2025 PYTH Fiyat Tahmini: Oracle Protokolü Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: PYTH’in Piyasa Konumu ve Yatırım Değeri

Pyth Network (PYTH), finansal piyasa verilerini birden fazla blokzincir ağına aktarabilen lider bir oracle olarak kurulduğu tarihten bu yana belirleyici başarılar elde etti. 2025 yılı itibarıyla PYTH’in piyasa değeri 991.929.650 $’a ulaşırken, dolaşımdaki arzı yaklaşık 5.749.983.480 token, fiyatı ise ortalama 0,17251 $ seviyesinde seyrediyor. “Zincirler arası veri oracle’ı” unvanını taşıyan bu token, çeşitli blokzincir ağlarında anlık finansal veri sağlama konusunda kritik bir rol üstleniyor.

Bu makale, PYTH’in 2025-2030 yıllarındaki fiyat eğilimlerini, geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurları dikkate alarak; uzman fiyat tahminleriyle birlikte yatırımcılara yönelik pratik stratejileri kapsamlı bir şekilde ortaya koymaktadır.

I. PYTH Fiyat Geçmişi ve Güncel Durum

PYTH Tarihi Fiyat Gelişimi

- 2024: PYTH, 16 Mart 2024 tarihinde fiyat geçmişindeki zirvesi olan 1,1552 $ seviyesine ulaşarak önemli bir dönüm noktasına imza attı.

- 2025: Piyasa, 22 Haziran 2025’te PYTH’in tüm zamanların en düşük seviyesi olan 0,08067 $’ı görmesiyle aşağı yönlü bir seyir izledi.

PYTH Güncel Piyasa Görünümü

19 Eylül 2025 tarihinde PYTH’in fiyatı 0,17251 $ düzeyindedir. Token farklı zaman aralıklarında dalgalı bir fiyat performansı sergiledi:

- Son 24 saatte %3,77 artış kaydederek kısa vadeli bir yükseliş ivmesi sergiledi.

- Son 7 günlük süreçte ise %2,28 oranında hafif bir düşüş yaşandı.

- 30 günlük performansı özellikle güçlü; %50,9 oranında anlamlı bir yükseliş kaydedildi.

- Ancak, son bir yıllık dönemde %42,71 oranında ciddi bir değer kaybı gerçekleşti.

PYTH’in piyasa değeri şu an 991.929.650 $ olup, genel kripto para piyasasında 112. sırada yer almaktadır. Dolaşımdaki arzı ise 5.749.983.480 PYTH ile toplam arzın %57,5’ine tekabül etmektedir.

24 saatlik işlem hacmi 7.522.013 $ olan PYTH, orta düzeyde piyasa hareketliliğine sahip. 56 farklı borsada işlem gören token, yatırımcılara yüksek likidite ve çeşitli işlem seçenekleri sunuyor.

Güncel PYTH piyasa fiyatını görmek için tıklayın

PYTH Piyasa Duyarlılık Göstergesi

2025-09-19 Korku ve Açgözlülük Endeksi: 53 (Nötr)

Kripto para piyasasında duyarlılık dengede. Korku ve Açgözlülük Endeksi 53 ile nötr bir tablo gösteriyor. Yatırımcılar aşırı iyimserlik veya kötümserlik göstermiyor. Portföylerde çeşitlendirmeye devam edilmesi ve olası duyarlılık değişikliklerine karşı gelişmelerin yakından izlenmesi önerilir. Karar verirken piyasa katalizörlerine dikkat etmek ve kapsamlı risk yönetimi uygulamak büyük önem taşır.

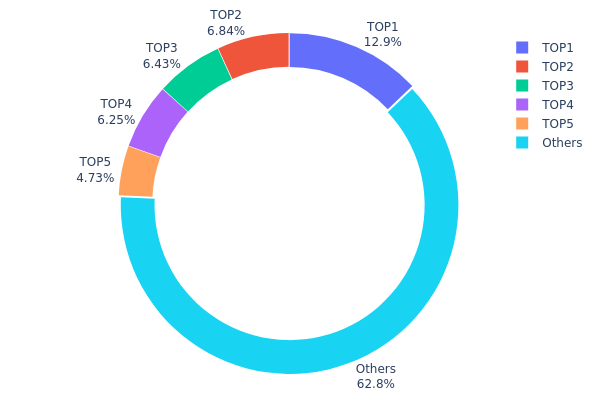

PYTH Varlık Dağılımı

Adres bazlı varlık dağılımı, PYTH tokenlerinin cüzdanlar arasında nasıl paylaşıldığına dair kritik bilgiler sunar. Mevcut analiz, ilk 5 adresin toplam arzın yaklaşık %37,18’ini elinde bulundurduğunu ve dağılımın orta derecede yoğunlaştığını gösteriyor. En büyük adres %12,94’lük paya sahipken, kalan ilk 4 adresin payı %4,73 ile %6,84 arasında değişiyor.

Bu oran, tek bir adresin piyasa üzerinde belirleyici bir hakimiyet kurmadığını ve dağılımın nispeten dengeli olduğunu gösterir. Ancak, en büyük adresin yüksek payı piyasa üzerinde etkili olabilir. Tokenlerin %62,82’si diğer adreslerde bulunmakta. Bu durum merkeziyetsizlik ve piyasa manipülasyonuna karşı direnç açısından olumlu bir gösterge olarak öne çıkıyor.

PYTH’in ekosisteminde bu dağılım yapısı, makul seviyede merkeziyetsizlik anlamına gelir. Büyük sahiplerin varlığı yüksek işlem hacimlerinde volatiliteye yol açabilir. Ancak önemli miktarın birden fazla büyük adreste ve özellikle “Diğerleri” kategorisinde yayılması, tek bir adresin piyasa üzerinde kontrol kurma riskini azaltır. Bu yapı, PYTH için dirençli ve istikrarlı bir piyasa zeminini destekler.

| İlk | Adres | Varlık Miktarı | Dağılım (%) |

|---|---|---|---|

| 1 | 5WumPY...Q85qfY | 1.294.475,65K | 12,94% |

| 2 | 5cz3Jz...q5BxCw | 684.291,67K | 6,84% |

| 3 | Ffz4sG...Ycjc2Q | 642.740,00K | 6,42% |

| 4 | E294ht...X7WJGM | 625.057,33K | 6,25% |

| 5 | 8m5Aj1...K4C5za | 473.063,97K | 4,73% |

| - | Diğerleri | 6.280.354,87K | 62,82% |

II. PYTH’in Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Dağılımı: Toplam arzın %22’si (2,2 milyar PYTH) veri sağlayıcılara, %52’si (5,2 milyar PYTH) ekosistem geliştirmesine, %10’u (1 milyar PYTH) protokol geliştirmeye ve %6’sı (600 milyon PYTH) topluluk/lansman aktivitelerine ayrılmıştır.

- Güncel Etki: Bu dağıtım modeli, ağ katılımını teşvik ederek uzun vadeli büyümeyi destekler ve token değerine olumlu yansıyabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Kullanım: Pyth Network, 45’in üzerinde blokzincire gerçek zamanlı piyasa verisi sağlayarak birçok DeFi protokolü ve blokzincir ağı tarafından aktif olarak kullanılmaktadır.

Makroekonomik Koşullar

- Riskten Korunma Aracı: Merkeziyetsiz oracle ağı olan PYTH, geleneksel finansal sistem risklerine karşı bir riskten korunma aracı olarak görülerek özellikle enflasyonist dönemlerde yatırımcıların ilgisini çekebilir.

Teknolojik Gelişim ve Ekosistem Güçlenmesi

- Zincirler Arası Fonksiyonellik: Pyth Network, çok zincirli desteğiyle kullanım kapsamını ve potansiyel kullanıcı tabanını önemli ölçüde genişletti.

- Veri Toplama Mekanizması: Pyth’in temel protokolü, farklı veri sağlayıcılardan bilgileri toplar ve her 400 milisaniyede birleşik fiyat ile güven aralığı üretir.

- Ekosistem Uygulamaları: Yüksek hız, geniş varlık kapsamı ve yüksek doğrulukla veri sağlayan Pyth Network, DeFi uygulamaları ve blokzincir sektöründe kilit rol oynar.

III. 2025-2030 PYTH Fiyat Tahminleri

2025 Görünümü

- İhtiyatlı tahmin: 0,12064 $ – 0,15000 $

- Nötr tahmin: 0,15000 $ – 0,17234 $

- İyimser tahmin: 0,17234 $ – 0,17923 $ (pozitif piyasa duyarlılığı ile)

2026-2027 Görünümü

- Piyasa aşaması beklentisi: Büyüme potansiyeli fazı

- Fiyat tahmin aralığı:

- 2026: 0,10547 $ – 0,20215 $

- 2027: 0,17385 $ – 0,25889 $

- Başlıca katalizör: DeFi uygulamalarında PYTH kullanımının artması

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,22393 $ – 0,33325 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,33325 $ – 0,38994 $ (güçlü piyasa performansı varsayımıyla)

- Dönüşüm senaryosu: 0,38994 $ – 0,45000 $ (PYTH’in blokzincir entegrasyonunun yaygınlaşması ile)

- 2030-12-31: PYTH 0,35324 $ (yıl sonu tahmini fiyat)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,17923 | 0,17234 | 0,12064 | 0 |

| 2026 | 0,20215 | 0,17579 | 0,10547 | 2 |

| 2027 | 0,25889 | 0,18897 | 0,17385 | 9 |

| 2028 | 0,32918 | 0,22393 | 0,18138 | 29 |

| 2029 | 0,38994 | 0,27655 | 0,2489 | 60 |

| 2030 | 0,35324 | 0,33325 | 0,2566 | 93 |

IV. PYTH için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

PYTH Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Yüksek risk toleransına ve uzun vadeli hedefe sahip olanlar

- İşlem önerileri:

- Piyasa düşüşlerinde PYTH token’ı biriktirin

- Belirgin fiyat hareketleri için fiyat alarmı oluşturun

- Varlıklarınızı güvenli cüzdanda ve düzenli yedeklemeyle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Eğilim ve uygun giriş/çıkış noktalarını saptamada kullanılır

- RSI: Aşırı alım veya satım durumlarını izlemek için kullanılır

- Dalgalı ticarette önemli noktalar:

- Farklı blokzincirlerde oracle kullanım oranlarını takip edin

- Pyth Network gelişmeleri ve iş ortaklıklarını güncel izleyin

PYTH Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Birden fazla oracle projesine yatırım yapın

- Zarar durdur: Potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Donanım cüzdanı: Uzun vade için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulamayı açın, özgün şifreler belirleyin

V. PYTH’in Potansiyel Riskleri ve Zorlukları

PYTH Piyasa Riskleri

- Yüksek volatilite: PYTH fiyatında önemli dalgalanmalar görülebilir

- Rekabet: Piyasada diğer oracle projeleri öne çıkabilir

- Tokenin blokzincir projeleri tarafından yavaş benimsenmesi piyasa değerini etkileyebilir

PYTH Regülasyon Riskleri

- Belirsiz regülasyonlar: Oracle projelerine karşı düzenleyici işlemler mümkün

- Sınır ötesi mevzuat: Farklı bölgelerde değişen regülasyonlar

- Veri gizliliği: Veri yönetimine dair olası incelemeler

PYTH Teknik Riskler

- Akıllı sözleşme açıkları: Oracle sisteminde olası güvenlik zafiyetleri

- Ağ tıkanıklığı: Desteklenen blokzincirlerde tıkanıklık performansı olumsuz etkileyebilir

- Veri doğruluğu: Hatalı veya manipüle edilmiş fiyat akışı riski

VI. Sonuç ve Eylem Önerileri

PYTH Yatırım Değeri Değerlendirmesi

Pyth Network, zincirler arası oracle çözümü olarak güçlü bir potansiyele sahip ancak ciddi piyasa rekabeti ve regülasyon belirsizliği ile karşı karşıya. Uzun vadede benimseme artışıyla değer kazanma olasılığı bulunurken, kısa vadede volatilite riski göz ardı edilmemelidir.

PYTH Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Çeşitlendirilmiş portföyde uzun vadeli ve düşük miktarlı yatırımlar tercih edilebilir

✅ Deneyimli yatırımcılar: Sıkı risk yönetimi ile kademeli alım (dolar maliyet ortalaması) uygulanmalı

✅ Kurumsal yatırımcılar: Detaylı analiz ve değerlendirme süreçleri yürütülmeli, PYTH daha geniş bir oracle stratejisinin parçası olarak değerlendirilmelidir

PYTH İşlem Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden PYTH token alımı

- Staking: Desteklenen platformlarda stake programlarına katılım

- DeFi entegrasyonu: Ek kazanç için PYTH’i desteklenen DeFi protokollerinde değerlendirin

Kripto para yatırımları son derece yüksek risk içerir; bu içerik yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre hareket etmeli, profesyonel finansal danışmanlardan görüş almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmaktan kaçının.

SSS

Pyth Network’ün geleceği var mı?

Evet, Pyth Network güçlü bir geleceğe sahip. Tahminler, 2030 itibarıyla fiyatının 0,717247 $ seviyelerine çıkabileceğini ve bu da %320,86’lık bir artış anlamına geldiğini gösteriyor.

PYTH token 2025’te ne kadar olacak?

2025 yılı için PYTH tokeninin 0,118035 $ ile 0,169026 $ bandında ve ortalama bu aralıkta işlem görmesi bekleniyor.

PYTH tokenine yatırımın riskleri nelerdir?

Piyasa volatilitesi, düzenleyici değişiklikler ve teknik zorluklar başlıca risklerdir. PYTH’in başarısı, oracle’ın benimsenmesi ve ağın büyümesiyle şekillenir.

Solana’da PYTH nedir?

PYTH, Solana ekosisteminde yerel bir oracle olup, blokzincir için yüksek hızlı ve düşük gecikmeli veri güncellemeleri sağlar. Akıllı sözleşmeler ve DApp’ler için güvenilir, anlık veri akışı sunar.

2025 ZBCN Fiyat Tahmini: Piyasa Trendlerini Değerlendirme ve Gelecekteki Değer Analizi

Zincir üstü veri analizi, kripto balinalarının hareketlerini nasıl ortaya çıkarabilir?

2025 ZBCN Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 ZERO Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 SOL Fiyat Tahmini: Solana Ekosisteminin Büyümesiyle Yükseliş Eğilimi

ORE'nin temel analizinin, 2025 yılındaki yatırım potansiyeli üzerindeki etkisi nedir?

2025 PUNDIAI Fiyat Tahmini: Uzman Analizi ve Yükselen AI Token İçin Piyasa Tahmini

LAB (LAB) iyi bir yatırım mı?: 2024’te Token’in Potansiyeli, Riskleri ve Piyasa Performansı Analizi

Major (MAJOR) gerçekten iyi bir yatırım mı?: Kripto para yatırımcıları için piyasa potansiyeli, riskler ve gelecekteki fırsatlar üzerine detaylı bir değerlendirme

BLESS Token’ı Tanıyın: Boşta Hesaplama Ağı Lansmanına Eksiksiz Bir Rehber

Telegram üzerinden CAT Gold Miner Game'i keşfedin: Detaylı Bir Kılavuz