PBTC35A vs CRO: Comparing Two Innovative Approaches in Cryptocurrency Investment

Introduction: Investment Comparison of PBTC35A vs CRO

In the cryptocurrency market, the comparison between PBTC35A vs CRO has always been an unavoidable topic for investors. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

PBTC35A (PBTC35A): Since its launch, it has gained market recognition for its role in Bitcoin mining power.

Cronos (CRO): Launched in 2018, it has been hailed as a leading blockchain ecosystem, representing one of the largest cryptocurrencies by global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between PBTC35A vs CRO, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning to investors:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

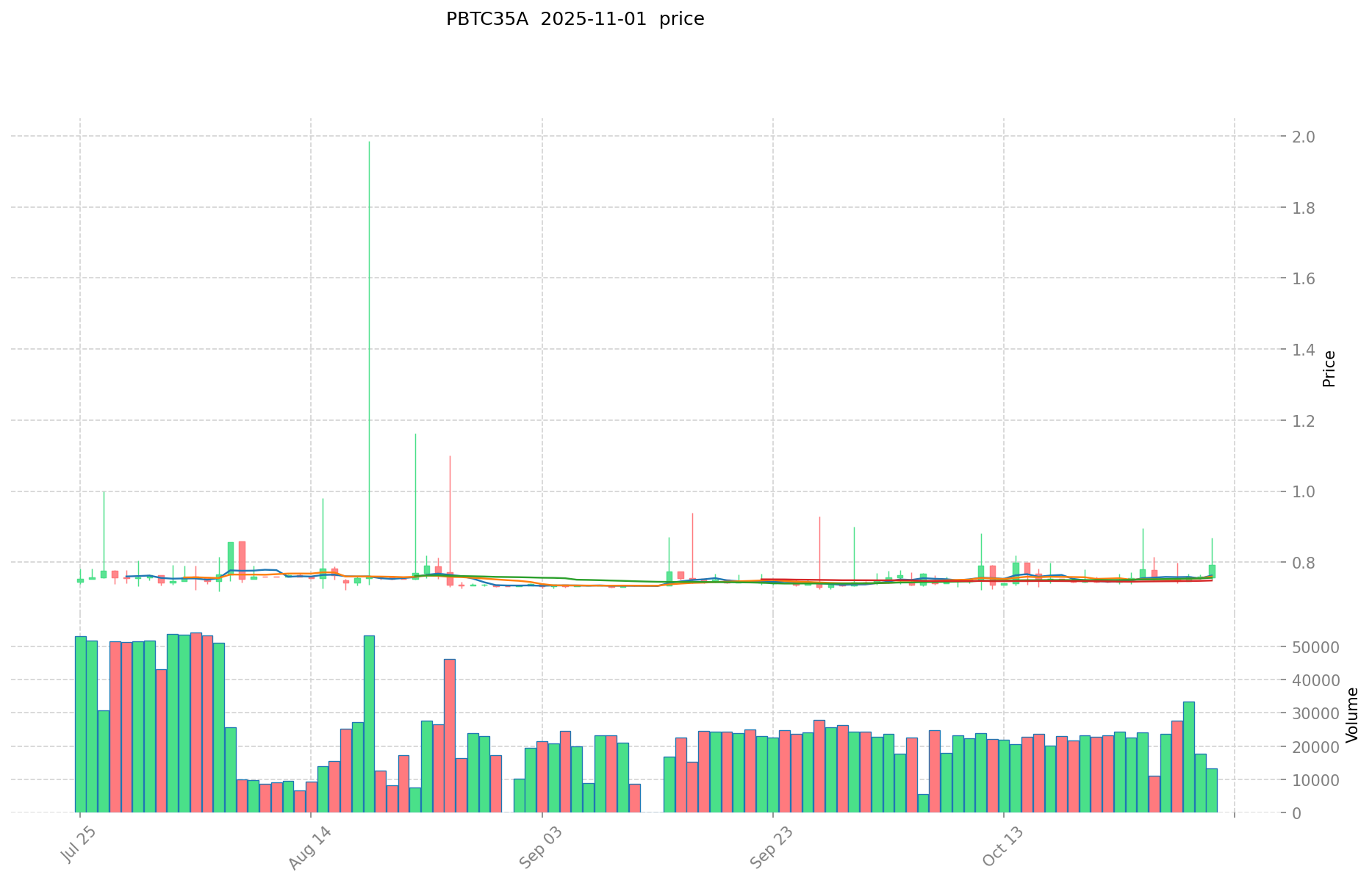

PBTC35A and CRO Historical Price Trends

- 2021: PBTC35A reached its all-time high of $216.53 on January 14, 2021.

- 2021: CRO hit its all-time high of $0.965407 on November 24, 2021, driven by the rebranding of Crypto.com Chain to Cronos.

- Comparative analysis: During the recent market cycle, PBTC35A dropped from its peak of $216.53 to a low of $0.478614, while CRO fell from $0.965407 to its current price of around $0.14602.

