2025 ZRX Fiyat Tahmini: Merkeziyetsiz Borsa Token’larının Geleceğinde Yol Almak

Giriş: ZRX'nin Piyasa Konumu ve Yatırım Değeri

0xProject (ZRX), Ethereum blokzinciri üzerinde merkeziyetsiz borsalar için geliştirilen açık kaynak bir protokol olarak, 2017 yılındaki çıkışından bu yana önemli ilerlemeler kaydetti. 2025 yılı itibarıyla 0xProject’in piyasa değeri 167.218.962 ABD doları seviyesinde, dolaşımdaki token adedi yaklaşık 848.396.562 ve fiyatı ise 0,1971 ABD doları civarında seyrediyor. Sektörde sıklıkla “DEX sağlayıcı” olarak anılan bu varlık, ERC20 tokenlarının merkeziyetsiz şekilde alım satımında giderek daha belirleyici bir rol üstleniyor.

Bu makalede, 0xProject’in 2025’ten 2030’a kadar olan fiyat hareketleri kapsamlı biçimde analiz edilmekte; geçmiş trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik parametreler birleştirilerek profesyonel fiyat tahminleri ve yatırımcılar için uygulanabilir stratejiler sunulmaktadır.

I. ZRX Fiyat Geçmişi İncelemesi ve Mevcut Piyasa Durumu

ZRX Tarihsel Fiyat Gelişimi

- 2017: İlk lansman, açılış fiyatı 0,05 ABD doları

- 2018: Boğa piyasası zirvesi, 13 Ocak’ta tüm zamanların en yüksek fiyatı 2,5 ABD doları

- 2020: Piyasa düşüşü, 13 Mart’ta tüm zamanların en düşük fiyatı 0,120667 ABD doları

ZRX Güncel Piyasa Durumu

19 Ekim 2025 tarihi itibarıyla ZRX, 0,1971 ABD doları seviyesinde işlem görüyor ve piyasa değeri 167.218.962 ABD doları. Token, son 24 saatte %1,45’lik bir düşüş, son bir haftada ise %3,58’lik artış yaşadı. Son 30 günde %27,88 ve son bir yılda %41,78 oranında değer kaybetti. Mevcut fiyat, tüm zamanların en yüksek değerinin %92,12 altında ve en düşük seviyesinin %63,34 üzerinde. Dolaşımdaki ZRX miktarı 848.396.562 olup, toplam arz 1 milyar; tokenın piyasa hakimiyeti ise %0,0051 düzeyinde.

Güncel ZRX piyasa fiyatını görmek için tıklayın

ZRX Piyasa Duyarlılığı Göstergesi

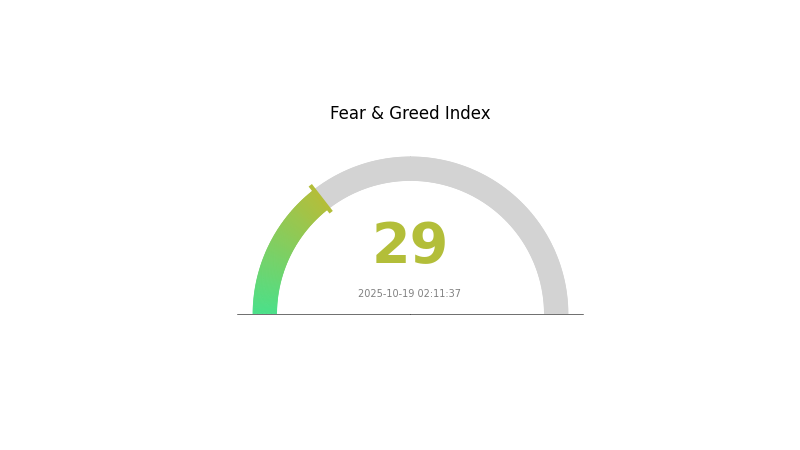

2025-10-19 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasası şu anda Korku ve Açgözlülük Endeksi’nde 29 puan ile korku döneminde bulunuyor. Bu duyarlılık, yatırımcıların temkinli olduğunu ve olası alım fırsatları aradığını gösteriyor. Böyle dönemlerde güncel kalmak ve rasyonel kararlar almak kritik önem taşır. Unutmayın, piyasa döngüleri doğal olup, korku fazları genellikle toparlanma öncesi yaşanır. Her zaman detaylı araştırma yapın ve volatil kripto piyasasında yatırım kararı vermeden önce risk toleransınızı göz önünde bulundurun.

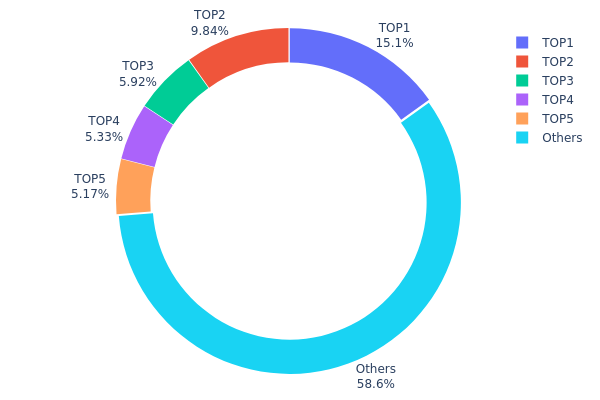

ZRX Varlık Dağılımı

ZRX adres varlık dağılımı verileri, orta derecede yoğunlaşmış bir sahiplik yapısını gösteriyor. En büyük beş adres, toplam arzın %41,32’sini elinde bulundururken, en büyük adresin payı %15,10. Bu yoğunlaşma, az sayıda büyük yatırımcının piyasada önemli etki potansiyeline sahip olduğunu ortaya koyuyor.

Bu dağılım aşırı merkeziyetçi olmasa da, piyasa manipülasyonu riskine dair bazı endişeler yaratıyor. Büyük sahipler, hacimli işlemlerle fiyat üzerinde etkili olabilir. Ancak, tokenların %58,68’i diğer adreslerde bulunuyor ve bu da daha küçük yatırımcılar arasında geniş bir dağılım olduğuna işaret ediyor; bu durum yoğunlaşma kaynaklı riskleri bir ölçüde azaltıyor.

Mevcut yapı, merkezi etkilerle yaygın katılım arasında denge sunan bir piyasa profiline işaret ediyor. Orta düzeyde merkeziyetsizlik, ZRX ekosisteminin uzun vadeli istikrarı ve adil işleyişi için kritik. Yatırımcılar, büyük sahiplerin potansiyel hamlelerinin piyasa dinamiklerine etkisini yakından takip etmelidir.

Güncel ZRX Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x1743...f27440 | 151.061,91K | 15,10% |

| 2 | 0x2063...e0fd43 | 98.350,94K | 9,83% |

| 3 | 0xf977...41acec | 59.191,09K | 5,91% |

| 4 | 0xdb63...d97303 | 53.252,50K | 5,32% |

| 5 | 0xba7f...7a5eaf | 51.657,98K | 5,16% |

| - | Diğerleri | 586.485,58K | 58,68% |

II. ZRX'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Oluşturma

-

Protokol Güncellemeleri: ZRX protokolü, verimliliği ve fonksiyonelliği artırmak için sürekli geliştiriliyor; bu, benimsenme ve değer üzerinde olumlu etki yaratabilir.

-

Ekosistem Uygulamaları: 0x Protocol, çeşitli merkeziyetsiz borsalar ve DeFi uygulamalarını destekleyerek kullanım alanını ve potansiyel fiyat artışını güçlendiriyor.

III. 2025-2030 Dönemi ZRX Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,15595 - 0,1974 ABD doları

- Tarafsız tahmin: 0,1974 - 0,22701 ABD doları

- İyimser tahmin: 0,22701 - 0,25662 ABD doları (sürekli piyasa büyümesi ve merkeziyetsiz borsaların yaygınlaşması durumunda)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Kademeli yükselişle olası konsolidasyon dönemi

- Fiyat aralığı tahmini:

- 2027: 0,16655 - 0,28835 ABD doları

- 2028: 0,19061 - 0,30068 ABD doları

- Temel katalizörler: DeFi ekosisteminin genişlemesi, Ethereum ölçeklenebilirliğinde iyileşmeler ve merkeziyetsiz protokollerin kurumsal kabulünün artması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,28457 - 0,35287 ABD doları (DeFi benimsenmesinin istikrarlı şekilde artması ve 0x protokolünün gelişiminin sürmesi halinde)

- İyimser senaryo: 0,35287 - 0,42116 ABD doları (merkeziyetsiz finansın hızlı büyümesi ve 0x ekosisteminde büyük güncellemeler gerçekleşirse)

- Dönüştürücü senaryo: 0,42116 - 0,45167 ABD doları (DeFi’nin yaygın şekilde benimsenmesi ve 0x’in sektörde baskın protokol haline gelmesi halinde)

- 2030-12-31: ZRX 0,45167 ABD doları (oldukça elverişli piyasa koşulları ve teknolojik ilerlemelerle potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,25662 | 0,1974 | 0,15595 | 0 |

| 2026 | 0,27014 | 0,22701 | 0,17707 | 15 |

| 2027 | 0,28835 | 0,24858 | 0,16655 | 26 |

| 2028 | 0,30068 | 0,26846 | 0,19061 | 36 |

| 2029 | 0,42116 | 0,28457 | 0,23335 | 44 |

| 2030 | 0,45167 | 0,35287 | 0,21525 | 79 |

IV. ZRX Profesyonel Yatırım Stratejisi ve Risk Yönetimi

ZRX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli değer yatırımcıları ve blokzincir teknolojisi meraklıları

- İşlem önerileri:

- Piyasa düşüşlerinde ZRX biriktirme

- Hedef tutma süresi olarak 3-5 yıl belirleme

- Tokenları güvenli bir donanım cüzdanı veya Gate Web3 cüzdanında saklama

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend belirlemek için 50 ve 200 günlük hareketli ortalamaları kullanın

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumlarını takip edin

- Dalgalı alım-satım için önemli noktalar:

- 0x protokolünün benimsenmesi ve ekosistem büyümesini izleyin

- Ethereum güncellemelerinin 0x üzerindeki olası etkilerini takip edin

ZRX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-8’i

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla DeFi protokolüne yaymak

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 cüzdanı

- Yazılım cüzdanı seçeneği: Resmi 0x cüzdanı veya Gate Web3 cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamayı etkinleştirin, güçlü parolalar kullanın

V. ZRX için Olası Riskler ve Zorluklar

ZRX Piyasa Riskleri

- Volatilite: Kripto piyasasındaki dalgalanmalar ZRX fiyatını etkileyebilir

- Rekabet: Yeni DEX protokolleri 0x’in pazar payını tehdit edebilir

- Likidite: Düşük işlem hacmi fiyat istikrarını bozabilir

ZRX Düzenleyici Riskler

- DEX düzenlemeleri: Merkeziyetsiz borsalara yönelik olası regülasyon baskıları

- Token sınıflandırması: ZRX’nin fayda tokenı olarak yasal statüsüne dair belirsizlik

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen düzenlemeler

ZRX Teknik Riskler

- Akıllı kontrat açıkları: 0x protokolünde olası istismarlar

- Ölçeklenebilirlik sorunları: Ethereum ağındaki tıkanıklıklar 0x performansını etkileyebilir

- Güncelleme zorlukları: Protokol güncellemeleri veya yönetişim değişikliklerinde yaşanabilecek komplikasyonlar

VI. Sonuç ve Eylem Önerileri

ZRX Yatırım Değeri Değerlendirmesi

ZRX, merkeziyetsiz borsa protokolleri için altyapı tokenı olarak uzun vadeli potansiyel sunuyor. Ancak, kısa vadeli dalgalanmalar ve mevzuat belirsizlikleri önemli riskler barındırıyor.

ZRX Yatırım Önerileri

✅ Yeni başlayanlar: Küçük, uzun vadeli pozisyonlarla başlayın ve eğitime odaklanın ✅ Deneyimli yatırımcılar: Hem tutma hem de alım-satım stratejilerinin dengeli bir yaklaşımını benimseyin ✅ Kurumsal yatırımcılar: Piyasa yapıcılığı ve yönetişime katılım fırsatlarını değerlendirin

ZRX Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden ZRX satın alın

- DeFi staking: 0x protokolünde likidite sağlayıcı olarak yer alın

- Yönetişim: ZRX tokenlarıyla 0x İyileştirme Tekliflerine (ZEIP) katılım sağlayın

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarını dikkate alarak dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

ZRX ne kadar yükselebilir?

ZRX, DeFi kullanımının artması ve protokol güncellemeleriyle 2026’da 3-5 ABD doları seviyelerine ulaşabilir. Ancak kripto piyasaları yüksek volatiliteye ve belirsizliğe sahiptir.

ZRX iyi bir kripto mu?

ZRX, güçlü potansiyele sahip umut vaat eden bir kripto varlıktır. 0x protokolünü çalıştırır ve merkeziyetsiz token alım-satımını mümkün kılar. DeFi’nin yaygınlaşmasıyla birlikte ZRX’nin kullanımı ve değeri önümüzdeki yıllarda artacaktır.

OX iyi bir kripto mu?

Evet, 0x (ZRX) umut vaat eden bir kripto paradır. Merkeziyetsiz borsalarda etkin rol oynar, verimli token değişimi sunar. DeFi’nin büyümesiyle birlikte 0x’in fiyat artışı potansiyeli güçlüdür.

ZRX kullanmanın riskleri nelerdir?

Başlıca riskler arasında piyasa volatilitesi, mevzuat değişiklikleri, akıllı kontrat açıkları ve 0x protokolü ekosisteminde potansiyel likidite sıkıntıları yer alır.

Kripto 2025'te Yeniden Yükselir mi?

2025 ETC Fiyat Tahmini: Ethereum Classic’in gelecekteki değeri için belirleyici faktörler ve piyasa trendlerinin profesyonel analizi

Kripto yatırımcıları için önde gelen merkeziyetsiz borsa platformlarını keşfedin

Merkeziyetsiz finans platformlarının geleceği: DeFi borsalarını keşfetmek

Merkeziyetsiz alım satım sistemlerinde yenilikçi yaklaşımlar

Velodrome Finance’ı Keşfedin: Velodrome Token ile İlgili Bilmeniz Gereken Her Şey

Dijital Sanat Oluşturma: NFT Üretiminde Öne Çıkan Yapay Zekâ Araçları

Kripto Parada Proof of Reserve'ın Anlaşılması

Ethereum Katman 2 Çözümlerini Keşfetmek: Optimism'e Odaklanma

Ethereum İşlem Maliyetlerini Azaltmaya Yönelik Etkin Stratejiler

NFT Nadirliğinde Uzmanlaşma: Puanlama ve Değerleme İçin Kapsamlı Rehber