2025 JOEPrice Prediction: Analyzing Market Trends and Growth Potential for Trader Joe's Native Token

Introduction: JOE's Market Position and Investment Value

JOE (JOE), as a governance token for the one-stop decentralized trading platform on the Avalanche network, has made significant strides since its inception. As of 2025, JOE's market capitalization has reached $64,718,737, with a circulating supply of approximately 402,980,933 tokens, and a price hovering around $0.1606. This asset, known as the "DeFi Swiss Army Knife" of Avalanche, is playing an increasingly crucial role in decentralized finance and trading.

This article will provide a comprehensive analysis of JOE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. JOE Price History Review and Current Market Status

JOE Historical Price Evolution

- 2021: JOE launched, price reached all-time high of $5.09 on November 21

- 2022: Market downturn, price declined significantly

- 2023-2025: Gradual recovery and stabilization, price fluctuating between $0.10 and $0.20

JOE Current Market Situation

As of September 28, 2025, JOE is trading at $0.1606, with a 24-hour trading volume of $51,103.56. The token has experienced a 3.4% decrease in the last 24 hours. JOE's market cap currently stands at $64,718,737.99, ranking it 583rd in the cryptocurrency market.

The token has shown mixed performance across different timeframes. While it has gained 1.95% in the past hour, it has declined by 14.71% over the last week. However, JOE has seen a 4.79% increase over the past 30 days, indicating some positive momentum in the medium term.

JOE's current price is significantly below its all-time high of $5.09, achieved on November 21, 2021. The token's all-time low was $0.02658814, recorded on August 11, 2021. With a circulating supply of 402,980,933.9325009 JOE tokens and a total supply of 499,707,962.2721376, the project has a circulating supply ratio of 80.59%.

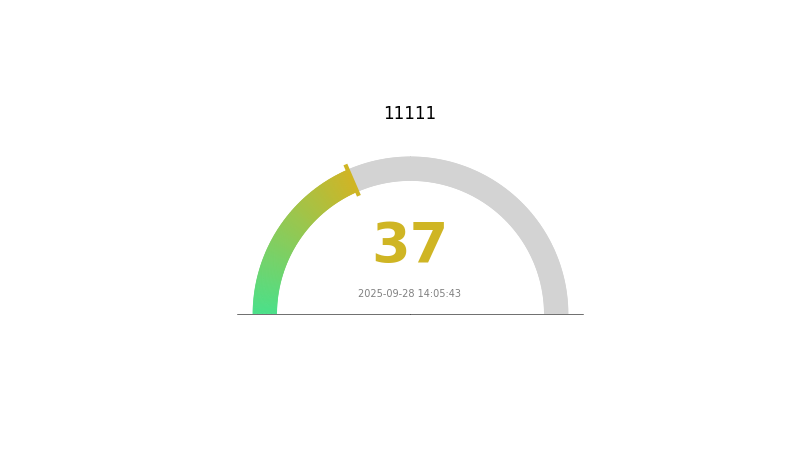

The market sentiment for cryptocurrencies is currently cautious, with the Fear and Greed Index showing a "Fear" reading of 37, suggesting a relatively pessimistic outlook among investors.

Click to view the current JOE market price

Here's the formatted output in English:

JOE Market Sentiment Indicator

2025-09-28 Fear and Greed Index: 37 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 37, indicating a state of fear. This suggests investors are proceeding with caution, potentially creating buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. As always, conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto market.

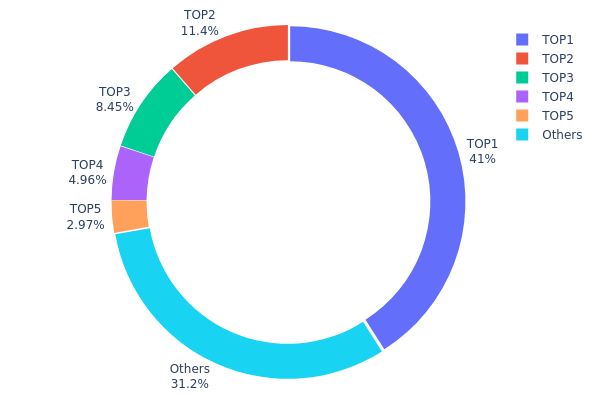

JOE Holdings Distribution

The address holdings distribution data for JOE reveals a significant concentration of tokens among a few top addresses. The top address holds a substantial 40.97% of the total supply, with the top five addresses collectively controlling 68.76% of JOE tokens. This high concentration raises concerns about the token's decentralization and potential market manipulation risks.

Such a concentrated distribution could lead to increased price volatility and susceptibility to large-scale sell-offs or accumulations. The dominant position of the top holder, owning over 40% of the supply, gives them considerable influence over the token's market dynamics. This concentration may also impact governance decisions if JOE incorporates on-chain voting mechanisms.

While a certain degree of concentration is common in many cryptocurrencies, the current distribution of JOE suggests a relatively centralized ownership structure. This could potentially affect market stability and may require careful monitoring by investors and traders to assess the associated risks and opportunities in the JOE market.

Click to view the current JOE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1a73...43cb51 | 204741.08K | 40.97% |

| 2 | 0xd858...2410ee | 57074.78K | 11.42% |

| 3 | 0x4aef...a013e8 | 42248.36K | 8.45% |

| 4 | 0x8f38...dd032d | 24779.25K | 4.95% |

| 5 | 0x5a52...70efcb | 14852.03K | 2.97% |

| - | Others | 156012.46K | 31.24% |

II. Key Factors Affecting JOE's Future Price

Supply Mechanism

- Inflation and Monetary Policy: The Federal Reserve's interest rate decisions and overall monetary policy stance significantly impact JOE's price. Lower interest rates tend to increase liquidity and risk appetite, potentially benefiting cryptocurrencies.

- Historical Patterns: Past cycles show that JOE tends to perform well during periods of monetary easing and increased liquidity in the financial markets.

- Current Impact: The Federal Reserve's recent interest rate cut and potential future easing could provide support for JOE's price, although the exact path of monetary policy remains uncertain.

Institutional and Whale Dynamics

- Institutional Holdings: ETF inflows for Bitcoin and Ethereum have slowed recently, indicating cautious sentiment among institutional investors due to macroeconomic uncertainties.

- Corporate Adoption: More traditional financial institutions are exploring cryptocurrency and blockchain-related products, which could drive demand for JOE.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's gradual easing approach and emphasis on data dependency create a complex environment for risk assets like JOE.

- Inflation Hedging Properties: JOE's performance as an inflation hedge remains uncertain, with its price sensitive to both inflation expectations and real interest rates.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions contribute to market volatility, potentially affecting JOE's price movements.

Technological Development and Ecosystem Growth

- Blockchain Applications: The growth of decentralized finance (DeFi), on-chain derivatives, stablecoins, and tokenization of real-world assets (RWA) provide fundamental support for the crypto market, including JOE.

- Ecosystem Expansion: The continued development of JOE's ecosystem and potential new use cases could drive long-term value and adoption.

III. JOE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.10317 - $0.14

- Neutral prediction: $0.14 - $0.16

- Optimistic prediction: $0.16 - $0.17732 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.15172 - $0.30977

- 2028: $0.20299 - $0.34353

- Key catalysts: Increased adoption, technological improvements, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.30189 - $0.34415 (assuming steady growth)

- Optimistic scenario: $0.34415 - $0.40000 (assuming strong market performance)

- Transformative scenario: $0.40000 - $0.46461 (assuming exceptional adoption and ecosystem expansion)

- 2030-12-31: JOE $0.34415 (114% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.17732 | 0.1612 | 0.10317 | 0 |

| 2026 | 0.2522 | 0.16926 | 0.10494 | 5 |

| 2027 | 0.30977 | 0.21073 | 0.15172 | 31 |

| 2028 | 0.34353 | 0.26025 | 0.20299 | 62 |

| 2029 | 0.38642 | 0.30189 | 0.17812 | 87 |

| 2030 | 0.46461 | 0.34415 | 0.1824 | 114 |

IV. Professional Investment Strategies and Risk Management for JOE

JOE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate JOE tokens during market dips

- Participate in Trader Joe governance to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor Avalanche network activity as it may impact JOE's price

- Pay attention to Trader Joe platform updates and new feature launches

JOE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different DeFi tokens and ecosystems

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable non-custodial wallets with strong security features

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for JOE

JOE Market Risks

- High volatility: JOE's price can experience significant fluctuations

- Competition: Increasing competition in the DeFi space on Avalanche and other networks

- Market sentiment: General crypto market trends can heavily influence JOE's price

JOE Regulatory Risks

- Unclear regulations: Potential for stricter DeFi regulations in various jurisdictions

- Compliance challenges: Trader Joe may face difficulties adapting to evolving regulatory requirements

- Geopolitical factors: Changes in global crypto policies could impact JOE's adoption and use

JOE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the Trader Joe platform

- Scalability issues: Challenges in handling increased transaction volume on the Avalanche network

- Interoperability concerns: Limitations in cross-chain functionality may hinder growth

VI. Conclusion and Action Recommendations

JOE Investment Value Assessment

JOE presents a high-risk, high-reward investment opportunity within the DeFi ecosystem. Its long-term value proposition lies in Trader Joe's continued innovation and growth on the Avalanche network. However, short-term volatility and regulatory uncertainties pose significant risks.

JOE Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about DeFi and the Avalanche ecosystem ✅ Experienced investors: Consider allocating a portion of your DeFi portfolio to JOE, balancing risk with other established projects ✅ Institutional investors: Conduct thorough due diligence and consider JOE as part of a diversified DeFi strategy

JOE Trading Participation Methods

- Spot trading: Buy and sell JOE tokens on Gate.com

- Yield farming: Participate in liquidity provision on Trader Joe to earn additional rewards

- Governance: Stake JOE tokens to participate in platform governance decisions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Joe a good investment?

Yes, Joe appears to be a good investment. Its prudent debt management and stable financial health suggest potential for growth and returns.

What is the price prediction for Joe coin?

Joe coin's price is predicted to range between $0.15 and $0.31 in 2025, potentially increasing by 92.74% based on current market trends.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed closely by Ethereum (ETH). These predictions are based on current market trends and expert analysis.

What is the value of Joe?

As of 2025-09-28, 1 JOE is worth $0.17 USD. For $1 USD, you can buy approximately 5.85 JOE tokens.

Share

Content