Current Market Situation (2025-11-01)

- PBTC35A current price: $0.793

- CRO current price: $0.14602

- 24-hour trading volume: PBTC35A $10,475.73 vs CRO $1,046,836.14

- Market Sentiment Index (Fear & Greed Index): 33 (Fear)

Click to view real-time prices:

- Check PBTC35A current price Market Price

- Check CRO current price Market Price

II. Key Factors Affecting Investment Value of PBTC35A vs CRO

Supply Mechanism Comparison (Tokenomics)

- PBTC35A: Dependent on enterprise operation success, value tied to business performance

- CRO: Features rising transaction model ensuring long-term ecosystem value appreciation

- 📌 Historical pattern: Supply mechanisms drive price cycle changes through market demand dynamics

Institutional Adoption and Market Applications

- Institutional holdings: Long-term investors focus on enterprises with core competitiveness

- Enterprise adoption: Investment success ultimately determined by core operational factors

- Regulatory attitudes: Investors should pay attention to market prospects and regulatory environment

Technical Development and Ecosystem Building

- Technical innovation: A crucial factor in determining long-term investment value

- Ecosystem support: Strong ecosystem backing enhances long-term appreciation potential

- Ecosystem comparison: CRO possesses greater long-term appreciation potential due to ecosystem structure

Macroeconomic and Market Cycles

- Performance in inflationary environments: Market demand influences value stability

- Monetary policy impacts: Economic uncertainty affects investment strategies

- Geopolitical factors: Global market conditions and cross-border transaction demands affect both assets differently

III. 2025-2030 Price Prediction: PBTC35A vs CRO

Short-term Prediction (2025)

- PBTC35A: Conservative $0.55 - $0.79 | Optimistic $0.79 - $0.96

- CRO: Conservative $0.11 - $0.15 | Optimistic $0.15 - $0.21

Mid-term Prediction (2027)

- PBTC35A may enter a growth phase, with estimated prices of $1.04 - $1.36

- CRO may enter a consolidation phase, with estimated prices of $0.17 - $0.25

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- PBTC35A: Base scenario $0.77 - $1.46 | Optimistic scenario $1.46 - $2.17

- CRO: Base scenario $0.21 - $0.28 | Optimistic scenario $0.28 - $0.34

Disclaimer: This information is for educational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

PBTC35A:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.959893 | 0.7933 | 0.547377 | 0 |

| 2026 | 1.26229896 | 0.8765965 | 0.780170885 | 10 |

| 2027 | 1.3581986171 | 1.06944773 | 1.0373642981 | 34 |

| 2028 | 1.480864271731 | 1.21382317355 | 1.1531320148725 | 53 |

| 2029 | 1.56291871826298 | 1.3473437226405 | 0.714092172999465 | 69 |

| 2030 | 2.168145518473092 | 1.45513122045174 | 0.771219546839422 | 83 |

CRO:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.2103264 | 0.14606 | 0.1051632 | 0 |

| 2026 | 0.197794452 | 0.1781932 | 0.146118424 | 22 |

| 2027 | 0.25003178858 | 0.187993826 | 0.17107438166 | 28 |

| 2028 | 0.2562449845293 | 0.21901280729 | 0.1401681966656 | 50 |

| 2029 | 0.320799009478027 | 0.23762889590965 | 0.130695892750307 | 62 |

| 2030 | 0.337848882759544 | 0.279213952693838 | 0.214994743574255 | 91 |

IV. Investment Strategy Comparison: PBTC35A vs CRO

Long-term vs Short-term Investment Strategies

- PBTC35A: Suitable for investors focused on Bitcoin mining exposure and enterprise performance

- CRO: Suitable for investors interested in ecosystem potential and long-term value appreciation

Risk Management and Asset Allocation

- Conservative investors: PBTC35A: 30% vs CRO: 70%

- Aggressive investors: PBTC35A: 60% vs CRO: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- PBTC35A: Highly dependent on Bitcoin mining industry performance

- CRO: Susceptible to overall cryptocurrency market sentiment

Technical Risk

- PBTC35A: Scalability, network stability

- CRO: Ecosystem development pace, security vulnerabilities

Regulatory Risk

- Global regulatory policies may have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- PBTC35A advantages: Direct exposure to Bitcoin mining industry, potential for high returns in bull markets

- CRO advantages: Strong ecosystem support, diverse application scenarios, potential for long-term value appreciation

✅ Investment Advice:

- Novice investors: Consider a higher allocation to CRO for its more established ecosystem

- Experienced investors: Balanced portfolio with both PBTC35A and CRO based on risk tolerance

- Institutional investors: Strategic allocation to both assets, with a focus on long-term ecosystem development

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between PBTC35A and CRO? A: PBTC35A is primarily focused on Bitcoin mining exposure, while CRO represents a broader blockchain ecosystem. PBTC35A's value is tied to Bitcoin mining performance, whereas CRO's value is driven by its ecosystem development and adoption.

Q2: Which asset has shown better historical price performance? A: Based on the information provided, CRO has shown better historical price performance. It reached its all-time high of $0.965407 in November 2021, compared to PBTC35A's all-time high of $216.53 in January 2021. However, both assets have experienced significant price declines since their peaks.

Q3: How do the supply mechanisms of PBTC35A and CRO differ? A: PBTC35A's supply is dependent on enterprise operation success and its value is tied to business performance. CRO features a rising transaction model that aims to ensure long-term ecosystem value appreciation.

Q4: What are the key factors affecting the investment value of these assets? A: Key factors include supply mechanisms, institutional adoption, market applications, technical development, ecosystem building, macroeconomic conditions, and market cycles.

Q5: What are the predicted price ranges for PBTC35A and CRO in 2030? A: According to the predictions provided, PBTC35A's price range for 2030 is estimated at $0.77 - $2.17, while CRO's price range is estimated at $0.21 - $0.34.

Q6: How should investors allocate their portfolio between PBTC35A and CRO? A: The allocation depends on an investor's risk tolerance. Conservative investors might consider 30% PBTC35A and 70% CRO, while aggressive investors might opt for 60% PBTC35A and 40% CRO. However, these are suggestions and not financial advice.

Q7: What are the main risks associated with investing in PBTC35A and CRO? A: Both assets face market risks, technical risks, and regulatory risks. PBTC35A is highly dependent on the Bitcoin mining industry, while CRO is more susceptible to overall cryptocurrency market sentiment. Both face potential regulatory challenges and technical risks related to scalability and security.

Share

Content