ASK ve GMX: İş İletişimi İçin İki Lider E-posta Sağlayıcısının Karşılaştırılması

Giriş: ASK ve GMX Yatırımlarının Karşılaştırılması

Kripto para piyasasında, ASK ve GMX karşılaştırması, yatırımcıların gündeminden hiç düşmeyen bir başlıktır. Her iki proje, piyasa değeri sıralaması, kullanım alanları ve fiyat performansı bakımından net farklılıklar gösterirken, kripto varlıklar evreninde de özgün bir konumlanmaya sahiptir.

ASK (ASK): Piyasaya girdiği günden itibaren, film ve televizyon eğlence sektörüne sunduğu katkı ile piyasa tarafından kabul görmüştür.

GMX (GMX): Lansmanından bu yana merkeziyetsiz sürekli vadeli işlemler borsası olarak öne çıkmış, yüksek işlem hacmi ve piyasa değeriyle dikkat çeken kripto paralardan biri olmuştur.

Bu makalede, ASK ve GMX’in yatırım değerleri; tarihsel fiyat hareketleri, arz mekanizmaları, kurumsal adaptasyon, teknik ekosistemler ve gelecek öngörüleri temelinde kapsamlı şekilde analiz edilecek, yatırımcıların en çok merak ettiği şu soruya ışık tutulacaktır:

"Şu anda en avantajlı yatırım hangisi?"

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

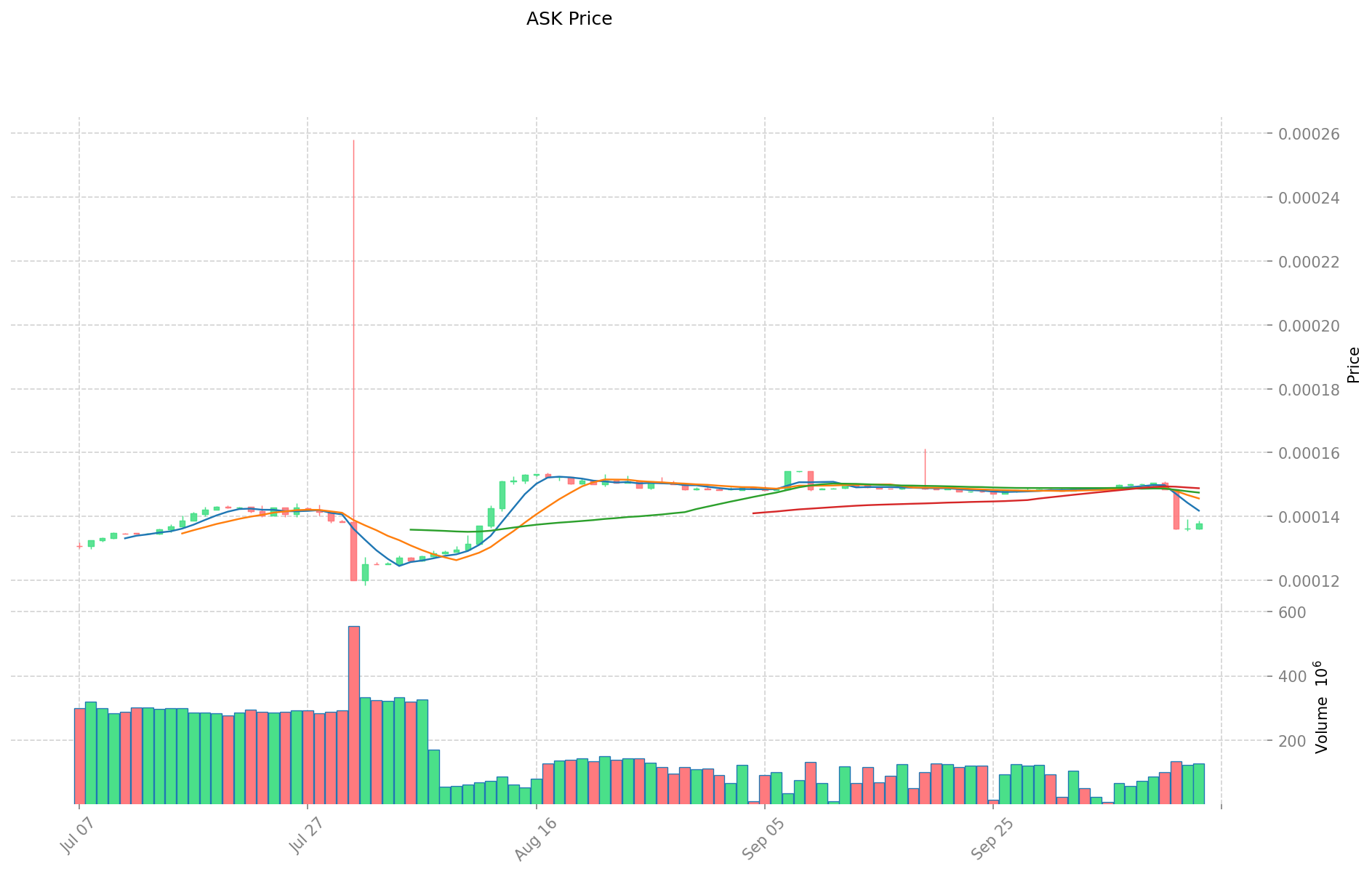

ASK (Coin A) ve GMX (Coin B) Tarihsel Fiyat Seyri

- 2024: ASK, 27 Ekim 2024’te 0,00005915 $ ile tüm zamanların en düşük seviyesini gördü.

- 2023: GMX, 18 Nisan 2023’te 91,07 $ ile tüm zamanların en yüksek değerine ulaştı.

- Kıyaslama: Döngü boyunca, ASK 0,00845153 $’dan 0,00005915 $’a kadar değer kaybederken, GMX de 91,07 $’dan 11,87 $’a geriledi.

Güncel Piyasa Durumu (14 Ekim 2025)

- ASK güncel fiyat: 0,00013778 $

- GMX güncel fiyat: 11,87 $

- 24 saatlik işlem hacmi: ASK 17.542,17 $ – GMX 233.840,73 $

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 38 (Korku)

Canlı fiyatları görmek için tıklayın:

- ASK anlık fiyatı Piyasa Fiyatı

- GMX anlık fiyatı Piyasa Fiyatı

II. ASK ve GMX Yatırım Değerini Belirleyen Temel Faktörler

Arz Mekanizması Karşılaştırması (Tokenomik)

- ASK: Maksimum 1 milyar token arzı bulunur ve önemli bir bölümü (%24) airdrop ve token yakımlarına ayrılarak deflasyonist baskı yaratılır.

- GMX: Maksimum 13,25 milyon token ile sabit arz söz konusu olup, zamanla azalan emisyon programı doğal kıtlık sağlar.

- 📌 Tarihsel eğilim: Deflasyonist tokenlar (ASK gibi) boğa piyasalarında değer kazanırken, GMX’in sınırlı arzı da dalgalı dönemlerde fiyatı desteklemiştir.

Kurumsal Benimseme ve Piyasa Kullanımları

- Kurumsal portföyler: GMX, oturmuş gelir modeli ve türev ekosistemiyle kurumlardan daha fazla ilgi görüyor.

- Kurumsal kullanım: GMX, kurumsal işlem ve takas için daha ileri çapraz zincir altyapısına sahipken, ASK ağırlıkla bireysel yatırımcı hedefler.

- Düzenleyici yaklaşım: Her iki proje de düzenleyici denetime tabi olmakla birlikte, GMX’in türev piyasasındaki etkinliği nedeniyle daha yoğun gözetim altındadır.

Teknik Gelişim ve Ekosistem Oluşturma

- ASK teknik geliştirmeleri: Yatırımcılara özel alım-satım önerileri ve risk yönetimi için yapay zeka tabanlı fonksiyonlar geliştiriliyor.

- GMX teknik geliştirmeleri: GMX V2 ile daha iyi sermaye verimliliği ve aralık limitli emirler gibi ileri işlem özellikleri sunuldu.

- Ekosistem karşılaştırması: GMX, kanıtlanmış gelir üretimiyle güçlü bir DeFi altyapısına sahipken; ASK, yapay zeka ve kullanıcı dostu işlem deneyimiyle yeni bir ekosistem inşa ediyor.

Makroekonomik ve Piyasa Döngüleri

- Enflasyonist ortamlarda dayanıklılık: GMX, gelir paylaşım modeliyle ayı piyasalarında daha güçlü durmuştur.

- Makro para politikası: Faiz artırımları, yeni tokenlarda (ASK gibi) daha olumsuz etki yaratırken, GMX gibi köklü protokoller daha dirençli kalmıştır.

- Jeopolitik faktörler: Sınır ötesi işlem talebi her iki platforma da katkı sağlarken, GMX’in küresel erişimi daha yaygındır.

III. 2025-2030 Fiyat Tahmini: ASK vs GMX

Kısa Vadeli Tahmin (2025)

- ASK: Muhafazakâr 0,00008265 $ – 0,00013775 $ | İyimser 0,00013775 $ – 0,0001473925 $

- GMX: Muhafazakâr 9,877 $ – 11,9 $ | İyimser 11,9 $ – 14,518 $

Orta Vadeli Tahmin (2027)

- ASK, büyüme fazına girebilir ve fiyatların 0,000108240093 $ – 0,000155687805 $ aralığında olması bekleniyor.

- GMX, yükseliş trendine girebilir ve fiyatların 11,7916743 $ – 21,9414699 $ bandında gerçekleşmesi öngörülüyor.

- Başlıca etkenler: Kurumsal sermaye girişi, ETF etkisi, ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- ASK: Temel senaryo 0,000128136242914 $ – 0,000180473581569 $ | İyimser senaryo 0,000180473581569 $ – 0,000220177769515 $

- GMX: Temel senaryo 19,588675727592562 $ – 23,04550085599125 $ | İyimser senaryo 23,04550085599125 $ – 31,111426155588187 $

Uyarı: Tahminler tarihsel veriler ve güncel piyasa trendlerine dayanmaktadır. Kripto para piyasaları aşırı dalgalanabilir ve hızla değişebilir. Bu bilgiler yatırım tavsiyesi değildir. Yatırım öncesinde kendi araştırmanızı yapmalısınız.

ASK:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0.0001473925 | 0.00013775 | 0.00008265 | 0 |

| 2026 | 0.00015397695 | 0.00014257125 | 0.000082691325 | 3 |

| 2027 | 0.000155687805 | 0.0001482741 | 0.000108240093 | 7 |

| 2028 | 0.000171738476325 | 0.0001519809525 | 0.0001459017144 | 10 |

| 2029 | 0.000199087448727 | 0.000161859714412 | 0.000135962160106 | 17 |

| 2030 | 0.000220177769515 | 0.000180473581569 | 0.000128136242914 | 30 |

GMX:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 14.518 | 11.9 | 9.877 | 0 |

| 2026 | 16.64334 | 13.209 | 7.52913 | 11 |

| 2027 | 21.9414699 | 14.92617 | 11.7916743 | 25 |

| 2028 | 20.4615401445 | 18.43381995 | 15.484408758 | 55 |

| 2029 | 26.6433216647325 | 19.44768004725 | 10.3072704250425 | 63 |

| 2030 | 31.111426155588187 | 23.04550085599125 | 19.588675727592562 | 94 |

IV. Yatırım Stratejilerinin Karşılaştırılması: ASK vs GMX

Uzun Vadeli ve Kısa Vadeli Yatırım Yaklaşımları

- ASK: Yapay zeka entegrasyonu ve eğlence sektöründeki büyüme potansiyeline odaklanan yatırımcılar için ideal

- GMX: Güçlü DeFi altyapısı ve kanıtlanmış gelir modelleriyle istikrarlı büyüme arayanlar için uygun

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar: %20 ASK – %80 GMX

- Agresif yatırımcılar: %40 ASK – %60 GMX

- Koruma araçları: Stablecoin tahsisi, opsiyonlar, çoklu para portföyleri

V. Potansiyel Risklerin Karşılaştırılması

Piyasa Riskleri

- ASK: Daha düşük piyasa değeri ve işlem hacmi nedeniyle daha yüksek volatiliteye sahip

- GMX: Genel DeFi piyasasındaki dalgalanmalar ve türev işlemlerden doğan risklere açık

Teknik Riskler

- ASK: Ölçeklenebilirlik, ağ istikrarı ve yapay zeka entegrasyonunda teknik zorluklar

- GMX: Akıllı kontrat açıkları ve zincirler arası işlem riskleri

Düzenleyici Riskler

- Küresel düzenleyici politikalar, GMX’in türev piyasasındaki etkinliği nedeniyle daha hızlı etki gösterebilir

VI. Sonuç: En İyi Yatırım Seçeneği Hangisi?

📌 Yatırım Değeri Özeti:

- ASK avantajları: Yapay zeka tabanlı işlemde büyüme potansiyeli ve deflasyonist token yapısı

- GMX avantajları: Güçlü gelir modeli, kurumsal benimseme ve piyasa dalgalanmalarına karşı kanıtlanmış direnç

✅ Yatırım Önerileri:

- Yeni yatırımcılar: Potansiyel büyüme için ASK’a küçük, istikrar için GMX’e daha yüksek oran ayırmayı düşünebilir

- Deneyimli yatırımcılar: Portföyü ASK ve GMX arasında risk profiline ve piyasa koşullarına göre dengeleyebilir

- Kurumsal yatırımcılar: GMX’in kurumsal altyapısı ve ileri düzey işlem olanakları öne çıkar

⚠️ Risk Uyarısı: Kripto para piyasaları aşırı oynaktır. Bu makale yatırım tavsiyesi değildir. None

SSS

S1: ASK ve GMX’in temel farkları nelerdir?

C: ASK, film ve televizyon eğlence sektörüne odaklanmış olup yapay zeka entegrasyonunu öne çıkarır. GMX ise merkeziyetsiz sürekli vadeli işlemler borsası olarak oturmuş bir DeFi altyapısına sahiptir. ASK’ın maksimum arzı 1 milyar token ve deflasyonist yapısı varken, GMX’in sabit arzı 13,25 milyon token’dır. GMX’in işlem hacmi, piyasa değeri ve kurumsal adaptasyonu daha yüksektir.

S2: Tarihsel olarak hangi coin daha iyi performans gösterdi?

C: GMX, tarihsel olarak daha iyi performans sergilemiştir. Nisan 2023’te 91,07 $ ile zirveye ulaşırken; ASK, Ekim 2024’te 0,00005915 $ ile dip seviyesini gördü. GMX, ayı piyasalarında da daha fazla direnç göstermiştir.

S3: ASK ve GMX’in güncel fiyatları ve piyasa koşulları nedir?

C: 14 Ekim 2025 itibarıyla ASK 0,00013778 $, GMX 11,87 $ seviyesindedir. ASK’ın 24 saatlik işlem hacmi 17.542,17 $, GMX’in ise 233.840,73 $’tır. Piyasa duyarlılık endeksi 38’de ve korku seviyesindedir.

S4: ASK ve GMX’in arz mekanizmaları nasıl karşılaştırılır?

C: ASK’ın maksimum 1 milyar token arzının %24’ü airdrop ve yakım için ayrılmış, deflasyonist baskı oluşturulmuştur. GMX’in ise sabit 13,25 milyon token arzı, zamanla azalan emisyon programı sayesinde doğal kıtlık sağlar.

S5: 2030’da ASK ve GMX’in fiyatları için öngörüler nelerdir?

C: ASK için temel senaryo 0,000128136242914 $ – 0,000180473581569 $, iyimser senaryo ise 0,000180473581569 $ – 0,000220177769515 $ aralığındadır. GMX’te temel senaryo 19,588675727592562 $ – 23,04550085599125 $, iyimser senaryo ise 23,04550085599125 $ – 31,111426155588187 $’dır.

S6: Yatırımcılar portföylerini ASK ve GMX arasında nasıl dağıtmalı?

C: Temkinli yatırımcılar %20 ASK, %80 GMX; daha agresif yatırımcılar %40 ASK, %60 GMX oranı düşünebilir. Yeni başlayanlar büyüme için ASK’ı düşük, istikrar için GMX’i yüksek oranda portföye ekleyebilir.

S7: ASK ve GMX yatırımlarında başlıca riskler nedir?

C: ASK, düşük piyasa değeri ve hacmi nedeniyle daha volatil, ayrıca yapay zeka entegrasyonunda teknik riskler barındırıyor. GMX ise geniş DeFi piyasası dalgalanmalarına, türev işlem ve akıllı kontrat risklerine maruz kalır. Her iki proje de düzenleyici risklere tabidir, GMX’in türev piyasasındaki rolü nedeniyle regülasyon etkisi daha hızlı hissedilebilir.

2025 JOE Fiyat Tahmini: Trader Joe’nun Yerel Token’ı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Aark (AARK) iyi bir yatırım mı?: Bu Yükselen Kripto Paranın Potansiyelini ve Risklerini Değerlendirmek

BLZ vs GMX: İki Önde Gelen Bulut Servis Sağlayıcısının Kapsamlı Analizi

DIAM ve GMX: Likiditeyi ve işlem verimliliğini artırmaya yönelik iki önde gelen merkeziyetsiz borsa protokolünün karşılaştırılması

ASTER'ın sermaye akışı, 2025 yılında piyasa eğilimini nasıl yansıtıyor?

2025 WOO Fiyat Tahmini: WOO Network'ün Gelecekteki Değerine Yönelik Piyasa Trendleri ve Uzman Tahminlerinin Analizi

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025