2025 ZERO Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: ZERO’nun Piyasa Konumu ve Yatırım Potansiyeli

ZERO (ZERO), Solana üzerinde hayata geçen ilk meta protokolün ilk token’ı olarak piyasaya çıktığı günden bu yana kendine özgü bir dijital varlık konumuna erişmiştir. 2025 yılı itibarıyla ZERO’nun piyasa değeri 2.439.150 $’a ulaşırken, dolaşımdaki arzı 21.000.000 token ve fiyatı yaklaşık 0,11615 $ civarında seyretmektedir. “Endeks Protokolü Öncüsü” olarak anılan ZERO, Solana ekosistemi ve merkeziyetsiz finans alanında giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, ZERO’nun 2025-2030 dönemindeki fiyat eğilimleri; geçmiş veriler, piyasa arz-talep dinamikleri, ekosistem gelişmeleri ve makroekonomik etkenler ışığında detaylı olarak analiz edilecek, yatırımcılara profesyonel fiyat öngörüleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. ZERO Fiyat Geçmişi ve Güncel Piyasa Durumu

ZERO’nun Tarihsel Fiyat Seyri

- 2023: Blok açık artırmasıyla gerçekleştirilen ilk halka arzda, fiyat 27 Aralık’ta 2,5 $ ile zirve yaptı

- 2024: Piyasa dalgalanmaları, fiyatta yüksek volatiliteye yol açtı

- 2025: Ayı piyasası döneminde fiyat tüm zamanların en yüksek seviyesinden 7 Nisan’da 0,05671 $’a kadar geriledi

ZERO’nun Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla ZERO, 0,11615 $ fiyat seviyesinde işlem görerek tüm zamanların zirvesine göre %95,35’lik bir değer kaybı sergilemektedir. Token, çeşitli zaman aralıklarında negatif performans göstermiştir; son 24 saatte %3,12, son 7 günde %10,95 ve son 30 günde %19,34 oranında düşüş yaşanmıştır. Mevcut piyasa değeri 2.439.150 $ ve dolaşımdaki arz 21.000.000 ZERO’dur. Son 24 saatlik işlem hacmi 15.368,92 $ olup, orta düzeyde işlem aktivitesine işaret etmektedir. Genel ayı trendine rağmen, ZERO’nun tüm zamanların en düşük fiyatının üzerinde kalması, mevcut seviyelerde olası bir destek bölgesine işaret etmektedir.

Güncel ZERO piyasa fiyatını görüntüleyin

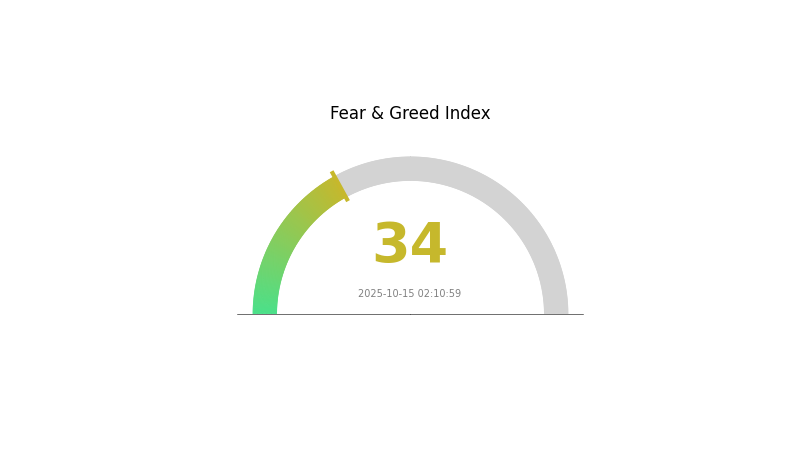

ZERO Piyasa Duyarlılık Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasasında şu an korku hâkim; Korku ve Açgözlülük Endeksi 34 seviyesindedir. Bu gösterge, yatırımcıların temkinli ve belirsizlik içinde hareket ettiğini ortaya koyuyor. Böyle dönemlerde, soğukkanlı kalmak ve aceleci kararlar almaktan kaçınmak kritik önem taşır. Bazı yatırımcılar, piyasada korkunun hâkim olduğu zamanları “Diğerleri korktuğunda açgözlü olun” yaklaşımıyla alım fırsatı olarak değerlendirse de, yatırım kararları öncesinde kapsamlı araştırma yapmak ve kişisel risk toleransını göz önünde bulundurmak gereklidir.

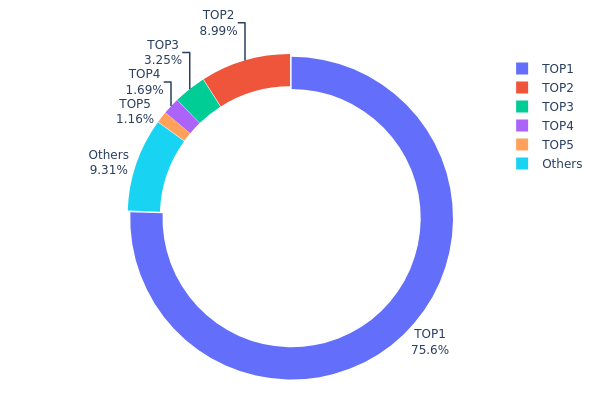

ZERO Varlık Dağılımı

ZERO adres varlık dağılımı, son derece yoğun ve merkezi bir sahiplik yapısını ortaya koymaktadır. En büyük adres, toplam arzın %75,59’unu oluşturan 15.874,21K token’a sahip. Bu yüksek yoğunlaşma, token’ın merkeziyetsizliği ve piyasa istikrarı açısından ciddi kaygılar doğurmaktadır.

İkinci sıradaki adres toplam arzın %8,99’unu elinde tutarken, ilk 5 adresin toplam kontrolü yaklaşık %6’dır. Geri kalan tüm adresler ise yalnızca %9,34 oranında bir dağılıma sahiptir. Bu dengesiz dağılım, piyasa manipülasyonu ve aşırı volatilite riskini artırmakta; büyük sahiplerin işlemleri fiyat üzerinde belirgin etki oluşturabilir.

Bu derecede yoğunlaşmış sahiplik, ZERO’nun zincir üstü yapısının şu an için dengesiz ve merkezi karar süreçlerine açık olduğunu gösteriyor. Küçük yatırımcılar için risk algısını artırabilir, projenin uzun vadeli sürdürülebilirliğini ve yaygın benimsenmesini sınırlayabilir. Bu dağılımdaki değişimleri izlemek, ZERO’nun daha dengeli ve merkeziyetsiz bir ekosisteme ulaşma yolculuğunda kritik öneme sahiptir.

Güncel ZERO Varlık Dağılımı için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 6G1nWW...3yeCt9 | 15.874,21K | 75,59% |

| 2 | A77HEr...oZ4RiR | 1.888,80K | 8,99% |

| 3 | u6PJ8D...ynXq2w | 681,86K | 3,24% |

| 4 | 8a93T1...gCJSYE | 355,00K | 1,69% |

| 5 | HugT8T...KkXM6y | 243,31K | 1,15% |

| - | Diğerleri | 1.955,99K | 9,34% |

II. ZERO’nun Gelecek Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Halving: ZERO arzı her dört yılda bir yarıya iniyor; bu da kıtlık yaratıp fiyatı yukarı taşıyabilir.

- Tarihsel Model: Önceki yarılanmalar, uzun vadede anlamlı fiyat artışları sağlamıştır.

- Güncel Etki: Yaklaşan halving ile arz azalacak; talebin artması halinde fiyat yükselişi beklenebilir.

Kurumsal ve “Whale” Dinamikleri

- Kurumsal Varlıklar: Büyük finans kuruluşları ZERO’yu portföylerine ekleyerek ana akımın ilgisini artırıyor.

- Kurumsal Benimseme: Bazı önde gelen şirketler ZERO’yu hazine varlığı veya işlem aracı olarak kullanmaya başladı.

- Devlet Politikaları: Bazı ülkelerdeki düzenleyici netlik, ZERO’ya kurumsal yatırımı destekliyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının faiz ve parasal genişleme kararları, ZERO’nun yatırım cazibesini doğrudan etkileyebilir.

- Enflasyona Karşı Koruma: ZERO, giderek daha fazla altın benzeri bir enflasyon koruma aracı olarak algılanıyor.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler ve siyasi gerilimler, yatırımcıları ZERO gibi güvenli limanlara yönlendirebilir.

Teknolojik Gelişim ve Ekosistem Genişlemesi

- Layer 2 Çözümleri: Layer 2 ölçeklendirme çözümleri, işlem hızını artırıp maliyetleri düşürüyor.

- Akıllı Sözleşme Güncellemeleri: ZERO’nun akıllı sözleşme yeteneklerindeki iyileştirmeler, kullanım alanlarını genişletiyor.

- Ekosistem Uygulamaları: ZERO’nun blockchain’i üzerinde artan DApp ve proje sayısı, talebi ve kullanımını artırıyor.

III. 2025-2030 ZERO Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,0813 $ - 0,10 $

- Tarafsız tahmin: 0,10 $ - 0,115 $

- İyimser tahmin: 0,115 $ - 0,12311 $ (olumlu piyasa koşulları halinde)

2027-2028 Görünümü

- Piyasa aşaması: Büyüme potansiyeli dönemi

- Fiyat tahmini aralığı:

- 2027: 0,13202 $ - 0,20767 $

- 2028: 0,14952 $ - 0,2225 $

- Ana katalizörler: Artan benimseme, teknolojik ilerlemeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,20025 $ - 0,23329 $ (istikrarlı piyasa büyümesi beklentisiyle)

- İyimser senaryo: 0,26633 $ - 0,31961 $ (güçlü piyasa performansı)

- Dönüştürücü senaryo: 0,31961 $+ (aşırı olumlu koşullar)

- 31 Aralık 2030: ZERO 0,31961 $ (iyimser tahminler doğrultusunda potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,12311 | 0,11614 | 0,0813 | 0 |

| 2026 | 0,17704 | 0,11962 | 0,08374 | 2 |

| 2027 | 0,20767 | 0,14833 | 0,13202 | 27 |

| 2028 | 0,2225 | 0,178 | 0,14952 | 53 |

| 2029 | 0,26633 | 0,20025 | 0,11014 | 72 |

| 2030 | 0,31961 | 0,23329 | 0,13531 | 100 |

IV. ZERO için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ZERO Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Uzun vadeli bakış açısına ve risk toleransına sahip olanlar

- İşlem önerileri:

- Piyasa düşüşlerinde ZERO biriktirin

- En az 2-3 yıl tutmayı hedefleyin

- Varlıklarınızı güvenli, kendi saklamalı cüzdanlarda koruyun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için

- RSI: Aşırı alım/aşırı satım tespiti için

- Swing trading için kilit noktalar:

- Solana ekosistemindeki gelişmeleri yakından izleyin

- Düşüş riskini kontrol altına almak için kesin stop-loss emirleri uygulayın

ZERO Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Koruma odaklılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: %5-10 arası

- Profesyoneller: En fazla %15

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Solana ekosistemindeki farklı projelere yatırım yaymak

- Stabilcoin kullanımı: Portföyün bir bölümünü hızlı denge için stabilcoinde tutmak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Solana token’larıyla uyumlu donanım cüzdanı

- Güvenlik: İki faktörlü doğrulama etkinleştirilmeli, güçlü ve benzersiz parolalar kullanılmalı

V. ZERO için Potansiyel Riskler ve Zorluklar

ZERO Piyasa Riskleri

- Yüksek volatilite: Fiyat kısa sürede aşırı değişebilir

- Sınırlı likidite: Büyük işlemlerde kayma riski yüksektir

- Solana ekosistemine bağımlılık: Performans, genel Solana benimsenmesine ve büyümesine doğrudan bağlıdır

ZERO Düzenleyici Riskler

- Belirsiz düzenleyici ortam: DeFi projelerine yönelik denetimler artabilir

- Sınır ötesi uyumluluk: Farklı ülkelerin mevzuatları küresel yayılımı etkileyebilir

- Vergi sonuçları: Değişen vergi düzenlemeleri ZERO sahiplerini ve yatırımcılarını etkileyebilir

ZERO Teknik Riskler

- Akıllı sözleşme açıkları: Protokolde istismar riski mevcut

- Ölçeklenebilirlik sorunları: Solana’nın yüksek performansı sürdürebilmesi gereklidir

- Birlikte çalışabilirlik kısıtları: Zincirler arası işlevlerdeki eksiklikler büyümeyi sınırlandırabilir

VI. Sonuç ve Eylem Önerileri

ZERO Yatırım Potansiyelinin Değerlendirilmesi

ZERO, Solana ekosisteminde yüksek risk ve yüksek getiri potansiyeli sunan bir dijital varlıktır. Uzun vadeli değer, Endeks protokolünün başarısına bağlı olup; kısa vadede piyasa oynaklığı ve mevzuatsal belirsizlikler risk oluşturmaktadır.

ZERO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Solana ekosistemini anlamak için küçük, eğitim odaklı pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle birlikte maliyet ortalaması stratejisi uygulayın ✅ Kurumsal yatırımcılar: Geniş kapsamlı analiz yaparak ZERO’yu çeşitlendirilmiş bir Solana portföyünün parçası olarak değerlendirin

ZERO İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden doğrudan token alımı

- Staking: Protokol sunuyorsa staking seçeneğini değerlendirin

- Likidite madenciliği: Likidite sağlama ile kazanç fırsatlarını, geçici kayıp riskini gözeterek inceleyin

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Her yatırımcı, kendi risk profilini göz önünde bulundurarak karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaldıramayacağınız tutarda yatırım yapmayınız.

Sıkça Sorulan Sorular

Zero token için fiyat tahmini nedir?

2025 yılında Zero token’ın 0,01902 $ ile 0,064412 $ arasında, nötr piyasa duyarlılığıyla işlem görmesi bekleniyor.

Hamster Kombat coin 1 $’a ulaşır mı?

Mevcut beklentilere göre, Hamster Kombat coin’in 2025’e kadar 1 $’a ulaşması olası görünmüyor. 2024 için ortalama fiyat yaklaşık 0,02 $ olup, 1 $ seviyesinden oldukça uzaktır.

Zerebro için tahmin nedir?

Zerebro’nun 2025’te %20,15 artış göstermesi bekleniyor. Yatırımcılar, fiyat eğilimlerini analiz etmek ve gelecekteki performansı tahmin etmek için sıklıkla hareketli ortalamaları baz alır.

LayerZero yükselir mi?

LayerZero’nun fiyatında artış öngörülüyor. Analistlere göre, 2030’a kadar güçlü büyüme potansiyeli var ve mevcut piyasa eğilimleri bu olumlu görünümü destekliyor.

2025 PYTH Fiyat Tahmini: Oracle Protokolü Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 ZBCN Fiyat Tahmini: Piyasa Trendlerini Değerlendirme ve Gelecekteki Değer Analizi

Zincir üstü veri analizi, kripto balinalarının hareketlerini nasıl ortaya çıkarabilir?

2025 ZBCN Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 SOL Fiyat Tahmini: Solana Ekosisteminin Büyümesiyle Yükseliş Eğilimi

ORE'nin temel analizinin, 2025 yılındaki yatırım potansiyeli üzerindeki etkisi nedir?

Ticaret hesaplayıcısının açıklaması: akıllı trader'ların bir ticarete girmeden önce kar planlaması.

Yeni Başlayanlar İçin Rehber: Kripto Paraları Şortlama için Etkili Stratejiler

Raoul Pal, neden çoğu coinden kaçındığını ve Kripto Varlıklara sıkı bir şekilde inandığını açıkladı.

Satoshi’den Bitcoin’e Dönüşüm: Temel Bilgiler Açıklandı

Güvenli Kripto Para Saklama için En Çok Tercih Edilen Cihazlar