2025 ZK Fiyat Tahmini: Kripto Piyasalarında Zero-Knowledge Teknolojisinin Geleceğinde Yolculuk

Giriş: ZK’nin Piyasa Konumu ve Yatırım Değeri

ZKsync (ZK), matematiksel olarak güvence altına alınan, sürekli gelişen bir doğrulanabilir blokzincir ağı olarak kuruluşundan bu yana önemli ilerlemeler kaydetmiştir. 2025 yılı itibarıyla ZKsync’in piyasa değeri 264.899.723 $’a ulaşmış, dolaşımdaki arzı yaklaşık 7.231.769.682 token seviyesine çıkmış ve fiyatı yaklaşık 0,03663 $ civarında seyretmektedir. “Matematiksel güvenlik öncüsü” olarak öne çıkan bu varlık, blokzincir ölçeklenebilirliği ve güvenliği alanında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, ZKsync’in 2025-2030 dönemi fiyat eğilimleri; tarihsel örüntüler, piyasa arz ve talep dengesi, ekosistem gelişimi ile makroekonomik faktörler ışığında kapsamlı biçimde analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. ZK Fiyat Geçmişi ve Güncel Piyasa Durumu

ZK Tarihsel Fiyat Gelişimi

- 2024: ZK, 17 Haziran’da 0,367 $ ile tüm zamanların en yüksek seviyesine çıkarak proje için önemli bir dönüm noktası oluşturdu.

- 2025: Piyasadaki gerileme sonucu ZK fiyatı, 10 Ekim’de 0,00736 $ ile dip seviyesini gördü.

ZK Güncel Piyasa Durumu

18 Ekim 2025 tarihinde ZK, 0,03663 $ seviyesinden işlem görüyor; bu, tarihi zirvesine göre %90,02’lik bir düşüş anlamına geliyor. Token kısa vadede toparlanma belirtileri gösterirken, son bir saatte %1,35 ve son 24 saatte %0,21 oranında değer artışı kaydedildi. Ancak uzun vadeli grafikler hâlâ düşüş yönünde: Son 30 günde %38,2 ve son bir yılda %70,95 oranında değer kaybı görüldü.

ZK’nın piyasa değeri şu anda 264.899.723 $ seviyesinde olup, kripto para piyasasında 237. sıradadır. Dolaşımdaki arzı 7.231.769.682 ZK ile toplam arzının %34,44’üne karşılık gelmektedir. ZK’nın tamamen seyreltilmiş değeri ise 769.230.000 $’dır.

Son 24 saatteki işlem hacmi 1.897.835 $ olarak gerçekleşmiş ve piyasada orta seviyede aktivite gözlemlenmiştir. Token, 52 borsada işlem görerek yatırımcılara çeşitli işlem alternatifleri sunmaktadır.

Güncel ZK piyasa fiyatını görüntülemek için tıklayın

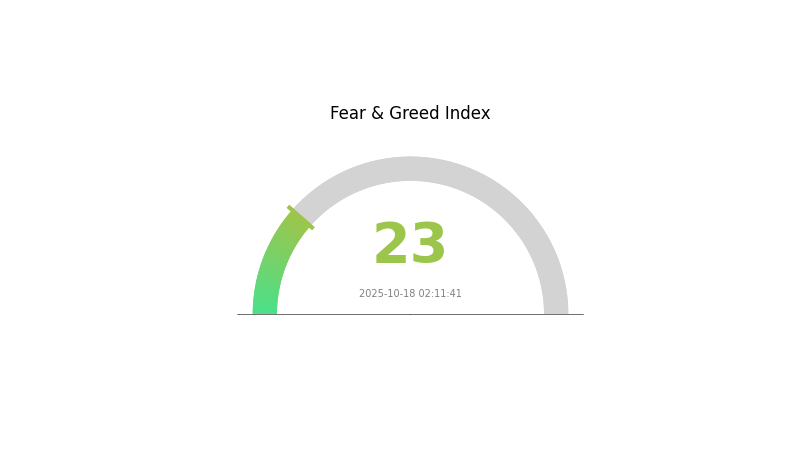

ZK Piyasa Duyarlılığı Göstergesi

18 Ekim 2025 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında aşırı korku hakim; duyarlılık endeksi 23 seviyesine kadar gerilemiş durumda. Bu derece kötümserlik, ters pozisyon alan yatırımcılar için potansiyel bir alım fırsatı doğurabilir. Ancak piyasa oynaklığının devam edebileceği göz önünde bulundurulmalı, yatırım kararları öncesi kapsamlı araştırma yapılmalı ve kişisel risk toleransı dikkate alınmalıdır. Unutmayın, piyasa duyarlılığı hızla değişebilir; bu dalgalı süreçte güncel kalmak kripto piyasasında yol almak için kritik önemdedir.

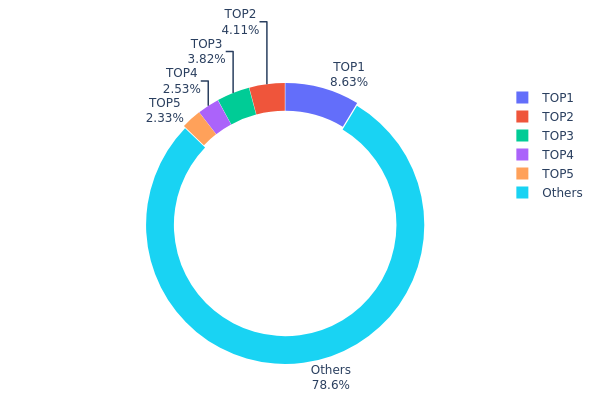

ZK Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, ZK token sahipliğindeki yoğunluk hakkında önemli bilgiler sunar. En büyük 5 adresin analizi, en büyük adresin toplam arzın %8,62’sine sahip olmasıyla orta düzeyde bir merkezileşmeye işaret ediyor. İlk 5 adres ZK token’larının %21,39’unu kontrol ederken, kalan %78,61’lik bölüm diğer yatırımcılar arasında dağılmıştır.

Bu dağılım yapısı, hiçbir adresin ezici çoğunluğa sahip olmadığı görece dengeli bir sahiplik ortamı göstermektedir. Ancak birkaç büyük yatırımcı, piyasa dinamikleri üzerinde etkili olabilir. 1,18 milyar token’dan fazla bulunduran lider adres, oylama ve piyasa hareketlerinde güçlü bir rol oynayabilir. Yine de token’ların neredeyse %80’inin daha küçük adreslerde olması merkeziyetsizlik açısından olumlu bir tablo sunmaktadır.

Mevcut dağılım, merkezi etkilerle geniş katılım arasında bir dengeyi yansıtmaktadır. Büyük sahiplerin büyük ölçekli işlemlerde fiyat oynaklığına yol açma potansiyeli olmakla birlikte, yaygın sahiplik tabanı aşırı manipülasyonları sınırlayabilir. Bu yapı, zincir üstünde makul düzeyde istikrarlı bir ortam ve ZK ekosisteminde hem kurumsal hem bireysel katılımın dengelendiği bir görünüm oluşturur.

Güncel ZK Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 1.186.955,15K | 8,62% |

| 2 | 0xacf9...607e9f | 565.603,69K | 4,11% |

| 3 | 0x6240...c9cc1f | 525.000,00K | 3,81% |

| 4 | 0x8d61...fe93a1 | 348.650,00K | 2,53% |

| 5 | 0xa01e...33070c | 319.991,29K | 2,32% |

| - | Diğerleri | 10.810.636,03K | 78,61% |

II. ZK’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Oluşumu

-

Sıfır Bilgi Kanıtları: ZK (Zero-Knowledge) teknolojisi sürekli evrilerek blokzincir uygulamalarında gizlilik ve ölçeklenebilirliği güçlendiriyor. Bu gelişmeler, ZK tabanlı projelerin benimsenmesi ve değerini olumlu etkileyebilir.

-

Ekosistem Uygulamaları: ZK ekosistemi, sıfır bilgi kanıtıyla gizlilik sağlayan çeşitli merkeziyetsiz uygulamalar (DApp) ile büyüyor. Bu uygulamalar, ZK token’ına olan kullanım ve talebi artırabilir.

III. 2025-2030 ZK Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,02118 $ - 0,03000 $

- Tarafsız tahmin: 0,03000 $ - 0,04500 $

- İyimser tahmin: 0,04500 $ - 0,05332 $ (olumlu piyasa ortamı ve artan kullanım şartıyla)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Artan benimsemeyle büyüme potansiyeli

- Fiyat aralığı öngörüsü:

- 2027: 0,03915 $ - 0,07941 $

- 2028: 0,04872 $ - 0,0812 $

- Başlıca katalizörler: Teknolojik yenilikler, ZK teknolojisinin geniş uygulama alanı, genel kripto piyasası toparlanması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,07444 $ - 0,09267 $ (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,09638 $ - 0,11091 $ (güçlü piyasa ve yaygın ZK uygulamasıyla)

- Dönüştürücü senaryo: 0,11091 $ - 0,15000 $ (büyük ortaklıklar veya teknolojik atılımlar gibi kayda değer olumlu gelişmelerde)

- 31 Aralık 2030: ZK 0,09267 $ (2025 ortalamasına göre %152 artış)

| 年份 | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,05332 | 0,03652 | 0,02118 | 0 |

| 2026 | 0,06693 | 0,04492 | 0,04043 | 22 |

| 2027 | 0,07941 | 0,05592 | 0,03915 | 52 |

| 2028 | 0,0812 | 0,06767 | 0,04872 | 84 |

| 2029 | 0,11091 | 0,07444 | 0,04764 | 103 |

| 2030 | 0,09638 | 0,09267 | 0,08804 | 152 |

IV. ZK İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ZK Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Sabırlı ve yüksek risk toleransına sahip yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde ZK biriktirin

- Kısmi kâr için fiyat hedefleri koyun

- Token’ları donanım cüzdanlarında güvenle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend tespiti için kullanılır

- RSI: Aşırı alım/aşırı satım bölgelerini belirler

- Dalgalı işlemde dikkat edilmesi gerekenler:

- ZK’nın başlıca kripto paralarla olan korelasyonunu izleyin

- Riskleri sınırlamak için zarar durdur emirleri belirleyin

ZK Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: %1-3

- Agresif yatırımcı: %5-10

- Profesyonel yatırımcı: %10-15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı farklı blokzincir projelerine dağıtın

- Opsiyon stratejileri: Düşüş riskine karşı satım opsiyonlarından yararlanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan tavsiyesi: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanları

- Güvenlik önlemleri: İki aşamalı doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. ZK İçin Potansiyel Riskler ve Zorluklar

ZK Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında sık rastlanan sert fiyat dalgalanmaları

- Likidite riski: Büyük hacimli işlemlerin gerçekleşmesinde zorluk

- Rekabet ortamı: Yeni Layer 2 çözümleri ZK’nın pazar payını etkileyebilir

ZK Düzenleyici Riskleri

- Belirsiz düzenleyici ortam: Kriptoya yönelik sıkılaşan kurallar olasılığı

- Sınır ötesi uyum: Farklı ülkelerde değişen düzenlemeler

- Vergi etkisi: Kripto varlıkların vergilendirilmesine ilişkin gelişen yaklaşımlar

ZK Teknik Riskler

- Akıllı sözleşme açıkları: İstismar veya yazılım hatası olasılığı

- Ölçeklenebilirlik sorunları: İşlem hacminde sınırlamalar yaşanabilir

- Birlikte çalışabilirlik sorunları: Diğer blokzincir ağlarıyla uyumluluk problemleri

VI. Sonuç ve Eylem Önerileri

ZK Yatırım Değeri Analizi

ZK, Ethereum için Layer 2 ölçekleme çözümü olarak uzun vadeli potansiyel sunarken, kısa vadede piyasa dalgalanması ve düzenleyici belirsizlik kaynaklı riskler taşımaktadır.

ZK Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, eğitime öncelik verin ✅ Deneyimli yatırımcılar: Maliyet ortalaması uygulayın, net çıkış stratejileri oluşturun ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, OTC işlemleri değerlendirin

ZK İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden ZK token alım-satımı yapabilirsiniz

- Staking: Pasif gelir için ZK staking programlarına katılabilirsiniz

- DeFi entegrasyonu: ZK tabanlı merkeziyetsiz finans uygulamalarını keşfedin

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatli şekilde vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

ZK alınacak iyi bir hisse senedi mi?

ZK bir hisse senedi değil, bir kripto para birimidir. Web3 alanında potansiyel gösteriyor; artan benimseme ve teknolojik yeniliklerle öne çıkıyor. Yatırım kararı öncesinde son performansını ve piyasa eğilimlerini dikkate alın.

ZKsync’in geleceği var mı?

Evet, ZKsync’in geleceği parlak. Ölçeklenebilirlik çözümleri ve büyüyen ekosistemi, Ethereum Layer 2 alanında uzun vadeli başarı için güçlü bir zemin oluşturuyor.

ZKsync ne kadar yükselebilir?

ZKsync, Ethereum ekosisteminde artan benimseme ve ölçeklenebilirlik gelişmeleriyle birlikte 2025’te teorik olarak 10-15 $ seviyelerine ulaşabilir.

ZKsync’e yatırım yapmalı mıyım?

Evet, ZKsync 2025’te umut vaat ediyor. Ölçeklenebilirlik çözümleri ve büyüyen ekosistemi, onu gelişen Web3 alanında cazip bir yatırım haline getiriyor.

Kripto'da ZK nedir?

ZK Ne Demektir? Blok Zinciri Kullanıcıları İçin Sıfır Bilgi Açıklaması

ETH Fusaka: Bilmeniz Gereken Her Şey

Katman 2 Ölçekleme Çözümü Nedir? Pratik Rehber

Katman 2 çözümlerini anlamak: Gate Layer ve Optimism OP Stack

Gate Layer: Web3’te Devrim Yaratan Optimize Edilmiş Layer 2 Çözümleri

American Bitcoin, hazinesini 4.783 BTC'ye çıkardı ve piyasanın neden buna dikkat etmesi gerektiği

Kripto piyasasında SOPR Nedir? Bu gösterge, piyasa kâr ve zararını nasıl gösterir

Kripto fiyatlarının yükselmesine ne yol açar? Piyasa rallilerinin temel faktörleri

Blockstream CEO'su Adam Back, tüm şirketlerin Bitcoin rezerv kuruluşuna dönüşebileceğini neden savunuyor?

BeatSwap Nedir ve Müzik Haklarını Alınıp Satılabilir Blockchain Varlıklarına Nasıl Dönüştürür