2025 ETC Fiyat Tahmini: Ethereum Classic’in gelecekteki değeri için belirleyici faktörler ve piyasa trendlerinin profesyonel analizi

Giriş: ETC'nin Piyasadaki Konumu ve Yatırım Değeri

Ethereum Classic (ETC), akıllı sözleşmelerin çalıştırılmasına olanak tanıyan merkeziyetsiz bir platform olarak, 2016'daki çıkışından bu yana büyük ilerleme kaydetmiştir. 2025 itibarıyla Ethereum Classic'in piyasa değeri 3,17 milyar ABD doları seviyesindedir, dolaşımdaki coin sayısı yaklaşık 153.457.938 ve fiyatı ise 20,64 ABD doları seviyelerinde dalgalanmaktadır. "Orijinal Ethereum" olarak da anılan bu varlık, merkeziyetsiz uygulamalar ve akıllı sözleşmeler alanında giderek daha kritik bir rol üstlenmektedir.

Bu makalede, Ethereum Classic'in 2025-2030 dönemi arasındaki fiyat eğilimlerini, önceki hareketleri, piyasa arz ve talep dengelerini, ekosistem gelişimini ve makroekonomik göstergeleri dikkate alarak kapsamlı biçimde analiz edeceğiz; yatırımcılar için uzman fiyat öngörüleri ve uygulamaya yönelik yatırım stratejileri sunacağız.

I. ETC Fiyat Geçmişi ve Güncel Piyasa Durumu

ETC Tarihsel Fiyat Gelişimi

- 2016: Ethereum’un hard fork’u ile ortaya çıkan ETC, 0,615038 ABD doları seviyesinden başladı

- 2017: Boğa piyasasında fiyat 40 ABD dolarının üzerine çıktı

- 2018-2019: Kripto kışı döneminde fiyat yaklaşık 4 ABD dolarına geriledi

- 2021: 7 Mayıs’ta tüm zamanların en yüksek seviyesi olan 167,09 ABD dolarına ulaştı

- 2022-2023: Piyasa düşüşüyle fiyat 15-20 ABD doları bandına indi

ETC Güncel Piyasa Görünümü

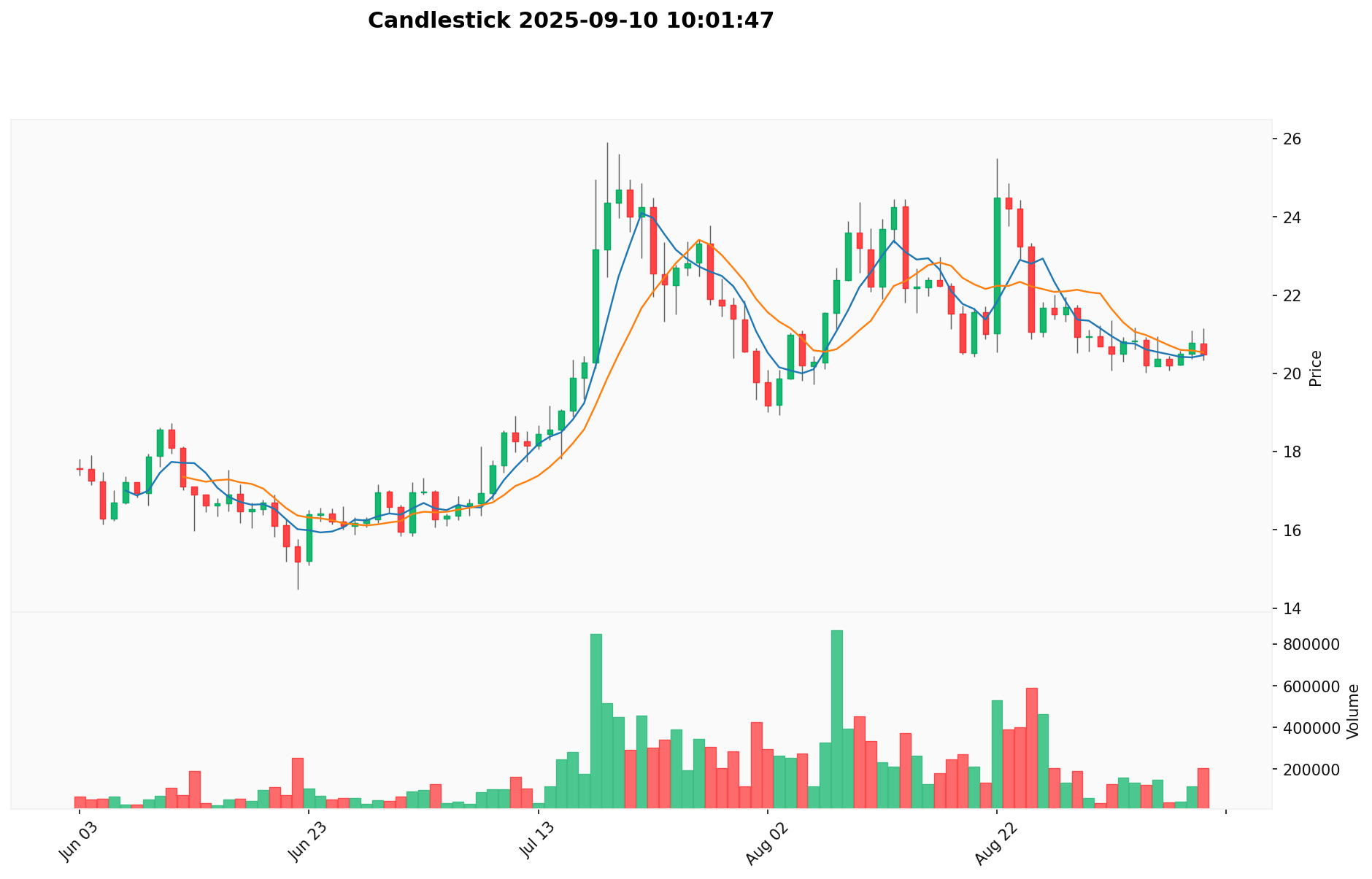

10 Eylül 2025 itibarıyla Ethereum Classic (ETC) 20,637 ABD doları seviyesinden işlem görüyor. 24 saatlik işlem hacmi 2.878.053,69 ABD doları, piyasa değeriyse 3.166.911.470 ABD dolarıdır. ETC, son 24 saatte yüzde 1,68, son 30 günde ise yüzde 10,78 oranında değer kaybetmiştir. Ancak, son bir yılda yüzde 12,57 artış göstermiştir. Mevcut fiyatı, 7 Mayıs 2021'de görülen tüm zamanların zirvesi olan 167,09 ABD dolarının yüzde 87,65 altında bulunuyor. ETC, kripto para piyasasında 51. sıradadır ve yüzde 0,076'lık piyasa payı ile işlem görmektedir.

Güncel ETC fiyatını görüntülemek için tıklayın

ETC Piyasa Duyarlılığı Göstergesi

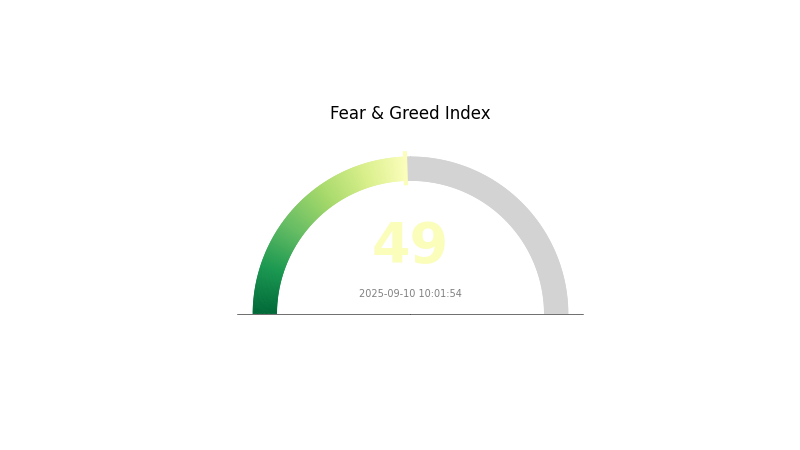

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Ethereum Classic (ETC) için kripto para piyasasındaki duyarlılık bugün dengede seyrediyor ve Korku & Açgözlülük Endeksi 49 ile nötr bir duruş sergiliyor. Bu denge, yatırımcıların ETC’ye yaklaşımında ne abartılı bir iyimserlik ne de gereksiz bir karamsarlık olduğunu gösteriyor. Piyasa her iki yönde hareket edebileceğinden, yatırımcıların temkinli olması, detaylı analiz yapması ve birden fazla unsur göz önünde bulundurularak işlem yapılması önem arz ediyor.

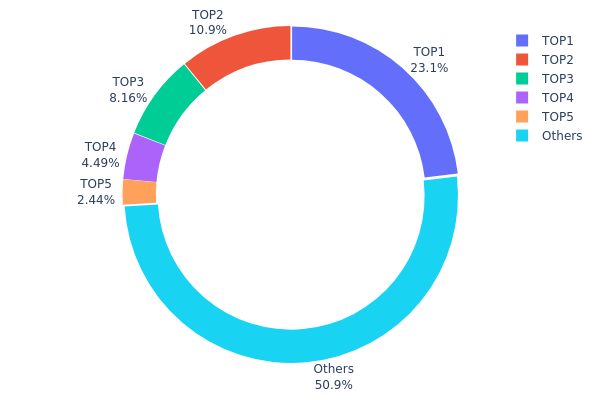

ETC Varlık Dağılımı

Adres bazında varlık dağılımı verileri, ETC sahipliğindeki yoğunlaşmanın derecesi hakkında önemli bir görünüm sunar. En büyük 5 adres, toplam ETC arzının yüzde 49,08’ini elinde bulundururken en büyük tek adres yüzde 23,11’lik paya sahiptir. Bu, ETC'nin birkaç büyük elde toplandığına ve bu durumun piyasa dinamiklerini etkileyebileceğine işaret etmektedir.

Böylesi bir yoğunlaşma, piyasa istikrarı ve yüksek hacimli işlemlere karşı kırılganlık doğurabilir. Toplam arzın yaklaşık dörtte birini elinde bulunduran en büyük adres, fiyat hareketleri üzerinde önemli bir etkiye sahip olabilir. Büyük yatırımcıların satış yapması durumunda, piyasada volatilitenin artması olasıdır. Ayrıca, üst düzey sahiplerin koordineli hareketleri fiyatlarda manipülasyon riskini beraberinde getirebilir.

Ancak, ETC arzının yüzde 50’sinden fazlası diğer adresler arasında dağılmış konumdadır ve bu da belirli bir merkeziyetsizlik seviyesine işaret etmektedir. Geniş dağılım, yüksek yoğunluğun yarattığı risklerin bir kısmını azaltabilir. Ama genel sahiplik yapısı, ETC’nin zincir üstü sahipliğinin hâlâ görece merkeziyetçi olduğunu ve uzun vadede istikrar ile merkeziyetsiz varlık olarak kabulünü kısıtlayabileceğini ortaya koymaktadır.

Güncel ETC Varlık Dağılımına ulaşmak için tıklayın

| Üst | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0x13cd...6d02ad | 35.631,88K | 23,11% |

| 2 | 0xd4e3...af5d4d | 16.810,59K | 10,90% |

| 3 | 0x00cd...0ade91 | 12.580,00K | 8,16% |

| 4 | 0x8793...5e494f | 6.912,82K | 4,48% |

| 5 | 0x1f1c...cd5b94 | 3.756,04K | 2,43% |

| - | Diğerleri | 78.434,11K | 50,92% |

II. ETC'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Deflasyonist Model: ETC’nin maksimum arzı 210,7 milyon coin ile sınırlandırılmıştır ve ihraç oranı giderek azalmaktadır.

- Tarihsel Eğilim: Geçmişte arz azaldığında, kıtlık etkisiyle fiyat genellikle yükselmiştir.

- Güncel Etki: ETC'nin yakın dönemde ihraç oranında yaşanacak azalma, talep sabit kalır ya da artarsa fiyat üzerinde yukarı yönlü baskı oluşturabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Birçok büyük kripto yatırım şirketi ETC’yi portföylerine eklemiş; bu durum, kurumsal ilginin arttığını göstermektedir.

- Kurumsal Kullanım: Bazı şirketler, akıllı sözleşme uygulamaları için ETC’yi değerlendirmekte olup, bu da talebi destekleyebilir.

- Ulusal Politikalar: Bazı bölgelerdeki düzenleyici netlik, ETC’yi kurumsal yatırımcılar açısından daha cazip kılmıştır.

Makroekonomik Ortam

- Parasal Politika Etkisi: Merkez bankalarının gevşek para politikalarını sürdürmesi, yatırımcıların ETC gibi kripto varlıklara yönelmesine neden olabilir.

- Enflasyondan Koruma Özelliği: ETC, enflasyon ortamında değer saklama aracı olarak görülmeye başlanmıştır.

- Jeopolitik Faktörler: Küresel belirsizlikler ve jeopolitik krizler, ETC gibi merkeziyetsiz varlıklara olan ilgiyi artırabilir.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Ethereum Uyumluluğu: ETC, Ethereum ile uyumluluğunu koruyarak dApp'lerin ve akıllı sözleşmelerin kolayca entegre edilmesini sağlar.

- Ölçeklenebilirlik Çözümleri: Katman-2 teknolojilerinin geliştirilmesi, ETC'nin işlem kapasitesini artırabilir ve ücretlerini düşürebilir.

- Ekosistem Uygulamaları: ETC üzerindeki DeFi ve NFT projelerinin büyümesi, kullanım alanını genişletip ağa yeni kullanıcılar çekmektedir.

III. 2025-2030 Dönemi için ETC Fiyat Tahmini

2025 Görünümü

- İhtiyatlı öngörü: 10,53 - 15,00 ABD doları

- Nötr öngörü: 15,00 - 20,65 ABD doları

- İyimser öngörü: 20,65 - 22,71 ABD doları (olumlu piyasa algısı ve artan benimseme gerekebilir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan volatiliteyle birlikte büyüme süreci

- Fiyat aralığı öngörüleri:

- 2027: 17,76 - 23,90 ABD doları

- 2028: 14,00 - 31,50 ABD doları

- Başlıca katalizörler: Teknolojik ilerlemeler, kurumsal kabulde artış ve kripto piyasası genel trendleri

2030 Uzun Vadeli Görünümü

- Temel senaryo: 30,40 - 35,00 ABD doları (istikrarlı büyüme ve benimsenme varsayımıyla)

- İyimser senaryo: 35,00 - 39,58 ABD doları (olumlu düzenleyici ortam ve artan kullanım durumunda)

- Dönüştürücü senaryo: 40,00 - 50,00 ABD doları (büyük ortaklıklar veya teknolojik sıçramalar gibi olağanüstü olumlu şartlarda)

- 31 Aralık 2030: ETC için öngörülen ortalama fiyat 31,67 ABD doları

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Fiyat Artış Oranı (%) |

|---|---|---|---|---|

| 2025 | 22,7128 | 20,648 | 10,53048 | 0 |

| 2026 | 23,84844 | 21,6804 | 15,39308 | 5 |

| 2027 | 23,90264 | 22,76442 | 17,75625 | 10 |

| 2028 | 31,50027 | 23,33353 | 14,00012 | 13 |

| 2029 | 35,91614 | 27,4169 | 17,82098 | 32 |

| 2030 | 39,58315 | 31,66652 | 30,39986 | 53 |

IV. Profesyonel ETC Yatırım Stratejileri ve Risk Yönetimi

ETC Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: İstikrarlı büyüme hedefleyen muhafazakâr yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde ETC biriktirin

- En az 2-3 yıllık bir tutma süresi belirleyin

- ETC'lerinizi güvenli donanım cüzdanında depolayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük hareketli ortalamalarla trendleri takip edin

- RSI: Aşırı alım ve aşırı satım seviyelerine dikkat edin

- Kısa vadeli işlemler için temel noktalar:

- Açık giriş ve çıkış noktaları belirleyin

- Kaybı sınırlamak için zarar durdur emirleri kullanın

ETC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Muhafazakâr yatırımcılar: Portföyün %1-3'ü

- Agresif yatırımcılar: Portföyün %5-10'u

- Profesyonel yatırımcılar: Portföyde en fazla %15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı farklı kripto paralara dağıtın

- Opsiyon işlemleri: Düşüş riskinden korunmak için satım opsiyonlarını değerlendirin

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı tavsiyesi: Gate Web3 Cüzdan

- Yazılım cüzdanı alternatifi: Resmi ETC cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. ETC için Potansiyel Riskler ve Zorluklar

ETC Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık görülen sert fiyat dalgalanmaları

- Rekabet: Diğer akıllı sözleşme platformlarından gelen baskı

- Piyasa duyarlılığı: Genel kripto piyasası eğilimlerinden etkilenme

ETC Düzenleyici Riskler

- Bilinmeyen düzenleyici ortam: Olası sıkı regülasyon riski

- Vergilendirme etkileri: Kripto işlemlerine ilişkin gelişen vergi mevzuatı

- Yasal statü: Farklı ülkelerde değişen hukuki tanıma

ETC Teknik Riskler

- 51% saldırıları: Düşük hash oranı nedeniyle ağ saldırılarına yatkınlık

- Akıllı sözleşme açıkları: dApp’lerdeki potansiyel güvenlik zafiyetleri

- Ölçeklenebilirlik sorunları: Yeni blokzincirlere kıyasla sınırlı işlem kapasitesi

VI. Sonuç ve Eylem Önerileri

ETC Yatırım Değeri Değerlendirmesi

Ethereum Classic, köklü bir akıllı sözleşme platformu olarak uzun vadeli potansiyele sahip olmakla birlikte, kısa vadede piyasa oynaklığı ve teknik zorluklarla karşı karşıyadır.

ETC Yatırım Önerileri

✅ Yeni başlayanlara: Piyasa dinamiklerini anlamak için düşük tutarlı ve düzenli yatırımla başlayın ✅ Deneyimli yatırımcılara: Tutma ve alım-satım stratejilerini dengeli biçimde uygulayın ✅ Kurumsal yatırımcılara: ETC'yi çeşitlendirilmiş bir kripto portföyünün parçası olarak değerlendirin

ETC Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden ETC alım ve saklama

- Vadeli işlemler: Kısa vadeli kaldıraçlı trading fırsatları

- Staking: Pasif gelir için ETC staking programlarına katılım

Kripto para yatırımları çok yüksek risk içerir. Bu makale herhangi bir yatırım tavsiyesi teşkil etmez. Yatırımcılar kendi risk toleranslarına göre dikkatli kararlar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular (SSS)

ETC 1.000 ABD dolarına ulaşabilir mi?

ETC'nin 1.000 ABD dolarına ulaşması iddialı bir hedef olsa da mümkündür. Piyasa trendleri ve artan benimseme bu seviyelere itebilir; ancak kesinlik yoktur.

2030'da ETC ne kadar olur?

Mevcut eğilimlere göre, ETC 2030 yılında yıllık %5-10 arası büyüme ile 30 ila 56 ABD doları bandında olabilir.

ETC'nin geleceği var mı?

Evet, ETC'nin potansiyeli mevcut. Şimdiye kadar fiyat artışları kaydetti ve geleceği, piyasa eğilimleri ile teknolojik yeniliklere bağlı. Yaygın benimseme ve inovasyon, uzun vadeli başarı için kritik önemdedir.

ETC 100 ABD dolarına ulaşır mı?

Evet, ETC'nin 100 ABD dolarına ulaşma potansiyeli bulunuyor. Piyasa trendleri ve artan benimseme, önümüzdeki yıllarda bu seviyeye ulaşmasını mümkün kılabilir.

Kripto 2025'te Yeniden Yükselir mi?

2025 ZRX Fiyat Tahmini: Merkeziyetsiz Borsa Token’larının Geleceğinde Yol Almak

Kripto yatırımcıları için önde gelen merkeziyetsiz borsa platformlarını keşfedin

Merkeziyetsiz finans platformlarının geleceği: DeFi borsalarını keşfetmek

Merkeziyetsiz alım satım sistemlerinde yenilikçi yaklaşımlar

Velodrome Finance’ı Keşfedin: Velodrome Token ile İlgili Bilmeniz Gereken Her Şey

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması