GHO (GHO) iyi bir yatırım mı?: Aave'nin yeni stablecoin'inin potansiyeli ve risklerinin incelenmesi

Giriş: GHO (GHO) Yatırım Durumu ve Piyasa Görünümü

GHO, kripto para dünyasında öne çıkan bir varlık olarak, stablecoin segmentinde kuruluşundan bu yana dikkat çekici ilerlemeler kaydetmiştir. 2025 yılı itibarıyla GHO’nun piyasa değeri 352.821.318,00 $, dolaşımdaki arzı 352.821.318 token ve mevcut fiyatı yaklaşık 1 $ seviyesindedir. “Merkeziyetsiz, aşırı teminatlandırılmış stablecoin” olarak tanımlanan GHO, özellikle “GHO (GHO) iyi bir yatırım mı?” sorusunu değerlendiren yatırımcıların odağında yer almaktadır. Bu makalede, GHO’nun yatırım değerini, geçmiş performansını, geleceğe yönelik fiyat tahminlerini ve yatırım risklerini ayrıntılı biçimde inceleyerek yatırımcılara referans sunulacaktır.

I. GHO Fiyat Geçmişi ve Güncel Yatırım Değeri

GHO Fiyat Geçmişi ve Yatırım Getirileri

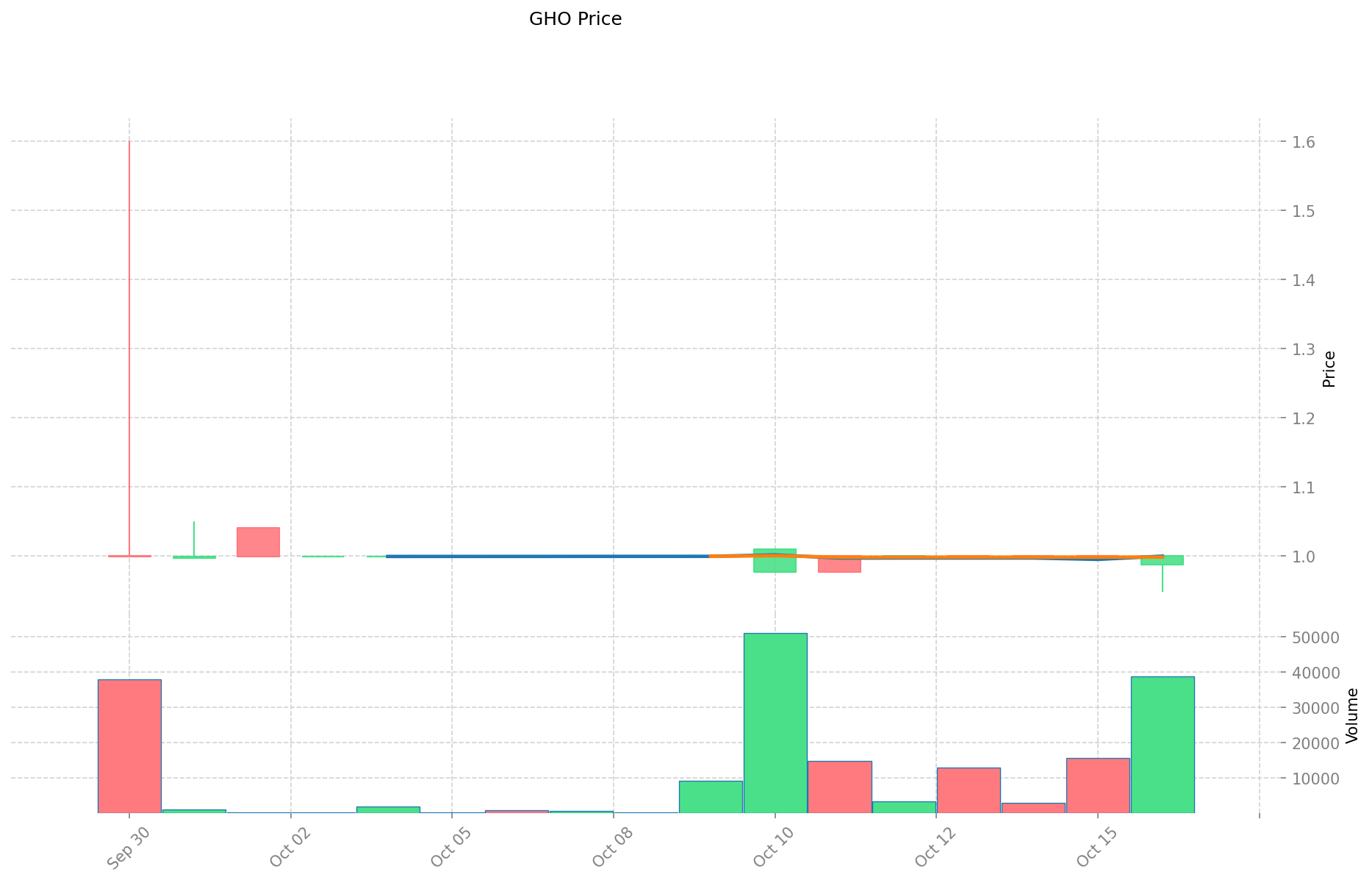

- Eylül 2025: 1,6 $ ile tarihi zirve → Erken yatırımcılara pozitif getiri

- Ekim 2025: 0,9478 $ ile tarihi dip → Fiyat dalgalanmalarıyla alım-satım fırsatları

Mevcut GHO Yatırım Piyasa Durumu (Ekim 2025)

- GHO güncel fiyatı: 1,00 $

- 24 saatlik işlem hacmi: 53.487,3073 $

- Piyasa değeri: 352.821.318 $

Gerçek zamanlı GHO piyasa fiyatını görüntülemek için tıklayın

II. GHO (GHO) Yatırımını Etkileyen Temel Faktörler

Arz Mekanizması ve Kıtlık (GHO yatırımında kıtlık)

- Talep üzerine üretim, yönetim tarafından belirlenen limitlerle sınırlandırılır → Fiyat ve yatırım değerini etkiler

