GOATED vs BTC: Comparing the Future of Digital Assets and Cryptocurrencies

Introduction: Investment Comparison between GOATED and BTC

In the cryptocurrency market, the comparison between GOATED vs BTC has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

GOATED (GOATED): Since its launch in 2025, it has gained market recognition for its Bitcoin-native ZK Rollup technology and sustainable BTC yield generation.

Bitcoin (BTC): Since its inception in 2008, it has been hailed as "digital gold" and is one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between GOATED vs BTC, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

GOATED and BTC Historical Price Trends

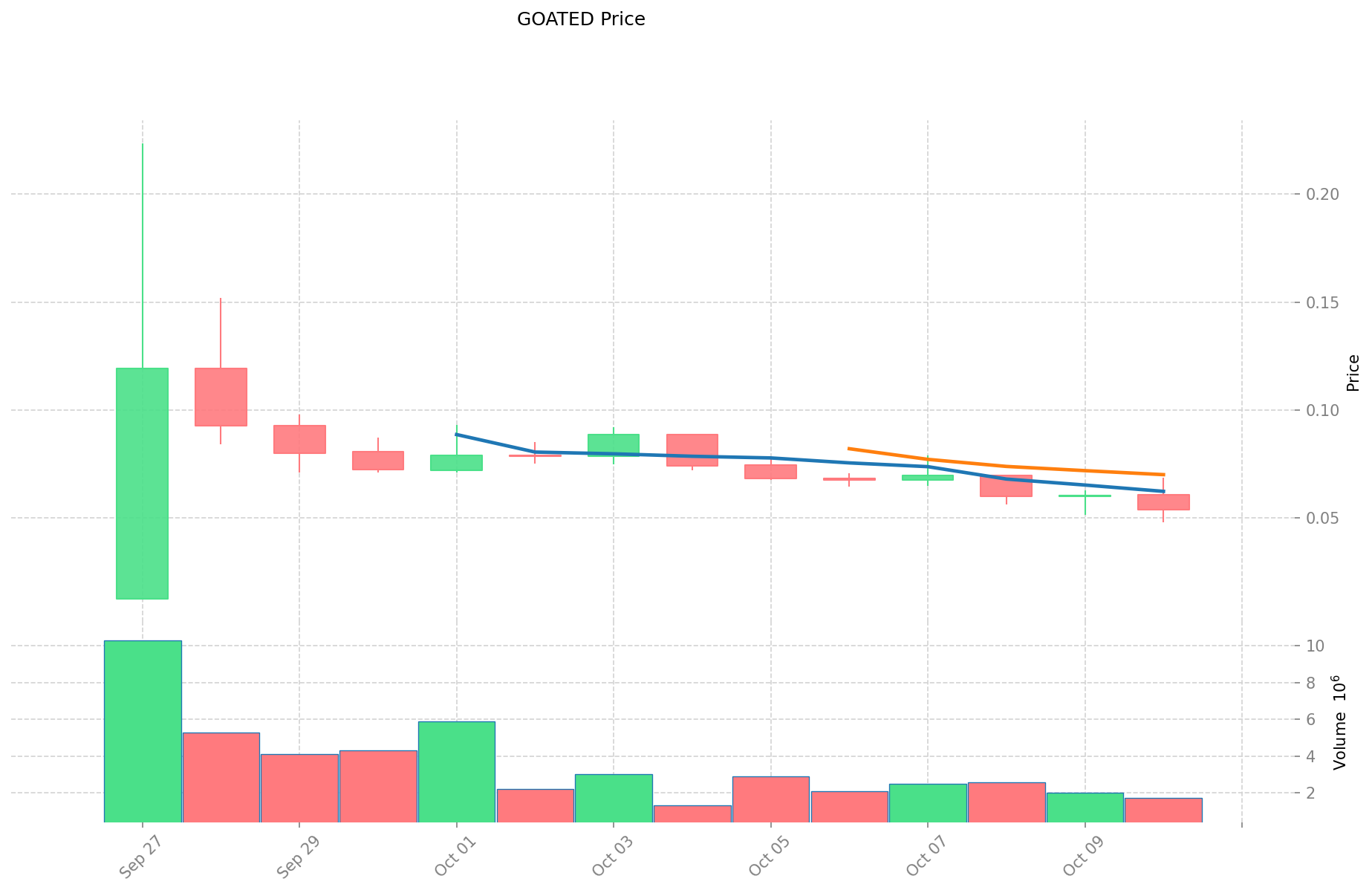

- 2025: GOATED reached its all-time high of $0.22367 on September 27.

- 2025: BTC hit a new all-time high of $126,080 on October 7.

- Comparative analysis: In this market cycle, GOATED has dropped from its high of $0.22367 to a current price of $0.05543, while BTC has shown more stability, currently trading at $111,951.1.

Current Market Situation (2025-10-11)

- GOATED current price: $0.05543

- BTC current price: $111,951.1

- 24-hour trading volume: $108,700.75 for GOATED vs $3,405,016,849.62 for BTC

- Market Sentiment Index (Fear & Greed Index): 27 (Fear)

Click to view real-time prices:

- View GOATED current price Market Price

- View BTC current price Market Price

II. Core Factors Affecting GOATED vs BTC Investment Value

Supply Mechanism Comparison (Tokenomics)

- GOATED: Value derived from real transaction fees, liquidity pools, and restaking - transparent, traceable, with BTC's security

- BTC: Fixed supply capped at approximately 19.87 million coins, with deflationary characteristics through halving events

- 📌 Historical Pattern: BTC has shown significant volatility yet steady growth over time with returns up to 340x from 2015-2025

Institutional Adoption and Market Applications

- Institutional Holdings: BTC ETFs continue to attract new investments while gold ETFs have experienced outflows

- Enterprise Adoption: BTC increasingly viewed as "digital crisis hedging tool" rather than just "digital gold"

- National Policies: US exploring national crypto reserve policies and clearer tax frameworks; EU advancing MiCA regulations

Technical Development and Ecosystem Building

- GOATED Technical Upgrades: ZK Rollup and BitVM2 technologies enable bridging BTC to Layer2, allowing direct DeFi participation

- BTC Technical Development: Evolution from value store to DeFi enabler through GOAT Network's innovations

- Ecosystem Comparison: GOATED redefines BTC's role in DeFi and smart contracts, creating sustainable BTC yield opportunities

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: BTC showing stronger appreciation than gold (38%) in inflationary environments

- Macroeconomic Monetary Policy: High interest rates (4.25-4.50%) creating pressure on traditional markets while supporting BTC growth

- Geopolitical Factors: Trade disputes and conflicts increasing appeal of both assets, with younger investors increasingly preferring BTC over traditional safe havens

III. 2025-2030 Price Prediction: GOATED vs BTC

Short-term Prediction (2025)

- GOATED: Conservative $0.038628 - $0.05365 | Optimistic $0.05365 - $0.076183

- BTC: Conservative $108,800.244 - $112,165.2 | Optimistic $112,165.2 - $130,111.632

Mid-term Prediction (2027)

- GOATED may enter a growth phase, expected price range $0.053078976225 - $0.079233834075

- BTC may enter a bullish market, expected price range $69,291.173952 - $175,117.6941696

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- GOATED: Base scenario $0.068509216159091 - $0.11231019042474 | Optimistic scenario $0.11231019042474 - $0.15948047040313

- BTC: Base scenario $156,478.6115255405952 - $186,284.06133992928 | Optimistic scenario $186,284.06133992928 - $236,580.7579017101856

Disclaimer

GOATED:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.076183 | 0.05365 | 0.038628 | -3 |

| 2026 | 0.088935605 | 0.0649165 | 0.06231984 | 17 |

| 2027 | 0.079233834075 | 0.0769260525 | 0.053078976225 | 38 |

| 2028 | 0.1030655251395 | 0.0780799432875 | 0.044505567673875 | 40 |

| 2029 | 0.13404764663598 | 0.0905727342135 | 0.0724581873708 | 63 |

| 2030 | 0.15948047040313 | 0.11231019042474 | 0.068509216159091 | 102 |

BTC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 130111.632 | 112165.2 | 108800.244 | 0 |

| 2026 | 130829.48928 | 121138.416 | 76317.20208 | 8 |

| 2027 | 175117.6941696 | 125983.95264 | 69291.173952 | 12 |

| 2028 | 179155.479851712 | 150550.8234048 | 105385.57638336 | 34 |

| 2029 | 207714.97105160256 | 164853.151628256 | 146719.30494914784 | 47 |

| 2030 | 236580.7579017101856 | 186284.06133992928 | 156478.6115255405952 | 66 |

IV. Investment Strategy Comparison: GOATED vs BTC

Long-term vs Short-term Investment Strategy

- GOATED: Suitable for investors focused on DeFi innovation and BTC ecosystem expansion

- BTC: Suitable for investors seeking stability and inflation-hedging properties

Risk Management and Asset Allocation

- Conservative investors: GOATED: 10% vs BTC: 90%

- Aggressive investors: GOATED: 30% vs BTC: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- GOATED: Higher volatility, lower liquidity compared to BTC

- BTC: Subject to market sentiment shifts and macroeconomic factors

Technical Risk

- GOATED: Scalability, network stability

- BTC: Mining centralization, potential security vulnerabilities

Regulatory Risk

- Global regulatory policies may have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- GOATED advantages: Innovative BTC-native ZK Rollup technology, sustainable BTC yield generation

- BTC advantages: Established market leader, strong institutional adoption, proven store of value

✅ Investment Advice:

- New investors: Consider a higher allocation to BTC for stability

- Experienced investors: Explore a balanced portfolio including both BTC and GOATED

- Institutional investors: Evaluate GOATED's potential in the context of broader BTC ecosystem development

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between GOATED and BTC? A: GOATED utilizes Bitcoin-native ZK Rollup technology for sustainable BTC yield generation, while BTC is the established market leader known as "digital gold" with a fixed supply cap and deflationary characteristics.

Q2: How do the current prices of GOATED and BTC compare? A: As of 2025-10-11, GOATED's price is $0.05543, while BTC's price is $111,951.1.

Q3: What are the main factors affecting the investment value of GOATED and BTC? A: Key factors include supply mechanisms, institutional adoption, technical development, ecosystem building, and macroeconomic conditions such as inflation and geopolitical events.

Q4: What are the long-term price predictions for GOATED and BTC by 2030? A: For GOATED, the base scenario predicts $0.068509216159091 - $0.11231019042474, while for BTC, it's $156,478.6115255405952 - $186,284.06133992928.

Q5: How should investors allocate their portfolio between GOATED and BTC? A: Conservative investors might consider 10% GOATED and 90% BTC, while aggressive investors might opt for 30% GOATED and 70% BTC.

Q6: What are the main risks associated with investing in GOATED and BTC? A: Risks include market volatility, technical challenges, and regulatory uncertainties. GOATED may have higher volatility and lower liquidity compared to BTC.

Q7: Which is considered the better buy for different types of investors? A: New investors might prefer a higher allocation to BTC for stability, experienced investors could explore a balanced portfolio of both, and institutional investors should evaluate GOATED's potential within the broader BTC ecosystem.

Share

Content