2025 USDD Price Prediction: Will This Stablecoin Maintain Its Dollar Peg Amidst Market Volatility?

Introduction: USDD's Market Position and Investment Value

Decentralized USD (USDD) as a stablecoin issued by the Wave Field DAO Reserve, has established itself as a stable and versatile cryptocurrency since its inception in 2022. As of 2025, USDD's market capitalization has reached $516,385,543, with a circulating supply of approximately 516,385,543 tokens, maintaining a price around $1. This asset, dubbed as a "decentralized stablecoin," is playing an increasingly crucial role in providing a stable medium of exchange and store of value in the cryptocurrency ecosystem.

This article will comprehensively analyze USDD's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. USDD Price History Review and Current Market Status

USDD Historical Price Evolution

- 2022: USDD launched, price initially stable around $1

- 2023: Reached all-time high of $1.052 on October 24

- 2022-2023: Experienced volatility, price dropped to all-time low of $0.928067 on June 20, 2022

USDD Current Market Situation

As of October 17, 2025, USDD is trading at $1, maintaining its peg to the US dollar. The 24-hour trading volume stands at $180,492.952. USDD has a market capitalization of $516,385,543, ranking it 147th among cryptocurrencies. The circulating supply matches the total supply at 516,385,543 USDD tokens. Over the past year, USDD has shown slight positive price movement, with a 0.35% increase. The token has demonstrated stability in recent periods, with minor fluctuations of 0.1% over the past week and 0.12% over the last month.

Click to view current USDD market price

Here's the content in the requested format:

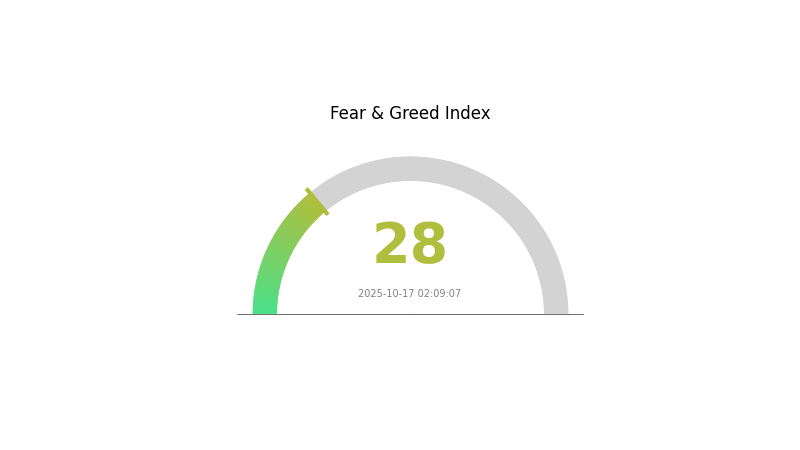

USDD Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index standing at 28. This sentiment suggests that investors are cautious and may be hesitant to make bold moves. During such times, it's crucial to stay informed and make well-considered decisions. Remember, market cycles are natural, and periods of fear can sometimes present opportunities for those with a long-term perspective. As always, conduct thorough research and consider your risk tolerance before making any investment decisions.

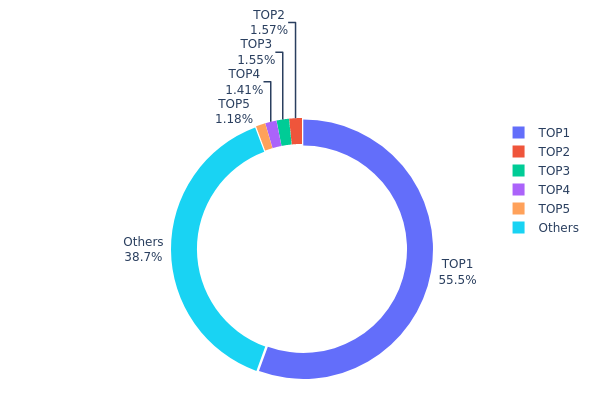

USDD Holdings Distribution

The address holdings distribution data for USDD reveals a highly concentrated ownership structure. The top address holds a staggering 55.54% of the total supply, equivalent to 282,931.41K USDD. This significant concentration in a single address raises concerns about centralization and potential market manipulation risks.

The subsequent top 4 addresses collectively hold only 5.69% of the supply, with individual holdings ranging from 1.17% to 1.57%. The remaining 38.77% is distributed among other addresses. This distribution pattern indicates a severe imbalance in USDD ownership, with one dominant player potentially wielding substantial influence over the token's ecosystem.

Such a concentrated distribution could lead to increased volatility and susceptibility to large-scale market movements initiated by the top holder. It also raises questions about the true decentralization of USDD and its resilience against potential single-point failures or manipulative actions.

Click to view the current USDD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | TKFREL...Bh3Mnf | 282931.41K | 55.54% |

| 2 | TUDwYw...or2mgf | 8000.01K | 1.57% |

| 3 | TUyj5Q...cq7uC9 | 7909.00K | 1.55% |

| 4 | TMhiDX...jjQMp7 | 7179.31K | 1.40% |

| 5 | TVRkSE...UJsztz | 6010.00K | 1.17% |

| - | Others | 197306.18K | 38.77% |

II. Key Factors Influencing USDD's Future Price

Supply Mechanism

- Market Demand and Supply: USDD's price is influenced by market demand and supply dynamics.

- Current Impact: Changes in supply and demand can affect USDD's price stability and market value.

Macroeconomic Environment

- Monetary Policy Impact: Major central bank policies, especially those of the Federal Reserve, can significantly influence USDD's price.

- Inflation Hedging Properties: USDD's performance in inflationary environments may affect its perceived value as a potential hedge.

- Geopolitical Factors: International geopolitical situations and tensions can impact USDD's price through their effects on global market sentiment.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development and adoption of DApps and ecosystem projects within the USDD network can influence its utility and, consequently, its price.

III. USDD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.62 - $0.90

- Neutral prediction: $0.90 - $1.10

- Optimistic prediction: $1.10 - $1.40 (requires stable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.96 - $1.28

- 2028: $0.97 - $1.49

- Key catalysts: Increased adoption of stablecoins, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $1.03 - $1.44 (assuming steady market growth)

- Optimistic scenario: $1.44 - $1.65 (assuming widespread USDD adoption)

- Transformative scenario: $1.65+ (assuming USDD becomes a leading stablecoin)

- 2030-12-31: USDD $1.43561 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.4 | 1 | 0.62 | 0 |

| 2026 | 1.26 | 1.2 | 1.116 | 20 |

| 2027 | 1.2792 | 1.23 | 0.9594 | 23 |

| 2028 | 1.49297 | 1.2546 | 0.96604 | 25 |

| 2029 | 1.49743 | 1.37379 | 1.03034 | 37 |

| 2030 | 1.65095 | 1.43561 | 1.32076 | 43 |

IV. Professional Investment Strategies and Risk Management for USDD

USDD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operational advice:

- Accumulate USDD during market dips

- Set up regular dollar-cost averaging purchases

- Store in a secure hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor for trend reversals and support/resistance levels

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor USDD's peg to USD for potential arbitrage opportunities

- Pay attention to overall crypto market sentiment and its impact on stablecoins

USDD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins and traditional assets

- Stop-loss orders: Implement to limit potential losses in case of severe de-pegging

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for USDD

USDD Market Risks

- De-pegging risk: USDD may lose its 1:1 peg to USD during market stress

- Liquidity risk: Potential difficulty in converting large amounts of USDD to other assets

- Competitive risk: Increased competition from other stablecoins may impact adoption

USDD Regulatory Risks

- Stablecoin regulation: Potential new regulations may impact USDD's operations

- Cross-border restrictions: Some jurisdictions may limit or ban USDD usage

- Compliance requirements: Increased KYC/AML measures may affect user privacy

USDD Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the USDD protocol

- Blockchain congestion: High network fees or slow transactions on the Tron network

- Oracle failures: Inaccurate price feeds could disrupt USDD's stability mechanism

VI. Conclusion and Action Recommendations

USDD Investment Value Assessment

USDD offers a potentially stable store of value within the crypto ecosystem, backed by the Tron DAO Reserve. However, investors should be aware of the risks associated with algorithmic stablecoins and the broader crypto market volatility.

USDD Investment Recommendations

✅ Beginners: Start with a small allocation as part of a diversified crypto portfolio

✅ Experienced investors: Consider USDD for short-term trading or as a temporary haven during market volatility

✅ Institutional investors: Evaluate USDD as part of a broader stablecoin strategy, considering regulatory and counterparty risks

USDD Trading Participation Methods

- Spot trading: Buy and sell USDD on Gate.com and other supported exchanges

- Yield farming: Explore DeFi protocols offering USDD liquidity pools for potential returns

- Arbitrage: Monitor USDD's peg for potential profit opportunities across different platforms

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

Bitcoin is predicted to have the highest price in 2026, potentially reaching several trillion dollars in market cap due to mass adoption and current trends.

What is the price prediction for USD in 2030?

The price prediction for USD in 2030 is $0.000177, with a projected growth rate of 27.63%. This forecast is based on current market models and trends.

What is the price prediction for DGB in 2025?

The price prediction for DGB in 2025 ranges from $0.009392 to $0.0208, based on current market analysis and expert forecasts.

What is the price prediction for Usdt?

As of 2025-10-17, USDT is expected to maintain its $1 peg. Minor fluctuations may occur, but long-term stability is anticipated due to its design as a stablecoin.

Share

Content