- Geçmişte: Arz değişimleri GHO fiyat dalgalanmalarını tetiklemiştir

- Yatırım açısından: Kıtlık, uzun vadeli yatırımın temel dayanağıdır

Kurumsal Yatırım ve Yaygın Benimseme (GHO'da kurumsal yatırım)

- Kurumsal varlık tutma trendi: Sınırlı veri mevcut

- Aave Protocol tarafından benimsenmesi → Yatırım değerini artırır

- Düzenleyici politikaların GHO yatırım potansiyeline etkisi

Makroekonomik Ortamın GHO Yatırımına Etkisi

- Para politikası ve faiz değişimleri → Yatırım cazibesini değiştirir

- Enflasyon ortamında koruma rolü → “Dijital dolar” konumlandırması

- Jeopolitik belirsizlikler → GHO’ya olan yatırım talebini artırabilir

Teknoloji ve Ekosistem Gelişimi (GHO yatırımı için teknoloji ve ekosistem)

- Aave Protocol güncellemeleri: Ağ performansını artırır → Yatırım cazibesini güçlendirir

- Ekosistem genişlemesi: Kullanım alanlarını artırır → Uzun vadeli değeri destekler

- DeFi uygulamaları yatırım değerini yükseltir

III. GHO Gelecek Yatırım Tahmini ve Fiyat Beklentisi (2025-2030 arası GHO(GHO) yatırımına değer mi?)

Kısa Vadeli Yatırım Tahmini (2025, kısa vadeli GHO yatırım görünümü)

- Ihtiyatlı tahmin: 0,84 $ - 0,95 $

- Tarafsız tahmin: 0,95 $ - 1,05 $

- İyimser tahmin: 1,05 $ - 1,18 $

Orta Vadeli Yatırım Görünümü (2027-2028, orta vadeli GHO(GHO) tahmini)

- Piyasa aşaması beklentisi: Dengeli büyüme ve artan benimseme

- Yatırım getirisi tahmini:

- 2027: 0,82 $ - 1,22 $

- 2028: 0,84 $ - 1,40 $

- Ana katalizörler: Aave ekosisteminin genişlemesi, DeFi’nin yaygınlaşması

Uzun Vadeli Yatırım Görünümü (GHO uzun vadeli yatırım için uygun mu?)

