2025 XPL Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: XPL’in Piyasa Konumu ve Yatırım Değeri

Plasma (XPL), yüksek performanslı ve stablecoin odaklı bir layer 1 blokzincir olarak, piyasaya girişinden bu yana kripto para ekosisteminde kendine güçlü bir yer edinmiştir. 2025 itibarıyla Plasma’nın piyasa değeri 870.300.000 ABD Doları’na ulaşmış, yaklaşık 1.800.000.000 adet dolaşımdaki token ile fiyatı 0,4835 ABD Doları civarında seyretmektedir. “Stablecoin blokzinciri” olarak anılan bu varlık, sıfır ücretli USD₮ transferlerini mümkün kılarak ve gizli ödemeleri destekleyerek kripto piyasasında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, Plasma’nın 2025-2030 arasındaki fiyat trendleri; geçmiş örüntüler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde kapsamlı biçimde analiz edilecek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. XPL Fiyat Geçmişi ve Güncel Piyasa Durumu

XPL Tarihsel Fiyat Gelişimi

- Eylül 2025: XPL, 1,692 ABD Doları ile tüm zamanların en yüksek seviyesine ulaşarak proje için önemli bir dönüm noktası oluşturdu.

- Eylül 2025: Zirve sonrası kısa sürede XPL, 0,075 ABD Doları ile tüm zamanların en düşük seviyesini gördü.

- Ekim 2025: Piyasa toparlanma sinyalleri vererek XPL fiyatı istikrar kazandı ve yukarı yönlü hareket gösterdi.

XPL Güncel Piyasa Durumu

16 Ekim 2025 tarihi itibarıyla XPL, 0,4835 ABD Doları seviyesinden işlem görüyor ve son 24 saatte %3,52 değer kazandı. Token’ın piyasa değeri 870.300.000 ABD Doları ile kripto para piyasasında 104. sırada yer alıyor. Son 24 saatteki işlem hacmi ise 24.916.156 ABD Doları seviyesinde gerçekleşerek, piyasadaki aktif ilgiyi gösteriyor.

Kısa vadeli pozitif performansa rağmen, XPL halen zorluklarla karşı karşıya. Son bir haftada %44,5, son 30 günde ise %41,97 oranında değer kaybetti. Buna karşın, XPL’in geçen yıl gösterdiği %153,92’lik uzun vadeli büyüme kayda değerdir.

XPL’in dolaşımdaki arzı 1.800.000.000 adet olup bu, toplam arz olan 10.000.000.000 XPL’in %18’ine karşılık gelmektedir. Bu düşük dolaşım oranı, ileride daha fazla token’ın piyasaya sürülmesiyle piyasa dinamiklerinde değişim potansiyeline işaret etmektedir.

Güncel XPL piyasa fiyatını görüntülemek için tıklayın

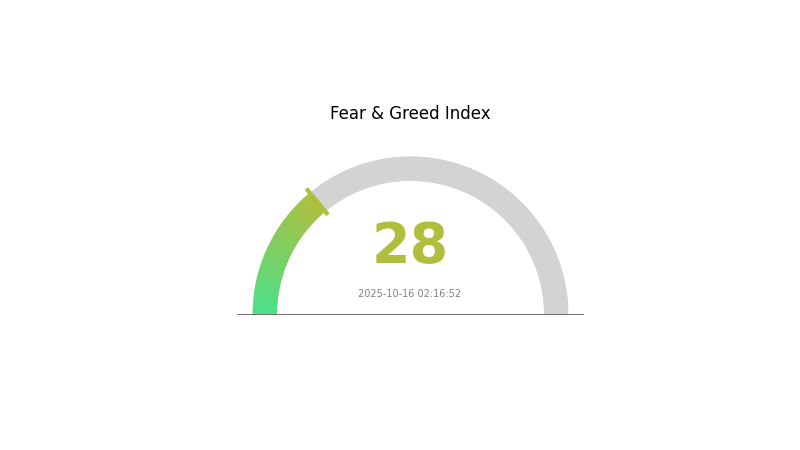

XPL Piyasa Duyarlılık Göstergesi

2025-10-16 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasası şu anda korku evresinde; Korku ve Açgözlülük Endeksi 28 seviyesinde. Bu durum, yatırımcıların temkinli davrandığını gösteriyor ve “diğerleri korkarken al” stratejisiyle hareket edenler için fırsat anlamına gelebilir. Ancak yatırım kararı almadan önce detaylı araştırma yapmak ve çok yönlü değerlendirme önemlidir. Piyasa trendleri ve haberleri yakından takip ederek duyarlılıktaki olası değişiklikleri gözlemleyin.

XPL Varlık Dağılımı

XPL’de adres bazlı varlık dağılımı, oldukça merkeziyetsiz bir sahiplik yapısına işaret etmektedir. Hiçbir adres toplam arzın kayda değer bir yüzdesini elinde bulundurmamakta; bu da büyük sahiplerin fiyat üzerinde oynaklığa yol açma veya piyasayı manipüle etme riskini minimize etmektedir.

Bu dağılım, XPL’in sağlıklı ve çeşitli bir ekosisteme sahip olduğuna, sahipliğin geniş topluluk katılımıyla yayıldığına işaret eder. Bu yapı, güçlü topluluk bağlılığı anlamına gelir ve tek bir büyük sahipten kaynaklanabilecek ani piyasa şoklarının önüne geçer.

Konsantre varlıkların yokluğu, XPL için zincir üstü istikrarı güçlendirmekte ve bu merkeziyetsiz yapı, blokzincir teknolojisinin temel ilkeleriyle uyumlu şekilde, piyasada daha fazla güven ve uzun vadeli sürdürülebilirlik sağlamaktadır.

Güncel XPL Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|

II. XPL’in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Token Kilit Açılımları: 2026 yılında planlanan önemli token serbest bırakımları; 28 Temmuz 2026’da ABD’li katılımcılar için 18 milyar XPL (dolaşımdaki arzın %18’i) ve Temmuz 2026’dan itibaren ekip ve yatırımcı tokenlarının %25’i.

- Tarihsel Örüntü: Avalanche gibi projelerde, kilit açılımları sırasında fiyatlarda %20-30 oranında gerileme yaşanmıştır.

- Mevcut Etki: Piyasa talebinin düşük olması halinde arzın artması, fiyatı baskılayabilir; ancak talep yüksek kalırsa fiyatlarda istikrar sağlanabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: 2026-2027 döneminde Aave, Ethena ve 100’den fazla DeFi ortağıyla iş birliği yapılması bekleniyor.

Makroekonomik Ortam

- Jeopolitik Faktörler: Özellikle ABD’deki düzenleyici gelişmeler, XPL’in geleceğinde belirleyici olacak.

Teknik Gelişim ve Ekosistem İnşası

- Sıfır Ücretli Transferlerin Yaygınlaştırılması: PlasmaBFT’nin yüksek işlem kapasitesiyle, Plasma dışındaki üçüncü taraf uygulamalarda da sıfır ücretli USDT transferleri başlatılması planlanıyor.

- Ekosistem Uygulamaları: Tron şu anda USDT işlem hacminin yaklaşık %60’ını elinde bulundururken, Plasma stablecoin transfer pazarında Tron ile rekabet etmeye hazırlanıyor.

III. 2025-2030 XPL Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,32307 - 0,4822 ABD Doları

- Tarafsız tahmin: 0,4822 - 0,53042 ABD Doları

- İyimser tahmin: 0,53042 - 0,58 ABD Doları (olumlu piyasa duyarlılığı ve proje gelişmeleriyle)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan benimsenmeyle büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,31168 - 0,6015 ABD Doları

- 2028: 0,32727 - 0,6488 ABD Doları

- Ana katalizörler: Teknolojik yenilikler, kullanım alanlarının genişlemesi ve genel kripto piyasa toparlanması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,61148 - 0,73989 ABD Doları (istikrarlı proje büyümesi ve piyasa dengesiyle)

- İyimser senaryo: 0,73989 - 0,99145 ABD Doları (yaygın benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,99145 - 1,20 ABD Doları (çığır açıcı inovasyonlar ve kitlesel kabul ile)

- 2030-12-31: XPL 0,73989 ABD Doları (2030 yılı için öngörülen ortalama fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,53042 | 0,4822 | 0,32307 | 0 |

| 2026 | 0,58732 | 0,50631 | 0,39492 | 4 |

| 2027 | 0,6015 | 0,54681 | 0,31168 | 13 |

| 2028 | 0,6488 | 0,57416 | 0,32727 | 18 |

| 2029 | 0,8683 | 0,61148 | 0,36689 | 26 |

| 2030 | 0,99145 | 0,73989 | 0,39954 | 53 |

IV. XPL İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

XPL Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Yüksek risk toleransına ve uzun vadeli vizyona sahip yatırımcılar

- Yöntem önerileri:

- Piyasa düşüşlerinde XPL biriktirin

- Düzenli yatırım planları oluşturun

- XPL’i güvenli ve kendi gözetiminizdeki cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve muhtemel dönüş seviyelerini tespit için kullanılır

- Göreceli Güç Endeksi (RSI): Aşırı alım veya satım koşullarını belirlemede yardımcı olur

- Dalgalı işlemlerde dikkat edilmesi gerekenler:

- Stablecoin piyasasına ilişkin duyarlılık ve haberleri izleyin

- Kesin zarar durdur ve kar alma seviyeleri belirleyin

XPL Risk Yönetim Çerçevesi

(1) Varlık Tahsisi Prensipleri

- Temkinli yatırımcılar: %1-3

- Aggresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-20

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Kripto ve geleneksel varlıklara dağılım sağlayın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdan önerisi

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve özel anahtarların çevrimdışı saklanması

V. XPL İçin Olası Riskler ve Zorluklar

XPL Piyasa Riskleri

- Oynaklık: Kripto piyasalarında sık görülen yüksek fiyat dalgalanmaları

- Likitide: Büyük emirlerin fiyatı önemli derecede etkilemeden gerçekleşmesinde yaşanabilecek güçlükler

- Rekabet: Yeni stablecoin odaklı blokzincir projelerinin ortaya çıkışı

XPL Düzenleyici Riskler

- Stablecoin düzenlemeleri: İhraççılar ve platformlar için daha sıkı denetim olasılığı

- Sınır ötesi kısıtlamalar: Farklı bölgelerde değişen regülasyonlar

- AML/KYC gereksinimleri: Kullanıcılar ve platformlar açısından artan uyum yükümlülükleri

XPL Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda potansiyel güvenlik zaafları

- Ölçeklenebilirlik: Yüksek talep dönemlerinde ağ tıkanıklığı riski

- Birlikte çalışabilirlik: Zincirler arası entegrasyonlarda yaşanabilecek sorunlar

VI. Sonuç ve Eylem Tavsiyeleri

XPL Yatırım Değeri Değerlendirmesi

Plasma (XPL), stablecoin’lere özel geliştirilmiş blokzincir yapısı ve artan pazar ihtiyacına yanıtıyla uzun vadede güçlü bir değer önerisi sunar. Ancak kısa vadede düzenleyici belirsizlikler ve piyasa dalgalanmaları önemli riskler arasındadır.

XPL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve stratejik alım-satımı bir arada kullanarak dengeli bir yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Ortaklık fırsatlarını araştırın ve Plasma’yı mevcut finansal ürünlere entegre edin

XPL İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında XPL alıp satın

- Stake etme: Varsa staking programlarına katılarak pasif gelir elde edin

- DeFi entegrasyonu: Plasma ağı üzerindeki merkeziyetsiz finans uygulamalarını keşfedin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli karar vermeli, profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırım yapmayın.

Sıkça Sorulan Sorular

XPL iyi bir yatırım mı?

XPL, 4 Al notu ve 1,50 ABD Doları fiyat hedefiyle büyüme potansiyeli taşımaktadır. Güncel trendler, cazip bir yatırım fırsatına işaret etmektedir.

XPL hissesi için fiyat tahmini nedir?

XPL hissesinin 2025’te 0,614675 ila 0,824304 ABD Doları aralığında olması öngörülüyor ve önümüzdeki gün için %0,55’lik bir artış bekleniyor.

2025’te XRP için fiyat tahmini nedir?

Piyasa analizlerine göre, XRP’nin fiyatı 2025’te 5,50 ile 8,50 ABD Doları arasında olabilir; piyasa koşulları ve benimsenme oranına bağlı olarak daha yüksek büyüme potansiyeli de mevcut.

XPL kripto nedir?

XPL, Plasma blokzincirinin yerel token’ıdır ve işlemler ile ödüllendirmelerde kullanılır. Belirli koşullarla halka arz edilen XPL, Plasma’nın altyapısı üzerinde çalışır.

2025 yılında XPL Kripto Parası'nın Güncel Piyasa Görünümü Nasıldır?

PYUSD vs ZIL: Dijital ödemelerde stablecoin’ler ile blockchain platformlarının karşılaştırılması

FDUSD ve APT: Dalgalı piyasalarda stablecoin performansının karşılaştırılması

USDP ve ZIL: Dalgalı Piyasalarda Stablecoin Performansının Karşılaştırılması

RSR vs LTC: Emeklilik Planlamasında Risk Paylaşım Rezervleri ile Uzun Süreli Bakım Sigortasının Karşılaştırılması

MeterStable (MTR) iyi bir yatırım mı?: Kripto piyasasında bu stablecoin’in potansiyeli ve risklerinin değerlendirilmesi

İşlem Ücreti Üç Aşama ve Kripto Dönemi Zorlukları

MetaMask’e Arbitrum Ekleme: Ayrıntılı Kılavuz

Marina Protokolü Günlük Quiz Cevabı 12 Aralık 2025

Dropee Günün Sorusu 12 Aralık 2025

Sorunsuz Blockchain Deneyimi Sunan En İyi Akıllı Telefonlar