2025 RESOLV Fiyat Tahmini: Piyasa trendleri ve gelecekteki değerleme potansiyelinin analizi

Giriş: RESOLV'un Piyasadaki Konumu ve Yatırım Değeri

Resolv (RESOLV), getiri ölçeklendiren bir stablecoin mimarisi olarak 2024’te piyasaya sürülmesinden bu yana önemli yol kat etti. 2025 yılı itibarıyla, RESOLV’un piyasa değeri 17.058.296 dolar seviyesine ulaştı; dolaşımdaki token adedi yaklaşık 158.800.000 ve fiyatı 0,10742 dolar civarında seyrediyor. “Getiri üretimi ve dağıtım altyapısı” olarak adlandırılan bu varlık, DeFi sektöründe giderek daha önemli bir rol üstleniyor.

Bu makale, 2025’ten 2030’a uzanan dönemde RESOLV’un fiyat trendlerine dair kapsamlı bir analiz sunacak; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler bir araya getirilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacak.

I. RESOLV Fiyat Geçmişi ve Mevcut Piyasa Durumu

RESOLV Tarihsel Fiyat Gelişimi

- 2024: Eylül ayında proje lansmanı, fiyat tüm zamanların en yüksek seviyesi olan 0,4139 dolara çıktı

- 2025: Piyasa dalgalanmalarıyla 30 Eylül’de fiyat tüm zamanların en düşük seviyesi olan 0,09954 dolara geriledi

RESOLV Güncel Piyasa Durumu

6 Ekim 2025 itibarıyla RESOLV, 0,10742 dolardan işlem görüyor. Token, son 24 saatte %1,33’lük pozitif değişim gösterdi; işlem hacmi 1.126.422,86 dolar oldu. Güncel piyasa değeri 17.058.296,0 dolar ve RESOLV kripto para piyasasında 1177’nci sırada. Dolaşımdaki miktar 158.800.000 RESOLV token ve bu, toplam arzın %15,88’ine karşılık geliyor (toplam arz: 1.000.000.000 token). Son kısa vadeli pozitif seyre rağmen, RESOLV uzun vadede ciddi değer kaybı yaşadı; 30 günde %30,49 ve bir yılda %55,17 düşüş kaydetti.

Güncel RESOLV piyasa fiyatını görüntülemek için tıklayın

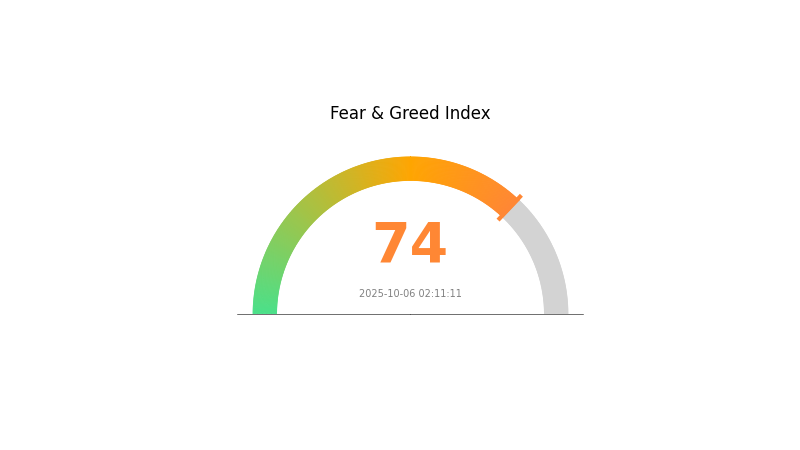

RESOLV Piyasa Duyarlılığı Göstergesi

06 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasası şu anda güçlü bir iyimserlik dalgası yaşıyor; Korku ve Açgözlülük Endeksi 74 seviyesinde ve piyasada belirgin bir açgözlülük hakim. Bu yükseliş, yatırımcıların kendilerini güvende hissettiğini ve daha fazla risk alma eğiliminde olabileceğini gösteriyor. Ancak, aşırı açgözlülüğün sıklıkla piyasa düzeltmelerinin habercisi olduğu unutulmamalı. Yatırımcılar, portföylerini çeşitlendirerek bu coşkulu piyasada riskleri azaltmalı. Her zaman olduğu gibi, detaylı araştırma ve dengeli yaklaşım, dalgalı piyasa koşullarında en doğru stratejidir.

