2025 USD1 Fiyat Tahmini: Dijital para birimlerinin değerini etkileyen temel piyasa unsurlarının ayrıntılı analizi ve gelecek öngörüsü

Giriş: USD1’in Piyasa Pozisyonu ve Yatırım Değeri

ABD Doları’na 1:1 oranında sabit, itibari para teminatlı bir stablecoin olarak tasarlanan USD1 (USD1), 2025’teki lansmanından bu yana önemli bir gelişim göstermiştir. 2025 yılı itibarıyla USD1’in piyasa değeri 2.149.655.498 ABD Doları’na ulaşırken, yaklaşık 2.151.591.931 adet dolaşımdaki token ile fiyatı 0,9991 ABD Doları civarında seyretmektedir. Dijital dolar eşdeğeri olarak tanımlanan bu varlık, itibari para ve dijital varlıklar arasında kesintisiz işlemleri kolaylaştırmada gittikçe daha önemli bir rol üstlenmektedir.

Bu makale, 2025’ten 2030’a uzanan USD1 fiyat trendlerini; tarihsel veriler, piyasa arz ve talebi, ekosistem gelişimi ile makroekonomik faktörler çerçevesinde ayrıntılı biçimde ele alarak, yatırımcılar için profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. USD1 Fiyat Geçmişi ve Mevcut Piyasa Durumu

USD1’in Tarihsel Fiyat Gelişimi

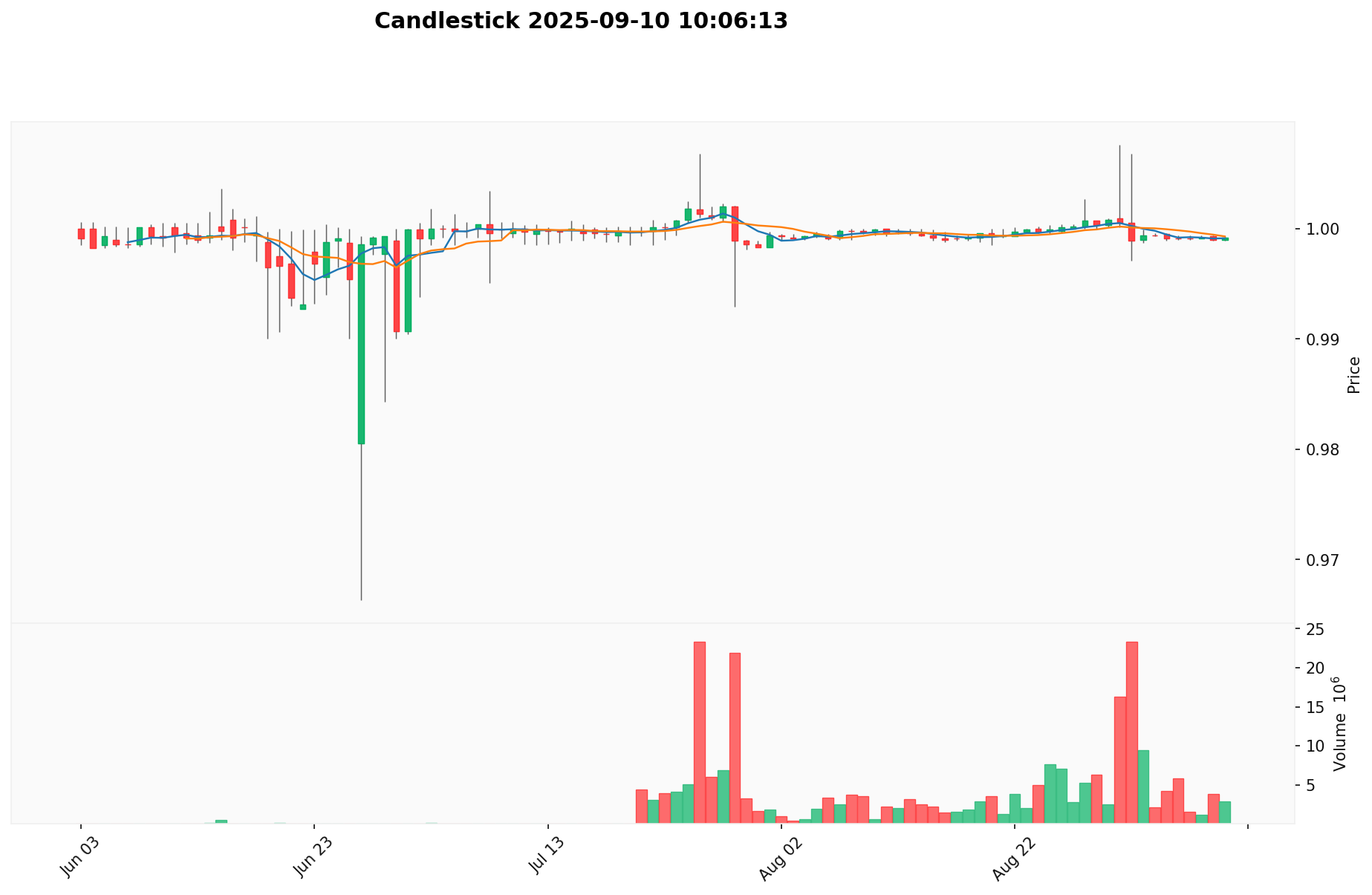

- Nisan 2025: World Liberty Financial tarafından USD1 piyasaya sürüldü, fiyat 1 ABD Doları’na sabit kaldı

- Haziran 2025: Kısa süreliğine 5.000 ABD Doları seviyesine yükseldi, hızla tekrar 1 ABD Doları’na sabitlendi

- Haziran 2025: 0,9663 ABD Doları ile en düşük seviye kaydedildi

USD1’in Güncel Piyasa Durumu

10 Eylül 2025 tarihinde USD1, ABD Doları’na sabit fiyatı olan 0,9991 ABD Doları ile işlem görmektedir ve bu sabitten yalnızca çok küçük sapmalar göstermektedir. 24 saatlik işlem hacmi 2.290.432,04 ABD Doları ile piyasada yüksek bir likidite ve katılım sergilemektedir. USD1’in piyasa değeri 2.149.655.498,26 ABD Doları olup, küresel kripto para piyasasında 63. sırada yer almakta ve %0,051’lik bir pazar payına sahiptir. Dolaşımdaki arz, toplam arz ile eşit olup, tam 2.151.591.931 USD1 tokenı dolaşımdadır. Küçük dalgalanmalara rağmen USD1, dolar sabitini korumada güçlü bir performans göstermekte; son bir saatte -%0,01, son bir haftada ise -%0,03 oranında hafif bir değişim izlenmiştir.

Güncel USD1 piyasa fiyatını görmek için tıklayın

USD1 Piyasa Duyarlılığı Endeksi

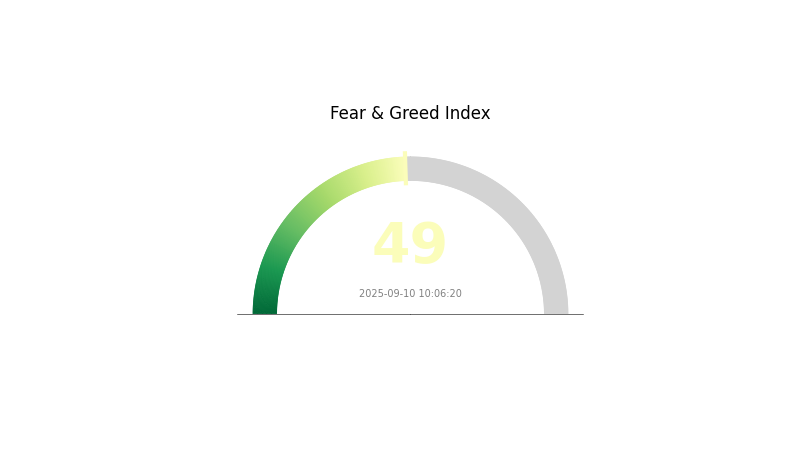

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Bugün kripto piyasasında duyarlılık dengede; Korku ve Açgözlülük Endeksi 49 olarak nötr bölgede seyrediyor. Bu durum, yatırımcıların aşırı iyimser veya karamsar olmadığını gösteriyor. Piyasada ihtiyatlı bir yaklaşım hâkimken aynı zamanda ılımlı bir iyimserlik de gözlemleniyor. Nötr bölgeler genellikle önemli fiyat hareketlerinden önce görülür; yatırımcıların teknik göstergeleri ve global ekonomik gelişmeleri dikkatle izlemeleri, sürpriz piyasa hareketlerine karşı hazırlıklı olmalarını sağlar.

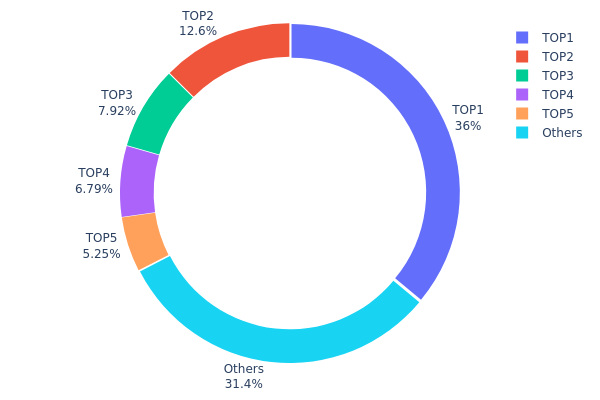

USD1 Token Dağılımı

Adres bazlı dağılım verileri, USD1 tokenlerinin cüzdanlar arasında ne kadar yoğunlaştığını göstermektedir. Analiz, USD1 piyasasında belirgin bir merkezileşme olduğunu ortaya koymaktadır. En büyük adres toplam arzın %36,02’sini elinde tutarken, en büyük beş adres USD1 tokenlerinin %68,52’sini kontrol etmektedir.

Birkaç adreste bu denli yoğun birikim, potansiyel piyasa manipülasyonu ve fiyat oynaklığına ilişkin endişeleri artırmaktadır. En büyük adresin arzın üçte birinden fazlasına sahip olması, fiyat dinamikleri üzerinde etkili olabilir. Ayrıca tokenların neredeyse %70’inin yalnızca beş adrese dağıtılmış olması, USD1 ekosisteminde merkeziyetsizliğin düşük olduğunu göstermektedir.

Böylesine konsantre bir dağılım, piyasa istikrarı ve likidite açısından risk oluşturabilir. Büyük yatırımcıların toplu alım-satım işlemleriyle fiyatlarda keskin değişimler yaşanabilir. Öte yandan, tokenların %31,48’i diğer adreslerde dağıldığı için portföy çeşitliliği açısından kısmen denge sağlanmakta ve aşırı merkezileşmenin riskleri kısmen azaltılmaktadır.

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x5be9...957dbb | 106.194,70K | 36,02% |

| 2 | 0xf977...41acec | 37.080,61K | 12,57% |

| 3 | 0xf584...72d621 | 23.335,89K | 7,91% |

| 4 | 0x36a7...d9c141 | 20.003,52K | 6,78% |

| 5 | 0x6de0...40d21f | 15.471,26K | 5,24% |

| - | Diğerleri | 92.675,28K | 31,48% |

II. USD1’in Gelecekteki Fiyatını Etkileyen Başlıca Faktörler

Arz Mekanizması

- Tam ABD Doları Teminatı: USD1’in tamamı, esas olarak ABD Hazine tahvilleri ve nakit olmak üzere ABD varlıklarıyla desteklenmektedir.

- Tarihsel Eğilim: Aylık şeffaf denetimler ve çoklu zincir dağıtımı, hızlı piyasa benimsenmesine katkı sağlamıştır.

- Güncel Etki: 1:1 ABD Doları teminatı, kurumsal ve ticari kullanımlar için güven oluşturmaktadır.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Portföyler: Abu Dabi menşeli yatırım şirketi MGX, 2 milyar ABD Doları’lık yatırım işlemi için USD1’i tercih etmiştir.

- Kurumsal Katılım: NASDAQ’ta işlem gören ALT5 Sigma, WLFI hazinesini başlatmak adına 1,5 milyar ABD Doları yatırım yapmıştır.

- Kamu Politikaları: ABD, stablecoinler için kapsamlı bir düzenleyici çerçeve oluşturacak GENIUS Yasası’nı ilerletiyor; bu yasa, USD1’in faaliyetleri ve düzenleyici uyumu açısından belirleyici olabilir.

Makroekonomik Çevre

- Para Politikası Etkisi: ABD Merkez Bankası’nın faiz ve enflasyon politikaları, USD1’in teminat varlıklarının değerini doğrudan etkilemektedir.

- Enflasyon Koruma Özelliği: ABD Doları’na sabit bir stablecoin olarak USD1’in performansı, doğrudan doların enflasyondaki gücüyle bağlantılıdır.

- Jeopolitik Faktörler: Trump ailesinin WLFI ve USD1 üzerindeki etkisi, küresel pazarlarda algı ve benimsemeyi şekillendirebilir.

Teknolojik Gelişmeler ve Ekosistem Oluşumu

- Çoklu Zincir Dağılımı: USD1, Ethereum, BNB Chain, Tron ve Solana ağlarında kullanıma sunularak erişilebilirliğini ve işlevselliğini artırmıştır.

- DeFi Entegrasyonu: Dolomite, Buildon ve Lista DAO gibi projelerle iş birliği, USD1’in merkeziyetsiz finans ekosistemlerindeki etkisini artırmaktadır.

- Ekosistem Uygulamaları: Dolomite (kredi ve marj işlemleri), Buildon (Meme projeleri ve Launchpad) ile Plume Network (rezerv varlık olarak USD1 kullanan RWA odaklı EVM zinciri) öne çıkan uygulamalardır.

III. 2025-2030 Dönemi için USD1 Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 0,61944 - 0,9991 ABD Doları

- Nötr tahmin: 0,9991 - 1,05905 ABD Doları

- İyimser tahmin: 1,05905 ABD Doları (olumlu piyasa koşulları gerektirir)

2027-2028 Beklentisi

- Piyasa fazı: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 1,15802 - 1,51912 ABD Doları

- 2028: 0,82929 - 2,01794 ABD Doları

- Başlıca tetikleyiciler: Piyasa benimsemesi, teknolojik gelişmeler

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 1,70004 - 2,00605 ABD Doları (istikrarlı piyasa büyümesi beklentisiyle)

- İyimser senaryo: 2,31206 - 2,3872 ABD Doları (güçlü piyasa performansına bağlı olarak)

- Dönüştürücü senaryo: 2,3872+ ABD Doları (aşırı olumlu piyasa şartlarında)

- 31 Aralık 2030: USD1 2,00605 ABD Doları (2025’e göre yaklaşık %100 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış (%) |

|---|---|---|---|---|

| 2025 | 1,05905 | 0,9991 | 0,61944 | 0 |

| 2026 | 1,46128 | 1,02907 | 0,71006 | 3 |

| 2027 | 1,51912 | 1,24518 | 1,15802 | 24 |

| 2028 | 2,01794 | 1,38215 | 0,82929 | 38 |

| 2029 | 2,31206 | 1,70004 | 1,30903 | 70 |

| 2030 | 2,3872 | 2,00605 | 1,18357 | 100 |

IV. USD1 Profesyonel Yatırım Stratejileri ve Risk Yönetimi

USD1 Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: İstikrara öncelik veren temkinli yatırımcılar

- Öneriler:

- Portföyün bir kısmını USD1’e ayırarak piyasa dalgalanmalarına karşı koruma sağlanabilir

- Ortalama maliyet yöntemiyle USD1 birikimi zaman içinde artırılabilir

- USD1’ler güvenli cüzdanlarda saklanıp düzenli yedek alınmalıdır

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa vadeli fiyat hareketleri izlenebilir

- RSI (Göreceli Güç Endeksi): Aşırı alım-satım bölgeleri tespit edilebilir

- Dalgalı alım-satım için ana noktalar:

- Kayıpları sınırlamak için zarar durdur emirleri kullanılabilir

- Fiyat hareketlerinin geçerliliği işlem hacmiyle kontrol edilebilir

USD1 Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %5-10

- Orta riskli yatırımcılar: %10-20

- Agresif yatırımcılar: %20-30

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırım birden çok stablecoin’e dağıtılabilir

- Teminat Yönetimi: Destek varlıkları ve teminat istikrarı düzenli olarak izlenebilir

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdanı

- Soğuk cüzdan: Yüklü varlıklar için donanım cüzdanı kullanılabilir

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifreler tercih edilmelidir

V. USD1’in Potansiyel Riskleri ve Zorlukları

USD1 Piyasa Riskleri

- Likidite riski: Büyük ölçekli geri çekilmelerde zorluklar yaşanabilir

- Rekabet riski: Daha gelişmiş stablecoin’lerin piyasaya çıkması

- İtibar riski: Olumsuz haberlerin kullanıcı güvenine etkisi

USD1 Düzenleyici Riskler

- Uyum zorlukları: Farklı ülkelerde değişen regülasyonlar

- Lisans gerekliliği: Yeni lisans süreçleri gerekebilir

- Raporlama yükümlülükleri: Regülatörlerden artan şeffaflık talepleri

USD1 Teknik Riskler

- Akıllı sözleşme açıkları: Kodlama hatası veya suistimal riski

- Blokzincir ağ yoğunluğu: İşlem gecikmeleri yaşanabilir

- Entegrasyon problemleri: Yeni platform veya protokollerde uyumluluk sorunları

VI. Sonuç ve Eylem Önerileri

USD1 Yatırım Değeri Analizi

USD1, kripto piyasasında istikrar sunarken düzenleyici baskı ve rekabetten kaynaklanan risklerle de karşılaşabilir. Uzun vadeli değer önerisi, sabitini koruması ve kullanım alanlarının gelişimine bağlıdır.

USD1 Yatırım Tavsiyeleri

✅ Yeni başlayanlar için: Kriptoya giriş aracı olarak portföyde küçük bir pay ayırılabilir

✅ Deneyimli yatırımcılar için: Kısa vadeli al-sat ve değer saklama amacıyla kullanılabilir

✅ Kurumsal yatırımcılar için: Hazine yönetimi ve riskten korunma stratejilerinin bir parçası olarak değerlendirilebilir

USD1 İşlem Katılım Yöntemleri

- Spot al-sat: USD1 Gate.com’da alınıp satılabilir

- Getiri elde etme: USD1 likidite havuzları sunan DeFi platformları değerlendirilebilir

- Ödeme aracı: USD1 uluslararası ödemeler veya e-ticarette tercih edilebilir

Kripto para yatırımları yüksek risk içerir, bu makale yatırım tavsiyesi olarak değerlendirilmemelidir. Yatırım kararlarınızı kendi risk iştahınıza göre dikkatli biçimde verin ve gerekirse profesyonel finansal danışman desteği alın. Yatırdığınız tutarın tamamını kaybetme riskini göz önünde bulundurun.

Sıkça Sorulan Sorular

2030’da USD1 için fiyat tahmini nedir?

Mevcut tahminlere göre, 2030’da USD1 fiyatının 1,28 ABD Doları olması bekleniyor. Bu öngörü, 2025’ten itibaren sürdürülebilir büyüme varsayımıyla yapılmıştır.

USD1 token yükselir mi?

Evet, USD1’in yükselmesi öngörülüyor. Mevcut tahmin modelleri, 2026’da değerinin %5 artışla 0,945 ABD Doları’na çıkacağını gösteriyor.

USD1 token ne kadar?

10 Eylül 2025 itibarıyla USD1 fiyatı 1,0001 ABD Doları’dır ve dolaşımdaki arzı 2,65 milyar token olarak belirtilmiştir.

2025 yılı için dolar fiyatı tahmini nedir?

Mevcut öngörülere göre, 2025 yılı için ABD Doları fiyatı tahmini 0,000160 ABD Doları’dır. Bu tahmin, Eylül 2025’teki son piyasa analizleri ve büyüme projeksiyonlarını yansıtmaktadır.

Falcon Finance (FF): Nedir ve Nasıl Çalışır

USD1 Coin: Nedir ve Nasıl Çalışır

2025 CRVUSD Fiyat Tahmini: Curve Stablecoin Piyasasının Geleceğine Bakış ve Belirleyici Temel Faktörler

2025 USDP Fiyat Tahmini: Küresel Stablecoin Ekosisteminde Pax Dollar’ın Piyasa Trendleri ve Gelecekteki Beklentilerinin Analizi

2025 BPrice Tahmini: Piyasa Eğilimleri ve Gelecekteki Değerlemeleri Belirleyen Temel Faktörlerin Analizi

GUSD: Kripto piyasasında güvenilir bir stablecoin varlık yönetim aracı.

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması