FEI vs MANA: DeFi Ekosisteminde İki Merkeziyetsiz Stabilcoinin Karşılaştırılması

Giriş: FEI ile MANA Yatırımı Karşılaştırması

Kripto para piyasasında FEI ile MANA arasındaki karşılaştırma, yatırımcılar için daima gündemde olan bir başlıktır. Bu iki kripto varlık; piyasa değeri sıralaması, kullanım alanları ve fiyat performansı bakımından ciddi farklılıklar gösterdiği gibi, kripto para varlık türleri açısından da farklı konumlarda yer alır.

FEI (FEI): 2021’de piyasaya sürülmesinden itibaren merkeziyetsiz stablecoin mekanizmasıyla piyasa tarafından kabul görmüştür.

MANA (MANA): 2017’den beri blokzincir tabanlı sanal dünyaların öncüsü olarak tanınmakta ve metaverse alanının önde gelen projelerinden biri olarak kabul edilmektedir.

Bu makalede, FEI ile MANA arasındaki yatırım değerleri kapsamlı şekilde analiz edilerek; geçmiş fiyat trendleri, arz mekanizmaları, kurumsal yatırım ilgisi, teknolojik ekosistemler ve gelecek tahminleri ele alınacaktır. Ayrıca yatırımcıların en çok merak ettiği şu sorunun yanıtı aranacaktır:

"Şu anda hangisi daha avantajlı bir yatırım?"