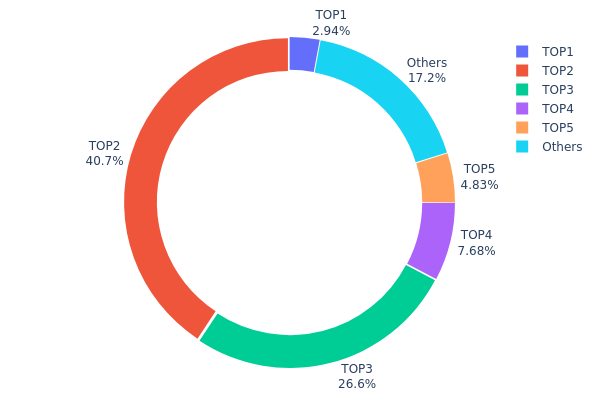

RESOLV Varlık Dağılımı

Adres varlık dağılımı verileri, RESOLV tokenlerinin yoğunlaşmasına ilişkin kritik bilgiler sunuyor. Analiz, en büyük 5 adresin toplam arzın %82,73’ünü kontrol ettiğini ve yapının oldukça merkezi olduğunu gösteriyor. Özellikle ikinci en büyük adres, tokenlerin %40,69’unu elinde tutarken, üçüncü en büyük adresin kontrolü %26,61 seviyesinde.

Bu yoğunlaşma, olası piyasa manipülasyonu ve fiyat oynaklığı riskini artırıyor. Tokenlerin büyük bir kısmının az sayıda adreste toplanması, büyük işlemlerin RESOLV’un piyasa dinamiklerinde ani değişimlere yol açabileceği anlamına geliyor. Varlıkların merkezileşmiş olması, merkeziyetsizlik düzeyini azaltıyor ve yönetim ile dayanıklılık açısından risk oluşturuyor.

Mevcut dağılım, zincir üstü yapının potansiyel olarak istikrarsız olabileceğine de işaret ediyor. Birkaç büyük sahibin hakimiyeti, piyasa belirsizliğini ve ani fiyat hareketlerine karşı hassasiyeti artırıyor; özellikle bu sahiplerden biri pozisyonunu tasfiye ederse.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x40e1...521a36 | 29.379,26K | 2,93% |

| 2 | 0x6025...dc4a0f | 406.964,80K | 40,69% |

| 3 | 0x47e2...f2e4af | 266.133,00K | 26,61% |

| 4 | 0xf977...41acec | 76.769,97K | 7,67% |

| 5 | 0xfe4b...2e5e23 | 48.341,54K | 4,83% |

| - | Diğerleri | 172.411,44K | 17,27% |

II. RESOLV’un Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Tarihsel Modeller: Geçmişteki arz değişiklikleri, token yakımları ve yükseltmeler RESOLV fiyatını ve piyasa dinamiklerini doğrudan etkiledi.

- Güncel Etki: Protokolün gelişimi ve ekosistem olaylarına bağlı olarak mevcut arz değişikliklerinin fiyat üzerinde etkili olması bekleniyor.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Büyük Transferler: Ana sahiplerin yaptığı büyük ölçekli transferler, RESOLV fiyatı ve piyasa duyarlılığında ciddi dalgalanmalara yol açabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özelliği: RESOLV’un enflasyonist dönemlerdeki performansı, yatırımcıların potansiyel koruma arayışına göre fiyatını etkileyebilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler ve farklı ülkelerdeki düzenleyici politikalar, RESOLV’un küresel benimsenmesini ve fiyatını etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Cross-chain Dağıtım: Resolv protokolünün planlanan zincirler arası entegrasyonu, tokenin fiyatı ve kullanım alanlarını doğrudan etkileyecek.

- Uyuşmazlık Çözümü SDK: Uyuşmazlık çözümü SDK’sı ile kullanım senaryoları ve benimsenme artışı fiyat üzerinde olumlu etki yaratabilir.

- Ekosistem Uygulamaları: Resolv ağındaki DApp ve ekosistem projeleri, RESOLV’un değerinin ve fiyat eğrisinin şekillenmesinde temel rol oynayacak.

III. 2025-2030 Dönemi için RESOLV Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,08031 - 0,09500 dolar

- Tarafsız tahmin: 0,10000 - 0,11500 dolar

- İyimser tahmin: 0,11500 - 0,12528 dolar (pozitif piyasa duyarlılığı ile)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan volatilite ile büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,08564 - 0,19982 dolar

- 2028: 0,09065 - 0,17291 dolar

- Ana katalizörler: Benimsenme, teknolojik ilerlemeler ve genel kripto trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,15847 - 0,20618 dolar (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: 0,20618 - 0,25000 dolar (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,25000 - 0,27490 dolar (çığır açan benimsenme ve olumlu piyasa ile)

- 2030-12-31: RESOLV 0,18829 dolar (potansiyel yıl sonu ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,12528 | 0,10708 | 0,08031 | 0 |

| 2026 | 0,15568 | 0,11618 | 0,11153 | 8 |

| 2027 | 0,19982 | 0,13593 | 0,08564 | 26 |

| 2028 | 0,17291 | 0,16788 | 0,09065 | 56 |

| 2029 | 0,20618 | 0,1704 | 0,15847 | 58 |

| 2030 | 0,2749 | 0,18829 | 0,13933 | 75 |

IV. RESOLV Profesyonel Yatırım Stratejisi ve Risk Yönetimi

RESOLV Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Kripto piyasasında temkinli getiri arayanlar

- Öneriler:

- Piyasa düşüşlerinde RESOLV token biriktirin

- Büyüme potansiyelinden yararlanmak için minimum 1-2 yıl elinizde tutun

- Tokenleri güvenli, gözetim dışı bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend, destek ve direnç seviyelerini belirler

- RSI (Relative Strength Index): Aşırı alım/aşırı satım bölgelerini takip edin

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Teknik göstergelere göre net giriş ve çıkış noktaları belirleyin

- Kayıpları sınırlamak için zarar durdur emirleri kullanın

RESOLV Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Ilımlı yatırımcı: Kripto portföyünün %3-5’i

- Agresif yatırımcı: Kripto portföyünün %5-10’u

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı DeFi protokollerine yatırım yapın

- Stablecoin eşleştirmesi: Volatiliteyi azaltmak için RESOLV/stablecoin paritesi değerlendirin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı kullanın

- Güvenlik: İki aşamalı doğrulamayı etkinleştirin, güçlü şifreler kullanın ve yazılımı düzenli güncelleyin

V. RESOLV için Potansiyel Riskler ve Zorluklar

RESOLV Piyasa Riskleri

- Oynaklık: Yeni bir proje olarak RESOLV, yüksek fiyat dalgalanmalarına açık

- Rekabet: Getiri sağlayan protokollerin artışı benimsenmeyi etkileyebilir

- Likidite: Düşük işlem hacmi, büyük işlemlerde fiyat kaymasına yol açabilir

RESOLV Düzenleyici Riskler

- Stablecoin düzenlemeleri: Stablecoin projeleri üzerinde olası regülasyon baskısı

- DeFi denetimi: Merkeziyetsiz finans alanında değişen düzenleyici ortam

- Sınır ötesi sınırlamalar: Farklı coğrafyalarda farklı yasal statüler

RESOLV Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda olası güvenlik zafiyetleri

- Ağ tıkanıklığı: Ethereum ana ağındaki yüksek gas ücretleri kullanıcı deneyimini olumsuz etkileyebilir

- İşbirliği zorlukları: Zincirler arası entegrasyon riskleri

VI. Sonuç ve Eylem Önerileri

RESOLV Yatırım Değeri Değerlendirmesi

RESOLV, getiri sağlayan stablecoin alanında benzersiz bir fırsat sunuyor ve güçlü büyüme potansiyeli barındırıyor. Yatırımcılar projenin erken aşamasında olduğunu ve riskleri göz önünde bulundurmalı.

RESOLV Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük bir pozisyon açıp DeFi getiri stratejilerini öğrenmeye odaklanmalı

✅ Deneyimli yatırımcılar: DeFi portföyünün orta bir kısmını RESOLV’a ayırabilir

✅ Kurumsal yatırımcılar: Detaylı inceleme yapıp RESOLV’u çeşitlendirilmiş bir DeFi stratejisinin parçası olarak değerlendirmeli

RESOLV Katılım Yöntemleri

- Doğrudan satın alma: Gate.com üzerinden RESOLV token alın

- Getiri çiftçiliği: Desteklenen DeFi protokollerinde likidite sağlama işlemlerine katılın

- Staking: Ekstra ödül kazanmak için mevcutsa staking seçeneklerini değerlendirin

Kripto para yatırımları yüksek risk taşır; bu yazı yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk profillerine göre vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Resolv coin’in geleceği nedir?

Resolv coin’in büyüme potansiyeli yüksek; tahminler 2030’da fiyatın 0,463515 dolara ulaşabileceğini ve mevcut seviyeye göre %324’lük bir artış yaşanabileceğini gösteriyor.

2025’te hangi meme coin patlama yapacak?

Bitcoin Hyper, PEPENODE ve ApeCoin, mevcut trendler ve piyasa analizlerine göre 2025’te öne çıkacak meme coin’ler arasında gösteriliyor.

Hamster Kombat coin 1 dolara ulaşır mı?

Hamster Kombat son dönemde yükselse de, 1 dolara ulaşması henüz kesinleşmedi. Mevcut trendler ve analist tahminleri bu potansiyeli doğrulamıyor; piyasa oynaklığı da belirsizliği artırıyor.

En yüksek fiyat tahmini hangi kripto parada?

Bitcoin, en yüksek fiyat tahminiyle 140.652 dolara ulaşabilir. Chainlink ise 62,60 dolarla en yüksek tahmine sahip ikinci kripto para.

ENA ile CRO: İki Önde Gelen Genomik Veri Deposu Arasında Karşılaştırmalı Bir Analiz

FeiUSD (FEI) yatırım için uygun mu?: Bu stablecoin'in değişken kripto piyasasındaki potansiyelini ve risklerini değerlendiriyoruz

GHO (GHO) iyi bir yatırım mı?: Aave'nin yeni stablecoin'inin potansiyeli ve risklerinin incelenmesi

2025 yılında ENA'nın mevcut piyasa durumu nedir?

2025 RSR Fiyat Tahmini: Dalgalı Kripto Piyasasında Reserve Rights Token'ın Geleceğine Yön Vermek

JST ve SNX: DeFi Ekosisteminde İki Sentetik Varlık Protokolünün Karşılaştırmalı Analizi

Dropee Günlük Kombinasyonu 9 Aralık 2025

Tomarket Günlük Kombinasyonu 9 Aralık 2025

Web3 Dünyasında Gerçek Varlıkların Tokenleştirilmesi Fırsatlarını Keşfedin

Lüks tutkunlarına özel, yat konseptli NFT koleksiyonlarını keşfedin

Verimli Kripto Musluk Yönetimi İçin En İyi Araçlar