 1:1 USD rezerviyle tamamen teminatlandırılmış stabilcoin olup, sabit $1 değerini korur

- APT: İlk arzı 1 milyar token’dır; staking ödülleri nedeniyle Ethereum’daki gibi maksimum arz sınırı yoktur

- 📌 Geçmiş desen: USDC’nin istikrarlı arz modeli fiyatı sabit tutarken; APT’nin enflasyonist yapısı, değerini sürdürebilmek için güçlü ekosistem büyümesine ihtiyaç duyar.

Kurumsal Benimseme ve Piyasa Kullanımı

- Kurumsal varlık: USDC, Coinbase, Visa ve Stripe gibi kurumlarca yaygın biçimde kullanılmakta; APT ise $350 milyonluk girişim sermayesi yatırımı çekmiştir

- Kurumsal uygulama: USDC, 23 blokzincirde sınır ötesi ödeme ve mutabakat sistemlerinde önde; APT ise yeni nesil merkeziyetsiz uygulamalar için altyapı konumunda

- Düzenleyici konum: USDC, MiCA ve GENIUS uyumlu; APT ise farklı ülkelerde değişen regülasyonlarla karşı karşıya

Teknoloji Gelişimi ve Ekosistem Oluşumu

- USDC teknolojisi: Circle’ın CCTP protokolü, zincirler arası likiditeyi kolaylaştırır; Solana ve Base üzerinde güçlü varlığa sahip

- APT teknolojisi: Yenilikçi Move diliyle geliştirilmiş olup teoride milyonlarca TPS’ye ulaşabilir ve düşük maliyetle yüksek performans sunar

- Ekosistem karşılaştırması: USDC, DeFi ve CEX’lerde tercih edilen teminat; APT ekosistemi ise hızla büyüyen DeFi projeleri ve artan Toplam Kilitli Varlık (TVL) ile öne çıkıyor

Makroekonomik Etkenler ve Piyasa Döngüleri

- Enflasyon döneminde performans: USDC istikrar sunarken enflasyona karşı koruma sağlamaz; APT ise piyasa genişleme dönemlerinde büyüme potansiyeli taşır

- Para politikası etkisi: Faiz oranları doğrudan USDC’nin rezerv getirilerini etkiler; APT fiyatı ise genel kripto piyasasının duyarlılığından etkilenir

- Jeopolitik faktörler: USDC, artan sınır ötesi ödeme talebinden yararlanır; APT’nin benimsenmesi ise küresel blokzincir teknolojisi kabulüne bağlıdır

III. 2025-2030 Fiyat Tahminleri: USDC ve APT

Kısa Vadeli Tahmin (2025)

- USDC: Temkinli $1,00 - $1,00 | İyimser $1,00 - $1,00

- APT: Temkinli $2,48 - $3,65 | İyimser $3,65 - $4,89

Orta Vadeli Tahmin (2027)

- USDC’nin istikrarını koruması ve $1,00’da kalması bekleniyor

- APT’nin büyüme fazına girmesi ve $3,99 - $6,79 aralığına yükselmesi öngörülüyor

- Temel faktörler: Kurumsal girişler, ETF gelişmeleri, ekosistem büyümesi

Uzun Vadeli Tahmin (2030)

- USDC: Temel senaryo $1,00 - $1,00 | İyimser senaryo $1,00 - $1,00

- APT: Temel senaryo $6,31 - $7,99 | İyimser senaryo $7,99 - $11,03

Feragatname

USDC:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

APT:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 4.891 | 3.65 | 2.482 | 0 |

| 2026 | 4.911075 | 4.2705 | 3.373695 | 17 |

| 2027 | 6.7943655 | 4.5907875 | 3.993985125 | 25 |

| 2028 | 7.798829805 | 5.6925765 | 4.89561579 | 56 |

| 2029 | 9.241613318925 | 6.7457031525 | 5.80130471115 | 85 |

| 2030 | 11.03124836528325 | 7.9936582357125 | 6.314990006212875 | 119 |

IV. Yatırım Stratejisi Karşılaştırması: USDC ve APT

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- USDC: İstikrar ve risk yönetimine öncelik veren yatırımcılar için uygundur

- APT: Ekosistem büyümesi ve uzun vadeli getiri arayan yatırımcılar için uygundur

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar: USDC %80 | APT %20

- Agresif yatırımcılar: USDC %40 | APT %60

- Koruma araçları: Stabilcoin portföyü, opsiyonlar, çapraz para dağılımı

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- USDC: Aşırı piyasa koşullarında sabitliğin bozulma riski

- APT: Yüksek volatilite ve genel kripto piyasa eğilimlerine bağımlılık

Teknik Risk

- USDC: Merkezileşme endişesi, geleneksel bankacılığa bağımlılık

- APT: Ölçeklenebilirlik sorunları, akıllı kontratlarda güvenlik açıkları

Düzenleyici Risk

- Küresel regülasyonlar iki varlığı farklı etkileyebilir; USDC, stabilcoin olduğu için daha fazla denetime tabi olabilir

VI. Sonuç: Hangisi Daha Avantajlı?

📌 Yatırım Değeri Özeti:

- USDC avantajları: İstikrar, yaygın kullanım, regülasyon uyumu

- APT avantajları: Büyüme potansiyeli, yenilikçi teknoloji, gelişen ekosistem

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: İstikrar için USDC’ye daha fazla pay ayırabilirsiniz

- Deneyimli yatırımcılar: USDC ve APT içeren dengeli portföy

- Kurumsal yatırımcılar: Risk toleransı ve hedeflere göre stratejik dağılım

⚠️ Risk Uyarısı: Kripto para piyasası yüksek derecede dalgalanma içerir. Bu makale yatırım tavsiyesi değildir. None

VII. SSS

S1: USDC ve APT arasındaki ana farklar nelerdir? C: USDC, ABD dolarına endeksli stabilcoin olup fiyat istikrarı ve sınır ötesi ödemelerde yaygın kullanım sunar. APT ise yüksek performans ve ölçeklenebilirlik odaklı Layer 1 blokzincir token’ıdır ve merkeziyetsiz uygulamalarda büyüme potansiyeline sahiptir.

S2: Hangisi daha istikrarlı, USDC mi APT mi? C: USDC, 1:1 ABD doları sabitini koruyacak şekilde tasarlanmıştır ve daha istikrarlıdır. APT ise piyasa dalgalanmalarına ve fiyat oynaklığına açıktır.

S3: USDC ve APT’nin arz mekanizmaları nasıl farklılık gösterir? C: USDC, 1:1 USD rezerviyle tamamen teminatlandırılmıştır. APT ise 1 milyar başlangıç arzına sahip olup staking ödülleri ile maksimum arz sınırı bulunmaz.

S4: Hangi coinin kurumsal benimsenmesi daha iyi? C: USDC, Coinbase, Visa ve Stripe gibi büyük şirketler tarafından yaygın biçimde kullanılırken; APT, yüksek girişim sermayesi yatırımı almış ancak kurumsal alanda gelişimini sürdürmektedir.

S5: Her coin’in potansiyel riskleri nelerdir? C: USDC, aşırı piyasa koşullarında sabitliğin bozulması ve regülasyon risklerine açıktır. APT ise yüksek piyasa volatilitesi, teknik riskler ve değişen regülasyon ortamı ile karşı karşıyadır.

S6: USDC ve APT enflasyon dönemlerinde nasıl performans gösterir? C: USDC istikrarlı kalır ancak enflasyona karşı koruma sunmaz. APT, piyasa genişlediğinde büyüme potansiyeli taşır ancak enflasyonist dönemlerde oynaklığı artabilir.

S7: Uzun vadeli yatırım için hangisi daha avantajlı? C: Tercih, kişisel yatırım hedeflerine bağlıdır. USDC istikrar ve risk yönetimi için daha elverişliyken, APT ekosistem gelişimine bağlı olarak uzun vadeli büyüme potansiyeli sunar. Dengeli portföyde her ikisi de yer alabilir.

2025 USDC Fiyat Tahmini: Değişen Kripto Düzenleyici Ortamında Stablecoin İstikrarının Analizi

2025 RSR Fiyat Tahmini: Reserve Rights Token’ın Gelecek Piyasa Potansiyeli ve Büyüme Faktörlerinin Analizi

2025 XPL Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

PayPal USD (PYUSD) yatırım için uygun mu?: PayPal’ın Stablecoin’inin Potansiyeli ve Risklerine Yakından Bakış

Plasma (XPL) iyi bir yatırım mı?: Bu yeni ortaya çıkan kripto paranın potansiyeli ve riskleri nasıl değerlendirilmeli?

Worldwide USD (WUSD) iyi bir yatırım mı?: Bu Yeni Ortaya Çıkan Stablecoin’in Potansiyeli ve Riskleri Üzerine Analiz

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi