2025 ZRO Price Prediction: Bullish Outlook as Adoption and Ecosystem Growth Accelerate

Introduction: ZRO's Market Position and Investment Value

LayerZero (ZRO), as a prominent omnichain interoperability protocol, has made significant strides in cross-chain communication since its inception. As of 2025, LayerZero's market capitalization has reached $290,245,595, with a circulating supply of approximately 198,255,188 tokens, and a price hovering around $1.464. This asset, often referred to as the "cross-chain messenger," is playing an increasingly crucial role in facilitating lightweight message passing across blockchain networks.

This article will provide a comprehensive analysis of LayerZero's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ZRO Price History Review and Current Market Status

ZRO Historical Price Evolution

- 2024: Launch of LayerZero, price reached all-time high of $7.557 on December 6

- 2025: Market correction, price dropped to all-time low of $0.859 on October 10

- 2025: Gradual recovery, current price stabilized around $1.464

ZRO Current Market Situation

As of November 15, 2025, ZRO is trading at $1.464, with a 24-hour trading volume of $790,271.16. The token has experienced a slight decrease of 0.2% in the past 24 hours. ZRO's market capitalization stands at $290,245,595.99, ranking it 203rd in the cryptocurrency market.

The current price represents a significant decrease from its all-time high of $7.557, recorded on December 6, 2024. However, it has shown resilience by maintaining a level well above its all-time low of $0.859, reached on October 10, 2025.

ZRO's price performance over various timeframes shows mixed results:

- 1-hour change: +0.051%

- 7-day change: -11%

- 30-day change: -20.68%

- 1-year change: -57.099%

These figures indicate a short-term stability with slight upward movement, but significant downward pressure in the medium to long term.

The token's circulating supply is 198,255,188.52 ZRO, which represents 19.83% of the total supply of 1,000,000,000 ZRO. The fully diluted market capitalization is $1,464,000,000.

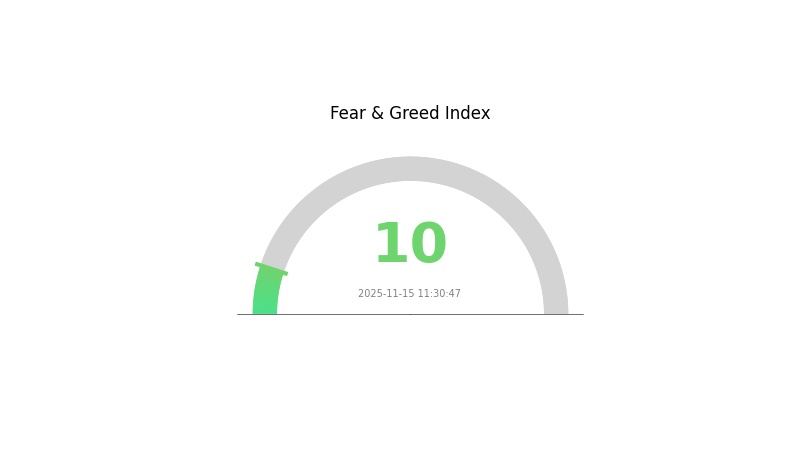

The current market sentiment for cryptocurrencies is characterized as "Extreme Fear" with a VIX index of 10, suggesting a highly cautious and risk-averse environment in the broader crypto market.

Click to view the current ZRO market price

ZRO Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the Fear and Greed Index hitting a low of 10. This indicates a significant level of pessimism and uncertainty among investors. During such times, it's crucial to remain calm and avoid making impulsive decisions. Remember, market cycles are natural, and periods of extreme fear often present potential buying opportunities for long-term investors. However, always conduct thorough research and consider your risk tolerance before making any investment decisions.

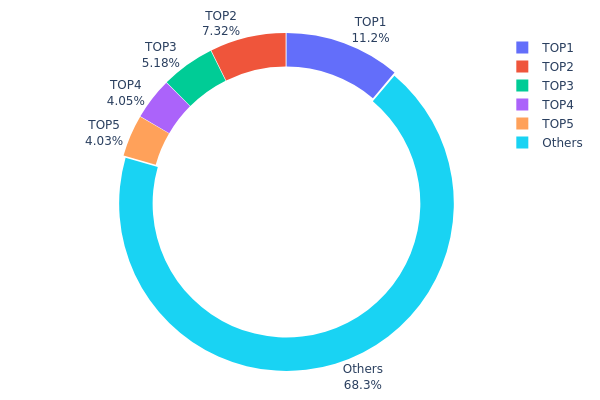

ZRO Holdings Distribution

The address holdings distribution data provides insight into the concentration of ZRO tokens among various wallet addresses. Analysis of this data reveals a moderate level of concentration in the ZRO market. The top five addresses collectively hold 31.71% of the total supply, with the largest holder possessing 11.15%. This distribution suggests a relatively balanced ownership structure, albeit with some significant players.

While there is a notable concentration among the top holders, it does not appear to be excessive. The majority of tokens (68.29%) are distributed among numerous other addresses, indicating a degree of decentralization. This distribution pattern may contribute to market stability by reducing the potential for large-scale market manipulation by a single entity. However, coordinated actions by the top holders could still significantly impact price movements and liquidity.

The current address distribution reflects a market with a healthy balance between major stakeholders and smaller holders. This structure suggests a moderate level of decentralization and on-chain stability for ZRO, which could be viewed positively by investors seeking assets with distributed ownership and reduced concentration risk.

Click to view the current ZRO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8f64...ba449c | 105935.09K | 11.15% |

| 2 | 0x744d...38da24 | 69549.76K | 7.32% |

| 3 | 0xc2f3...a2d412 | 49200.00K | 5.18% |

| 4 | 0x9219...c4273f | 38422.11K | 4.04% |

| 5 | 0x637c...bbf7bf | 38229.52K | 4.02% |

| - | Others | 648194.27K | 68.29% |

II. Key Factors Affecting ZRO's Future Price

Supply Mechanism

- Fixed Supply: ZRO has a fixed total supply, which creates scarcity and potentially supports long-term price appreciation.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, ZRO may be viewed as a potential hedge against inflation, similar to other digital assets.

Technical Development and Ecosystem Building

- Ecosystem Applications: ZRO is likely to have various DApps and ecosystem projects built on its platform, which could drive adoption and value.

III. ZRO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.34 - $1.46

- Neutral prediction: $1.46 - $1.60

- Optimistic prediction: $1.60 - $1.73 (requires positive market sentiment)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $1.42 - $1.98

- 2027: $1.66 - $2.09

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $2.15 - $2.56 (assuming steady market growth)

- Optimistic scenario: $2.56 - $3.74 (assuming strong market performance)

- Transformative scenario: $3.74+ (extremely favorable market conditions)

- 2030-12-31: ZRO $3.74 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.72752 | 1.464 | 1.34688 | 0 |

| 2026 | 1.97874 | 1.59576 | 1.42023 | 9 |

| 2027 | 2.09108 | 1.78725 | 1.66214 | 22 |

| 2028 | 2.36578 | 1.93917 | 1.20228 | 32 |

| 2029 | 2.97042 | 2.15248 | 1.44216 | 47 |

| 2030 | 3.73971 | 2.56145 | 1.63933 | 74 |

IV. Professional Investment Strategies and Risk Management for ZRO

ZRO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate ZRO during market dips

- Set price targets and regularly reassess position

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor LayerZero network adoption and partnerships

- Stay informed about cross-chain interoperability developments

ZRO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple interoperability projects

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ZRO

ZRO Market Risks

- High volatility: ZRO price may experience significant fluctuations

- Competition: Other interoperability protocols may gain market share

- Adoption risk: Slow uptake of LayerZero technology could impact token value

ZRO Regulatory Risks

- Uncertain regulatory environment: Changes in crypto regulations may affect ZRO

- Cross-border compliance: Varying international laws could impact LayerZero's operations

- Security token classification: Potential for ZRO to be classified as a security

ZRO Technical Risks

- Smart contract vulnerabilities: Potential for exploits in LayerZero's code

- Scalability challenges: Possible network congestion as adoption grows

- Interoperability issues: Unforeseen complications in cross-chain communications

VI. Conclusion and Action Recommendations

ZRO Investment Value Assessment

ZRO presents a high-risk, high-potential investment in the growing field of blockchain interoperability. Long-term value proposition is strong, but short-term volatility and adoption risks remain significant.

ZRO Investment Recommendations

✅ Beginners: Start with small positions, focus on education and understanding LayerZero technology ✅ Experienced investors: Consider moderate allocation, actively monitor market trends and project developments ✅ Institutional investors: Conduct thorough due diligence, potentially include ZRO in diversified crypto portfolios

ZRO Trading Participation Methods

- Spot trading: Buy and hold ZRO tokens on Gate.com

- Staking: Participate in ZRO staking programs if available

- DeFi integration: Explore LayerZero-powered DeFi applications for additional utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is zro coin a good investment?

ZRO coin shows potential for growth in the Web3 ecosystem. Its innovative features and increasing adoption suggest it could be a promising investment for those interested in crypto assets.

What to do with a zro token?

ZRO tokens can be used for staking, governance voting, and accessing premium features on the Zero Exchange platform. Holders may also benefit from potential value appreciation.

How much is the ZRO token worth?

As of November 2025, the ZRO token is valued at approximately $0.85. This price reflects recent market trends and growing adoption in the Web3 ecosystem.

Will ZOO token prices increase by 2025?

Yes, ZOO token prices are likely to increase by 2025 due to growing adoption and ecosystem expansion. Market trends suggest a positive outlook for ZOO in the coming years.

Share

Content