2Z ve GRT: Yükselen Teknoloji Pazarında Hakimiyet Savaşı

Giriş: 2Z ve GRT Arasında Yatırım Karşılaştırması

Kripto para piyasasında DoubleZero (2Z) ile The Graph (GRT) arasındaki karşılaştırma, yatırımcıların gündeminden düşmeyen bir konu haline gelmiştir. Bu iki varlık, piyasa değeri sıralaması, kullanım alanları ve fiyat performansı açısından belirgin farklılıklar gösterirken, kripto varlıklar arasında da farklı pozisyonlara işaret etmektedir.

DoubleZero (2Z): Lansmanından itibaren, yüksek performanslı merkeziyetsiz ağların oluşturulması ve yönetilmesi için sunduğu merkeziyetsiz yapı sayesinde piyasada kabul görmüştür.

The Graph (GRT): 2020’de tanıtılan GRT, özellikle Ethereum ağı üzerine odaklanan, blokzincir verilerini endeksleme ve sorgulama konusunda merkeziyetsiz bir protokol olarak öne çıkmıştır.

Bu makalede, 2Z ve GRT’nin yatırım değerleri kapsamlı şekilde analiz edilecek; geçmiş fiyat hareketleri, arz yapıları, kurumsal benimseme, teknolojik ekosistemler ve gelecek öngörüleri ele alınacak ve yatırımcılar için en kritik soruya yanıt aranacaktır:

"Şu anda hangisi daha iyi bir yatırım fırsatı sunuyor?"

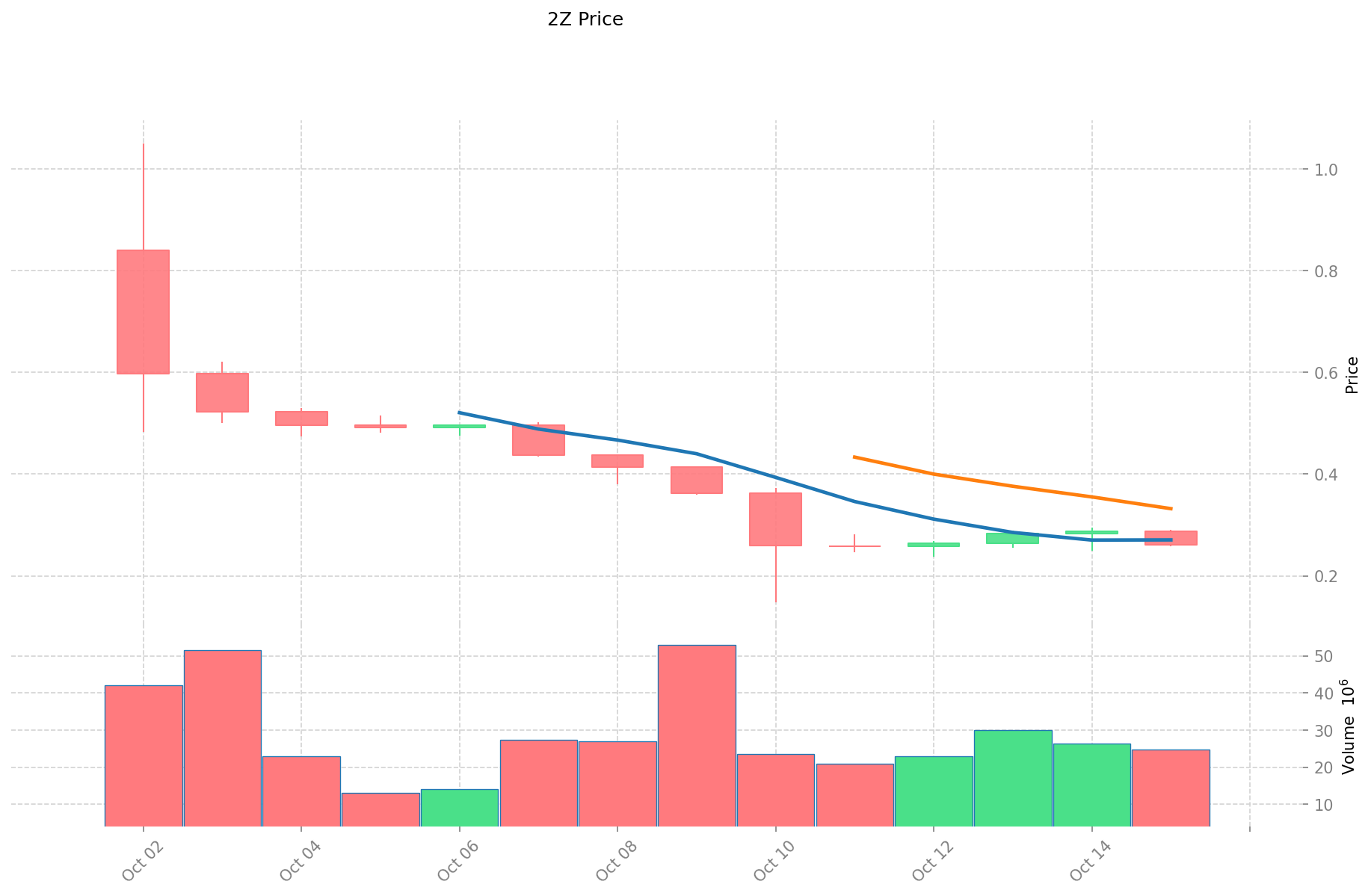

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

DoubleZero (2Z) ve The Graph (GRT) Tarihsel Fiyat Eğilimleri

- 2025: DoubleZero (2Z), 2 Ekim’de 1,05 $ ile tüm zamanların en yüksek seviyesini gördü, ardından 10 Ekim’de 0,14848 $ ile en düşük seviyesine indi.

- 2025: The Graph (GRT), yıl boyunca fiyatının 0,17 $’dan 0,06657 $’a düşmesiyle kayda değer bir dalgalanma yaşadı.

- Kıyaslama Analizi: Bu piyasa döngüsünde 2Z, 1,05 $’dan 0,2595 $’a gerilerken; GRT ise 0,17 $’dan 0,06657 $’a düştü. Her iki token da önemli oranda değer kaybetti.

Güncel Piyasa Durumu (16 Ekim 2025)

- DoubleZero (2Z) güncel fiyat: 0,2595 $

- The Graph (GRT) güncel fiyat: 0,06657 $

- 24 saatlik işlem hacmi: 6.588.054,93 $ (2Z) ve 367.781,06 $ (GRT)

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 28 (Korku)

Canlı fiyatları görmek için tıklayın:

- 2Z güncel fiyatı Piyasa Fiyatı

- GRT güncel fiyatı Piyasa Fiyatı

Yatırım Değeri Analizi: 2Z vs GRT

I. 2Z ve GRT’nin Yatırım Değerini Etkileyen Temel Faktörler

Arz Mekanizması Karşılaştırması (Tokenomik)

- GRT: The Graph, ağ katılımcılarını teşvik edebilmek için kontrollü token dağıtımıyla enflasyonist bir model uygular

- 📌 Tarihsel Eğilim: Arz mekanizmaları, genellikle token dağıtım etkinlikleri ve ağ güncellemeleri etrafında fiyat döngüleri oluşturur.

Kurumsal Benimseme ve Piyasa Uygulamaları

- Kurumsal Portföyler: The Graph (GRT), blokzincir alanında veri endeksleme yetenekleriyle kurumsal düzeyde kabul görmektedir

- Kurumsal Kullanım: GRT, blokzincir uygulamalarında merkeziyetsiz veri sorgulama ve endeksleme için yaygın olarak kullanılmaktadır

- Düzenleyici Yaklaşımlar: Farklı ülkeler, veri odaklı blokzincir protokolleri için giderek daha fazla düzenleyici çerçeve geliştirmektedir

Teknik Gelişim ve Ekosistem Oluşturulması

- GRT Teknik Gelişim: The Graph protokolü, sorgu yeteneklerini geliştirerek desteklediği ağ sayısını artırmaktadır

- Ekosistem Karşılaştırması: GRT, verimli veri erişimine ihtiyaç duyan birçok DeFi uygulaması için temel altyapı konumundadır

Makroekonomik Faktörler ve Piyasa Döngüleri

- Enflasyonist Ortamlarda Performans: GRT gibi veri altyapısı tokenleri, belirli piyasa koşullarında dayanıklılık gösterebilir

- Makro Para Politikası: Faiz oranları ile doların gücü, genel kripto piyasasının duyarlılığını ve dolayısıyla her iki varlığın da değerini etkiler

- Jeopolitik Faktörler: Merkeziyetsiz veri çözümlerine artan talep, belirsiz dönemlerde The Graph gibi protokollere avantaj sağlayabilir

III. 2025-2030 Fiyat Tahmini: 2Z vs GRT

Kısa Vadeli Tahmin (2025)

- 2Z: Muhafazakâr 0,23-0,26 $ | İyimser 0,26-0,29 $

- GRT: Muhafazakâr 0,05-0,07 $ | İyimser 0,07-0,08 $

Orta Vadeli Tahmin (2027)

- 2Z, büyüme evresine geçerse fiyatı 0,23-0,41 $ aralığında olabilir

- GRT, büyüme evresine geçerse fiyatı 0,05-0,12 $ aralığında olabilir

- Başlıca etkenler: Kurumsal sermaye girişi, ETF’ler ve ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- 2Z: Temel senaryo 0,35-0,55 $ | İyimser senaryo 0,55-0,67 $

- GRT: Temel senaryo 0,10-0,12 $ | İyimser senaryo 0,12-0,15 $

Feragatname

2Z:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,2895312 | 0,25851 | 0,232659 | 0 |

| 2026 | 0,380888634 | 0,2740206 | 0,172632978 | 5 |

| 2027 | 0,41259281742 | 0,327454617 | 0,23249277807 | 26 |

| 2028 | 0,5476351014708 | 0,37002371721 | 0,1961125701213 | 42 |

| 2029 | 0,633184584889752 | 0,4588294093404 | 0,279885939697644 | 76 |

| 2030 | 0,666128536480392 | 0,546006997115076 | 0,349444478153648 | 110 |

GRT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,0815244 | 0,06628 | 0,0483844 | 0 |

| 2026 | 0,100506992 | 0,0739022 | 0,039907188 | 11 |

| 2027 | 0,1177262046 | 0,087204596 | 0,04621843588 | 30 |

| 2028 | 0,119884518351 | 0,1024654003 | 0,09221886027 | 53 |

| 2029 | 0,136745199970365 | 0,1111749593255 | 0,10450446176597 | 67 |

| 2030 | 0,151231297170477 | 0,123960079647932 | 0,100407664514825 | 86 |

IV. Yatırım Stratejisi Karşılaştırması: 2Z ve GRT

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- 2Z: Merkeziyetsiz ağ performansı ve potansiyel ekosistem büyümesine odaklanan yatırımcılar için uygundur

- GRT: Blokzincir veri endeksleme ve sorgulama altyapısıyla ilgilenen yatırımcı profilleri için uygundur

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar: 2Z %30 – GRT %70

- Agresif yatırımcılar: 2Z %60 – GRT %40

- Koruma araçları: Stablecoin tahsisi, opsiyonlar, çapraz para portföyleri

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- 2Z: Düşük piyasa değeri ve işlem hacmi nedeniyle daha yüksek dalgalanma

- GRT: Genel kripto piyasası trendleri ve duyarlılığına karşı hassastır

Teknik Risk

- 2Z: Ölçeklenebilirlik, ağ istikrarı

- GRT: Sorgu hızı, veri doğruluğu

Düzenleyici Risk

- Küresel düzenleyici politikalar, özellikle veri yönetimi ve merkeziyetsiz ağlar kapsamında her iki token için de farklı sonuçlar yaratabilir

VI. Sonuç: Hangisi Daha Avantajlı Yatırım?

📌 Yatırım Değeri Özeti:

- 2Z avantajları: Daha yüksek büyüme potansiyeli, merkeziyetsiz ağ performansı

- GRT avantajları: Kurumsal ekosistem, blokzincir veri endeksleme için altyapı standardı

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: GRT’nin yerleşik kullanım alanları nedeniyle dengeli ve hafif GRT ağırlıklı bir yaklaşım düşünülebilir

- Deneyimli yatırımcılar: Her iki token için de fırsatlar araştırılabilir, dağılım risk toleransına göre ayarlanabilir

- Kurumsal yatırımcılar: GRT, blokzincir veri altyapısı potansiyeli açısından değerlendirilirken 2Z’nin gelişimi de yakından izlenmelidir

⚠️ Risk Uyarısı: Kripto para piyasaları yüksek volatiliteye sahiptir. Bu makale yatırım tavsiyesi değildir. None

VII. SSS

S1: 2Z ile GRT arasındaki temel farklar neler? C: 2Z, yüksek performanslı merkeziyetsiz ağların oluşturulması ve yönetilmesine odaklanırken; GRT, blokzincir verilerinin özellikle Ethereum üzerinde endekslenmesi ve sorgulanmasına yönelik bir protokoldür. GRT, DeFi uygulamalarında yaygın şekilde kullanılırken, 2Z merkeziyetsiz ağ performansında büyüme potansiyeline sahiptir.

S2: Son dönemde hangi token daha iyi fiyat performansı gösterdi? C: Verilere göre, 2Z son dönemde daha iyi fiyat performansı sergilemiştir. 16 Ekim 2025 itibarıyla 2Z fiyatı 0,2595 $ iken, GRT 0,06657 $ seviyesindedir. Bununla birlikte, her iki token da mevcut döngüde ciddi değer kaybı yaşamıştır.

S3: 2Z ve GRT’nin arz mekanizmaları nasıl farklılık gösteriyor? C: GRT, enflasyonist yapıda olup, kontrollü token dağıtımıyla ağ katılımcılarını teşvik eder. 2Z’nin arz mekanizması verilen bilgilerde belirtilmemiştir.

S4: Bu tokenların yatırım değerini etkileyen temel faktörler nelerdir? C: Arz mekanizmaları, kurumsal benimseme, piyasa uygulamaları, teknik gelişim, ekosistem inşası, makroekonomik faktörler ve piyasa döngüleri başlıca faktörlerdir. Ayrıca, düzenleyici yaklaşımlar ve jeopolitik unsurlar da etkileyicidir.

S5: 2030’da 2Z ve GRT için öngörülen fiyat aralıkları nedir? C: 2Z için temel senaryo 0,35-0,55 $; iyimser senaryo 0,55-0,67 $. GRT için temel senaryo 0,10-0,12 $; iyimser senaryo ise 0,12-0,15 $’tır.

S6: Yatırımcılar 2Z ve GRT yatırımlarında risk yönetimini nasıl ele almalı? C: Temkinli yatırımcılar 2Z’ye %30, GRT’ye %70; agresif yatırımcılar ise 2Z’ye %60, GRT’ye %40 ayırabilir. Stablecoin tahsisi, opsiyonlar ve çapraz para portföyleri gibi koruma araçları da kullanılabilir.

S7: 2Z ve GRT yatırımlarında başlıca riskler nelerdir? C: Piyasa riski (oynaklık ve genel piyasa trendleri), teknik risk (ölçeklenebilirlik, ağ istikrarı, sorgu verimliliği, veri doğruluğu) ve düzenleyici risk (küresel politikaların veri yönetimi ve merkeziyetsiz ağlar üzerindeki etkileri) öne çıkmaktadır.

S8: Farklı yatırımcı profilleri için hangi token daha uygun olabilir? C: Yeni yatırımcılar, GRT’nin yerleşik kullanım alanları sayesinde hafif GRT ağırlıklı dengeli bir yaklaşımı tercih edebilir. Deneyimli yatırımcılar, iki token arasında dağılımı risk toleranslarına göre ayarlayabilir. Kurumsal yatırımcılar, GRT’yi blokzincir veri altyapısı potansiyeliyle değerlendirebilir, 2Z’nin gelişimini de yakından takip etmelidir.

Ethereum Kurucusu Vitalik Buterin: Yaş, Geçmiş ve Başarılar

2025 ENS Fiyat Tahmini: Merkeziyetsiz Alan Adlarının Geleceğinde Yol Almak

ENS vs GMX: Web3’te Hangi Merkeziyetsiz Alan Adı Sistemi Hakimiyet Kuracak?

2025 GEL Fiyat Tahmini: Gürcistan Larisi, Başlıca Para Birimleri Karşısında Güç kazanacak mı?

Yearn Finance'in yETH Saldırısı: 3 Milyon Dolar Tornado Cash'e Aktarıldı - DeFi Güvenlik Analizi

Blockchain veri akışlarıyla DeFi'nin potansiyelini ortaya çıkarmak

Kripto dünyasında İşlem Kimliğinin Anlamı

Kripto Sektöründe SPWN Ne İfade Eder?

Sei ve Xiaomi, 2026’da piyasaya sürülecek yeni akıllı telefonlara kripto cüzdanlarını önceden yüklemek üzere ortaklık kurdu

Gemini, CFTC’den onay aldı; bu gelişme kripto tahmin piyasaları açısından ne ifade ediyor

State Street & Galaxy, 2026'da Solana tabanlı tokenlaştırılmış likidite fonu SWEEP'i piyasaya sunacak