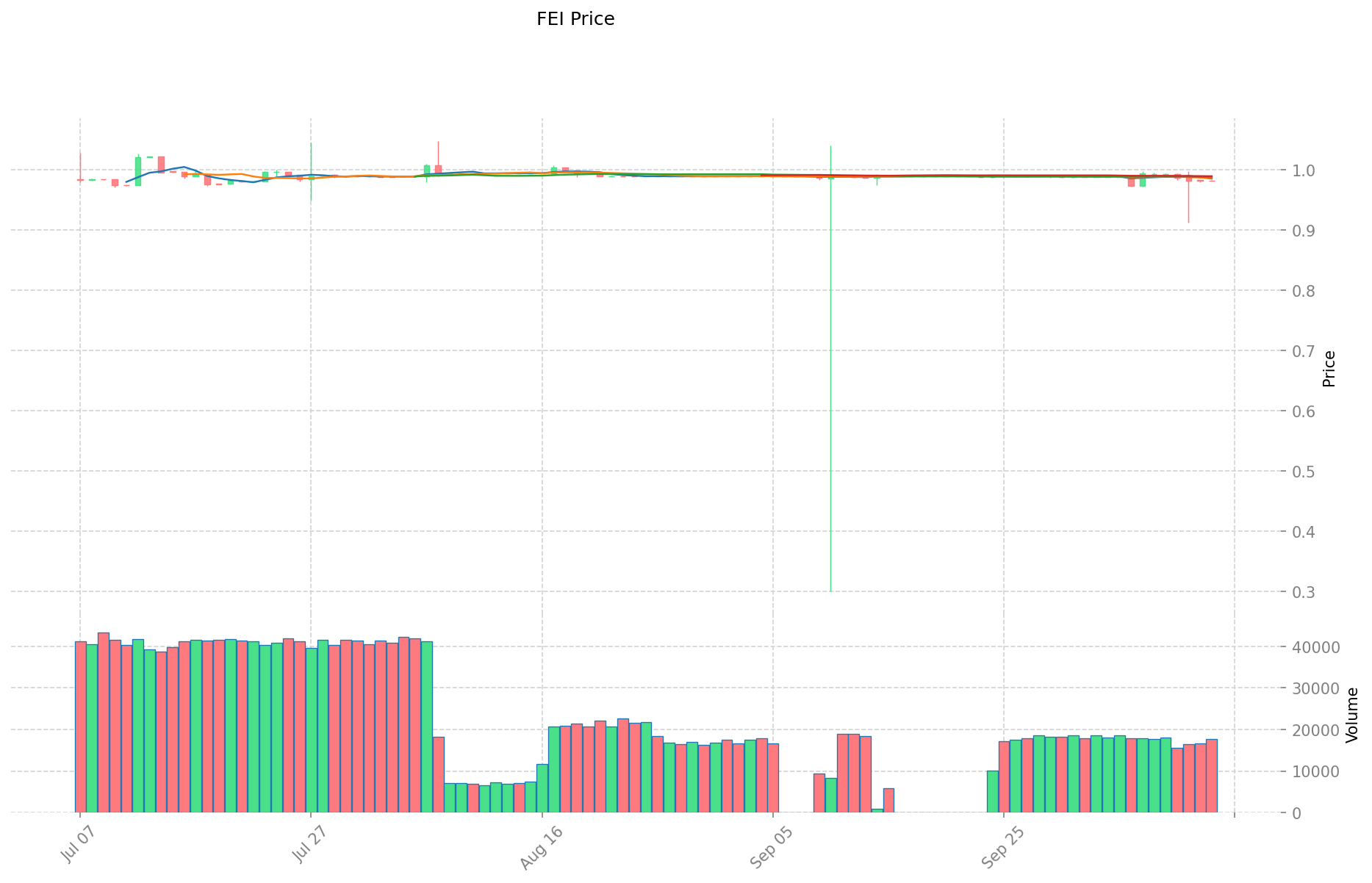

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

FEI (Coin A) ve MANA (Coin B) Geçmiş Fiyat Trendleri

- 2023: FEI, yüksek dalgalanma yaşadı ve 30 Aralık 2023’te 0,15544 $ ile dip seviyeye indi.

- 2024: MANA, kayda değer bir fiyat artışı gösterdi ve 16 Mart 2024’te 5,85 $ ile tüm zamanların zirvesine ulaştı.

- Karşılaştırmalı analiz: Son piyasa döngüsünde FEI, 5,55 $’dan 0,15544 $’a gerilerken; MANA daha istikrarlı kaldı ve şu anda 0,2837 $ seviyesinden işlem görüyor.

Güncel Piyasa Durumu (14 Ekim 2025)

- FEI güncel fiyatı: 0,9823 $

- MANA güncel fiyatı: 0,2837 $

- 24 saatlik işlem hacmi: FEI 17.423,30 $ | MANA 727.520,53 $

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 38 (Korku)

Anlık fiyatları görmek için tıklayın:

- FEI güncel fiyatını inceleyin Piyasa Fiyatı

- MANA güncel fiyatını inceleyin Piyasa Fiyatı

II. FEI ile MANA Yatırım Değerini Etkileyen Temel Unsurlar

Arz Mekanizmalarının Karşılaştırılması (Tokenomics)

- FEI: Protokol Kontrollü Değer (PCV) modeliyle rezervleri protokol yönetir ve algoritmik istikrar mekanizmaları uygular

- MANA: 2,19 milyar sabit arzlı token ve Decentraland’daki LAND alımları yoluyla deflasyonist yapı

- 📌 Tarihsel bakış: FEI istikrarı hedeflerken, MANA’nın değeri metaverse benimsenmesi ve sanal arazi talebiyle dalgalanır.

Kurumsal Benimsenme ve Piyasa Kullanımı

- Kurumsal portföyler: MANA, metaverse alanında köklü konumu sayesinde daha fazla kurumsal ilgi çekiyor

- Kurumsal işbirlikleri: MANA, büyük markalarla sanal deneyim projeleri yürütüyor; FEI ise DeFi uygulamalarına odaklanıyor

- Regülasyon yaklaşımı: Her iki varlık da farklı regülasyonlara tabi; metaverse tokenları (MANA) genellikle stablecoin’lere (FEI) göre daha az doğrudan denetimle karşılaşıyor

Teknik Gelişim ve Ekosistem Oluşturma

- FEI teknik güncellemeleri: Tribe DAO ekosistem entegrasyonu ve PCV mekanizmasının geliştirilmesi

- MANA teknik gelişimi: Decentraland platformu, metaverse altyapısı ve içerik üretici araçlarında sürekli yenilemeler

- Ekosistem karşılaştırması: MANA, Decentraland’da NFT’ler, sanal arazi ve sosyal deneyimlerle gelişmiş bir ekosistem sunarken; FEI, DeFi uygulamaları ve istikrar mekanizmalarına odaklanır

Makroekonomik Unsurlar ve Piyasa Döngüleri

- Enflasyon ortamı: FEI, enflasyona karşı istikrar için tasarlanırken; MANA, yüksek enflasyon dönemlerinde metaverse büyümesinden faydalanabilir

- Para politikası: Faiz oranları FEI’nin istikrar mekanizmasını etkiler; MANA ise teknoloji benimseme döngülerinden etkilenir

- Jeopolitik faktörler: Dijital ve sanal dünyanın yaygınlaşması MANA’yı desteklerken, ekonomik belirsizlik stablecoin’lere olan talebi artırabilir ve FEI’ye avantaj sağlayabilir

III. 2025-2030 Fiyat Tahmini: FEI ile MANA

Kısa Vadeli Tahmin (2025)

- FEI: İhtiyatlı 0,72 - 0,98 $ | İyimser 0,98 - 1,44 $

- MANA: İhtiyatlı 0,22 - 0,28 $ | İyimser 0,28 - 0,30 $

Orta Vadeli Tahmin (2027)

- FEI, büyüme dönemine girebilir, fiyat aralığı 1,14 - 1,96 $

- MANA, büyüme dönemine girebilir, fiyat aralığı 0,23 - 0,50 $

- Ana itici güçler: Kurumsal sermaye girişi, ETF’ler, ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- FEI: Temel senaryo 1,46 - 2,08 $ | İyimser senaryo 2,08 - 2,85 $

- MANA: Temel senaryo 0,53 - 0,57 $ | İyimser senaryo 0,57 - 0,64 $

Yasal Uyarı: Bu analiz, geçmiş verilere ve tahminlere dayanır. Kripto para piyasası yüksek derecede dalgalı ve öngörülemezdir. Buradaki bilgiler yatırım tavsiyesi olarak değerlendirilmemelidir. Yatırım kararlarınızda kendi araştırmanızı yapmalısınız.

FEI:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1,443834 | 0,9822 | 0,717006 | 0 |

| 2026 | 1,61331261 | 1,213017 | 1,17662649 | 23 |

| 2027 | 1,96429907895 | 1,413164805 | 1,14466349205 | 43 |

| 2028 | 1,94204173327125 | 1,688731941975 | 1,5874080254565 | 71 |

| 2029 | 2,341849020533831 | 1,815386837623125 | 1,670155890613275 | 84 |

| 2030 | 2,847706562837514 | 2,078617929078478 | 1,455032550354934 | 111 |

MANA:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,295672 | 0,2843 | 0,221754 | 0 |

| 2026 | 0,40888026 | 0,289986 | 0,24068838 | 2 |

| 2027 | 0,4961950446 | 0,34943313 | 0,2306258658 | 23 |

| 2028 | 0,583483440474 | 0,4228140873 | 0,325566847221 | 49 |

| 2029 | 0,63396744249762 | 0,503148763887 | 0,4025190111096 | 77 |

| 2030 | 0,64247065660731 | 0,56855810319231 | 0,528759035968848 | 100 |

IV. Yatırım Stratejisi Karşılaştırması: FEI ile MANA

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- FEI: DeFi uygulamaları ve istikrar mekanizmalarına odaklanan yatırımcılar için uygundur

- MANA: Metaverse potansiyeline ve sanal ekonomideki büyümeye ilgi duyan yatırımcılar için uygundur

Risk Yönetimi ve Varlık Dağılımı

- İhtiyatlı yatırımcılar: FEI %70 | MANA %30

- Agresif yatırımcılar: FEI %40 | MANA %60

- Koruma araçları: Stablecoin tahsisi, opsiyonlar, çapraz para portföyleri

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- FEI: Stablecoin piyasasında volatilite, sabitlenme kaybı riski

- MANA: Metaverse benimsenmesine ve spekülasyona bağlı yüksek volatilite

Teknik Risk

- FEI: Ölçeklenebilirlik, ağ istikrarı, akıllı sözleşme açıkları

- MANA: Platform güvenliği, sanal dünya altyapısında istikrar

Regülasyon Riski

- Küresel regülasyon politikaları stablecoin’ler (FEI) ve metaverse tokenları (MANA) üzerinde farklı etkiler yaratabilir

VI. Sonuç: Hangisi Daha Avantajlı?

📌 Yatırım Değeri Özeti:

- FEI’nin avantajları: İstikrar mekanizması, DeFi entegrasyonu, tutarlı değer potansiyeli

- MANA’nın avantajları: Yerleşik metaverse varlığı, önemli markalarla iş birlikleri, sanal ekonomilerde büyüme potansiyeli

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: İstikrar için FEI’ye hafif ağırlık verilmiş dengeli bir portföy tercih edilebilir

- Tecrübeli yatırımcılar: Piyasa geri çekilmelerinde MANA’da fırsat yatırımı yapabilir, FEI ile portföy istikrarı sağlayabilir

- Kurumsal yatırımcılar: Her iki varlığa stratejik tahsis, MANA ile uzun vadeli metaverse maruziyeti ve FEI ile likidite yönetimi

⚠️ Risk Uyarısı: Kripto para piyasası yüksek volatiliteye sahiptir. Bu makale yatırım tavsiyesi değildir. None

VII. Sıkça Sorulan Sorular

S1: FEI ile MANA arasındaki başlıca farklar nedir? C: FEI, Protokol Kontrollü Değer modeliyle fiyat istikrarı sağlamaya odaklanan bir stablecoin’dir; MANA ise Decentraland metaverse platformunda kullanılan bir tokendir. FEI istikrara odaklanırken, MANA’nın fiyatı metaverse benimsenmesi ve sanal arazi talebine göre dalgalanır.

S2: Son dönemde hangi coin daha iyi fiyat performansı gösterdi? C: MANA, son piyasa döngülerinde daha istikrarlı bir seyir izledi. FEI, 5,55 $’dan 0,15544 $’a gerilerken; MANA, Mart 2024’te 5,85 $ ile tüm zamanların en yüksek seviyesine ulaştı ve şu anda 0,2837 $’da işlem görüyor.

S3: FEI ile MANA’nın arz mekanizmaları nasıl farklılık gösteriyor? C: FEI, algoritmik istikrar mekanizmalarına sahip Protokol Kontrollü Değer modeli ile değerini korur. MANA ise 2,19 milyar sabit arzlı token ve Decentraland’da LAND alımlarından kaynaklanan deflasyonist unsurlara sahiptir.

S4: Hangi coin daha fazla kurumsal ilgi gördü? C: MANA, metaverse alanındaki güçlü konumu ve büyük markalarla sanal deneyim iş birlikleri sayesinde daha fazla kurumsal yatırımcı ilgisi görmektedir.

S5: 2030 için FEI ve MANA’da uzun vadeli fiyat tahminleri nedir? C: FEI için temel senaryo 1,46 - 2,08 $, iyimser senaryo 2,08 - 2,85 $; MANA için temel senaryo 0,53 - 0,57 $, iyimser senaryo 0,57 - 0,64 $’tır.

S6: Yatırımcılar portföy dağılımını FEI ve MANA arasında nasıl yapmalı? C: İhtiyatlı yatırımcılar FEI’ye %70, MANA’ya %30, agresif yatırımcılar ise FEI’ye %40, MANA’ya %60 oranında ağırlık verebilir. Nihai dağılım, kişisel risk toleransı ve yatırım hedeflerine göre belirlenmelidir.

S7: FEI ile MANA yatırımlarında başlıca riskler nelerdir? C: FEI için riskler stablecoin piyasasında volatilite ve sabitlenme kaybı; MANA için ise metaverse benimsenmesine ve spekülasyona bağlı yüksek volatilitedir. Her iki varlık da akıllı sözleşme açıkları ve regülasyon belirsizlikleri gibi teknik risklere maruz kalabilir.

Bitcoin Ve AUD

PAXG nedir: Altın destekli dijital varlık ve modern yatırım portföylerindeki yeri

2025 USD1 Fiyat Tahmini: Dijital para birimlerinin değerini etkileyen temel piyasa unsurlarının ayrıntılı analizi ve gelecek öngörüsü

Ondo Finance: Nedir ve ONDO Token Nasıl Çalışır

Teminatsız USDT Kredisi: Nasıl Çalışır ve Nereden Alınır

Falcon Finance (FF): Nedir ve Nasıl Çalışır

Talus Network: Web3’e Yönelik Yapay Zekâ Destekli Layer 1 Altyapı

SEC Başkanı Paul Atkins’in ICO Düzenlemesi Üzerine Değerlendirmeleri: Kripto Projeleri İçin Bilinmesi Gerekenler

Responsible Financial Innovation Act’in Temelleri: ABD Kongresi Kripto Düzenleme Rehberi

Bitcoin 94.000 Dolar Seviyesine Yükseldi: Fed’in Faiz İndirimleri Kripto Rallisinde Nasıl Rol Oynuyor?

Gate Perp DEX: Kripto Tüccarları İçin En İyi Yüksek Performanslı Merkeziyetsiz Sürekli Ticaret Platformu