- Temel senaryo: 0,93 $ - 1,81 $ (DeFi sektöründeki sürekli büyüme varsayımıyla)

- İyimser senaryo: 1,81 $ - 2,50 $ (Yaygın benimseme ve olumlu piyasa koşulları varsayımıyla)

- Risk senaryosu: 0,50 $ - 0,93 $ (Aşırı piyasa daralması veya regülasyon zorlukları halinde)

GHO uzun vadeli yatırım ve fiyat tahmini için tıklayın: Fiyat Tahmini

17 Ekim 2025 - 2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,93 $ - 1,81 $ (İstikrarlı ilerleme ve ana akım uygulamalarda kademeli artışla uyumlu)

- İyimser senaryo: 1,81 $ - 2,50 $ (Kapsamlı benimseme ve olumlu piyasa ortamı ile uyumlu)

- Dönüştürücü senaryo: 2,50 $ üzeri (Ekosistemde çığır açıcı gelişmeler ve ana akım yaygınlaşma durumunda)

- 31 Aralık 2030 tahmini en yüksek: 1,81 $ (İyimser gelişme varsayımıyla)

Feragatname: Bu bilgiler genel referans amaçlıdır ve yatırım tavsiyesi niteliği taşımamaktadır. Kripto para piyasaları yüksek oynaklık ve öngörülemezliğe sahiptir. Her yatırım kararınızdan önce kendi araştırmanızı mutlaka yapınız.

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1,18 | 1 | 0,84 | 0 |

| 2026 | 1,2317 | 1,09 | 0,6867 | 9 |

| 2027 | 1,2188925 | 1,16085 | 0,8242035 | 16 |

| 2028 | 1,404048075 | 1,18987125 | 0,8448085875 | 18 |

| 2029 | 1,361807645625 | 1,2969596625 | 1,206172486125 | 29 |

| 2030 | 1,807961769525 | 1,3293836540625 | 0,93056855784375 | 32 |

IV. GHO'ya Nasıl Yatırım Yapılır?

GHO Yatırım Stratejisi

- GHO’yu HODL etmek: Tutucu yatırımcılar için uygundur

- Aktif alım-satım: Teknik analiz ve dalgalı işlem gerektirir

GHO Yatırımında Risk Yönetimi

- Varlık dağılımı: Tutucu / Agresif / Profesyonel yatırımcılar

- Riskten korunma stratejileri: Çoklu varlık portföyü + hedge araçları

- Güvenli saklama: Sıcak ve soğuk cüzdanlar + donanım cüzdanı tavsiyeleri

V. Stablecoin Yatırımının Riskleri

- Piyasa riski: Yüksek oynaklık, fiyat manipülasyonu

- Düzenleyici risk: Farklı ülkelerde politika belirsizlikleri

- Teknik risk: Ağ güvenlik açıkları, güncelleme hataları

VI. Sonuç: GHO İyi Bir Yatırım mı?

- Yatırım özeti: GHO, uzun vadede yüksek yatırım potansiyeli sunarken, kısa vadede fiyat oynaklığı oldukça yüksek olabilir.

- Yatırımcıya öneriler: ✅ Yeni başlayanlar: Maliyet ortalaması ile alım + güvenli cüzdan kullanımı ✅ Deneyimli yatırımcılar: Dalgalı alım-satım + portföy çeşitlendirmesi ✅ Kurumsal yatırımcılar: Stratejik uzun vadeli tahsis

⚠️ Not: Kripto para yatırımı yüksek risk içerir. Bu makale yalnızca bilgilendirme amaçlıdır, yatırım tavsiyesi değildir.

VII. Sıkça Sorulan Sorular

S1: GHO nedir ve diğer stablecoin’lerden farkı nedir? C: GHO, Aave Protocol tarafından geliştirilen merkeziyetsiz ve aşırı teminatlandırılmış bir stablecoin’dir. Geleneksel stablecoin’lerden ayrılarak, talep üzerine üretilir ve yönetim tarafından belirlenen limitlerle sınırlandırılır; bu durum fiyat ve yatırım değerine yansır.

S2: GHO’nun fiyat istikrarını hangi faktörler etkiler? C: GHO’nun fiyat istikrarı; arz mekanizması, kurumsal benimseme, makroekonomik koşullar ve Aave ekosisteminin yanı sıra geniş DeFi uygulamalarının gelişimi gibi birçok etkene bağlıdır.

S3: GHO uzun vadeli yatırım için uygun mu? C: GHO, uzun vadeli yatırımda potansiyel taşır; farklı senaryolara göre 2030’da fiyatı 0,93 $ – 2,50 $ aralığında öngörülmektedir. Ancak tüm kripto yatırımlarında olduğu gibi yüksek risk ve oynaklık söz konusudur.

S4: GHO'ya nasıl yatırım yapabilirim? C: GHO'ya iki temel yöntemle yatırım yapabilirsiniz: Tutucu yatırımcılar için HODL (al-tut) veya teknik analiz ve yüksek risk toleransı olanlar için aktif alım-satım. Daima donanım cüzdanı gibi güvenli saklama yöntemlerini tercih edin.

S5: GHO yatırımında başlıca riskler nelerdir? C: Başlıca riskler; piyasa oynaklığı, olası fiyat manipülasyonu, düzenleyici belirsizlikler ve ağ açıkları veya güncelleme problemleri gibi teknik risklerdir.

S6: 2025 için GHO'nun tahmini fiyat aralığı nedir? C: 2025 yılı için ihtiyatlı tahmin 0,84 $ – 0,95 $, tarafsız tahmin 0,95 $ – 1,05 $ ve iyimser tahmin 1,05 $ – 1,18 $ aralığındadır.

S7: GHO’nun performansı geleneksel finansal yatırımlarla karşılaştırıldığında nasıldır? C: GHO, fiyat istikrarını 1 $ seviyesinde koruma hedefindedir; bu nedenle daha oynak kripto paralara kıyasla değerlenme potansiyeli sınırlıdır. Ancak düşük faiz dönemlerinde, geleneksel tasarruf hesaplarına göre daha yüksek getiri sunabilir; buna karşın risk seviyesi de daha yüksektir.

2025 RESOLV Fiyat Tahmini: Piyasa trendleri ve gelecekteki değerleme potansiyelinin analizi

ENA ile CRO: İki Önde Gelen Genomik Veri Deposu Arasında Karşılaştırmalı Bir Analiz

2025 yılında ENA'nın mevcut piyasa durumu nedir?

FeiUSD (FEI) yatırım için uygun mu?: Bu stablecoin'in değişken kripto piyasasındaki potansiyelini ve risklerini değerlendiriyoruz

2025 RSR Fiyat Tahmini: Dalgalı Kripto Piyasasında Reserve Rights Token'ın Geleceğine Yön Vermek

JST ve SNX: DeFi Ekosisteminde İki Sentetik Varlık Protokolünün Karşılaştırmalı Analizi

Web3 ortamında Mnemonic Phrase’lerin Kullanımı: Güvenliğe Dair Açıklamalar

Metaverse Yatırımı ve Pazar Görünümü: MANA ve SAND Üzerine Son Analiz

DEX İşlem Likiditesini Optimize Etmeye Yönelik En Etkin Çözümler

Kurumsal Birikim Sinyali: Amerika Bitcoin 416 Daha BTC Ekledi, Toplam Varlıklar 4,783'e Yükseldi

Büyük Sermaye Akışları Bitcoin'e Geri Dönüyor: BlackRock'un BTC ETF'si Yeniden Girişleri Yönetiyor, Yeni Bir Yatırım Eğilimini İşaret Ediyor